Since the last FOMC meeting, on March 19th, a great deal has happened – Liberation Day, bond market crisis, stock market crash, a tariff pause, stock market surge, sentiment slump but labor market and hard data surged… and trump has demanded rate-cuts.

Gold has been a dramatic outperformer since March, stocks are rather shockingly unchanged-ish (after collapsing on Liberation Day), Treasury yields are higher, while crude has collapsed…

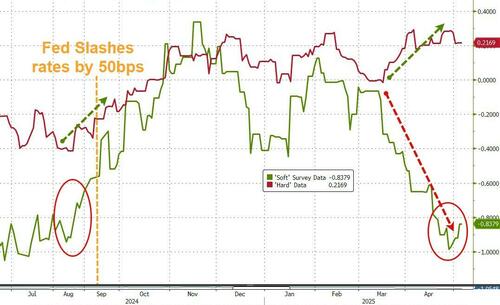

‘Soft’ data has collapsed since the last FOMC meeting while ‘hard’ data has improved…

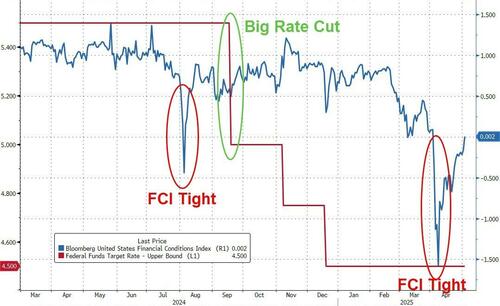

Should Powell be pre-emptively cutting... like he did when financial conditions tightened ahead of the election…

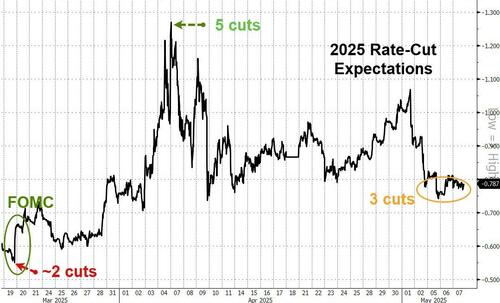

The market is expecting only 3 cuts this year now (up from 2 cuts before the last FOMC)…

…and nothing from The Fed today…

And that’s what they got…

- *FED HOLDS BENCHMARK RATE IN 4.25%-4.5% TARGET RANGE

But risks have risen on both sides – raising the spectre of stagflation:

- *FED: RISKS OF HIGHER UNEMPLOYMENT, HIGHER INFLATION HAVE RISEN

Uncertainty has risen:

- *FED SAYS UNCERTAINTY ABOUT OUTLOOK HAS ‘INCREASED FURTHER’

Read the full redline here…

And so all eyes and ears are now focus on what Powell says at the presser for Powell to explain the difference:

-

Sept 2024: weak soft data, tight financial conditions, August market crash, cut rates by 50bps

-

May 2025: weak soft data, tight financial conditions, April market crash, pause

Oh, one more difference: Sept 2024: Democrat President; May 2025: Trump President

Loading…