Authored by Chris MacIntosh via InternationalMan.cm,

Incoming…

Theft, that is.

Consider that the deindustrialisation of the communist union of Europe continues apace and with it the acceleration of the bankruptcy.

Of course, the blow dried TV robots won’t tell you this, but…

The next step in this process is asset seizure.

Remember when they first printed trillions and told us inflation was “transitory?”

Now, they’re taxing trillions and telling us taxes are transitory.

France just announced new tax hikes. Italy is raising capital gain taxes from 26% to 42%. The UK got rid of their “non-dom” rules essentially destroying tax incentives, and across the rest of Europe it’s plain wealth taxes.

Norway showed us how this will transpire. The muppets in power there raised wealth taxes to bring an additional $146 million in yearly tax revenue. Instead, individuals worth $54 billion left the country, leading to a loss of $594 million in yearly wealth tax revenue. A net decrease of $448 million.

Spain just recorded 1,000 fewer high-net-worth taxpayers. It was the first negative millionaire migration for the country since they imposed a wealth tax.

Thousands of millionaires are leaving while (coincidentally) tax pressure is at all-time highs.

Democracy is a joke. Who for example voted for higher taxes? Nobody of course, but the peasants will get them anyway.

In the UK, it’s the same story. Millionaires and billionaires are escaping as fast as they can.

Just in 2023, the UK lost around 12,500 high-net-worth individuals (HNWls). Another 9,500 more are expected to have left in 2024.

The proposed solution? An exit tax for citizens leaving the country.

Modern feudalism is already here in Europe.

I don’t want to sound like a broken record, but the next steps are all too obvious. We’ve had inflation, taxation, and next comes confiscation.

The first steps towards this have been taken. The requirement for all citizens to register all your assets in a central EU register to “help with financial transparency.”

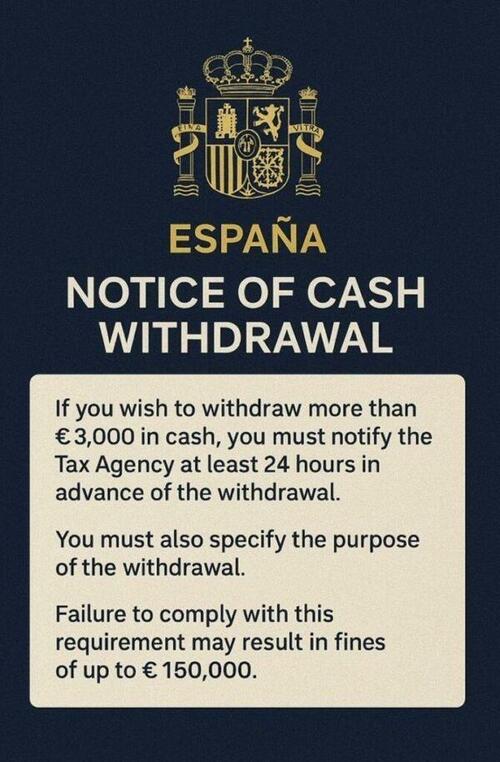

Eliminating cash is well underway.

Your bank accounts, shares, cars, real estate, precious metals, works of art, that old bottle of plonk that might be worth a few hundred bucks… and crypto, of course. Be a good little peasant and register it all to “fight money laundering.”

They’re going to seize it all. Watch!

This brings me to Bitcoin…

I haven’t spoken much about Bitcoin as it’s not in our portfolio. The reason is simple. Buying Bitcoin in your Interactive Brokers account means you’re losing the most critical value component of it: the ability to self custody. Buy Bitcoin and get it off exchanges. They can’t seize Bitcoin you self-custody.

What will they do instead? Probably revoke your passport, which is another excellent reason to get more than one.

* * *

As governments tighten the screws—through inflation, taxation, and looming asset registries—the game is changing fast. The old playbook no longer works. What we’re witnessing isn’t just policy—it’s a full-blown clash of systems. If you see the writing on the wall and want to position yourself before the next phase hits, don’t miss our latest special report: Clash of the Systems: Thoughts on Investing at a Unique Point in Time. This isn’t business as usual. It’s survival thinking. Click here to read it now.

Loading…