US equity futures and global stocks dropped, but were well off session lows, as a stream of negative tariff headlines and dialed-back expectations for interest-rate cuts prompted doubts about the market’s ability to sustain recent highs and sent 30Y yields above 5%, a level seen as a redline for further stock appreciation. As of 7:00am, the S&P 500 was on track for a second straight decline, with futures down 0.1% after , while Nasdaq futures were 0.3% lower after closing at a record; the small-caps Russell 2000 is seeing an early outperformance bid. Pre-mkt, Mag7/semis are mixed as are Cyclicals with Banks seeing an offer into the next batch of earnings. In Europe, the Stoxx 600 slipped 0.2%, weighed down by technology shares as ASML Holding NV trimmed its growth outlook for next year, citing trade tensions; French car giant Renault slumped 16% after slashing its profit guidance. Treasury yields are flat as is the USD. Commodities are mostly higher with Ags leading, precious metals following while energy is modestly weaker. Today’s macro data focus is the PPI data which will give more clues about how tariffs are affecting companies after mixed CPI numbers. We have another batch of Fedspeakers who will say nothing of importance.

In premarket trading, Mag 7 stocks are mixed (Apple +0.3%, Alphabet +0.2%, Meta +0.3%, Microsoft little changed, Tesla -0.4%, Amazon -0.5%, Nvidia -0.6%). Here are some other notable premarket movers:

- Crypto-linked stocks rose with Bitcoin prices in premarket trading Wednesday as President Donald Trump said the House will pass the GENIUS Act stablecoin bill on Wednesday after a procedural vote Tuesday failed (Among gainers Strategy +1.5%, Circle Internet Group +1.6%, Coinbase +0.8%, Galaxy Digital +4.1%, Hut 8 +2.3%, Hive Digital Technologies +0.7%, MARA Holdings +1.8%, Cleanspark +1.8%, Riot Platforms +2.1%, Cipher Mining +0.5%, Bitfarms +2.9%, Terawulf +1.6%, Bit Digital +6.4%, SharpLink Gaming +13%, and Bitdeer Technologies +2.6%).

- ASML ADRs (ASML) fall 8.4% after the chip equipment maker struck a more cautious tone about growth outlook next year.

- JB Hunt reported 2Q earnings that beat estimates, but flagged “higher professional driver wages and equipment-related costs.”

- Brighthouse Financial (BHF) is up 7.4% on light volume after the Wall Street Journal said Aquarian is in exclusive talks to buy the provider of annuities and life insurance, citing people familiar.

- Global Payments (GPN) is up 6.4%; activist investor Elliott Investment Management has amassed a sizable position in payments services company, according to a person with knowledge of the matter.

- Renault SA shares sank 16% after the automaker lowered its profitability outlook for the year and named company veteran Duncan Minto interim chief executive officer.

- Nvidia Corp. boss Jensen Huang anticipates getting the first batch of US licenses to export H20 AI chips to China soon.

- Barclays Plc was fined £42 million ($56 million) over failures to properly identify financial crime risks with two clients.

- Huawei Technologies Co. took the top spot in China’s smartphone market for the first time in more than four years.

Among trade headlines, Trump said he was likely to impose tariffs on pharmaceuticals as soon as the end of the month and that levies on chips could come soon as well. Traders further pared bets to their lowest level in a month for two Federal Reserve interest rate cuts this year on anticipation that tariff-related costs are increasingly being passed on to consumers (a continuation of a bet that has so far been dead wrong). Elsewhere, EU’s McGrath says a trade deal between the EU and US can be done by Aug. 1 and expects two weeks of “intense negotiations.” Meanwhile, UBS strategists said US equity investors are complacent in their view that tariffs are predominantly a negotiation tool. They put their S&P 500 year-end target of 5,300 – some 1000 lower than where the S&P is trading now – under review.

Traders trimmed expectations for Fed rate cuts after the CPI data, but the main Fed focus today is on who may replace Powell. Kevin Hassett is the early frontrunner, Bloomberg reported, with Kevin Warsh also in the top two. The Trump administration is also said to be finalizing an executive order that would pave the way for 401(k) retirement savings plans to invest in private equity.

After big bank earnings got off to an underwhelming start on Tuesday, investors will be looking at the next flurry of results with Bank of American Corp., Goldman Sachs and Morgan Stanley reporting today. “We have toned down our risk by a notch,” said Mohit Kumar, chief European strategist at Jefferies International. “However, technicals are still supportive and news flow of more deals being struck over the coming weeks should offset some of the negative trade rhetoric.”

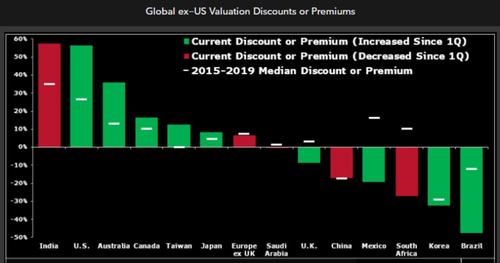

US stocks are back to near-historic premiums over global peers, but bargain hunters must also work harder to find options outside the world’s biggest market, according to Bloomberg Intelligence. The S&P 500 now trades at a 55% forward P/E premium to the Bloomberg Global ex-US Index, more than double the roughly 25% median from 2015-19.

Economic data due later Wednesday is expected to show a similar trend for producer goods. “The tariff inflation shock starts to hit,” wrote Robin Brooks, a senior fellow at the Brookings Institution and former chief currency strategist at Goldman Sachs Group Inc. “This effect will keep building in intensity as pre-tariff inventories are depleted.”

In Europe, the Stoxx 600 is down 0.2%, falling for a fourth straight session after some disappointing corporate updates from the region. Autos are leading declines as Renault shares fall 17% after the French carmaker issued a profit warning. Technology stocks also underperform as ASML shares fall 8% in Amsterdam after the CEO walked back the company’s growth forecast for next year due to trade disputes and global tensions. Equities have struggled to hit new highs in recent weeks amid lingering uncertainty around the US trade war. Among notable moves, Richemont rises on better-than-expected sales, defying a wider downturn for luxury goods. Renault shares tumble after a profit warning. Here are some of the more notable equity movers:

- Richemont shares rise as much as 2.4% after the Cartier-owner reported surging sales at its jewelry division despite a tough backdrop for the luxury goods industry.

- Partners Group climbs as much as 7.3%, after the Swiss private equity company delivers a beat on assets under management in the first half and reiterates its outlook for the full year.

- Barco shares surge as much as 17%, hitting the highest since April 2024, following the visualization specialist’s first-half Ebitda beat.

- ASML shares fall as much as 7.3%, the most in three months, after the chip equipment maker cautioned about growth next year.

- Renault shares fall as much as 17%, the steepest drop since March 2020, after the French carmaker issued a profit warning on Tuesday evening, lowering operating margin guidance for this year and also trimming its free cash flow expectations.

- AstraZeneca shares drop as much as 1.6%, after its experimental drug for a rare plasma cell disorder failed to delay death or reduce the number of hospitalizations for heart problems.

- Ontex shares plunge as much as 12%, after the maker of disposable personal hygiene products delivered quarterly results below expectations and cut its full-year earnings outlook.

- Bakkafrost falls as much as 14%, the most since July 2023, after the seafood group issued a profit warning.

- Nel falls as much as 8.1%, the most since May, after the hydrogen technology supplier reported a sharp fall in new orders in the second quarter. Citi said weak order intake is a continued concern.

- Fuchs shares plunge as much as 16%, the biggest drop since 2011, as the lubricant maker cut its annual guidance after second-quarter profit came in lower than expected.

- DNO shares drop as much as 8.1% after the oil producer said it has temporarily suspended operations at its Tawke license in the Kurdistan region of Iraq following three explosions early this morning.

- Svenska Handelsbanken declines as much as 8%, the worst performer on the Stoxx 600 Banks Index, after net interest income at the Nordic lender missed analysts estimates for the second quarter.

Earlier in the session, Asian stocks were mixed, as gains in Hong Kong and optimism over the tech sector were countered by dimming prospects for Federal Reserve easing. The MSCI Asia Pacific Index dipped 0.1%. Key gauges declined in Australia and South Korea, while shares rose in Taiwan as well as Hong Kong. TSMC and Alibaba climbed for a second day after news that the US would allow resumption of some AI chip shipments to China. The regional benchmark has traded sideways in July after a three-month rally. Broader sentiment took a hit Wednesday after US consumer price data indicated companies are beginning to pass through some tariff-related costs, with Fed Dallas President Lorie Logan saying. Hong Kong stocks advanced meanwhile, with the Hang Seng Index heading for its highest close since February 2022 on a rebound in risk appetite amid signs of easing US-China tensions. Still, upcoming Chinese corporate results are expected to show weak earnings growth.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The euro outperforms its G-10 peers slightly with a 0.2% gain. The pound fades post-CPI gains, trading flat versus the greenback just below $1.34.

In rates, Treasuries are steady ahead of more US inflation data later on Wednesday in the form of producer prices. US 10-year yields are flat at 4.48%. Japan’s super-long bonds rebounded following a sharp selloff earlier in the week, as investors weighed the potential for increased fiscal spending after this weekend’s upper house election. Gilts fall along the curve after UK inflation unexpectedly rose to its highest level since January 2024, prompting traders to trim bets on easing by the Bank of England this year. UK 10-year yields rise 3 bps to 4.65%. Bunds are little changed.

In commodities, spot gold rises $16 to around $3,340/oz. Bitcoin climbs 2% and back above $119,000. WTI falls 0.5% to near $66.20 a barrel.

Today’s US economic data slate includes June PPI and July New York Fed services business activity (8:30am) and June industrial production (9:15am). Fed speaker slate includes Barkin (8am), Hammack (9:15am), Barr (10am), Bostic (3:30pm) and Williams (6:30pm), and Fed releases Beige book at 2pm

Market Snapshot

- S&P 500 mini -0.1%

- Nasdaq 100 mini -0.3%

- Russell 2000 mini little changed

- Stoxx Europe 600 -0.1%

- DAX +0.2%

- CAC 40 little changed

- 10-year Treasury yield -1 basis point at 4.48%

- VIX unchanged at 17.38

- Bloomberg Dollar Index little changed at 1206.71

- euro +0.2% at $1.162

- WTI crude -0.3% at $66.32/barrel

Top Overnight News

- Trump said on Tuesday that Treasury Secretary Scott Bessent could be a candidate to replace Federal Reserve Chairman Jerome Powell, but suggested that might not happen. When asked if Powell’s renovation cost overrun were a fire able offense, Trump said “I think it sort of is.” RTRS

- President Donald Trump said he was likely to impose tariffs on pharmaceuticals as soon as the end of the month and that levies on semiconductors could come soon as well, suggesting that those import taxes could hit alongside broad “reciprocal” rates set for implementation on Aug. 1. BBG

- Kevin Hassett, one of President Donald Trump’s longest-serving economic aides, is the early frontrunner to replace Jerome Powell as Federal Reserve chief next year, followed by Kevin Warsh. BBG

- Trump is expected to sign an executive order in the coming days designed to help open up 401(k)s to private-market investments, according to WSJ.

- Senator Cassidy said President Trump is to sign Fentanyl Act into law on Wednesday.

- Defense Secretary Hegseth ordered the release of 2000 National Guard troops from the federal protection mission in LA.

- Japan’s super-long bonds rose, reversing course after a rout earlier in the week over concern that this weekend’s election will result in higher government spending. BBG

- Rio Tinto’s macro commentary on the Chinese economy – “industrial activity and net exports grew strongly during the quarter on the back of China’s highly competitive manufacturing sector. Trade diversification continued as the decline in exports to the US was more than offset by shipments to other regions. Retail sales growth was supported by ongoing stimulus measures while the government remains committed to infrastructure investment. However, headwinds such as trade tensions and a soft property market continue to pose challenges.”

- Indonesia’s central bank cut its policy rate by 25bp to 5.25% (analysts were split on the outcome of this meeting, with some anticipating a cut while others felt rates would stay unchanged). WSJ

- ASML (-7.3% in pre) walked back growth forecasts for next year due to the trade uncertainty, even as its second-quarter orders beat estimates. The stock slumped. BBG

- Inflation unexpectedly rose in the U.K., likely keeping policymakers at the BOE cautious despite a limping economy. Headline, core, and services CPI all were higher than anticipated. WSJ

- Taiwan, Switzerland and India, none of which received letters letters from Trump last week, are all potentially closing in on deals that could be announced in the coming weeks. Politico

- Fed’s Logan (2026 voter) said the base case is that monetary policy needs to hold tight for a while longer to bring inflation down and she wants to see low inflation continue longer to be convinced, while she added that June CPI data suggests PCE inflation, which the Fed targets at 2%, will rise. Logan also commented that softer inflation and a weakening labor market could call for lower rates fairly soon and under the base case, the Fed can sustain maximum employment even with modestly restrictive policy.

Trade/Tariffs

- US President Trump they are working on five to six trade deals and there will probably be two to three deals by August 1st.

- US President Trump said pharma tariffs will probably begin at month-end and initial tariffs on pharmaceuticals will be low, while Trump also said they will release tariff letters for smaller countries soon and will probably set one tariff for all of them over 10%.

- US President Trump said a great deal for everybody was just made with Indonesia with Indonesia to pay 19%, while the US will pay nothing and similar deals are in the works. Trump later posted that “Indonesia has committed to purchasing $15 Billion Dollars in U.S. Energy, $4.5 Billion Dollars in American Agricultural Products, and 50 Boeing Jets, many of them 777’s.”

- US Trade Representative announced the initiation of a Section 301 investigation of Brazil’s unfair trading practices.

- China’s Commerce Ministry said China and Australia signed a memorandum of understanding on the implementation and review of the China-Australia Free Trade Agreement.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued following the lacklustre handover from Wall St owing to an acceleration in US CPI data, while trade uncertainty lingered after President Trump suggested pharma tariffs could begin at month-end and tariff letters for smaller countries could be sent out soon. ASX 200 retreated with nearly all sectors in the red aside from tech and with miners not helped by the indecisive performance in Rio Tinto following its quarterly operations update in which it registered higher iron ore production but a decline in shipments Y/Y. Nikkei 225 traded indecisively in which the index swung between gains and losses amid the lack of pertinent drivers for Japan and some political concerns ahead of Sunday’s upper house election as a recent poll showed the ruling bloc was at risk of losing its majority. Hang Seng and Shanghai Comp were mixed in the absence of any major fresh pertinent macro drivers and despite comments from China’s Vice Premier He Lifeng who stated that China is accelerating the construction of a modern industrial system and is stepping up efforts to boost consumption.

Top Asian News

- China’s Vice Premier He Lifeng said China is accelerating the construction of a modern industrial system and its industrial upgrading providing support to global industrial and supply chain operations, while He added China is stepping up efforts to boost consumption.

- Japan’s ruling coalition risks losing a majority at the upper house election, according to Nikkei.

European bourses opened mixed/mostly lower, but have traded with an upward bias throughout the European morning, to show a mixed picture. European sectors are mixed, with underperformance in Autos, dragged lower by post-earning losses in Renault (-16.4%) after it cut guidance; Stellantis (-4%) also moves lower after it halted its hydrogen fuel cell technology development programme. Tech has also been pressured by ASML (-8.7%) after its Q2 results; the Co. reported better-than-expected headline metrics, but guidance was light and the CEO said they cannot confirm growth in 2026.

Top European News

- BoE Governor Bailey said multilateral institutions are essential for good policymaking and they are following financial stability risks closely, while he noted countries with big deficits typically come under most financial market pressure and he is yet to be convinced about the need for a retail CBDC.

European earnings

- ASML -8.7%: Lowered Q3 rev., margin outlook, does not confirm 2026 growth target.

- Renault -16.2%: Provided dreary FY guidance, stressed poor retail market.

- Rio Tinto +1.2%: Pilbara iron ore output rise, copper production exp. at top of FY guidance.

- Richemont +0.5%: Q1 sales at constant FX rise.

- Sandvik -0.9%: mixed results, noted of strong momentum noted in mining, highest order intake ever in Q2

FX

- The dollar is giving back some of Tuesday’s gains seen in the aftermath of US CPI data. Further inflation data is due today with Y/Y PPI expected to decline to 2.5% from 2.6%, M/M is expected to pick up to 0.2% from 0.1%. Once released, markets will be able to cement calls for the upcoming PCE report (the Fed’s preferred inflation gauge). Today’s Fed docket is a busy one with Barkin, Barr, Cook, Hammack, Logan, Kugler & Williams all due on deck. Note, the Fed Beige Book at 19:00BST will be parsed for the impact of Trump’s tariff regime at a regional level. DXY sits towards the top end of Tuesday’s 97.97-98.69 range.

- EUR is attempting to atone for Tuesdays’ losses, which saw EUR/USD slip onto a 1.15 handle for the first time since 25th June. French politics moved back into focus yesterday after PM Bayrou unveiled his plans to bolster France’s finances. His outline was subsequently met with threats of no confidence from the hard left and far right. EUR/USD sits towards the bottom end of Tuesday’s 1.1593-1.1692 range.

- JPY flat vs. the USD after a recent run of losses, which have lifted USD/JPY from the low seen on July 1st at 142.68 to a multi-month high today at 149.18. The main drivers for the move have been a broad pick-up in the USD and angst over the lack of trade progress between Japan and the US. The next upside level for USD/JPY comes via the 3rd April high at 149.33.

- GBP has seen some mild support in the wake of hotter-than-expected UK inflation metrics. Y/Y CPI unexpectedly advanced to 3.6% from 3.4% (exp. 3.4%) and the services metric held steady at 4.7% vs. expectations of a decline to 4.6%. Nonetheless, markets still expect the BoE to cut rates next month, but US Jobs data will be in focus on Thursday. Whilst Cable did briefly make its way back onto a 1.34 handle with a session high at 1.3416, the upside was limited by the aforementioned stagflationary outlook facing the UK.

- Antipodeans are slightly mixed vs. the USD with no obvious driver for the mild discrepancy. Newsflow surrounding both currencies remains light as markets await tomorrow’s Australian jobs report.

- PBoC set USD/CNY mid-point at 7.1526 vs exp. 7.1914 (Prev. 7.1498)

Fixed Income

- USTs are incrementally firmer/flat (whilst global peers are broadly lower). Currently in a in a very thin 110-08+ to 111-13+ band, awaiting PPI, Industrial Production and Fed speak. PPI will be scoured to see if the series’ internals are evident of tariff-driven price pressures emerging; a slew of Fed speakers are also due.

- Bunds are modestly lower today, but well off lows in a 129.19-56 band, matching Tuesday’s trough ahead of the 129.12 low from last Friday. The main event today for the bloc is the EU Multiannual Financial Framework (MFF) presentation, i.e. the bloc’s budget for the next seven years. As it stands, Commission President von der Leyen is scheduled to unveil it at 16:00BST.

- OATs are trading broadly in-line with peers, down by a handful of ticks. In French politics, PM Bayrou’s plan to save EUR 43.8bln from the budget in 2026 in order to get the debt-to-GDP ratio down, in-line with existing commitments/targets. The proposal has already drawn criticism from various political parties, unsurprisingly National Rally (RN) has said they will move to censure Bayrou if he does not change his plans.

- Gilts are underperforming, opened lower by 19 ticks and then slipped another 21 in short order to a 91.17 base. Notching a new WTD low and taking Gilts back to 91.16 from the first week of June. If breached, then we look to 90.11 from May as the next major point of support. Pressure emerged on the morning’s June inflation. A hotter-than-expected series, driven by motor fuel prices. While hotter, the series has only sparked a relatively modest move in BoE pricing with c. 1bps of implied easing removed from August and only around 3bps by end-2025.

- UK DMO sells GBP 1.5bln 4.5% 2034 Gilt: b/c 3.32x, average yield 4.553%, tail 0.4bps.

- Germany sells EUR 1.129bln vs exp. EUR 1.5bln 2.90% 2056 and EUR 0.8bln vs exp. EUR 1.0bln 1.25% 2048 Bunds

Commodities

- WTI and Brent are currently incrementally lower, and have held a negative bias throughout the European morning. Brent Sept’25 has traded in a very tight USD 68.46-69.09/bbl range, and ultimately awaiting US PPI.

- Precious metals are mixed with Palladium a little lower whilst spot Gold and Silver post modest gains. Newsflow has been relatively light today and Dollar price-action has been muted. The yellow-metal is seemingly attempting to pare back losses seen in the prior session. XAU/USD currently trades in a USD 3,325.21-3,342.49/oz range, with the low for today incrementally above its 50 DMA (3,323.42)

- Base metals are broadly lower continuing the downbeat mood seen overnight, in-fitting with the broader risk tone across the equities complex. 3M LME Copper currently trades towards the lower end of a USD 9,613.1-9,663/t range.

- US Private Sector Inventory data showed (bbls) crude +0.8mln (exp. -0.6mln), gasoline +1.9mln (-1.0mln), distillate +0.8mln (+0.2mln), according to Reuters citing sources.

- Gulf Keystone Petroleum has temporarily shut in production at the Shaikan field (capacity approx. 55k BPD) following reports over the past two days of explosions at several nearby oil fields.

Geopolitics: Middle East

- US President Trump’s administration asked Israel to stop its strikes on Syrian military forces in the south of the country, while Israel promised that it would cease the attacks on Tuesday evening, according to a US official cited by Axios.

- US President Trump is to meet with the Qatari PM today to discuss negotiations over Gaza’s ceasefire deal and are expected to discuss efforts to resume negotiations between the US and Iran to reach a new nuclear agreement, according to Axios.

- US, France and Germany agreed that Iran faces stiff sanctions if there is no deal by the end of August, according to Axios.

- Foreign tanker reportedly seized by Iran for ‘smuggling’ 2mln litres of fuel, according to SNN.

- Iranian Parliament issues statement saying negotiations with US cannot begin until preconditions are met, according to ISNA

Geopolitics: Ukraine

- US President Trump said weapons are already being shipped to Ukraine and NATO will pay them back for everything and won’t have boots on the ground, while he added that Iran wants to talk but he is in no rush to talk with Iran.

- Russia’s Kremlin says subject of weapon supplies to Ukraine is high on agenda, via Ifax; phone call with US President Trump not planned but can be organised quickly, via Tass.

US Event Calendar

- 7:00 am: Jul 11 MBA Mortgage Applications, prior 9.4%

- 8:30 am: Jun PPI Final Demand MoM, est. 0.2%, prior 0.1%

- 8:30 am: Jun PPI Ex Food and Energy MoM, est. 0.2%, prior 0.1%

- 8:30 am: Jun PPI Final Demand YoY, est. 2.5%, prior 2.6%

- 8:30 am: Jun PPI Ex Food and Energy YoY, est. 2.7%, prior 3%

- 9:15 am: Jun Industrial Production MoM, est. 0.1%, prior -0.2%

- 9:15 am: Jun Capacity Utilization, est. 77.4%, prior 77.4%

Central Banks

- 8:00 am: Fed’s Barkin Gives Speech in Westminister, MD

- 9:15 am: Fed’s Hammack Speaks on Community Development

- 10:00 am: Fed’s Barr Speaks on Financial Regulation

- 2:00 pm: Fed Releases Beige Book

- 3:30 pm: Fed’s Bostic Appears on Fox Business Network

- 6:30 pm: Fed’s Williams Speaks on Economic Outlook, Policy

DB’s Jim Reid concludes the overnight wrap

Morning from Berlin. I was at an important dinner last night in this beautiful city and got a phone call from my wife. I said I was at a work dinner and could I call her back later. Before I could finish she said. “It’s an emergency. I have five nine-year-old girls over for a sleepover specifically to see the new Zombies 4 film just released. They’ve all been waiting three years for this day (since Zombies 3) and I can’t get into our Disney+ account. Do you know the password?” I had to make my excuses to leave the table and go through my phone to desperately try to find it. Thankfully I did and the world could move on.

Meanwhile, markets have struggled to move on from the debate as to how inflationary the US tariff policy will be with yesterday’s US CPI providing something for everyone on this topic. On the one hand, the core CPI print was below expectations for a 5th consecutive month, and the S&P 500 even moved up to an intraday record at the open. But as investors digested the print and focused on the more obvious tariff impacts in the various components, Treasuries extended their decline and the 30yr yield (+4.3bps) moved back above the 5% mark again (closing at 5.02%). It’s previously closed above 5% for only 9 days since 2007. 6 days were during the issuance- and Fed-driven Treasury sell-off in autumn 2023, and 3 days were back in May this year after the Moody’s downgrade and amid increased focus on the implications of the Republican budget bill that was passing through the House.

In terms of the details of the print, monthly CPI came in at +0.29% in June (vs. +0.3% expected), which was a 5-month high but broadly in line with expectations. Moreover, the core CPI measure was a comparatively softer +0.23% (vs. +0.3% expected), which eased fears that this month would see a big jump thanks to the tariffs. However, there were some concerning signs under the surface, and household appliances (+1.9%) saw their biggest monthly price jump in records back to 1999. And if you looked at core goods (excluding used cars and trucks) there was a decent +0.32% monthly gain that was the strongest since February 2023. So the fear is that as the tariff impact is more fully felt (with plenty more in the pipeline), those increases could become more widespread across the consumer basket. Indeed, those concerns were clear in market pricing too, and the 2yr US inflation swap (+2.0bps) moved up to a fresh two-year high of 2.97%. Watch out for PPI today and importantly the usual read through to those categories that directly feed into core PCE. Our economists are tracking +0.30% for the PPI print after yesterday’s data (see their CPI reaction note for more).

That growing pessimism on inflation meant investors dialled back their expectations for rate cuts this year. They are now pricing in a rate cut by September as only a 58% probability, down from 65% the day before. And for the year as a whole, investors now see just 44bps of rate cuts by the December meeting, down from 48bps the day before. That said, there was another round of calls for rate cuts from President Trump, who posted afterwards that the “Fed should cut Rates by 3 Points. Very Low Inflation. One Trillion Dollars a year would be saved!!!” But there was no such urgency in the limited Fedspeak following the CPI print, with Boston Fed President Collins saying that “an ‘actively patient’ approach to monetary policy remains appropriate”. And for markets, the prospect of fewer rate cuts and more inflation helped to push Treasury yields higher across the curve. So the 2yr yield (+4.1bps) was up to 3.94%, the 10yr yield (+4.8bps) hit a one-month high of 4.48%, and the 30yr yield (+4.3bps) closed above 5% for the first time since May 23rd, at 5.02%.

The hawkish implications from the CPI print meant that most equities struggled. The S&P 500 fell by -0.40% in a very broad-based decline that saw 453 stocks lose ground, which was the largest number of decliners in eight weeks. Indeed, the only S&P sector to advance was information technology (+1.27%), which was led by a +4.04% gain for Nvidia, as the chipmaker reached a new all-time high after news the previous evening that it would resume AI chip deliveries to China. The boost for tech stocks meant that the NASDAQ (+0.18%) hit another all-time high, having now surged by +35.4% since its closing low just after Liberation Day. By contrast, banks were among the underperformers after earnings from several US financials, with the KBW Bank Index falling -2.42%. Wells Fargo (-5.48%) and BlackRock (-5.88%) saw sizeable slumps after missing estimates, with JPMorgan (-0.74%) falling back more modestly after their release. On the other hand, Citigroup (+3.68%) rose to its highest since 2008 after beating revenue estimates and announcing increased stock buybacks. S&P 500 and NASDAQ 100 futures are both down by -0.15% this morning.

Elsewhere, the tariff deadline on August 1 remains in focus, although it’s clear that markets aren’t pricing in a full bounceback in the tariffs yet, with the expectation that further trade deals or delays will avoid that outcome. Speaking of which, Trump announced yesterday that he had reached a deal with Indonesia. This will see goods from Indonesia facing US tariffs of 19%, above the 10% interim tariff over the past three months but clearly below the 32% the country faced under the initial Liberation Day tariffs on April 2. Trump later posted that Indonesia also agreed to buy $15bn in US energy, $4.5bn of agricultural products and 50 Boeing jets. Boeing’s shares briefly rallied on the news but were back in the red (-0.22%) by the close. Trump also added that “Transshipment from a higher Tariff Country” via Indonesia would face additional tariffs.

Asian equity markets are mostly lower with the S&P/ASX 200 (-0.92%) leading the way after nearing record highs earlier this week. Additionally, the KOSPI (-0.86%), the CSI (-0.33%) and the Shanghai Composite (-0.13%) are also lower. The Hang Seng (+0.28%) is bucking the regional trend, continuing its strong gains from the previous session, buoyed by NVIDIA’s announcement that it will be resuming H20 AI chip sales to China. The Nikkei (+0.55%) is being helped by a Yen at its weakest since April and a JGB rally at the long-end with 30 and 40yr yields -3bps and -8bps, respectively, after yesterday’s slump. 10yr JGBs are +1.5bps, likely catching up with yesterday’s global sell-off that saw the 10yr yield hit its highest intraday level since 2008, and the 30yr yield move to its highest intraday level since that maturity was first issued in 1999. I wrote about this more in my chart of the day yesterday (link here ), and our FX strategists also have a new podcast on the political and policy choices facing Japan and the market impact on the yen. You can listen to it on Spotify here or the DB Research website here. It’s a timely discussion before the Upper House election on Sunday.

Back in Europe, the tone was more downbeat yesterday, with equities losing ground across the continent. That included a 3rd consecutive decline for the STOXX 600 (-0.37%), and a 4th consecutive decline for the DAX (-0.42%). However, sovereign bond yields did move off their highs from the previous day, with those on 10yr bunds (-1.7bps), OATs (-2.6bps) and BTPs (-2.0bps) all moving lower. That outperformance for OATs came as French PM Bayrou proposed some €44bn of measures to reduce the deficit, including ending two public holidays on Easter Monday and VE Day. The leader of the National Rally party Marine Le Pen has threatened to bring down the government unless Bayrou rows back the proposed measures. Meanwhile, in the UK gilts lost further ground, with the 10yr yield up +2.4bps, whilst the 30yr yield (+2.9bps) moved up to its highest since late May, at 5.46%.

There wasn’t much other data yesterday, with Canada’s CPI rising as expected to +1.9% in June. However, the CPI-median measure followed by the Bank of Canada ticked up to +3.1% (vs. +3.0% expected), which led investors to push back the timing of the next rate cut, whilst 10yr government bond yields rose +8.4bps on the day. Meanwhile in Germany, the ZEW survey rose more than expected in July, with the expectations component up to a three-year high of 52.7 (vs. 50.4 expected).

To the day ahead now, and US data releases include the PPI reading for June, along with industrial production and capacity utilisation. In the UK, there’s also the CPI print for June. From central banks, we’ll hear from the Fed’s Barkin, Hammack, Barr and Williams, and the Fed will release their Beige Book. The European Commission will also be releasing its proposal for the next 7-year EU budget running from 2028 to 2034 (see our economists’ preview here). Finally, earnings releases include Bank of America, Morgan Stanley, Goldman Sachs and United Airlines.

Loading…