US equity futures jumped, rapidly approaching all time highs, while oil and the dollar tumbled on hopes the worst is over in the middle east, even as traders parse rapidly-changing headlines on Iran where the fragile ceasefire with Iran announced by President Donald Trump was promptly violated by both sides, sparking several angry outbursts by Trump this morning, starting with this one…

- ISRAEL. DO NOT DROP THOSE BOMBS. IF YOU DO IT IS A MAJOR VIOLATION. BRING YOUR PILOTS HOME, NOW! DONALD J. TRUMP, PRESIDENT OF THE UNITED STATES

… followed by this:

- ISRAEL is not going to attack Iran. All planes will turn around and head home, while doing a friendly “Plane Wave” to Iran. Nobody will be hurt, the Ceasefire is in effect! Thank you for your attention to this matter! DONALD J. TRUMP, PRESIDENT OF THE UNITED STATES

… and Trump even dropped the F-bomb in frustration.

Trump says Israel and Iran ‘don’t know what the fuck they’re doing’ pic.twitter.com/FWoVCqdLL9

— Danny Kemp (@dannyctkemp) June 24, 2025

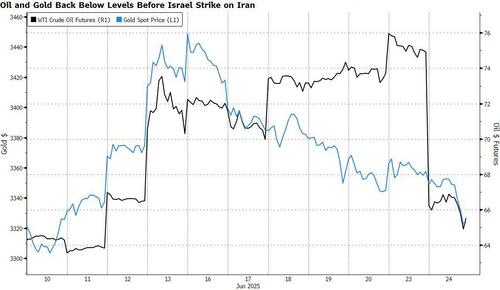

In any case, for now markets are giving the lack of a ceasefire the benefit of the doubt – after all Trump probably already printed hats commemorating the end of the “12 Day War“, and as of 8:00am, S&P futures rose 0.8%, signaling a second day of gains, while Nasdaq 100 futures surged 1%, with all Mag7 stocks higher premarket led again by TSLA with semis and cyclicals ex-energy also higher. European stocks and Asian stocks also advanced. has plunged 15% from Monday’s intraday high, sliding an additional 5.6% on Tuesday as it fell below the level of June 12, the day before Israel began attacking Iran’s nuclear sites. The benchmark later pared some losses to trade above $69 a barrel after Israel reported a missile launch from Iran and instructed its military to respond; but for the most part oil has completely shrugged off reports that the ceasefire is obviously being violated. The dollar headed for its biggest drop since the outbreak of the conflict. The yield on 10-year Treasuries was little changed, as investors’ awaited the first day of Fed Chair Jerome Powell’s testimony before lawmakers on Tuesday (at 10am ET) which is adding fuel to the rally. The yield curve is twisting steeper as USD decline continues. Cmdtys are lower, dragged by Energy, but precious metals are under pressure. Today’s macro data focus is on housing prices, Consumer Confidence, and regional Fed activity indicators. Barring another escalation in the Middle East, focus will shift back to the Fed, with six speakers today including Powell.

In premarket trading,Mag7 stocks are all higher alongside index futures (Tesla +2.2%, Amazon +1.5%, Alphabet +1.2%, Apple +1.2%, Nvidia +0.9%, Meta +0.7%, Microsoft +0.6%). Tesla (TSLA) is outperforming fellow Magnificent 7 stocks in premarket trading on Tuesday, rising 2.2%, after launching its much-anticipated driverless taxi service to a handful of riders. Here are the other notable premarket movers:

- Airline stocks around the world surged after President Donald Trump announced a ceasefire between Israel and Iran, spurring optimism over a potential easing of airspace disruptions in the Middle East.

- Circle Internet Group Inc. shares (CRCL) fell 1.9% in premarket trading after the stablecoin issuer was initiated at Compass Point Research & Trading with a recommendation of neutral as competition is expected to increase after US stablecoin legislation was passed.

- CommScope shares (COMM) are up 2.2% in premarket trading, after Deutsche Bank added the communications equipment company to its catalyst call buy list.

- Crypto-linked stocks are rising on Tuesday with Bitcoin gaining as much as 2.2% amid broader market gains after Israel and Iran reached a ceasefire.

- Energy stocks fall and airlines rise after a ceasefire announcement by President Donald Trump pointed to a potential reduction of tensions in the Middle East. Iran has yet to confirm publicly that it agreed to the ceasefire.

- Lyft shares (LYFT) rise as much as 5.4% in premarket trading on Tuesday as TD Cowen raised to buy from hold citing multiple growth levers.

- Mastercard (MA +2.7%) deepens its partnership with Fiserv (FI +4.4%) to integrate its new FIUSD token across a range of Mastercard products and services, expanding stablecoin adoption and utility for their shared customers around the world.

- NextDecade Corp. (NEXT) gains 4.6% premarket after TD Cowen analyst Jason Gabelman raised the recommendation to buy from hold, citing the expectation of final investment decisions in favor of two new liquefaction trains at the Rio Grande liqufied natural gas project in Texas.

- Teladoc Health shares (TDOC) rise 5.2% in premarket trading on Tuesday, putting stock on track to extend gains after Citron Research said the market is underestimating the value of the virtual health-care platform.

- Uber Technologies Inc. (UBER) rose 3.5% on Tuesday as it’s set to begin offering its customers driverless Waymo rides in Atlanta, making it the second market, after Austin, where the two companies are teaming up instead of competing against each other.

In corporate news, Alphabet’s Google is set to face more scrutiny from the UK’s antitrust watchdog over its online search and advertising business. Starbucks said it’s not currently considering a full sale of its China business, disputing a report from Caixin Global that had sent the shares higher in late trading on Monday.

The rapid-fire sequence of events followed a turbulent stretch in financial markets, which have been roiled for nearly two weeks by fears of an escalating conflict. Volatility was particularly high in oil, as concerns over supply and shipping disruptions had pushed Brent crude to nearly $80 a barrel. However, the subsequent collapse in the price of Brent below $70 helped the narrative on inflation risk and, together with equity positioning that suggests investors are still on the sidelines, could create upside potential. Barring another escalation in the Middle East, focus will shift back to the Fed, with six speakers today including Powell.

“If the ceasefire holds – and there is no guarantee that it will – it will undoubtedly be greeted positively by markets as it will at the margin reduce uncertainty,” said Daniel Murray, chief executive officer of EFG Asset Management in Switzerland. Lower oil prices will reduce inflationary pressure and “also help support consumption trends and hence growth overall.”

The greenback slipped 0.4% against a basket of currencies as demand to hedge against higher oil prices receded.

“The US dollar was one of the key beneficiaries of the hostilities so it is now rolling over,” said Sean Callow, a senior analyst at InTouch Capital Markets. “Investors have been very keen to draw a line under the Israel-Iran conflict, choosing to leave aside any concerns over the path Iran might choose beyond the very short term.”

Elsewhere, Powell is due to testify before two committees in Washington this week amid ongoing pressure from Trump who said interest rates should be “at least two to three points lower.” Further geopolitical headlines might come from a two day NATO summit starting today in the Netherlands.

“We’re going to go back to the bigger picture, and that is to talk about tariffs and growth,” Mislav Matejka, head of global equity strategy at JPMorgan Chase & Co., told Bloomberg TV. “To believe that tariffs are fully digested and that inflation pickup will not happen whatsoever, i think that is premature.”

In Europe, the Stoxx 600 rose 1.4%, lifted by airline shares, as President Donald Trump said a ceasefire was in place between Iran and Israel, easing worries about a prolonged conflict. Energy and utility sectors are the only two in the red. Here are some of the biggest movers on Tuesday:

- Energy stocks fall in European trading while airlines rise after US President Donald Trump said a ceasefire is now in place between Iran and Israel.

- AstraZeneca shares rise as much as 1.8% after the drugmaker’s Datroway medicine received US approval for the treatment of some patients with lung cancer.

- Melexis shares rise as much as 7.9% after it was upgraded to overweight at Morgan Stanley as a likely beneficiary of a cyclical recovery in autos, and named as top pick in European semiconductor small caps.

- DKSH gains as much as 4.9% after the Swiss distribution company receives a new buy rating from Berenberg, which hails its market-leading position in the Asia-Pacific region.

- Lindt shares fall as much as 4.4% after BofA downgraded the chocolate maker to neutral from buy, saying that a strong 1H is already priced in and the valuation is looking stretched.

- OVH Groupe slumps as much as 17% after the cloud computing company releases its third-quarter results. Analysts note high expectations heading into the print following strong share-price advance year-to-date.

- Shares of precious metals miners drop as gold falls on ebbing haven demand after US President Donald Trump announced that Israel and Iran had agreed to a ceasefire.

In FX, the Bloomberg Dollar Spot Index dropped 0.5% to a one-week low. The kiwi dollar is leading gains against the greenback, rising 1%.

In rates, treasuries mixed with the yield curve steeper in early US session. US front-end yields are more than 3bp lower on the day with long-end tenors little changed, leaving 2s10s and 5s30s spreads wider by 2bp-3bp, extending Monday’s move. 5s30s spread topped at 99.98bp, approaching year’s high 100.9bp, reached May 22. the 10-year is flat at 4.35%, outperforming bunds and gilts in the sector by 5bp and 1.5bp. European bond markets are broadly weaker on the day led by Germany, which announced plans to borrow about a fifth more than planned in the third quarter, spurring long-end-led selloff. Longer-dated bonds lead declines with German 30-year yields rising 10 bps to 3.06%. US 30-year borrowing costs also rise 2 bps to 4.90%. US shorter-dated yields fall. The Treasury auction cycle starts with $69 billion 2-year note sale at 1pm New York time and includes $70 billion 5-year Wednesday and $44 billion 7-year Thursday. WI 2-year yield near 3.82% is ~13.5bp richer thank last month’s, which stopped through by 1bp

In commodities, Brent crude futures fall over 3% to $69 a barrel after US President Donald Trump announced a ceasefire agreement between Israel and Iran had gone into effect. Oil prices pared losses briefly after Israel has accused Iran of breaching the ceasefire, while Tehran denied firing missiles at Israel after truce. Spot gold falls $49 to around $3,319/oz, and together with oil, was back below levels before the Israeli strike on Iran. Bitcoin rises 1.6% and above $105,000.

The US economic data slate includes June Philadelphia Fed non-manufacturing activity and 1Q current account balance (8:30am), April FHFA house price index and S&P CoreLogic home prices (9am), June Richmond Fed business conditions and consumer confidence (10am). Fed speakers include Hammack (9:15am), Powell (10am), Williams (12:30pm), Kashkari (1:45pm), Collins (2pm), Barr (4pm) and Schmid (8:15pm)

Market Snapshot

- S&P 500 mini +0.8%

- Nasdaq 100 mini +1.1%

- Russell 2000 mini +1.1%

- Stoxx Europe 600 +1.4%

- DAX +2.2%

- CAC 40 +1.4%

- 10-year Treasury yield +1 basis point at 4.36%

- VIX -1.7 points at 18.16

- Bloomberg Dollar Index -0.5% at 1202.68

- euro +0.3% at $1.1608

- WTI crude -3.3% at $66.27/barrel

Top overnight news

- US equity futures bid higher after Trump declared a ceasefire between Iran and Israel. Benjamin Netanyahu confirmed the truce, saying Israel had achieved its war goals. But within hours, the country accused Tehran of launching more missiles, a charge that Iran denied. BBG

- Trump said interest rates should be “at least two to three points lower” ahead of Jerome Powell’s testimony before a House committee. The Fed chair is expected to defend holding rates until at least September. He appears before the Senate tomorrow. BBG

- Germany will borrow about a fifth more than planned in the coming months to fund a surge in spending, while a deal to secure a €46 billion ($53 billion) package of tax breaks highlighted how debt needs are set to grow. BBG

- China’s advantages in developing artificial intelligence are about to unleash a wave of innovation that will generate more than 100 DeepSeek-like breakthroughs in the coming 18 months, according to a former top official. The new software products “will fundamentally change the nature and the tech nature of the whole Chinese economy,” Zhu Min, who was previously a deputy governor of the People’s Bank of China, said during the World Economic Forum in Tianjin on Tuesday. BBG

- The custodians of trillions of dollars of global central bank reserves are eyeing a move away from the greenback into gold, the euro and China’s yuan as the splintering of world trade and geopolitical upheaval spark a rethink of financial flows. RTRS

- “Big Banks are worried [US] President Trump could turn the power of the federal government against them with an executive order on “debanking.””, via WSJ

- The PBOC set the strongest yuan fixing since November as the dollar fell. BBG

- JGB futures slid after a weaker-than-expected 20-year debt auction, Japan’s first since trimming its bond sales plans last week. BBG

- Europe signals it could soften digital rules aimed at American tech giants for the first time as it seeks relief from Trump’s impending trade tariffs. Politico

- ECB’s Villeroy says the central bank can still cut rates despite recent geopolitical-driven volatility in oil markets. FT

- Fed’s Bostic sees economic growth slowing to 1.1% this year, inflation rising to 2.9%; no need to cut rates now, sees single 25bps reduction late this year.

- House GOP leaders were still unsure whether they would cancel the July 4 recess to pass the mega bill, depending on whether the Senate could clear the bill by the weekend as planned. The decision depended on what changes the Senate made and whether the House would need to alter the bill: Politico

- US Senate Majority Leader Thune said House will ultimately accept what the Senate passes, according to three senators in the room: Punchbowl.

- US President Trump posted “Members of Congress are united in their commitment to deliver the One Big Beautiful Bill “

- NHTSA seeks information from Tesla (TSLA) after Robotaxi debut, with regards to issues seen in online videos. Tesla (TSLA) is sued by the estates of three people killed in a September 2024 crash in Model S with autopilot, according to a court filing: BBG

- Starbucks (SBUX), when asked to comment on media report, says it is not currently considering a full sale of its China operation. Earlier, it was reported Starbucks (SBUX) is reportedly mulling full sale of China business, according to Caixin.

Iran/Israel

- US President Trump announced that Israel and Iran agreed to a complete and total ceasefire, from 05:00BST/00:00ET, which would last for 12 hours. After which, the war would be considered officially ended.

- Under the ceasefire announced by Trump, Iran would stop striking Israel in six hours (at midnight ET on Tuesday), and Israel is expected to stop striking Iran 12 hours after that (at noon ET Tuesday). Then, after another 12 hours, or at midnight ET Wednesday, the war will be considered over, a White House official confirmed to CBS News.

- Strikes continued into and after the Iranian proposed time of 01:30BST/20:30ET. After the Trump deadline of 05:00BST/00:00ET, Iran is said to have fired some missiles at Israel, though they claim it was fired just before the deadline.

- At 06:04BST/01:04ET Trump posted that the “ceasefire is now in effect”.

- At 07:17BST/02:17ET Israeli PM Netanyahu confirmed the ceasefire is now in effect, war achieved its goals, will respond forcefully to any violations. PM’s office adds that Netanyahu will deliver a statement later today.

- The ceasefire agreement seems to have broken down only 4 hours after being in effect, with the IDF suggesting it had detected and intercepted fresh ballistic missiles from Iran. In response to this latest attack, the IDF Minister instructed the military to respond “forcefully” to Iran’s violation of the ceasefire. Iran has denied firing missiles at Israel after the ceasefire.

Trade/Tariffs

- Japanese Economy Minister Akazawa is reportedly arranging to visit the US as early as June 26th for tariff talks, according to Yomiuri.

- The EU said it would not give up decision‑making power for a US trade deal, according to the WSJ citing European Commission President von der Leyen.

- US and South Korean trade ministers reaffirmed commitment to reaching a tariff deal early, according to the South Korean ministry.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded firmer across the board with the region coat-tailing gains from Wall Street, which initially stemmed from Iran’s “symbolic” strike on a US base in Qatar—de-escalatory in nature given the clear effort to minimise casualties and collateral damage. Sentiment was further boosted at the resumption of futures trading after US President Trump announced a ceasefire between Israel and Iran, although the Iranian Foreign Minister later clarified that there was no “agreement”, but Iran would stop attacking if Israel also halts. ASX 200 was bolstered by most sectors, although energy producers and gold miners bore the brunt of the slide in oil and gold. Nikkei 225 gains and tested the 39k mark to the upside amid broader market optimism, although gains were somewhat capped by gradual JPY strength. Hang Seng and Shanghai Comp conformed to the broader tone across the market amid optimism surrounding the Israel-Iran ceasefire alongside the step-down in tensions with the US.

Top Asian News

- Japan’s Chief Cabinet Secretary Hayashi said Japan would hold its Upper House election on July 20th, according to Reuters.

- Japan’s finance ministry said top foreign exchange diplomat Atsushi Mimura would be reappointed for his second year, as he remained involved in US trade talks, according to Reuters.

- PBoC injected 406.5bln via 7-day reverse repos with the rate maintained at 1.40%.

- PBoC issues guidelines on financial support to boost consumption; to increase credit support for services consumption and key areas To increase support for the real economy. Support employment, boost income. Improve financial institutions capabilities, expand supply in consumer sector. Maintain ample liquidity. Strengthen financial services to help optimise consumption environment. Encourage issuance of consumption ETF. Support eligible enterprises in consumption industry chain to raise funds through listing. Support qualified consumer infrastructure companies in issuing REITs in the sector. To increase investment in key areas of services consumption.

European bourses (STOXX 600 +1.2%) opened entirely in the green and still trade at elevated levels, albeit have cooled a touch off peaks. Sentiment today has been boosted by US President Trump’s “complete and total ceasefire” announcement between Iran and Israel. Though this seems to have broken down only 4 hours after being in effect, with the IDF suggesting it had detected and intercepted fresh ballistic missiles from Iran. In response to this latest attack, the IDF Minister instructed the military to respond “forcefully” to Iran’s violation of the ceasefire. Iran has denied firing missiles at Israel after the ceasefire. Complex continues to remain buoyed. European sectors hold a strong positive bias, in-fitting with the positive risk-tone seen across markets. It comes as no surprise that Energy sits right at the foot of the pile, due to the latest slump in oil prices, following the latest ceasefire agreement. Travel & Leisure takes the top spot, lifted by lower oil prices and with airliners generally buoyed by the broader sentiment.

Top European News

- ECB’s Villeroy said the ECB could still proceed with rate cuts despite volatility in oil markets, according to the FT. He noted that inflation expectations remained moderate.

- BoE’s Greene says underlying activity is weak, the labour market has loosened further and the disinflationary process is continuing. Worries about both demand and supply sides of the economy. Continue to think risks remain two sided but skewed to the downside on growth and to the upside on inflation. Given the period of elevated inflation through which we have just come, I think price stability is the key priority. A careful and gradual approach to removing monetary policy restrictiveness continues to be warranted. On the domestic front, noisy data means that it will take longer for me to take comfort from recent disinflationary trends. On the global front, there are a number of key events playing out between now and our next meeting, including the deadline for the pause on so-called “reciprocal tariffs” from the US, the potential passage of a budget in the US and the unfolding of events in the Middle East. It’s unlikely that the uncertainty from these events – and subsequent developments – will be resolved any time soon (in reference to global points of uncertainty, i.e. tariffs, geopols). Still expect trade policy to have a net disinflationary impact on the UK, but it may be muted relative to my expectations in May, when it was a factor in my decision to cut Bank Rate. The risk that our near-term plateau in inflation feeds through into second round effects is skewed to the upside.

- UK Grocery Inflation 4.7% in the four weeks to June 15th (prev. 4.1% in May), via Kantar; “Grocery footfall hit a five-year high”, grocery volumes -0.4% Y/Y, the first such decline in 2025.

- German Finance Ministry says it is to issue EUR 19bln more than initially planned in Q3; includes EUR 15bln increase in borrowing on the capital market and EUR 4bln increase on the money market.

- German Finance Agency says will “probably” continue upward adjustments to bond issuance in Q4. Very good demand for long term bonds. 50yr Bond not planned for this year but internal conditions have been created.

FX

- DXY is lower as the safe-haven premium continues to unwind for the USD. This comes after US President Trump declared a ceasefire between Iran and Israel; which was subsequently later acknowledged by Israel. However, Israel has since stated that Iran has breached the ceasefire. Accordingly, DXY has bounced from a 97.96 low and made its way back onto a 98.0 handle. Focus will be on Fed Chair Powell at 15:00 BST / 10:00 EDT alongside US Consumer Confidence.

- EUR is firmer vs. the USD but to a lesser extent than peers. EUR/USD rose to a session peak at 1.1622, benefiting from the Iran-Israel ceasefire, but the move for the Single-Currency ran out of steam around the same time that Israel claimed that Iran had violated the ceasefire. In terms of domestic drivers, German IFO data saw a larger-than-expected increase for the Business climate metric. A slew of ECB speakers are due throughout the day. If upside in EUR/USD resumes, the YTD high from June 12th sits at 1.1631.

- JPY is towards the top of the G10 leaderboard despite the unwind in the safe-haven premium seen elsewhere. JPY is instead benefitting from the pullback in oil prices, given that it is a net importer. Furthermore, Japanese Economy Minister Akazawa is reportedly arranging to visit the US as early as June 26th for tariff talks, according to Yomiuri. USD/JPY has pulled back markedly from Monday’s 148.03 peak and briefly slipped onto a 144 handle with a current session low at 144.95.

- GBP is firmer vs. the USD and EUR as it benefits from the bump in risk sentiment. Fresh UK-specific macro drivers are lacking for today’s session. However, that could change given the busy BoE speaker slate which includes MPC members Bailey, Greene, Ramsden, Pill and Breeden. Markets will be looking for any clues over the MPC’s future easing intentions given the three dovish dissenters at last week’s meeting, as well as a recent run of soft data points, including last week’s retail sales release.

- Antipodeans are both are near the top of the G10 leaderboard on account of the positive risk-tone. Fresh macro drivers for both have been on the light side. However, traders are mindful of Australian monthly CPI metrics overnight, which are expected to see the Weighted Y/Y CPI metric decline to 2.3% from 2.4%.

- CAD firmer vs. the USD but to a lesser extent than peers as the declines in oil prices caps gains for the currency. Attention today will be on domestic inflation data with Y/Y CPI for May set to hold steady at 1.7%, M/M is expected to rise to 0.5% from -0.1%. Note, at its most recent meeting (where it left rates unchanged), the Bank stated that further rate cuts may be warranted if tariff-related uncertainty spreads but inflationary cost pressures remain contained.

- PBoC sets USD/CNY mid-point at 7.1656 vs exp. 7.1605 (prev. 7.1710); strongest CNY fix since Nov 8th 2024

- Brazil’s central bank announced a spot dollar auction for 25 June, offering up to USD 1bln. It also announced a reverse FX swap auction on the same date, offering up to 20k contracts, according to a statement.

Fixed Income

- USTs are lower by a handful ticks in what has been a choppy European morning so far. Overnight, benchmarks lost their haven allure given Trump’s Iran-Israel ceasefire agreement. Though this was short-lived, as Israel claimed Iran had broken the agreement by launching two missiles into the area – This sparked a modest bid in the USTs, taking it to 111-14. Pressure has since resumed more recently in tandem with Bunds, after the latest updates from the German Finance Agency (details below); USTs are currently trading just of lows at around 111-09+. For the US specifically, traders will eye US Consumer Confidence, 2yr supply and a slew of Fed speakers (incl. Fed Chair Powell).

- Bunds tracked peers overnight and into the morning, on the aforementioned geopolitical updates. For the region itself, the German Finance Ministry said it is to issue EUR 19bln more than initially planned in Q3. Thereafter, the agency said it will “probably” continue upward adjustments to bond issuance in Q4; commentary which saw German paper slip to a fresh trough of 130.35. On the data front, German Ifo printed firmer than the prior across the board. German auction was okay, with decent demand but with a higher avg. yield – ultimately unable to stop the continued pressure in Bunds, which is now down to a 130.35 low. Ahead, a slew of ECB speakers.

- Gilts are softer and trading marginally heavier than peers, potentially as a function of confirmation that the UK will pledge to increase defence spending to 3.5% (prev. 2.3%) by 2035. In slight contrast to Bunds and USTs, Gilts have exactly matched Monday’s 92.25-93.21 confines, but are yet to breach them. A couple BoE speakers have already appeared today (and a few more still yet to come); BoE’s Greene said underlying activity is weak and the labour market has loosened further and the disinflationary process is continuing.

- Germany sells EUR 3.066bln vs exp. EUR 4bln 1.70% 2027 Schatz: b/c 2.9x (prev 2.9x), average yield 1.85% (prev 1.78%), retention 23.35% (prev 18.27%)

- UK sells GBP 1.7bln 1.125% 2035 I/L Gilt: b/c 3.02x (prev. 3.36x) & real yield 1.386% (prev. 1.268%)

Commodities

- Crude drilled lower overnight after the announcement of an Israel-Iran ceasefire which came into effect at 05:00 BST. Benchmarks now trade lower by around -3.5%, with recent two-way action seen on reports of ceasefire violations. In an update which lifted benchmarks this morning, the IDF said that it had detected missiles launched from Iran, which the nation said it had intercepted. Far-Right Israeli Finance Minister, Smotrich said the ceasefire was violated, and that Tehran will tremble in response. More recently, downticks were seen across the complex after Iran denied firing missiles towards Israel, we now look for further clarity. Brent Aug’25 currently trades around USD 69.30/bbl.

- Spot gold is firmly in the red, towards session lows and suffering from the positive mood after the US announced an Israel-Iran ceasefire.

- Base metals are trading firmer given the positive risk environment, alongside the softer USD.

- Kazakhstan’s Tengiz oil output seen at 35.7mln T in 2025, according to KazMunayGas.

Geopolitics:

Iran’s attack on US base in Qatar

- Iran’s Foreign Minister said Tehran’s attack on a US air base in Qatar was in response to US aggression against Iran’s territorial integrity and sovereignty, adding that Iran would be ready to respond again if the US took further action, according to Reuters.

- US President Trump posted “CONGRATULATIONS WORLD, IT’S TIME FOR PEACE!”

- Saudi Arabia stated that Iranian aggression against Qatar was unacceptable, could not be justified, and constituted a flagrant violation of international law, according to Al Arabiya.

- US Vice President Vance said Iran is now incapable of building a nuclear weapon with the equipment they have because the US destroyed it, according to a Fox News interview.

Israel-Iran Ceasefire

- US President Trump announced that Israel and Iran have agreed to a complete and total ceasefire, to begin at 00:00 EDT/05:00 BST, and lasting 12 hours. Trump stated that the war would be considered officially ended following this sequence. He praised both nations for ending what he termed “THE 12 DAY WAR.”

- Under the ceasefire announced by Trump, Iran would stop striking Israel in six hours (at midnight ET on Tuesday), and Israel is expected to stop striking Iran 12 hours after that (at noon ET Tuesday). Then, after another 12 hours, or at midnight ET Wednesday, the war will be considered over, a White House official confirmed to CBS News.

- US President Trump called the ceasefire between Iran and Israel — which he announced — a wonderful day for the world, according to NBC News. He said he believes the ceasefire is unlimited and is going to go “forever.”

- US President Trump and Vice President Vance discussed the Israel-Iran ceasefire proposal with Qatar’s emir after Iranian attacks on the airbase in Qatar on Monday, according to an official cited by Reuters. Qatar’s prime minister secured Iran’s agreement to the US ceasefire proposal in a call.

- Israel’s Channel 12 reported that Israeli Prime Minister Netanyahu agreed to a ceasefire with Iran during talks with US President Trump, on the condition that Iran stopped its attacks.

- Israeli PM Netanyahu announced an agreement with Iran, noting that a comprehensive ceasefire agreement had been reached, according to Al Arabiya.

- Iranian Foreign Minister Araqchi said there was no “agreement” on any ceasefire or cessation of military operations between Israel and Iran. He stated that Iran had consistently made clear it was Israel that launched the war, not Iran. However, if Israel halted its “illegal aggression” against the Iranian people by 4 a.m. Tehran time, Iran had no intention to continue its response. He added that the final decision on halting Iran’s military operations would be made later.

- Israel attacked a “substantial percentage” of the targets approved as part of Operation Am Kalvi, according to i24 journalist Stein. An Israeli source told him: “We will complete the attacks on all the approved targets within a few days.” The source warned: “If we need to, we have a very large pool of targets. There are still many places to attack in Iran.”

- Iranian officials made clear to the Trump administration that they would come back to the negotiating table and discuss their nuclear program on the condition that Israel stops bombing them, according to a senior US official via NYT.

- Iranian Supreme Leader Khamenei posted on X that “the Iranian nation isn’t a nation that surrenders.”

- US President Trump posted that Israel and Iran came to him “almost simultaneously” and said “PEACE!”, declaring that he knew the time was now. He said the world and the Middle East were the real winners. Trump added that both nations had much to gain and much to lose if they strayed from the road of righteousness and truth. He said the future for Israel and Iran was unlimited and filled with great promise.

Strikes since ceasefire announcement

- Israeli strikes were continuous as markets headed into Iran’s proposed ceasefire time (01:30 BST) vs Trump’s guided time (05:00 BST). Iranian media reported that tonight marked the most intense defensive operation since the beginning of Israel’s attacks on Tehran, according to Iran International.

- Iranian strikes continued after 01:30 BST, with several missiles fired towards Israel. Some reports noted an Iranian ballistic missile hitting an Israeli residential building, with three killed.

- An Iraqi military official said an unknown drone targeted the Taji military base north of Baghdad, with no casualties reported, according to the state news agency. Al Hadath reported a drone attack on US bases in Iraq, stating that four Iraqi military bases housing US forces were targeted, and added that there were no human casualties resulting from the attacks on the Iraqi military bases.

- The Israeli military said a fifth wave of missiles had been launched from Iran towards Israel.

- There were reports of the Israeli assassination in Tehran of Iranian nuclear scientist Mohammad Reza Sediqi.

- “Drone strike on radar of air base in southern Iraq”, according to Sky News Arabia.

After the ceasefire came into effect

- “Iran fires missiles towards Israel, violating ceasefire announced by Trump”, according to BNO Newsroom; ” Israeli army: We are monitoring a sixth Iranian attack on Israel”, according to Al Jazeera.

- Iran fired the last round of missiles towards Israel before the ceasefire came into effect, according to Iran’s SNN.

- US President Trump posts, at 06:09BST/01:09ET, “THE CEASEFIRE IS NOW IN EFFECT. PLEASE DO NOT VIOLATE IT!”

- At 07:17BST/02:17ET Israeli PM Netanyahu confirmed the ceasefire is now in effect, war achieved its goals, will respond forcefully to any violations. PM’s office adds that Netanyahu will deliver a statement later today.

Israel claims Iran has violated the ceasefire agreement

- Times of Israel journalist posts on X “The IDF says it has detected a new launch of ballistic missiles from Iran. Sirens are expected to sound in northern Israel in the coming minutes”.

- Israel Finance Minster Smotrich says the ceasefire was violated, one launch was identified from Iran – “Tehran will tremble”, via N12 News.

- “Two Iranian missiles were launched at northern Israel and intercepted according to an initial assessment”, via Horowitz on X.

- Israel Defence Minister says he instructed the military to respond “forcefully” to Iran’s violation of the ceasefire with high-intensity strikes against targets in the heart of Tehran.

- “Iran denies firing missiles at Israel after ceasefire – state media”, via Soylu on X.

- Iran Top Security Body says “Iran’s armed forces have no trust in the words of its enemies and will keep finger on trigger to respond to any further act of aggression”, via Fars News.

US Event Calendar

- 8:30 am: 1Q Current Account Balance, est. -445.5b, prior -303.94b

- 9:00 am: Apr FHFA House Price Index MoM, est. 0%, prior -0.1%

- 9:00 am: Apr S&P CoreLogic CS 20-City YoY NSA, est. 3.94%, prior 4.07%

- 10:00 am: Jun Richmond Fed Manufact. Index, est. -10, prior -9

- 10:00 am: Jun Conf. Board Consumer Confidence, est. 99.8, prior 98

Central Banks (All Times ET):

- 9:15 am: Fed’s Hammack Speaks on Monetary Policy

- 10:00 am: Fed’s Powell to Deliver Semiannual Policy Testimony

- 12:30 pm: Fed’s Williams Gives Keynote Remarks

- 1:45 pm: Fed’s Kashkari Participates in Town Hall Event

- 2:00 pm: Fed’s Collins Speaks on State of Nation’s Housing

- 4:00 pm: Fed’s Barr Gives Welcoming Remarks

- 8:15 pm: Fed’s Schmid Speaks on the Economic Outlook

DB’s Jim Ried concludes the overnight wrap

Despite all the fears over the weekend, over the last 12 hours we’ve seen a pretty remarkable de-escalation of tensions in the Middle East. The best scorecard of this has been the price of oil which now trades just below $70/bbl, having opened at just over $80/bbl early yesterday morning in Asia. Brent crude (-7.18%) posted its biggest daily decline since 2022 and is subsequently trading another -2.56% lower this morning at $69.65/bbl, close to the levels before Israel’s strikes against Iran on June 13. Easing geopolitical concerns helped the S&P 500 rebound +0.96%, with futures another +0.55% higher overnight. Easing inflation fears supported bonds, with Treasuries also benefitting from more dovish Fedspeak, more on which later.

To recap developments, shortly after yesterday’s European market close, Iran launched missiles at a US air base in Qatar, but with the attack being well telegraphed and Qatar suspending air traffic shortly before. Markets soon rallied as it became apparent that Iran’s retaliation did not involve energy targets and was likely seeking to avoid any escalatory spiral with US, with reporting that Iran had warned Qatar ahead of the strikes. Later in the US afternoon, Trump posted that there were no casualties from Iran’s “very weak response” while also thanking Iran for “giving us early notice” of the strikes. This was followed by a surprise post by Trump at around 11pm London time last night claiming that Iran and Israel have agreed to a “Complete and Total CEASEFIRE (in approximately 6 hours from now, when Israel and Iran have wound down and completed their in progress, final missions!), for 12 hours, at which point the War will be considered, ENDED! Officially, Iran will start the CEASEFIRE and, upon the 12th Hour, Israel will start the CEASEFIRE and, upon the 24th Hour, an Official END to THE 12 DAY WAR will be saluted by the World.”

As I write this around 6 hours after the post above, we are yet to hear formal confirmation on the ceasefire from Israel or Iran, with US media reporting that the ceasefire was brokered by Trump in direct conversation with Netanyahu”. Iran’s foreign minister posted that Iran has “no intention to continue our response” if Israel stops its aggression but that “as of now, there is NO ‘agreement’ on any ceasefire or cessation of military operations”. So there are still outstanding questions, from whether a ceasefire will hold given that mutual strikes had continued overnight, to the future of what remains of Iran’s nuclear programme. But as things stand, the past 12 days look set to join the long list of geopolitical shocks that proved temporarily disruptive but had little lasting effect on markets.

Prior to those Middle East developments, the main new story of the day had been on the Fed, as rate cut speculation got further support after comments from Michelle Bowman, the Fed’s Vice Chair for Supervision. She commented how inflation had come in at or beneath expectations recently, and said “we should recognize that inflation appears to be on a sustained path toward 2 percent and that there will likely be only minimal impacts on overall core PCE inflation from changes to trade policy.” As such, she said that she’d support a rate cut as soon as the next meeting in late July, if “inflation pressures remain contained”. Those remarks meant futures dialled up the likelihood of a July rate cut, rising from 17% before the weekend to 23% by the close, while pricing of rate cut by September rose to 96%, its highest since mid-May. So that really heightens the importance of the next CPI report, as a 5th downside surprise in a row would really keep up the momentum for a rate cut. There has been talk about potential candidates for the Fed Chair role becoming more vocal around dovish thoughts if they believe in them given the President’s very public view on what the Fed should do so this may be something to bear in mind in the weeks and months ahead. Powell’s term ends in May 2026 but a replacement could be named very soon. Staying with all things Fed and rates related, today, we’ll see Fed Chair Powell appearing before the House Financial Services Committee, so it’ll be interesting to hear his thoughts too but this time the gap between this and last week’s FOMC isn’t large so new information may not be forthcoming.

With oil prices falling and markets pricing in more rate cuts, this proved good news for US Treasuries, with the 2yr yield down -4.5bps to 3.86% and the 10yr down -2.9bps to 4.35% and another -1.5bps lower overnight. That’s their lowest levels since May 7, before US and China announced a pause in the retaliatory tariffs. Rising rate cut expectations and easing geopolitical risks also drove a big turn around for the dollar, which had climbed by as much as three-quarters of a percent by European lunchtime, but ended the day -0.29% lower.

Another boost to markets yesterday came from the flash PMIs for June. They were broadly in line with expectations, but that cemented the narrative that the global economy was still holding up after Liberation Day, with no obvious signs of a deterioration, even with the 10% baseline tariffs that have been in place. That was echoed across the major economies, with the US composite PMI beating expectations at 52.8 (vs. 52.2 expected), whilst the Euro Area composite PMI held steady at 50.2 (vs. 50.4 expected). So both were still in expansionary territory, although France was an underperformer as its composite PMI fell back to 48.5 (vs. 49.3 expected), remaining in contractionary territory for a 10th consecutive month.

That backdrop proved supportive for US equities, though the impact of the data was dominated by volatility around the Middle East headlines. The S&P 500 had opened with a solid gain, reversed this as reports of imminent Iranian retaliation emerged, but then rallied to close around the day’s highs (+0.96%) to end a run of 3 consecutive declines. Tesla (+8.23%) was the strongest performer in the entire S&P after they launched their robotaxis over the weekend, which in turn helped the Magnificent 7 rise +1.58%. But the advance was pretty broad, with solid gains for the NASDAQ (+0.94%) and the small-cap Russell 2000 (+1.11%).

Over in Europe, markets didn’t perform quite as well. In large part that was as markets closed before the more sanguine news out of the Middle East and the big decline in oil played out, but also as European markets didn’t get as much of a benefit from the rate cut speculation centered on the Fed. So by the close, the STOXX 600 was down -0.28%, along with the DAX (-0.35%) and the CAC 40 (-0.69%). Moreover, the bond rally was also more subdued, with yields on 10yr bunds (-1.0bps), OATs (-1.4bps) and BTPs (-1.5bps) seeing smaller moves than Treasuries.

In Asia the mood is upbeat with the KOSPI (+2.78%) leading the gains led by a jump in index heavyweight Samsung Electronics. Elsewhere the Hang Seng (+1.93%), the CSI (+1.09%), the Shanghai Composite (+1.01%), the Nikkei (+1.07%) and the S&P/ASX 200 (+0.99%) are all experiencing major gains in early trade. S&P 500 (+0.55%) and NASDAQ 100 (+0.78%) futures are also higher.

Meanwhile, demand for Japan’s 20-year bond auction was marginally below the average of the past year, despite the government’s adjustments to its borrowing strategy. The bid-to-cover ratio came in at 3.11, stronger than from the last two auctions, but with many expecting a more positive outcome. The sale comes after the Finance Ministry yesterday approved a plan to reduce the volume of 20-, 30- and 40-year bonds sold in regular auctions by a total of ¥3.2 trillion ($22 billion) until the end of March 2026.

In response to the reduction in long-term funding, the ministry plans to enhance the issuance of shorter-term securities, which will include 2-year notes and six-month Treasury bills. These changes will be evident starting from the auctions next month.

To the day ahead now, and aside from Fed Chair Powell’s appearance before the House Financial Services Committee mentioned above, there will be attention on the annual NATO summit being held in the Hague today and tomorrow. This is expected to confirm a 5% of GDP spending target, including 3.5% on core defence spending, up from 2% before. Our European economists have previewed the summit and its fiscal implications here. Today Germany is also set to unveil its spending plan, with reporting yesterday that this will aim for an increase in core defence spending to 3.5% of GDP in 2029 and amount to a pretty speedy ramp up in spending already in 2025.

Other events today include central bank speak from the Fed’s Hamack, Williams, Kashkari, Collins, Barr and Schmid, ECB Vice President de Guindos, the ECB’s Kazimir and Lane, BoE Governor Bailey, and the BoE’s Greene, Ramsden, Pill and Breeden. Data releases include US Conference Board’s consumer confidence for June in the US, the Ifo’s business climate indicator for June in Germany, and Canada’s CPI for May. Finally, the NATO summit will begin.

Loading…