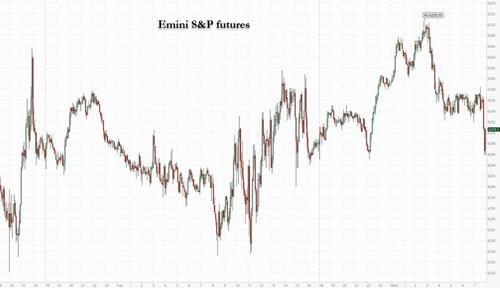

US equity futures are flat, after trading in a narrow overnight range, with small caps outperforming as we see more signs of a Value rotation as H2 kicks off and after yesterday’s dramatic momentum plunge. As of 8:00am ET, S&P futures are fractionally in the red, reversing an earlier 0.3% gain as President Donald Trump’s July 9 tariff deadline gets ever closer — Trump said on Tuesday he won’t delay the date for imposing higher levies on trading partners; Nasdaq futures drop 0.1% with Mag7 names mixed in premarket trading. Futures for the small-cap Russell 2000 rose 0.9% to outperform as Tuesday’s rotation out of high-momentum stocks extended, which helped Cyclicals led by Financials continue to outperform. European equities advanced 0.4%. Bond yields are higher as the curve bear steepens and USD catches a bid which accelerates as US traders walk in. Commodities are rallying across all 3 complexes, with Brent trading back over $68. Yesterday, stocks fell into the bell on Trump comments about not extending the July 9 deadline and possibly not reaching a deal with Japan but recovered their initial losses. Today’s macro data focus is on ADP though it has not been a reliable predictor of NFP.

In premarket trading,Apple climbs 0.7% following an upgrade at Jefferies (from Sell to Hold) while Tesla (TSLA) rises 0.8% as the company saw its first increase in vehicle deliveries from its Shanghai factory this year. The rest of the Mag 7 is mixed (Amazon -0.2%, Meta -0.1%, Alphabet -0.9%, Nvidia -0.6%, Microsoft -0.2%). Here are some other notable movers:

- BrightView (BV) declines 8% after the commercial landscaping company cut its revenue guidance for the full year.

- Cava Group Inc. (CAVA) inches 2% higher after KeyBanc initiated coverage of the Mediterranean restaurant chain with a recommendation of overweight as it sees growth opportunities.

- Centene Corp. (CNC) tumbles 27% after the health insurer pulled its 2025 guidance, citing insurance market trends that veered from its assumptions and threaten $1.8 billion in revenue.

- Crocs (CROX) slips 1% after Goldman Sachs started coverage of the footwear company with a sell rating.

- Oscar Health (OSCR) falls 10% as Barclays initiates coverage at underweight, with the broker saying the stock presents assymetric downside risk after shares gained more than 50% in June alone on “speculative retail interest” despite elevated policy risks. Shares are also being hurt after peer Centene withdrew its 2025 guidance.

- Verint Systems (VRNT) gains 9% after Bloomberg News reported that the call-center software maker is in talks with buyout firm Thoma Bravo to acquire the company, according to people familiar, who also said there is no certainty the parties will reach an agreement.

The stocks of US banks including JPMorgan, Goldman and Bank of America all rose in premarket trading after boosting their dividends. Wall Street’s largest lenders passed this year’s Federal Reserve stress test, with regulators softening some requirements set in previous years.

As the US continues talks with key trading partners, Trump has turned up pressure on Japan and reaffirmed he won’t delay his tariff deadline, now just a week away. While markets swung wildly on trade headlines in April, equity indexes are now signaling diminished concern with stocks near record highs. The following comment helps explain why: Trump’s warning to Japan “is a non-event,” said Karen Georges, equity fund manager at Ecofi in Paris. “The next two possible catalysts for the markets will be the jobless claims and the deadline for tariff negotiations.”

Elsewhere, data so far this week has affirmed the resilience of the US economy in the face of Trump’s tariff agenda. Wednesday’s ADP Research employment numbers and tomorrow’s non-farm payrolls will offer investors additional insight into the labor market and the likely path of interest rates.

In Europe, the Stoxx 600 rises 0.4%, set for its first gain this week, with mining, bank and energy shares leading the advance. Here are the biggest European movers:

- Santander rises as much as 2.8% after agreeing agreed to buy Banco Sabadell SA’s UK unit for £2.65 billion ($3.64 billion).

- Spectris shares rise as much as 5.3%, trading higher than the value of an agreed offer from KKR, buoyed by the prospect of a bidding war for the company.

- Tate & Lyle shares rise as much as 4.3% after the ingredients company outlined a “clear picture for future growth” at its capital markets event in London on Tuesday, according to analysts at Goodbody.

- Avanza gains as much as 15%, after newspaper Dagens Industri reported its biggest shareholder Sven Hagstromer’s family is in talks with a private equity firm to take the comapny private.

- Alfen shares rose as much as 1.2% after the firm announced Chief Executive Marco Roeleveld will retire early due to his health and depart at the end of this year.

- Hellenic Exchanges Athens shares gain as much as 14%, the most since 2020, as Euronext says it is in talks to buy the Athens stock market operator.

- European mining shares gain, as iron ore and steel surged, after China’s top leadership vowed to crack down on “disorderly” low-price competition and phase out some industrial capacity.

- European renewables stocks rally after a US excise tax seen as an existential threat to the solar and wind industry was stripped from the Senate GOP tax megabill that passed the chamber in a tie-breaking vote Tuesday.

- Bytes Technology shares fall as much as 27%, after the UK software provider issued a profit warning, citing a challenging macroeconomic environment that has led some customers to defer buying decisions.

- Jet2 shares fall as much as 3.7% as Panmure Liberum cuts its rating on the stock to hold from buy, seeing limited upside after the travel firm’s strong re-rating in recent months.

- ConvaTec shares extend decline in biggest two-day drop since August 2021, after the US Centers for Medicare & Medicaid Services filed a proposal for certain chronic care products to be included in the Competitive Bidding Program.

- Greggs shares drop as much as 15% to approach a three-month low after the food-on-the-go retailer said full-year operating profit could be “modestly” below last year due to hot weather in Britain.

Earlier in the session, Asian equities traded in a narrow range as fresh tariff threats from President Donald Trump weighed on sentiment. The MSCI Asia Pacific Index declined as much as 0.5% before paring most of the losses, with Nintendo, Mitsubishi Heavy and Advantest among the biggest drags. Japanese shares slid after Trump threatened to impose levies of 30%-35% on imports amid dim prospects for a deal before next week’s deadline. Benchmarks also declined in South Korea, India, and Indonesia. Trump’s comments spurred caution over a recent rally driven by anticipation of progress in trade deals, hopes for dollar-driven foreign inflows and prospects for interest-rate cuts by the Federal Reserve.

“There is a lot more risk of things falling apart than is being priced in by the market,” said Zuhair Khan, a fund manager at UBP Investments. “There is always the risk of a policy blunder by either side.”

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The yen is nursing the largest decline against the greenback among the G-10 currencies, falling 0.5% which takes USD/JPY above 144. The pound also underperforms as it weakens 0.4%.

“The dollar usually loses value when the global economy is in decent shape and the Fed is cutting rates,” noted Nicholas Colas, co-founder of DataTrek Research. “Both factors are relevant now.”

In rates, treasuries fall for a second day heading into a double whammy of labor data, following an unexpected jump in US job opening numbers. US 10-year yields rise 5 bps to 4.29%. European bonds also decline, with gilts faring slightly worse than their German counterparts. UK 10-year borrowing costs rise 4 bps to 4.50%. Swaps now imply about 63 basis points of Fed policy easing by year-end, down from 67 basis points on Tuesday before data unexpectedly showed that US job openings rose to the highest since November.

In commodities, spot gold is steady around $3,342/oz. WTI rises 0.8% to near $66 a barrel.

Looking at today’s calendar, US economic data slate includes June Challenger job cuts (7:30am) and ADP employment change (8:15am); no Fed speakers are scheduled

Market Snapshot

- S&P 500 mini +0.1%

- Nasdaq 100 mini little changed

- Russell 2000 mini +0.8%

- Stoxx Europe 600 +0.4%

- DAX +0.4%

- CAC 40 +1.1%

- 10-year Treasury yield +4 basis points at 4.28%

- VIX little changed at 16.82

- Bloomberg Dollar Index +0.2% at 1191.33

- euro -0.3% at $1.1769

- WTI crude +0.7% at $65.89/barrel

Top Overnight News

- A handful of hard-line House conservatives are threatening to tank a Wednesday procedural vote for the party’s reconciliation bill, a revolt that would bring the lower chamber to a screeching halt and potentially derail GOP leadership’s plan of clearing the legislation by July 4. The Hill

- US House Speaker Johnson said the Senate went a “little further than many of us would have preferred” in amending the bill, according to Punchbowl. It was later reported that US House Speaker Johnson said voting on the bill will be on Thursday at the latest, according to a Fox News interview.

- Punchbowl says the Reconciliation Bill schedule is to bring the US House back at 09:00ET/14:00BST today and vote as soon as possible. Punchbowl spoke to several people on the House GOP whip team Tuesday night, they expressed alarm about what they’re seeing on their whip cards. Sources said that they were racking up no’s from lawmakers who they didn’t expect would be opposed to the bill. Reports that a “bunch” of House Freedom Caucus members are saying they’ll vote no. Elsewhere, on the Democratic leader Jeffries’ Magic Minute, sources suggest it will be around one hour long.

- The Pentagon has halted shipments of some air defense missiles and other precision munitions to Ukraine due to worries that U.S. weapons stockpiles have fallen too low. Politico

- Israel has agreed to “conditions to finalize” a 60-day ceasefire with Hamas in Gaza according to Trump (Hamas said its ready for a ceasefire, but wants a complete end to the war). NYT

- Private employers in the US probably added 98,000 jobs in June, up from just 37,000 in the previous month, ADP data is expected to show. BBG

- Chinese artificial-intelligence companies are loosening the U.S.’s global stranglehold on AI, challenging American superiority and setting the stage for a global arms race in the technology. OpenAI’s ChatGPT remains the world’s predominant AI consumer chatbot, with 910 million global downloads compared with DeepSeek’s 125 million, but other Chinese companies have started to snatch customers by offering performance that is nearly as good at vastly lower prices. WSJ

- Xi Jinping addressed the price wars that plague many industries in China, saying that enterprises’ “disorderly low-price competition” needs to be regulated. SCMP

- Japan said it’s engaging in trade talks in good faith with the US after Trump reiterated his July 9 deadline. PM Shigeru Ishiba said Japan will work to reduce the deficit, but noted that the US needs to produce cars that meet the country’s safety standards. BBG

- China’s largest ports received almost 1.4 million barrels per day of Iranian crude from January to June, according to Kpler, highlighting a significant gap in US efforts to uphold existing sanctions. BBG

- Crude inventories at Cushing fell by 1.42 million barrels last week, the API is said to have reported. If confirmed, that would be the biggest decline since January and also cut holdings at the hub close to minimum operating levels of 20 million. BBG

- Netflix (NFLX) is reportedly discussing music-related events with Spotify (SPOT), via WSJ citing sources.

- Apple (AAPL) is facing a “hurdle” after supplier Foxconn (2317 TW) has pulled Chinese staff from India, according to Bloomberg.

Tariffs/Trade

- Japan’s tariff negotiator Akazawa is arranging a US visit as early as this weekend for trade talks, according to TV Asahi; Japan and the US are continuing vigorous trade talks. Notes that staff level talks were held on June 30th, reiterates that an agreement that would hurt Japan’s national interests for the sake of timing should not be made, will not deny possibilities of travelling to the US, but has no specific schedule to do so

- Canada’s Ambassador to Washington said Canada still aims to lift all Trump tariffs as part of a deal with the US, according to the Globe and Mail.

- South American bloc Mercosur concluded talks for a free-trade agreement with European bloc EFTA, while the blocs are set to announce finalisation of a free trade agreement on Wednesday, according to Brazilian sources cited by Reuters.

- EU Trade Commissioner Sefcovic is to visit China in August, via SCMP citing sources; his team is reportedly compiling a list of specific “asks” that would seek from China; in turn, Sefcovic has been asked to be more specific with his requests. Chinese investment within Europe is seen as a potential area for discussion. On this, the SCMP piece references EVs and battery plants.

- Maersk (MAERSKB DC) says many customers are reassessing shipment timings in light of potential reintroduction of US-China tariffs in August, making Q3 planning more complex.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed following a similar handover from the US where participants digested data, trade commentary and a slew of central bank rhetoric. ASX 200 gained as strength in the mining, materials and real estate sectors offset the losses in tech and financials, but with further upside contained by disappointing Australian Retail Sales and Building Approvals data. Nikkei 225 declined amid trade uncertainty after President Trump noted doubts about a deal with Japan and suggested Japan could pay 30% or 35% tariffs. Hang Seng and Shanghai Comp traded mixed with the Hong Kong benchmark underpinned on return from the holiday closure as gambling stocks surged owing to the jump in Macau gaming revenue for June, while the mainland was contained after the PBoC’s open market operations resulted in a net CNY 266.8bln drain.

Top Asian News

- Japanese government issues emergency earthquake warning, near Tokara; with a 5.1 magnitude earthquake reported off the coast of Japan’s Kagoshima prefecture, via NHK; Earthquake hit around 15:26 JST (07:26BST). No tsunami warning.

European indices opened in the green, shrugging off a mixed APAC lead. Euro Stoxx 50 +0.5%; newsflow has been a little light, primarily focussed on trade. European sectors were entirely in the green, Banks outperforming initially, bolstered by numerous equity specifics; however, strength has faded with sectors now mixed, Real Estate lags given the elevated yield environment.

Top European News

- UK PM Starmer won the vote in parliament on welfare reform; was forced to back down on certain aspects of his proposal. Savings under the plan are now expected to be closer to GBP 2bln vs. initially planned GBP 5bln.

- EU reportedly blocks Britain’s attempts to join the pan-European trading bloc, according to the FT.

- ECB’s Centeno says the ECB remains cautious on the rate path.

- ECB’s Rehn says the ECB should be mindful of the risk that inflation stays persistently below 2% target; says joint EU borrowing to finance defence could also boost EUR’s role by creating new safe asset.

- ECB’s Wunsch says there is an argument for providing a mildly supportive policy stance; not uncomfortable with market rate expectations.

- BoE’s Taylor says a soft landing on interest rates is at risk, don’t think bigger cuts are needed or desirable. UK neutral real rate to be around 0.75-1.0%, putting the nominal rate around 2.75-3.0%. In Q1, reading of the deteriorating outlook suggested that the BoE needed to be on a lower rate path, needing five cuts in 2025 rather than the market-implied quarterly pace of four. QT is not on a pre-set path, like rates.

FX

- USD is attempting to atone for recent pressure with the DXY firmer and eyeing 97.00 to the upside, having breached Tuesday’s 96.94 peak. Today’s data slate sees Challenger layoffs and ADP employment, ahead of tomorrow’s NFP print with markets likely to be particularly sensitive to any downside surprise.

- G10 peers are all lower vs the USD. The CAD fares best and is essentially flat on return from holiday and benefitting from crude strength.

- JPY lags, USD/JPY above 144.00 in a 143.33 to 144.24 band. Hit by the increasingly sour tone from the US administration regarding US-Japan trade talks. To recap, US President Trump said he doubts they’ll have a deal with Japan; suggested Japan could pay 30% or 35% tariffs.

- Sterling under pressure against the USD, Cable below 1.37 to a 1.3689 trough, and also the EUR. Macro focus on the Welfare Reform vote which required another u-turn to ensure its passage, highlighting concern around the fiscal backdrop for the UK.

- While the EUR outpaces GBP, it is softer against the USD with EUR/USD below 1.18 and taking a breather from the 1.1830 multi-year peak that printed on Tuesday. Ongoing remarks from the Sintra conference, but nothing that has moved the dial thus far.

- PBoC set USD/CNY mid-point at 7.1546 vs exp. 7.1623 (Prev. 7.1534).

Fixed Income

- In the red, Gilts lag after further concessions on the Welfare Reform Bill. Concessions that increase the odds of tax increases and calls into question the government’s fiscal credibility, writes IFS. Lower by over 50 ticks on the session, but above support at 92.85 and 92.83 from last Friday and this Monday, respectively.

- A softer session for EGBs as well. Specifics light with nothing groundbreaking from Sintra just yet. Bunds at the low-end of a 130.08 to 130.50 band. One that is 10 ticks below Tuesday’s base but a similar amount clear of the WTD 130.00 base. If breached, we look to 129.92 and then 129.30 from the last two weeks of May.

- USTs also lower, though to a slightly lesser degree than the above peers. Holding at the low-end of a 111-20+ to 111-30+ band. A tick below Tuesday’s base and notching a fresh WTD low by half a tick. If the move continues, there is a bit of a gap until 110-25 from the week before.

- UK sells GBP 5bln 4.375% 2028 Gilt: b/c 3.46x (prev. 3.08x), average yield 3.847% (prev. 4.062%) & tail 0.1bps (prev. 0.3bps)

- Germany sells EUR 4.557bln vs exp. EUR 6bln 2.60% 2035 Bund: b/c 1.6x, average yield 2.63%, retention 24.05%

Commodities

- Crude benchmarks are in the green and continuing to climb as the session progresses. Magnitude of strength initially in-line with that seen in European equity benchmarks but has since extended. Newsflow this morning light, handful of updates on the geopolitical front and no sustained follow through to the surprise private inventory build last night.

- WTI resides in a USD 65.23-65.93/bbl range while its Brent counterpart trades in a USD 66.94-67.75/bbl range.

- Precious metals somewhat mixed, XAU and XAG wane from peaks set in APAC trade, hit this morning as the USD gains ground. Though, for XAU, parameters are not too pronounced as participants await the next macro inflection point and look to Challenger Layoffs before ADP.

- Base metals mostly but modestly firmer, upside capped by discussed USD strength. For copper, attention on reports of mining disruptions in Peru while LME on-warrant aluminium stockpiles have hit a 2025 peak.

- US Private inventory data (bbls): Crude +0.7mln (exp.-1.8mln), Distillate -3.5mln (exp. -1.0mln), Gasoline +1.9mln (exp. -0.2mln), Cushing -1.4mln.

Geopolitics

- US President posted that his representatives had a long and productive meeting with the Israelis on Gaza and Israel agreed to the necessary conditions to finalise a 60-day ceasefire during which they will work with all parties to end the war. Furthermore, the Qataris and Egyptians will deliver this final proposal and he hopes, for the good of the Middle East, that Hamas takes this deal, because it will not get better and will only get worse.

- US officials said Iran made preparations to mine the Strait of Hormuz last month although mines were not deployed in the strait, according to Reuters.

- “Iranian Minister of Communications: Internet outages in the country caused by external attacks”, according to Al Jazeera.

- “Advisor to the Commander-in-Chief of the IRGC: The war has stopped, but the United States and Israel have not achieved their goals”, according to Iran International.

- US Pentagon has halted shipments of some air defence missiles and other precision munitions to Ukraine due to worries that US weapons stockpiles have fallen too low, according to Politico.

- Quad joint statement expresses serious concern over the situation in the East China Sea and South China Sea, while they called for the perpetrators, organisers and financiers of the April 22nd attack in Indian Kashmir to be brought to justice.

US event calendar

- 7:00 am: Jun 27 MBA Mortgage Applications, prior 1.1%

- 7:30 am: Jun Challenger Job Cuts YoY, prior 47%

- 8:15 am: Jun ADP Employment Change, est. 98k, prior 37k

DB’s Jim Reid concludes the overnight wrap

My rain dance continues as it’s so hot the kids can’t sleep, my wife can’t sleep, Brontë the dog can’t sleep and I can’t sleep. The kids have come in to our bedroom a few times this week, waking us up just to tell us they have an itchy bite on their legs. That then leads to a 10 minute conversation about there being nothing we can do about it but ultimately leads to a trip downstairs for some bite cream. An hour later we may get back to sleep. Meanwhile I’ve had more diet cokes to help cool me down over the last few days than the fridge can hold in the Oval Office.

Markets also seemed to wilt a little in the heat yesterday and struggled to keep up their recent momentum, with the S&P 500 (-0.11%) slipping back from its record high even if it did get a small boost from news that the tax bill finally passed the Senate with VP JD Vance providing the casting tie-break busting vote (51-50). The bill now goes on to the House of Representatives, and both chambers have to pass the same version of the bill before it can reach President Trump’s desk. Remember that the first House vote was also very tight, with just a 215-214 margin, and the Republicans only have a 220-212 majority to start with. So there’s not much room for manoeuvre if they want to pass this by Trump’s July 4 deadline. There is a vote scheduled for later today, but already a handful of GOP lawmakers who voted for the first version of the bill are signaling opposition to the Senate changes. So it’s not going to be easy. If it ultimately passes, the bill would extend the Trump tax cuts from the first term, and it also includes a $5tn increase in the debt ceiling, so it would remove that risk coming up later in the summer too.

One of the most important developments of the last 24 hours was the latest JOLTS report of job openings in the US, which pointed to a tighter labour market than previously thought. On one level, it demonstrated continued resilience and strong labour demand, but investors responded by lowering the likelihood of rate cuts this year, which led to a small spike in Treasury yields across the curve. So the 10yr Treasury yield (+1.4bps) ultimately pared back its early decline (4.185% at the lows) and moved back up to 4.24% after getting as high as 4.275% as London went home. The 2yr yield (+5.3bps) moved up to 3.77% from a low of 3.696% before the data.

In more detail, the JOLTS report showed job openings were up to a 6-month high of 7.769m in May (vs. 7.3m expected). So that pushed back against the narrative of a softening labour market, and it raised the ratio of vacancies per unemployed individuals to 1.07. Moreover, the details pointed in a similar direction, with the quits rate of those voluntarily leaving their jobs back up to 2.1%. So collectively, that countered the dovish trend of recent days, where Fed cuts were looking increasingly likely, particularly after a few speakers floated the idea of a cut as soon as the next meeting in July. But with that JOLTS report, investors dialled back the likelihood of aggressive cuts, with the amount priced in by the December meeting down -2.2bps on the day to 64bps. Admittedly, there was some other data yesterday, including the ISM manufacturing. But the numbers were broadly as expected, with the headline index at 49.0 (vs. 48.8 expected), so they didn’t really shift investors’ perception of the outlook.

We did hear from Fed Chair Powell at the ECB’s Sintra forum, but he stuck to his cautious mantra, saying on inflation that “We’re watching. We expect to see over the summer some higher readings”. He also added that if not for the worries about inflation rising due to tariffs, the Fed would likely already have lowered the policy rate further. Meanwhile, Trump continued his own attacks on Powell, saying that “Anybody would be better than Powell” and that he had “two or three top choices” to succeed the current Fed Chair but failed to expand further.

Otherwise, the big focus has been on trade, with just a week left until the 90-day reciprocal tariff extension runs out on July 9. There were optimistic noises around a trade deal with India, with Treasury Secretary Bessent saying they were “very close” to a deal, whilst India’s External Affairs Minister Subrahmanyam Jaishankar said in a Newsweek interview that “I believe it’s possible, and I think we’ll have to watch this space for the next few days”. Separately, Stephen Miran, who chairs the White House Council of Economic Advisers, said he was “optimistic” on an EU deal. President Trump again struck a negative tone on the trade deal with Japan in comments to the press, saying they should “pay 30%, 35% or whatever the number is that we determine, because we also have a very big trade deficit with Japan.” On whether the US would push back the July 9th deadline, the president noted he was “not thinking about the pause” and that he could be “writing letters to a lot of countries.”

This backdrop proved a trickier one for equities, and the S&P 500 fell -0.11% by the close. However, that was influenced by a sharp fall for Tesla (-5.34%), which fell after Trump posted that Elon Musk “may get more subsidy than any human being in history, by far” and “Perhaps we should have DOGE take a good, hard, look at this? BIG MONEY TO BE SAVED!!!” So that meant the Magnificent 7 fell -1.17% yesterday, which helped drag down US equities more broadly. Indeed, if you look at the equal-weighted S&P 500 (+1.10%), it was actually a very positive day and the index hit a 6-month high, so it wasn’t all bad news.

Over in Europe, the tone was generally more positive than in the US, with sovereign bonds rallying across the curve. That came as the flash Euro Area CPI print came in at +2.0% in June, exactly in line with the ECB’s target. Core was a little bit higher, at +2.3%, but that was also as expected. So that added to the sense that the ECB would still have the space to cut rates again this year. Moreover, ECB Vice President de Guindos commented that if the Euro moved above $1.20, then “that would be much more complicated. But $1.20 is perfectly acceptable.” So that again offered a potential justification for more rate cuts, particularly as a stronger appreciation for the euro would bring down import prices and dampen inflation. Indeed, the amount of further ECB cuts priced by the December meeting moved up +1.0bps on the day to 24.7bps. So that supported a bond rally across the continent, with yields on 10yr bunds (-3.3bps), OATs (-3.3bps) and BTPs (-2.7bps) all coming down. Nevertheless, equities still struggled and the STOXX 600 fell -0.21%. In addition, the Euro gained for a ninth straight session to its highest level since September 2021.

While much of the market is focused on US politics, here in the UK Prime Minister Starmer faced a tough vote on the government’s welfare reform last night. After a week of watering down the welfare cuts in the bill, the government decided at the last minute to offer more concesssions. This is remarkable for a government in its first year and with a huge majority. It potentially creates a £5bn funding black hole that may need to be closed with tax rises in the autumn, just as many countries launch tax cuts to combat the new tariff era.

Asian equity markets outside of China are on the weaker side this morning given a little more concern over trade. The KOSPI (-0.85%) stands out as the largest underperformer, while the Nikkei (-0.21%) is slipping on trade concerns although both indices have rallied back a fair amount as I’ve been typing this morning. By contrast, the Hang Seng (+0.77%) is defying the trend, with mainland Chinese equities broadly flat. S&P 500 (+0.27%) and NASDAQ 100 (+0.34%) futures having been edging higher while this paragraph has evolved.

To the day ahead now, and central bank speakers will include ECB President Lagarde, Vice President de Guindos, the ECB’s Cipollone and Lane, and the BoE’s Taylor. Otherwise, data releases include the ADP’s report of private payrolls in the US for June, along with the Euro Area unemployment rate for May.

Loading…