On Monday, the Dutch government took control of Chinese-owned semiconductor maker Nexperia – citing risks to Europe’s economic security after alleging “serious governance shortcomings” at the company.

One day later, and the EU is on the cusp of applying major pressure on Beijing. As Bloomberg reports, the European Union is “considering forcing Chinese firms to hand over technology to European companies if they want to operate locally,” in an aggressive new push to make the bloc more competitive – particularly when it comes to electric vehicles and the transfers of battery technology and know-how.

The new rues would apply to companies seeking access to key digital and manufacturing markets such as cars and batteries, and would also require Chinese firms to use a set amount of EU goods or labor, according to people familiar with the plans.

Another lever under discussion would be to force joint ventures.

The new rules, which would be on the table for November, would apply to all non-EU firms, with the goal of keeping China’s manufacturing from overwhelming European industry.

“We are welcoming foreign direct investment under the conditions that they are real investment,” said EU Trade Commissioner Maros Sefcovic in a Tuesday statement to reporters, following an EU trade ministers’ meeting in Horsens, Denmark, adding that the move would mean job creation in Europe, value added to Europe, and technology transfers to Europe, “as European companies have been doing when they’ve been investing in China.”

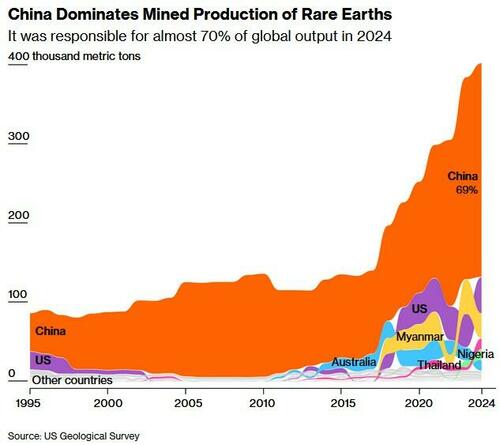

The potential move comes at a key moment in Europe – as the Chinese government’s subsidized wares have been dominating EU industries, while Beijing’s looming restrictions on rare earth minerals threaten to further hamstring the bloc’s manufacturers. That said, Bloomberg suggests targeting China is likely to provoke retaliation – potentially damaging a critical trading relationship.

“Several measures are being considered to foster a strong, competitive, and decarbonised European industry,” said Thomas Regnier, a spokesperson for the European Commission, the EU’s executive arm preparing the regulations, adding that “no final decision has been made regarding the exact scope and nature of these measures.” ‘Decarbonised’ eh?

The tit-for-tat between China and Europe has already begun – with the EU recently moving to double tariffs on steel imports to offset Chinese dumping, while Beijing – days later – said it would adopt new export controls on critical rare earth minerals, prompting the EU to adopt a more defensive position in regards to dependency on China – something the bloc has spent the last few years vowing to protect against. The new regulations would accelerate that effort, arriving as part of a legislative proposal called the Industrial Accelerator Act.

“The future of clean tech will continue to be made in Europe,” said European Commission President Ursula von der Leyen last month. “But for that, we also need to make sure that our industry has the materials here in Europe.”

“In sum, when it comes to digital and clean tech: faster, smarter and more European,” she continued.

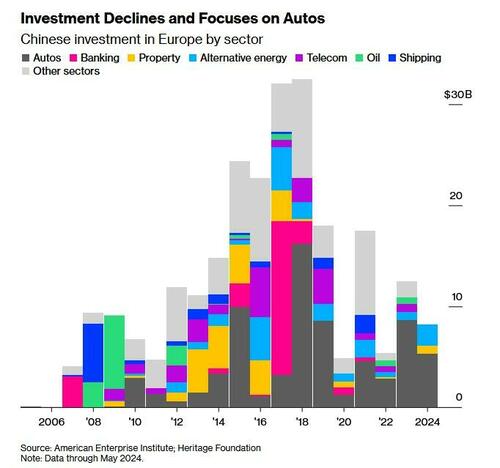

With its plan, the EU is mimicking Beijing, which has long put strict parameters on outside firms wanting to enter its market. Simultaneously, China has invested heavily in Europe and other parts of the world through its Belt and Road Initiative, hoovering up technical knowledge in the process. -Bloomberg

Speaking after the ministers’ meeting, Danish Foreign Minister Lars Lokke Rasmussen says that the EU “should be inspired” by the move, adding “We find ourselves in new circumstances. It’s not just about free trade, free trade, free trade, even though we subscribe to this idea.”

Europe’s economy has been dragged down by Germany’s dismal performance, causing lobbying groups to call for the commission to consider drastic action to gain access to technologies for which China has developed an edge.

“It’s essential that foreign investments, such as in batteries and other clean tech, come with technology transfer and the skilling of European workforce,” according to Victor van Hoorn, director at the industry group Cleantech for Europe. “This needs to be agreed upon at EU level.”

Rasmussen backed the statement, saying “If we invite China’s investments to Europe, it must come with the precondition that we also have some kind of technology transfer.“

To wit, Europe is sucking wind when it comes to EV battery tech, with EU automakers heavily reliant on Beijing for these components.

The Chinese have already begun scaling up their presence in Europe, with companies such as BYD Co. investing in a plant in Hungary, and vowing to ramp up EV battery production across the continent.

One of China’s largest advanced battery makers, CATL, is planning to send 2,000 workers to build and staff a ($4.6 billion) battery plant in Spain in a joint venture with Stellantis.

Under the terms of the new proposal, foreign carmakers wanting to sell cars in the EU would have to locally source a specific amount of goods and services, while simplifying the permitting process for European companies.

Loading recommendations…