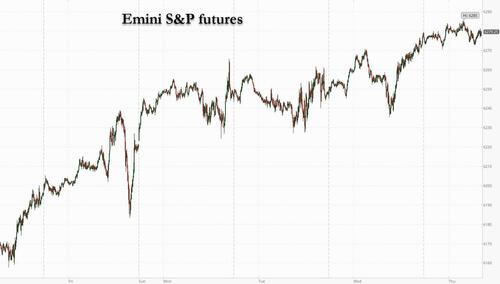

US equity futures are slightly higher with small caps outperforming into the payrolls report. As of 8:10am ET, S&P 500 futures are up 0.2% while Nasdaq 100 contracts were up 0.1%. The tax/budget bill appears likely to pass later this morning after a dramatic overnight session, so keep an eye on yields though any impact may be delayed until next week given the holiday. Payrolls are the key event of a trading day which finishes at 1 pm. Consensus has the print at 106K, while the whisper number is 96K and the Bloomberg Economics’ Nowcast model forecasts job gains of 119k, higher than consensus while Goldman expects a downbeat 85K number. Scenarios laid out by JPMorgan see the S&P as most likely to rise after the data, though a reading of less than 85k would lead to a 2% to 3% drop for the index. A poor number ( especially after the negative ADP jobs reading) would strengthen the case for a July rate cut and would add to pressure on Fed Chair Powell, who has repeatedly declined to say whether he will step down when his term as chair expires in May. European stocks are also little changed; Siemens is higher after saying the US has dropped its restrictions on software, used to design semis, exports to China, CDNS/SNPS are both up more than 6%. The Dollar is mixed but trading in tight ranges across G10: sterling is recovering this morning in tandem with GILT’s after the UK Prime Minister Starmer confirmed Chancellor Reeves has his backing yesterday, alleviate further fiscal uncertainty. US bond yields are lower reflecting heighten downside risk to NFP today; the 10Y at 4.26%. Commodities are higher led by ags, base/precious, and oil. Besides the jobs report, we also get the ISM services index for June, the weekly initial jobless claims, as well as the trade balance and factory orders for May

In premarket trading, Magnificent Seven stocks are mixed (Tesla, Meta +0.6%, Amazon +0.2%, Microsoft -0.03%, Alphabet -0.03%, Nvidia -0.06%, Apple -0.5%).

- ASML (ASML) falls 1.6% after a Nikkei Asia report that Samsung Electronics is delaying completion of a chip factory in Texas, as it struggles to find customers for the plant’s output.

- Datadog (DDOG) gains 9.6% as the company will replace Juniper Networks in the S&P 500, effective prior to the opening of trading on July 9.

- FedEx (FDX) climbs 1.2% after being double-upgraded at BNP Paribas Exane, with the broker saying the stock is “arguably oversold,” expecting the firm’s relative operational outperformance vs. rival UPS to continue.

- Synopsys (SNPS) gains 5% and Cadence Design (CDNS) rises 5% after the US lifted export license requirements for chip design software sales in China, clearing the way for the companies to resume services in the world’s second-biggest economy.

- Xponential Fitness (XPOF) soars 20% after saying that after cooperating with an SEC probe, the regulator concluded its investigation without action.

Markets will be laser focused on the latest US employment numbers this morning including NFP and the unemployment rate, keeping in mind we have a shortened NY trading session today going into a long weekend. Consensus expects nonfarm payrolls to rise +106k today and that unemployment rate will round up to 4.3% (full preview here). US stock trading is set to close at 1 p.m. New York time for the July 4 holiday, with bond dealing wrapping up an hour later.

Thursday’s cross-asset moves underscored cautious optimism as traders contend with areas of uncertainty ahead of the employment report that will help identify the path ahead for Federal Reserve interest rates. A weak report may boost Fed doves and support stocks near record highs, while stronger data could complicate the outlook.

“Markets might be getting ahead of themselves if we see a negative number,” said Susana Cruz, a strategist at Panmure Liberum. “Powell has been clear that any decision on rate cuts will depend on the data. But it is too early to assess that data, particularly inflation.”

Investors are also closely tracking the US fiscal situation, as House Republican leaders worked urgently to secure enough support for Trump’s massive tax and spending package, with the process moving toward a final vote. Concerns about mounting US deficits may weigh stronger on bond investors’ minds than the jobs report, said Frederique Carrier, head of investment strategy for RBC Wealth Management in the British Isles and Asia.

“It’s a structural deficit at a time of full employment,” Carrier said. “It doesn’t mean that a disaster is imminent, but it does mean that it’s something that the market at one point will deal with. There is definitely a lot of complacency.”

In Europe the Stoxx 50 is little changed. FTSE 100 outperforms peers, adding 0.5%, while FTSE MIB lags, dropping 0.3%. Consumer products, telecoms and travel are the worst performing sectors. Following yesterday’s “Truss-like” crash, Gilts rebounded, outperforming peers, after PM Starmer said Reeves will stay on as chancellor “for many years to come.” The UK 30-year yield drops 11 bps, close to erasing Wednesday’s surge. The pound is also the only G-10 currency that’s up versus the dollar this session. Here are the biggest movers Thursday:

- Siemens shares rise as much as 3% after the company said the US has lifted export license requirements for chip design software sales in China, allowing it to resume sales in the country

- Redcare Pharmacy shares rose as much as 7.8%, the most in almost three months, after the German online pharmacy reported preliminary second quarter revenue growth of 26%

- Currys shares rise as much as 9.8%, extending year-to-date gains, after results that analysts said point toward a change in emphasis toward growth

- Stolt-Nielsen shares climb as much as 6.7% after the bulk liquid transportation and logistics company delivered earnings above expectations in the second quarter, with its full-year target also running ahead of consensus, according to DNB Carnegie

- Virbac shares jumped as much as 7.4% after Oddo BHF upgraded its rating and price target for the French healthcare care group, expecting momentum to build in the second half of the year

- Grenke gains as much as 5.2%, climbing to the highest since mid-March, as Warburg says the German lease finance provider saw solid new business in the second quarter

- Pluxee rises as much as 9.4%, extending gains into a sixth day, after the employee benefit provider today maintained its targets for the full-year. The firm delivered third-quarter results that analysts view as generally in-line, or perhaps a small beat

- Novartis shares fall 1% as the Swiss pharma giant’s Cosentyx missed primary endpoint in a novel indication. As a result, Vontobel removes peak sales estimates of $150m for the drug

- Nordic Semiconductor falls as much as 4.3% after BofA Global Research cut its recommendation to underperform from buy, saying FY25/26E consensus revenue estimates are too high, given IoT/broad market weakness and low visibility

- Watches of Switzerland shares drop as much as 10%, the most in three months, after the company warned its margin could contract this year, which analysts at Shore said is disappointing following the recovery in profitability seen in FY25

Earlier in the session, A key Asian equity benchmark advanced, boosted by a rally in South Korean stocks and technology names in the region. The MSCI Asia Pacific Index rose as much as 0.4%, with Samsung Electronics, BHP Group and TSMC among the biggest contributors. South Korea’s Kospi Index closed at a near four-year high after its parliament passed an amendment to Commercial Act which aims to protect the rights of minority shareholders. Stock benchmarks also rose in Taiwan, India and Japan. Asian shares have traded sideways this week after rallying to a four-year high, as investors await the outcome of talks for various nations ahead of Donald Trump’s July 9 tariff deadline. An index of Chinese stocks listed in Hong Kong led decliners around the region. China’s services activity slipped more than forecast in June to reach a nine-month low, a worry for the economy as higher US tariffs threaten exports. Vietnam’s key equity gauge edged lower Thursday despite the announcement of a deal with the US overnight.

In FX, USD is trading mixed and within tight ranges across the G10 complex this morning ahead of NFP where we see clearer asymmetry for the Dollar in a weaker report today. GBP is leading gains across G10, trading +20bps higher, retracing some of yesterday’s losses on headlines confirming Rachel Reeves “will stay in her role for many years”. GBP vol is now coming off across the curve, but led by the front end with 1m now trading at 8.1vols, down from the highs of 8.75vols yesterday. JPY (-15bps vs USD) is underperforming this morning despite the move lower in US yields and headlines that BOJ member Takata confirmed that the bank is still looking to raise interest rates. Looking ahead towards the 8:30am NFP print, the market has priced in a 55bp gap in EUR, 50bp gap in AUD, and 60bp gap in JPY. Our trading desk see a clear market asymmetry to an NFP release sub 100k and any unemployment rate at or above a rounded 4.3%. In this scenario, we could see the market price increased odds of a Fed cut and send the Dollar to fresh lows. On the other hand, our research team notes that a stronger report should counter some of the recent Dollar weakness we’ve seen, although believe Dollar positioning is close to neutral levels, and in terms of the tariff narrative, think a stronger set of data could more easily be dismissed as a timing mismatch on the impact from tariffs

In rates, USTs are bull flattening this morning vs yesterday’s 3pm level, supported by bid & recovery in UK Gilts in early London trade. PMI data and supply from Spain and France had little market impact as focus shifts on OBBB going through the house and US NFP later this morning. Overnight was busy with UK rates retracing 10bps in the long end and parting yesterday’s sell off, flows on the desk were biased towards steepeners in USD rates and buying in front end spreads from RM. As mentioned above, following yesterday’s “Truss-like” crash, Gilts rebounded and are outperforming peers, after PM Starmer said Reeves will stay on as chancellor “for many years to come.” The UK 30-year yield drops 11 bps, close to erasing Wednesday’s surge.

In commodities, WTI trades within Wednesday’s range, falling 0.8% near $66.90. Spot gold falls roughly $7 to trade near $3,350/oz. Spot silver gains 1.2% near $37.

Looking at today’s calendar, we get the June jobs report at 8:30am New York time, where the median estimate for nonfarm payrolls increase is 106k; Bloomberg’s crowd-sourced whisper number is 97k.US economic data slate also includes weekly jobless claims and May trade balance (8:30am), June final S&P Global US services PMI (9:45am), June ISM services index and May factory orders (10am). Fed speaker slate includes Bostic at 11am, speaking on monetary policy in Frankfurt

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini +0.1%

- Russell 2000 mini +0.6%

- Stoxx Europe 600 +0.2%

- DAX little changed

- CAC 40 little changed

- 10-year Treasury yield -2 basis points at 4.26%

- VIX +0.1 points at 16.71

- Bloomberg Dollar Index little changed at 1189.55

- euro little changed at $1.1791

- WTI crude -0.9% at $66.87/barrel

Top Overnight News

- House Republicans overcame a key procedural hurdle to advance Donald Trump’s tax and spending bill. The final vote may come later in the morning in Washington, with Speaker Mike Johnson confident it’ll pass shortly. BBG

- Trump posted on Truth Social calling for Fed Chair Powell to “resign immediately” and linked an article regarding calls by Fannie Mac and Freddie Mac Chairman, Bill Pulte, who called on Congress to investigate Fed Chair Powell due to his political bias and deceptive Senate testimony, which is enough to be removed “for cause”.

- The United States has lifted restrictions on exports to China for chip design software developers and ethane producers, a further sign of de-escalating U.S.-Sino trade tensions including concessions from Beijing over rare earths. Siemens said it restored full access for Chinese customers, while Synopsys and Cadence said they’re in the process. RTRS, BBG

- A private gauge of China’s services sector activity expanded in June, but at a softer pace despite efforts by businesses to attract new customers. China’s Caixin services PMI for June came in below expectations at 50.6 (down from 51.1 in May and under the consensus estimate of 50.9). WSJ

- The BOJ should be ready to resume policy tightening if U.S. trade talks progress, policy board member Hajime Takata said, confirming that the bank is still looking to raise interest rates. WSJ

- Japan’s 30-year bond auction saw strong demand, with a bid-to-cover ratio of 3.58, the highest since February. BBG

- June Nonfarm payrolls are expected to rise by 106k in June, down from May’s 139K and below the three-month average of +135k.

- U.S. and India trade negotiators were pushing on Wednesday to try to land a tariff-reducing deal ahead of President Donald Trump’s July 9 negotiating deadline, but disagreements over U.S. dairy and agriculture remained unresolved, sources familiar with the talks said. BBG

- The Treasury is likely to meet its increased borrowing needs w/short-term bills rather than notes or bonds in an effort to remove upward pressure on yields at the long-end of the curve. BBG

- Trump said Jerome Powell should resign “immediately” after FHFA head Bill Pulte urged Congress to investigate the Fed chair, alleging his Senate testimony about the central bank’s planned renovations was “deceptive.” BBG

Reconciliation Bill

- US House Republicans have now opened the way for final bill vote; rule vote passes with 219-213.

- The Democrat leader in the House began his Magic Minute at around 10:00BST/05:00ET; expected to last for one hour. After this, speaker Johnson will take the floor and then the final vote can begin.

Trade/Tariffs

- Siemens (SIE GY) said the US rescinded curbs for the Co. related to chip design software sales to China, according to Bloomberg. Siemens later confirmed it has resumed sales and support to Chinese customers after it was recently notified by the US Commerce Department that export control restrictions on EDA software and technology to customers in China are no longer in place.

- South Korea’s President Lee said he cannot say if they can conclude US tariff talks by July 8th and the two sides are not really clear on what they want concerning tariff talks, while he added that US tariff negotiations are looking very difficult.

- Senior CCP official on US-China relations, says setting up barriers and thresholds will eventually harm both, says the US should recognise how much it has to gain from US-China cooperation.

- Vietnamese Foreign Minister says US and Vietnamese negotiating teams are coordinating to finalise the trade deal. Agreement creates expectation and hope for businesses. To continue boost exports and expand ties with other countries

A more detailed look at global markets courtesy of Newsquawk

APAC stocks failed to sustain the mostly constructive handover from Wall St counterparts with sentiment in the region cautious as participants braced for the key US jobs data and digested Chinese Caixin Services and Composite PMIs. ASX 200 marginally declined amid weakness in telecoms, financials and the consumer sectors, while trade data showed a monthly contraction in Australian exports. Nikkei 225 lacked conviction in the absence of tier-1 data from Japan and following mixed rhetoric from BoJ’s Takata, while US-Japan trade uncertainty lingered and trade negotiator Akazawa recently reiterated that an agreement which would hurt Japan’s national interests for the sake of timing should not be made. Hang Seng and Shanghai Comp were ultimately mixed following Chinese PMI data in which Caixin Services PMI missed expectations but Caixin Composite PMI accelerated and returned to expansionary territory.

Top Asian News

- BoJ’s Takata said the price stability target is close to being achieved and careful monitoring continues to be warranted, while he added that the BoJ should continue to further adjust the degree of monetary accommodation if it can confirm the positive corporate behaviour is being maintained. Takata also commented that given uncertainties regarding various US policies remain high, the BoJ should conduct monetary policy in a more flexible manner without being too pessimistic and to maintain momentum toward hitting its price target, the BoJ also needs to maintain its current accommodative monetary policy stance. Furthermore, his view is that the BoJ needs to support economic activity for the time being by maintaining its current accommodative monetary policy stance but at the same time, he believes the BoJ should gradually and cautiously shift gears in its monetary policy.

- PBoC has asked European financial institutions for advice on dealing with the effects of low interest rates, according to the FT.

- European Commission VP Kallas and Chinese Foreign Minister Wang reaffirmed EU’s commitment to engage constructively with China to address global challenges, while Kallas called on China to end distortive practices, including restrictions on rare earth exports, which pose significant risks to European companies and endanger the reliability of global supply chains. Kallas also highlighted the serious threat Chinese companies’ support for Russia’s war poses to European security.

- Japan Trade Union Rengo says final data shows avg. wage hike of 5.25% for fiscal 2025 (prev. 5.10% hike in 2024).

European bourses began the session with gains into a packed afternoon agenda; however, as session has progressed this strength has waned a touch and the picture is now more mixed. Euro Stoxx 50 -0.2%; FTSE 100 +0.3% outperforms after the pressure seen on Wednesday. Sectors primarily in the green at first, though as above the picture has turned to more of a mixed one. Retail outperforms led by the initial readthrough of US-Vietnam updates, though the higher-than-expected tariff levy has caused this to fade. Real Estate also strong given UK yields.

Top European News

- UK PM Starmer said Rachel Reeves will be the Chancellor for years to come and will be the Chancellor at the next election.

- ECB officials question whether the euro has strengthened too much as policymakers at the central bank fret that a surging currency increases the risk of inflation undershooting, according to FT

FX

- DXY is broadly flat intraday in typical pre-NFP trade. DXY just firmer in a 96.686 to 96.879 band, within yesterday’s 96.62-97.16 parameter. ING does not believe that the FX market has reached “peak bearishness” on the USD, despite widespread negative sentiment and forecasts

- G10s are contained, but generally softer, vs the USD. Antipodeans have at points been at the bottom of the pile, with the AUD hit by primarily weaker Australian trade data overnight and potentially focus on the US-Vietnam deal.

- EUR contained on either side of 1.1800 throughout the morning. Since, has come under some modest pressure and slipping towards lows of 1.1787, clear of yesterday’s 1.1746 base. Specifics light thus far, no move to Final PMIs. Awaiting US events.

- JPY and CHF mixed. USD/JPY lacked conviction overnight amid the flimsy risk appetite in the region, little move to a Rengo update for FY25; JPY under slight pressure but shy of 144.00. CHF a touch firmer after domestic inflation came in above market consensus, but roughly in-line with the SNB’s quarterly view.

- Sterling outperforms, bouncing as markets in the UK welcome PM Starmer backing Chancellor Reeves after the sell off seen after PMQs. GBP/USD currently resides in a 1.3624-1.3675 range, well within yesterday’s 1.3560-1.3752 parameter.

- PBoC set USD/CNY mid-point at 7.1523 vs exp. 7.1618 (Prev. 7.1546).

Fixed Income

- Gilts bounce as Starmer supports Reeves in extensive media rounds. Benchmark gapped higher by 23 ticks before extending further to a 92.74 peak. However, this still leaves it shy of Wednesday’s 93.41 peak and the WTD high above at 93.76. Amidst these moves, focus on yields as they recover from yesterday’s spike; 10yr down to 4.51% vs a 4.68% peak on Wednesday, 30yr to 5.30% vs 5.45%.

- USTs firmer, but only modestly so, into a frontloaded US agenda headlined by NFP (exp. 110k, prev. 139k). Thus far, the focus has been on the Reconciliation Bill; Rule vote passed, full vote expected in the next few hours, at this stage it should pass without too much issue. USTs in a slim sub-10 tick band, entirely within yesterday’s slightly more expansive 111-16+ to 111-30+ parameter.

- Bunds bid and firmer by just over 30 ticks at best. Picked up gradually throughout the European morning with newsflow light aside from modest revisions to Final PMIs, no reaction to the prints. Supply well received, but again no reaction. Awaiting direction from the above US events.

- Spain sells EUR 6.049bln vs exp. EUR 5.0-6.0bln 2.40% 2028, 3.15% 2035, 3.50% 2041 Bono & EUR 0.735bln vs exp. EUR 0.25-0.75bln 1.15% 2036 I/L

- France sells EUR 11.95bln vs exp. EUR 10-12bln 3.20% 2035, 3.60% 2042 & 3.75% 2056 OAT

Commodities

- Crude benchmarks are softer, despite limited newsflow. Bearishness potentially emanating from the lack of escalations regarding Iran, although a sixth round of US-Iranian negotiations is expected to be held in Oslo next week. More broadly, focus is beginning to turn to the weekend’s OPEC+ meeting, where a production increase is expected.

- WTI resides in a USD 66.65-67.50/bbl range while its Brent counterpart trades in a USD 68.32-69.00/bbl range.

- Precious metals generally firmer into data. XAU has pulled back from WTD bests, but remains bid overall. As high as USD 3365/oz, vs USD 3329/oz from June 23rd.

- Base metals mixed, given the cautious typical pre-NFP tone. 3M LME Copper topped USD 10k/t and has been trading on either side of the level since.

- UAE’s ADNOC restores most Murban crude oil supply for equity holders in July after earlier cuts.

US Event calendar

- 8:30 am: Jun Change in Nonfarm Payrolls, est. 106k, prior 139k

- 8:30 am: Jun Change in Private Payrolls, est. 100k, prior 140k

- 8:30 am: Jun Change in Manufact. Payrolls, est. -2k, prior -8k

- 8:30 am: Jun Unemployment Rate, est. 4.3%, prior 4.2%

- 8:30 am: Jun Average Hourly Earnings MoM, est. 0.3%, prior 0.4%

- 8:30 am: Jun Average Hourly Earnings YoY, est. 3.8%, prior 3.9%

- 8:30 am: Jun 28 Initial Jobless Claims, est. 240.5k, prior 236k

- 8:30 am: May Trade Balance, est. -71b, prior -61.62b

- 8:30 am: Jun 21 Continuing Claims, est. 1962k, prior 1974k

- 9:45 am: Jun F S&P Global U.S. Services PMI, est. 53.1, prior 53.1

- 9:45 am: Jun F S&P Global U.S. Composite PMI, est. 52.8, prior 52.8

- 10:00 am: Jun ISM Services Index, est. 50.6, prior 49.9

- 10:00 am: May Factory Orders, est. 8.15%, prior -3.7%

- 10:00 am: May F Durable Goods Orders, est. 16.4%, prior 16.4%

- 10:00 am: May F Durables Ex Transportation, est. 0.5%, prior 0.5%

- 10:00 am: May F Cap Goods Orders Nondef Ex Air, est. 1.65%, prior 1.7%

- 10:00 am: May F Cap Goods Ship Nondef Ex Air, est. 0.5%, prior 0.5%

DB’s Jim Reid concludes the overnight wrap

It’s been an eventful 24 hours in markets, with a bunch of competing narratives across different asset classes. On the bright side, the S&P 500 (+0.47%) hit a new record after the US reached a trade deal with Vietnam, which raised hopes they were about to announce multiple deals before the reciprocal tariff deadline on July 9. But in the latest twist of 2025, the UK became the centre of market attention again as investors zeroed in on their public finances again. So 10yr gilt yields (+15.8bps) saw their biggest daily jump since the Liberation Day turmoil in April, alongside a cross-asset slump that dragged down UK equities and the pound sterling as well.

In terms of those UK developments, the market nerves had already begun the previous day, as the government made a significant U-turn over cuts to welfare spending, which raised doubts about fiscal discipline. That was coming at a sensitive time, because they’d just made another U-turn last month over winter fuel payments.

That selloff gathered pace yesterday thanks to growing question marks around whether Chancellor of the Exchequer Rachel Reeves would remain in post. For markets, the logic is that Reeves has been a big defender of the fiscal rules, and there’ve been growing calls for these rules to be eased and for borrowing to go up. So the concern in bond markets is that a new Chancellor might trigger a fresh wave of borrowing that pushes rates up further. Earlier, Prime Minister Starmer refused to confirm whether Chancellor Reeves would stay in post, but much later he said to the BBC that she would remain chancellor “for many years to come” which seems to take away some of the short term pressure.

Looking forward, the immediate issue is that the government left a very narrow margin in March against their fiscal rules they set themselves. And since then, that margin has disappeared thanks to factors like the spending U-turns and the tariff announcements after Liberation Day. So unless we got a big burst of growth before the Budget, then the government would need to announce further tax rises or spending cuts if they still want to meet the fiscal rules. So this leaves them in a tricky position. On tax, they’ve ruled out raising several large taxes like income tax and VAT, and the tax rises already announced generated unpopularity. On spending, they’ve come under intense pressure in response to the spending reductions so far, which have resulted in U-turns. And if they eased the fiscal rules, the fear would be a fresh market selloff like yesterday. So it’s not obvious which way they turn. Our UK economist thinks tax hikes will bear the brunt of the heavy lifting on any fiscal consolidation, but given the controversy they generated back in the Autumn budget, it’s clearly a difficult situation.

This backdrop led to a heavy selloff among UK assets yesterday. Gilts were at the epicentre, with the 10yr yield (+15.8bps) up to 4.61%. That selloff was particularly clear at the long-end of the curve, and the 30yr yield (+19.1bps) saw an even bigger rise to 5.42%. Interestingly, the pound sterling slumped as well, which isn’t what normally happens when longer-term interest rates are rising, as that should make the currency more attractive, other things equal. So that was reminiscent of the market patterns seen after Liz Truss, and the pound fell -0.80% against the US Dollar, making it the worst-performing G10 currency yesterday. That spread to UK equities too, with the FTSE 100 (-0.12%) being the only major European index to lose ground. And notably, the FTSE 250, which is a more domestically-focused index, fell by -1.34%, which was its biggest daily decline since the Liberation Day turmoil in early April.

Whilst the UK was dominating attention, it wasn’t all bad news yesterday, and the S&P 500 (+0.47%) climbed to a new record as hopes mounted about potential trade deals. The main catalyst was Trump’s announcement of a deal with Vietnam, which he said would see them pay a 20% tariff on goods exported to the US, whilst the US would pay a zero tariff on their own exports. So that raised hopes about further announcements before the July 9 reciprocal tariff deadline next week. And some of the more trade-sensitive sectors did particularly well, with the Philadelphia Semiconductor index up +1.88% on the day and the S&P 500 Autos subsector was up +4.64%.

Looking forward, attention will remain on the US today, as the jobs report for June is coming out later on. This month it’s on a Thursday because of the Independence Day holiday tomorrow, and our US economists at DB expect nonfarm payrolls to come in at +100k. That’s a bit slower than recent months, with the 3-month average currently at +135k, but they point to higher initial jobless claims in the survey week, and a pattern of subdued summer payroll gains over the last couple of years. In turn, they think the unemployment rate will rise to 4.3%, although the risk is that it could round down.

Ahead of that reading, there was some nervousness about the US labour market yesterday, as the ADP’s report of private payrolls contracted by -33k in June (vs. +98k expected). That was the first negative print since March 2023, and it’s the 3rd month in a row that the ADP print has slowed, so it added to fears that the economy might be starting to show the signs of a slowdown after Liberation Day. Indeed, futures moved to price in marginally more rate cuts this year, with the amount expected by the December meeting up +0.5bps on the day to 65bps. But long-end Treasuries were more influenced by the global bond selloff and fiscal fears, with a decent steepening that took the 10yr yield (+3.5bps) up to 4.277%. They’ve rallied back around -1.2bps overnight.

While the White House continued to make progress on trade deals, President Trump’s tax bill seemed to hit a snag. House Republicans delayed a vote on Wednesday as some of the more fiscally conservative members took issue with the amount of spending the Senate’s amendments added to the bill. Speaker Johnson can only lose three votes on a bill that only passed 215-214 last month. President Trump’s self-imposed July 4th deadline would be in trouble if the House were to make significant changes that could cause the bill to be sent back to the Senate.

Elsewhere in Europe, the mood was a lot more positive outside the UK. In part, that came about thanks to optimism about the Vietnam trade deal, raising hopes that something might also be agreed between the EU and the US. So most indices put in a decent performance, including the DAX (+0.49%) and the CAC 40 (+0.99%), although the Europe-wide STOXX 600 (+0.18%) was dragged down by the UK’s weakness. Meanwhile for bond markets, the UK selloff didn’t help elsewhere, with yields on 10yr OATs (+7.0bps) and BTPs (+6.5bps) both rising. And for 10yr bunds there was a change in the specific bond used with a new 10yr auction, but the generic 10yr yield was up +9.0bps.

In Asia, markets are mixed. The Hang Seng is -0.96%, around its largest drop in two weeks, while the S&P/ASX 200 is also slightly lower at -0.13%. Meanwhile, the Nikkei is flat but the KOSPI (+0.95%) and the CSI (+0.47%) are up alongside US equity futures which are up around a tenth of a percent.

Early morning data indicated that the Chinese services sector expanded less than anticipated in June, as weak domestic and overseas demand significantly impacted new business activity. The Caixin services PMI fell to a 9-month low of 50.6 in June, below the expected 50.9 and down from the 51.1 recorded the previous month. This disappointing services PMI contrasts with the relatively positive manufacturing data released earlier in the week. Although official PMIs indicated a slowdown in manufacturing, the Caixin PMI data released yesterday suggested a rapid return to growth in the manufacturing sector.

In other news, Australia’s trade surplus sharply decreased to A$2.24 billion in May, compared to A$5.0 billion, marking its lowest level since November 2019, as weak global demand has adversely affected exports. This decline was primarily driven by a -2.7% month-on-month decrease in exports.

To the day ahead now, and US data releases include the jobs report for June, the ISM services index for June, the weekly initial jobless claims, as well as the trade balance and factory orders for May. Otherwise we’ll get the final services and composite PMIs for June in the US and Europe. From central banks, we’ll hear from the Fed’s Bostic, and the ECB will publish the account of their June meeting

Loading…