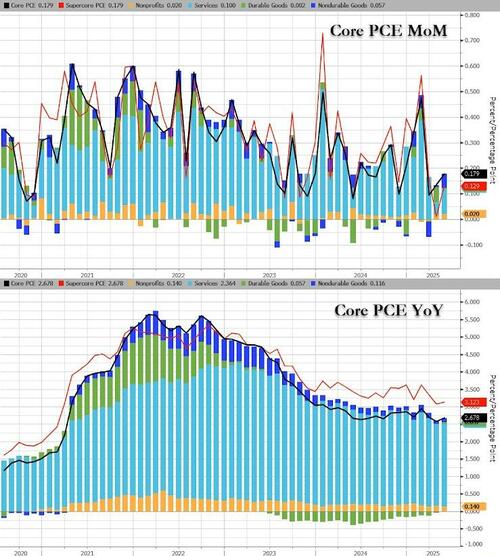

The Fed’s favorite inflation indicator – Core PCE – came in hotter than expected in May, rising 0.2% MoM (+0.1% MoM exp) and +2.7% YoY (+2.6% YoY exp)…

Source: Bloomberg

Not exactly the hyped-up inflationary surge the tariff fearmongers had hoped for as non-0durable goods price show modest increase MoM…

Source: Bloomberg

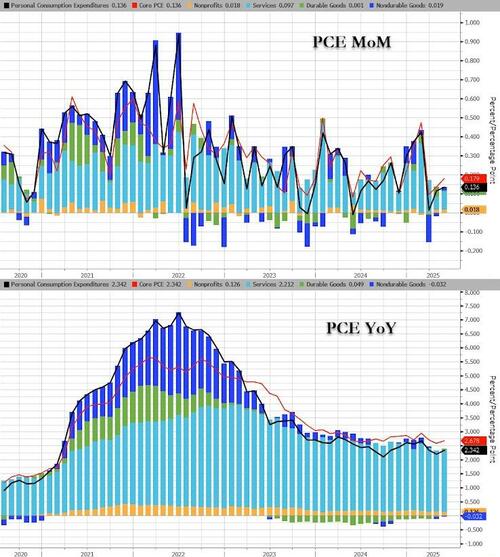

Headline PCE rose 0.1% MoM (as expected) and the YoY change ticked up to +2.3% YoY…

Source: Bloomberg

Non-durable goods flipped from deflationary to inflationary (modestly) in May…

Source: Bloomberg

SuperCore PCE inched higher on a YoY basis (from +3.07% to +3.12% YoY)…

Source: Bloomberg

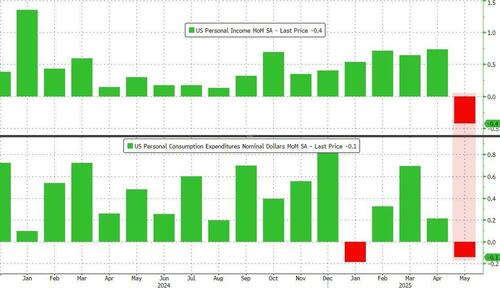

Both personal income and spending tumbled in May (the former by the most since Sept 2021)…

Source: Bloomberg

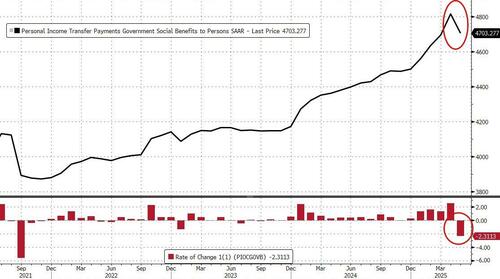

Income’s drop was due to a plunge in government handouts…

Source: Bloomberg

With the biggest drop in social security benefit handouts ever as DOGE killed all the payments to those ‘dead’ or extremely old people…

Source: Bloomberg

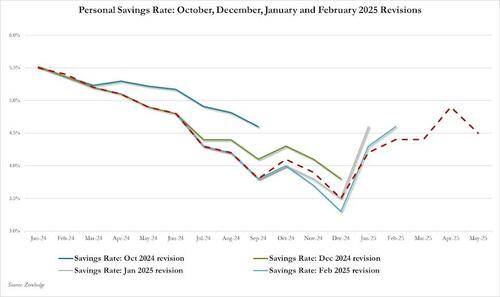

The savings rate dropped significantly to 4.5% of DPI…

Source: Bloomberg

Is there enough here to nudge The Fed towards a cut? Or do we keep waiting for the ‘lagged’ effect of tariffs to finally show up in prices?

This is the ‘transitory’ no inflationary impact period!

Loading…