Your credit score has long determined whether you can get a mortgage, car loan, or credit card. For decades, the FICO score dominated that decision. Created in 1956 by William Fair and Earl Isaac, it became the standard measure of a borrower’s risk and is used in about 90% of lending decisions in the U.S, according to the Wall Street Journal.

But WSJ writes that a recent $10 fee increase has sparked an open battle over control of this critical number. Fair Isaac Corp. depends on credit data from Equifax, Experian and TransUnion. Those three firms have spent years trying to weaken FICO’s power by promoting their own scoring model, VantageScore.

When Federal Housing Finance Agency chief Bill Pulte accused FICO of anticompetitive behavior and declared that VantageScore could be used in many mortgage approvals, tensions exploded. Pulte wrote, “FICO, and any other monopoly who has ripped off Americans for decades, should not be using improper efforts to threaten regulators.”

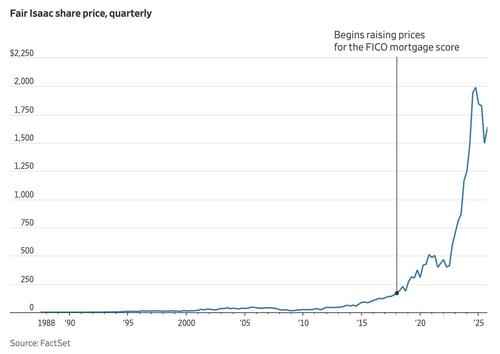

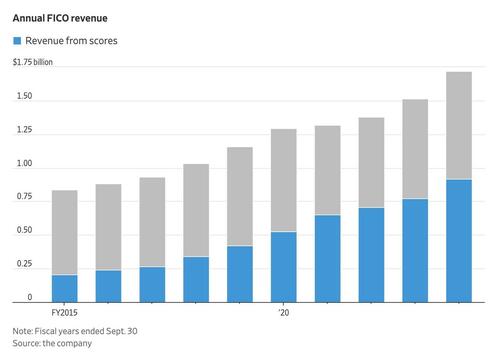

The relationship among the four companies has turned hostile. One longtime industry figure said what previously looked like a mutually beneficial partnership now appears closer to war. At FICO, CEO Will Lansing raised prices to reflect what he called the true value of their score. FICO’s mortgage-score fee climbed from just cents years ago to $4.95 in 2025 and is set to double to $10. Mortgage lenders complain the increases cut into already thin margins, especially when borrowers back out and lenders must absorb the fee.

Lansing argues that competition will motivate lenders to favor lenient scoring, warning that “choice encourages mortgage participants to shop for the most lax score” and creates a “race to the bottom.” He said, “The FICO score is the backbone of safety and soundness in the mortgage industry.” Meanwhile, the bureaus say VantageScore can evaluate millions of people who lack traditional credit histories and expand access to homeownership.

You know, the kind of people that probably shouldn’t own homes…

As pressure rose in Washington, lawmakers took interest. Sen. Josh Hawley said, “FICO has abused its government-granted market power.” FICO lobbied aggressively, while Pulte and his agency pushed for more competition.

To limit the bureaus’ influence, FICO changed strategy and enabled “tri-merge resellers” to generate scores using the company’s algorithm. That move cut out the bureaus and shifted profits toward FICO, driving its stock higher and theirs lower. In response, the bureaus began offering VantageScore for free on many loans.

The outcome will determine who controls access to credit in America and how much borrowers pay. What began as a small fee hike has escalated into a fight over the financial future of millions. Stay tuned…

Loading recommendations…