While Donald Trump has been warning about China’s mercenary, mercantilist trade practices for much of the past decade – ‘ripping us off’ and hollowing out the middle class – (and who facilitated that?), Europe and Latin America, who until recently were screaming loudly to anyone who bothered to listen just how great BFFs they are with Beijing, are finally getting a taste.

In the latest shock to millions of TDS afflicted so-called “economists” and “experts”, during a session on the global economy at the G

Overnight the world’s largest maker of EVs, China’s BYD (it surpassed Tesla last year) unleashed a price war nuke, cutting prices by up to 34%. Other Chinese automakers immediately followed. This will send a deflationary shockwave and spark major trade war escalation by Europe

— zerohedge (@zerohedge) May 27, 2025

7 summit in Kananaskis, Canada, EU Commission President Ursula von der Leyen admitted that, yes, “Donald is right” on China, as she slammed Beijing for disrupting global trade with subsidies to boost its own companies – accusing the CCP of “weaponizing” its leading position in the production and refinement of raw materials used for cars, batteries and wind turbines.

“On this point, Donald is right — there is a serious problem,” she said, encouraging Trump to join forces with US allies to address China’s trade imbalances, rather than punishing them with his own tariff scheme.

“When we focus our attention on tariffs between partners, it diverts our energy from the real challenge — one that threatens us all.”

She also slammed China for “undercutting intellectual property protections, massive subsidies with the aim to dominate global manufacturing and supply chains,” adding “This is not market competition — it is distortion with intent,” Politico reported, costing the liberal publication’s editors several years of life expectancy.

She then warned of “a new China shock,” accusing Beijing of flooding the world with cheap, state-subsidized products, and urged G7 nations to step up and combat its dominance in the raw materials sector.

In response, the G7 leaders created a draft statement in which they will pledge to implement a “G7 critical minerals action plan,” though it does not call out China by name – instead only mentioning “non-market policies and practices in the critical minerals sector.”

It’s not just Europe: as anyone who gets in bed with China, eventually learn there is a price.

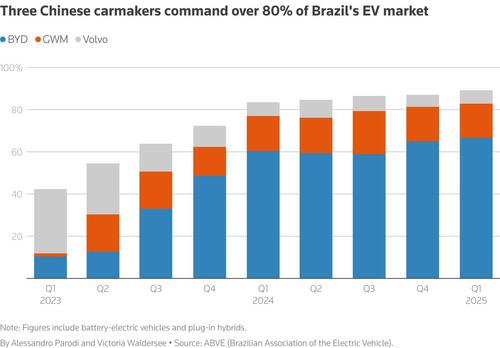

On Thursday, Reuters reported that Brazil is being flooded by cheap Chinese crap (in this case electric vehicles) offering Brazilian car shoppers ‘relatively low-priced options in a market where the green-car movement is still in its infancy.’ Of course, the dumping of Chinese products means death for domestic producers, and now, Brazilian auto-industry officials and labor leaders are terrified that the influx of cars from BYD and other Chinese carmakers will set back domestic auto production and hurt jobs.

BYD has deployed a growing fleet of cargo ships to accelerate its expansion overseas, with Brazil becoming its top target, according to Reuters analysis of shipping data and company statements. The late-May shipment was the fourth of the Chinese carmaker’s ships to dock in Brazil this year, totaling around 22,000 vehicles, according to Reuters calculations.

BYD, the world’s top producer of electric and plug-in hybrid cars, is the largest among several Chinese brands targeting Brazil for growth. China-built vehicle imports are expected to grow nearly 40% this year, to about 200,000, according to Brazil’s main auto association. That would account for roughly 8% of total light-vehicle registrations. -Reuters

In late May, a BYD ship docked at Itajaí for the fourth time this year, unloading a cargo that brings the company’s total Brazilian deliveries to an estimated 22,000 vehicles in 2024 alone. BYD has deployed a growing fleet of cargo vessels to support its aggressive global expansion, with Brazil now emerging as its top overseas market, according to shipping data and company statements analyzed by Reuters.

Chinese-built vehicle imports to Brazil are expected to rise nearly 40% this year to 200,000 units—roughly 8% of all light vehicle registrations—according to Brazil’s main auto association, ANFAVEA.

“Countries around the world started closing their doors to the Chinese, but Brazil didn’t,” said Aroaldo da Silva, a Mercedes-Benz worker and president of IndustriALL Brasil, a confederation of unions across six industrial sectors. “China made use of that.”

BYD’s intensified focus on Brazil comes as opportunities shrink elsewhere. Domestically, it faces a bruising price war, recently cutting its entry-level Seagull model to under $10,000, putting a strain on profit margins (as discussed in “China Auto Industry On Verge Of Collapse As Six Major Cities Run Out Of Car-Buying Subsidies“)

Abroad, Chinese automakers are hitting stiff new trade barriers: a 45.3% duty in Europe, a tariff of more than 100% in the U.S., and bans on Chinese software in vehicles.

Overnight the world’s largest maker of EVs, China’s BYD (it surpassed Tesla last year) unleashed a price war nuke, cutting prices by up to 34%. Other Chinese automakers immediately followed. This will send a deflationary shockwave and spark major trade war escalation by Europe

— zerohedge (@zerohedge) May 27, 2025

For years, Brazilian officials sought to balance green ambitions with industrial development. In 2015, tariffs on electric vehicles were eliminated to encourage EV adoption. But that policy shifted last year with the reintroduction of a 10% import tariff, set to rise gradually to 35% by 2026. Now, ANFAVEA and others are urging the government to accelerate the schedule.

“We support the arrival of new brands in Brazil to produce, promote the components sector, create jobs and bring new technologies,” ANFAVEA President Igor Calvet told Reuters. “But from the moment that an excess of imports causes lower investment in production in Brazil, that worries us.”

Brazil’s Ministry of Development, Industry and Foreign Trade said it is reviewing the request to fast-track the tariff increases. A ministry spokesperson defended the current timetable as one designed to allow companies to continue with their development plans and respect the maturity of manufacturing in the country.

In the meantime, Chinese automakers are racing to take advantage of remaining incentives. Under current policy, Brazil allows toll-free imports of up to $169 million worth of plug-in hybrids and $226 million for battery-electric vehicles through mid-2025—a loophole analysts say is driving a surge in front-loaded shipments.

In 2023, BYD announced plans to convert a former Ford plant in Bahia into a production hub, a move hailed by President Luiz Inácio Lula da Silva’s administration as a green industrial milestone. But progress has been slow. An investigation into labor violations at the site has pushed back the start of full production to December 2026, according to local officials.

Da Silva of IndustriALL said unions have not seen any signs that BYD is establishing local supplier contracts—typically underway 18 months before operations begin. “Even if the factory is here—what value is it really adding if the components, development, and technology is all from abroad?” he asked.

BYD did not respond to Reuters’ request for comment regarding its supply chain or production timeline.

Another Chinese automaker, Great Wall Motor (GWM), which purchased a former Mercedes-Benz plant in 2021, has also delayed its start. However, GWM now says it will begin production of its Haval H6 SUV next month and is actively negotiating with around 100 local suppliers.

“This year, imported cars will coexist alongside cars produced in Brazil,” said Ricardo Bastos, head of government relations for GWM Brazil and president of ABVE, the country’s electric vehicle association.

President Lula’s Workers Party government finds itself in a delicate position—caught between the need to protect jobs and the desire to promote clean technologies ahead of the COP30 global climate summit, which Brazil will host in November.

More than 80% of electric vehicle sales in Brazil come from China, according to ABVE. While the country is rich in minerals needed for battery production—like lithium—it lacks the infrastructure to build a full-scale EV supply chain.

Brazil has abundant mineral resources including lithium and other key ingredients to make EV batteries. But the infrastructure to produce all the necessary components for electric cars does not exist yet, said Ricardo Bastos, director of government relations at GWM Brazil and president of ABVE.

Until then, BYD and its rivals may continue to dominate Brazil’s green-car movement from across the Pacific, even as the long-promised benefits of local EV manufacturing remain out of reach for many Brazilian workers.

In short…

Loading…