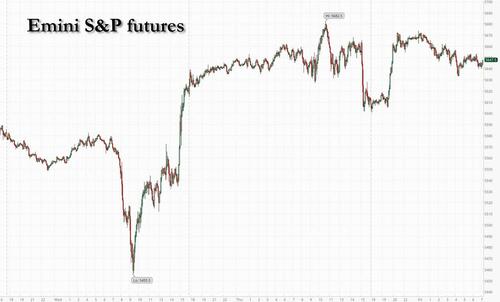

US equity futures gained ahead of the April Payolls report, but were well of their highs, after China said it is assessing the possibility of trade talks with the US, the first sign that negotiations could begin between the two sides since Donald Trump hiked tariffs last month. As of 8:10am ET, S&P futures are up 0.4% while Nasdaq 100 contracts add 0.2%, limited by weakness in the tech sector as Apple and Amazon.com shares fall in premarket after their respective updates appeared to underwhelm investors. If the S&P 500 closes in the green on Friday, it would mark a ninth day of gains, the longest winning streak for the US benchmark since November 2004. Asian markets were also broadly higher and Europe’s Estoxx 50 advances 1.5% in early London session, with risk sentiment stoked after China hinted at the possibility of trade talks. Bond yields are unchanged, reversing an earlier drop, oil and USD are both lower, while gold rebounds +0.7% from recent losses. Today, all eyes on NFP at 8.30am ET to assess market sentiment; Consensus expects a 138k print vs. 228k prior and the Unemployment Rate to hold at 4.2% (more in the full preview here).

In premarket trading, Apple falls 3% after the iPhone maker reported China sales that were disappointing, and warned about the impact of tariffs. Amazon.com slips 0.5% after the e-commerce and cloud-computing company gave a weaker-than-expected outlook for operating income as tariff uncertainties weigh. Here are the other Mag7s: Alphabet +0.8%, Meta +1%, Nvidia +1.1%, Microsoft +0.3%, Tesla +0.4%. US-listed Chinese stocks rise as Beijing says its assessing the possibility of trade talks with America (Alibaba (BABA) +3%, Baidu (BIDU) +2%, NetEase (NTES) +1.3%). Airbnb (ABNB) fell 5% after issuing a weak outlook for the second quarter, citing economic uncertainties for softer travel demand in the US. Here are some other notable premarket movers:

- Ardelyx (ARDX) drops 17% after the biotech firm’s first-quarter revenue missed estimates,

- Atlassian (TEAM) sinks 17% after the software company gave an outlook that analysts are cautious about, although Barclays questioned the scale of the stock’s drop.

- Block (XYZ) sinks 21% after the financial services and digital payments company cut its adjusted operating income guidance for the full year.

- Chevron Corp. (CVX) slips 2% as the company will reduce share buybacks this quarter after oil prices tumbled.

- Cytokinetics (CYTK) falls 11% after the drug developer said US regulators need more time to review a safety plan for the company’s experimental heart drug aficamten.

- Duolingo (DUOL) gains 8% after raising its full-year sales and profit outlook as artificial intelligence offerings drive users to its higher-priced subscriptions.

- Exact Sciences (EXAS) gains 11% after the maker of the Cologuard cancer test boosted its revenue and adjusted Ebitda forecasts for the full year following a largely better-than-expected first quarter.

- Exxon Mobil Corp. (XOM) climbs about 1% after the company met earnings estimates due to higher production from low-cost projects, allowing it to maintain its share buybacks despite the recent drop in crude prices.

- Ingersoll Rand (IR), a company that makes equipment designed to control the flow of energy such as air and gas compressors, falls 4% after the reducing its full year adjusted Ebitda forecast.

- LendingTree (TREE) declines 13% after the online loan marketplace cut its revenue guidance for the full year. The company also trimmed the upper end of its forecast range for year adjusted Ebitda.

- Take-Two Interactive Software (TTWO) declines 15% after announcing a delay in the release date of Grand Theft Auto VI.

- Twilio (TWLO) rises 8% after the communications software firm boosted some fiscal year forecasts.

- Reddit (RDDT) rises 8% after the social-networking company gave a second-quarter forecast that beat expectations.

Optimism is steadily fueling an equity comeback. If the S&P 500 closes in the green on Friday, it would mark the longest winning streak for the US benchmark since November 2004. Indeed, investors are now betting on a more market-friendly stance from President Donald Trump in the coming months, and fears about a US recession could diminish further if Friday’s key jobs report shows resilience, according to Bank of America Corp.’s Michael Hartnett.

“It seems we may have reached peak policy uncertainty,” said Kevin Thozet, a member of the investment committee at Carmignac in Paris. “There are talks ongoing, and Trump seems to have watered down some of his policies. If you add in that the earnings season has been fairly positive, the overall backdrop isn’t that bad.”

Even so, bets are rising the Federal Reserve will be forced to accelerate interest rate cuts to head off an economic slowdown. Money markets are pricing in almost four quarter-point rate cuts in 2025, one more than was anticipated before Trump’s tariff announcement on April 2.

Meanwhile, economists expect the jobs report to show only 138,000 new positions added in April after the data blew away expectations in March. The surveys behind the report were conducted the second week of April, when Trump put some levies on hold and sharply raised those on China goods (full preview here).

European stocks followed their Asian counterparts higher The Stoxx 600 is up 0.8%, led by gains in mining, technology and construction names. Utilities underperform. Here are some of the biggest movers on Friday:

- ING shares rise as much as 5.7% as analysts welcome the Dutch bank’s ‘solid’ first-quarter results and net profit beat, while warning the increase to CET1 guidance by year end may disappoint investors.

- Shell shares rise as much as 4.4% in London after the oil major’s first-quarter profit beat expectations, and it announced a $3.5 billion buyback.

- Commodity stocks are outperforming in Europe on Friday as oil and metal prices got a boost after China said it was evaluating having trade talks with the US, raising optimism that negotiations could reduce tariffs between the two largest economies.

- NatWest shares rose as much as 4.5%, hitting their highest level since 2011, after the UK bank delivered a profit beat to mark a “strong start” to 2025, according to RBC Capital Markets.

- Danske Bank shares rise as much as 3.9% after reporting pretax profits that beat estimates, driven by better-than-expected net interest income and fee income.

- SSP Group shares rise as much as 7.4% after a Financial Times report issued after the close on Thursday said activist investor Irenic Capital Management is building a stake in the catering and food concession company and plans to push management to boost profitability.

- Atalaya Mining shares jump as much as 6.6%, hitting their highest level since early October, after it was confirmed the copper-focused firm will join the FTSE 250.

- Colruyt shares fall as much as 19%, the steepest drop since September 2022, after the Belgian retailer cut its full-year guidance, citing stronger competition in the domestic market and lower-than-anticipated food inflation.

- Landis + Gyr shares fall as much as 8.2% after the Swiss energy management firm reported 2024 results that Vontobel analysts say were below expectations and cut its dividend.

- BASF shares fall as much as 3.3% after the German chemicals firm said uncertainty caused by US trade tactics means it can’t make reliable predictions for its business this year.

Earlier, Asian stocks surged to their highest level more than five weeks in broader regional rally after China said it was mulling trade talks with the US. The MSCI Asia Pacific Index rose as much as 1.8% to the highest since March 25, with TSMC, Alibaba and Tencent among the biggest boosts. The key regional gauge is on track for a third-straight week of gains in the rebound from Donald Trump’s tariff offensive. Taiwan’s benchmark advanced more than 2% Friday, leading gains around the region as many markets reopened after holidays. Hong Kong’s Hang Seng Index climbed more than 1% after China’s Commerce Ministry said it was assessing the possibility of trade talks with the Washington, the first sign since Trump hiked tariffs last month that negotiations could begin. Mainland markets remain shut. Australia and Singapore are gearing up for federal elections to be held on Saturday, with cost-of-living issues top of mind for voters in both nations. Australian stocks rose for a seventh straight day ahead of the vote, while shares were higher in Singapore on Friday.

In FX, the Bloomberg Dollar Spot Index falls 0.4%. The Aussie dollar and Swedish krona are leading gains against the greenback. EUR/USD rose 0.3% to 1.1329; GBP/USD rose 0.1% to 1.3229

In rates, treasuries are flat ahead of the US jobs report, as 10-year yields reverse a 2 bpsdrop to trade flat at 4.22%. Gilts outperform, with UK 10-year yields falling 7 bps to 4.41%. Bunds fall, with little reaction shown to euro-area CPI which rose slightly more than expected in April.

In commodities, oil prices decline as traders weigh the possibility of US-China trade talks and a fresh sanctions threat against Iranian flows against a potential supply hike from OPEC+. WTI falls 0.8% to $58.80 a barrel. Spot gold rises $22 to around $3,260/oz. Bitcoin edges up 0.3% toward $97,000.

Looking at today’s calendar, the highlight is April jobs report (8:30am), and March factory orders and durable goods orders (10am)

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.2%

- Russell 2000 mini +0.8%

- Stoxx Europe 600 +0.9%

- DAX +1.5%

- CAC 40 +1.4%

- 10-year Treasury yield -2 basis points at 4.2%

- VIX -0.5 points at 24.08

- Bloomberg Dollar Index -0.4% at 1224.77

- euro +0.3% at $1.1328

- WTI crude -0.8% at $58.74/barrel

Top Overnight News

- China said Friday it was weighing starting talks with the U.S. to halt a trade war, but only if Washington shows sincerity through concrete measures such as by canceling tariffs against Beijing. WSJ

- China has started to exempt some goods from tariffs that may cover about $40 billion, or a quarter of its imports from the US, to soften the blow of the trade war on its own economy. BBG

- Japan’s chief negotiator expressed hopes of reaching a trade agreement with the US in June, even as a media report indicated the two sides remained at odds on the key issue of its car exports. BBG

- The US is working to ensure tensions between India and Pakistan don’t escalate, JD Vance said. He also told Fox News India will be among the first trade deals done. BBG

- US President Trump is planning to release his FY 2026 budget on Friday, according to Axios. It was separately reported that President Trump is to propose slashing USD 163bln in government programs in budget blueprint: WSJ.

- US Envoy told NATO allies that US President Trump may skip the NATO summit; Trump may not attend if there is no 5% spending target agreement: Spiegel

- Eurozone CPI for Apr runs hot on headline (+2.2% vs. the Street +2.1%) and esp. on core (+2.7% vs. the Street +2.5%, and up from +2.4% in Mar) BBG.

- US bank reserves dropped by $209 billion to $3 trillion in the week through April 30. That’s the lowest since Jan. 1 and the biggest weekly decline this year. BBG

- Apple added to fears about levies, warning its costs will jump by $900 million this quarter. Amazon cut its operating profit projections, saying it expects to be “materially affected” by tariffs, FX fluctuations and recession worries. AAPL -3.15% premkt, AMZN -85bps. BBG

- America’s money managers are more bearish today than they have been in nearly 30 years. Barron’s latest Big Money poll of professional investors finds 32% of respondents bearish on the outlook for stocks over the next 12 months—the highest percentage since at least 1997. BBG

Trade/Tariffs

- US Department of Commerce launched the Section 232 steel and aluminium inclusions process which allows US manufacturers and trade associations to request the inclusion of new derivative articles under Section 232 steel and aluminium tariffs, according to a statement cited by Reuters.

- De minimis exception for products from China and Hong Kong imported to the US is now voided, as scheduled.

- US Secretary of State Rubio said the Chinese want to meet and talk, while he added those talks will come up soon and there’s a broader question about how much we should buy from China going forward.

- China is said to be conducting an assessment on US trade negotiations and urged the US to demonstrate sincerity for trade talks, while it urged the US to correct mistakes regarding tariffs and noted it is currently evaluating possible US trade talks.

- China’s MOFCOM said the tariff and trade war was unilaterally initiated by the US and the US should show its sincerity in talks, while it added the US has repeatedly expressed its willingness to negotiate with China on the tariff issue and has recently taken the initiative to convey information to the Chinese side through relevant parties on several occasions, hoping to talk with the Chinese side. MOFCOM added that China’s position has always been the same: ‘talk, the door is open,’ as well as noted the US should show sincerity if it wants to talk and that in any possible dialogue or meeting if the US does not correct its unilateral tariff measures, it has no sincerity at all. Furthermore, it stated the US should be prepared to take action in correcting erroneous practices and cancelling unilateral tariffs.

- Japanese PM Ishiba said there is no change at all to Japan’s stance of requesting the US to cancel tariffs, while he added they are not in a situation where common ground has been found yet but he received a report from Economic Minister Akazawa that talks were forward-looking. Furthermore, Ishiba commented that reaching a deal in haste is not necessarily in the best interest.

- Japanese Finance Minister Kato said Japan’s huge US Treasury holdings are among the tools it can wield in trade negotiations with the US but added that whether Japan wields that card is a different question.

- Japan’s Economic Minister Akazawa said that US tariff negotiations lasted for 130 minutes and they were able to have a thorough discussion in which repeated its request for a review of tariffs on Japan, while they talked about how Japan can expand trade, non-tariff measures and economic security with the US. Akazawa said they told the US that tariff measures are regrettable and they want to hold the next meeting after mid-May, while they asked the US to review tariff measures on auto parts and the negotiation was handled as a package. Furthermore, they did not talk about China during the talks and he understands that the US wants to reach some kind of agreement within the 90-day window with various countries.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher as many regional participants returned from the Labor Day holiday and with some hopes for US-China trade talks. ASX 200 gained with the advances led by outperformance in the energy sector following the upside in oil prices and with a continuation of the status quo seen as the outcome in tomorrow’s federal election with Australian PM Albanese highly favoured to win a second term. Nikkei 225 rallied at the open but is off intraday highs after stalling near the 37,000 level and following a surprise increase in Japan’s unemployment rate. Hang Seng outperformed on return from the holiday closure and despite the continued absence of mainland participants, while there were reports that China is currently evaluating possible US trade talks and noted that the US has repeatedly expressed its willingness to negotiate with China on the tariff issue, although it urged the US to demonstrate sincerity for trade talks and correct its unilateral tariff measures.

Top Asian news

- China-linked group was accused of meddling in Australia’s election with the Chinese Communist Party-linked Australia Hubei Association said to have mobilised volunteers to support an independent candidate ahead of Saturday’s federal election in Australia, according to Nikkei.

European bourses (STOXX 600 +1%) are entirely in the green as the region returns from holiday; sentiment today has been boosted following a strong session on Wall Street in the prior session, and mostly positive APAC trade overnight. Price action has been relatively rangebound and near recent highs, with traders ultimately cautious ahead of the day’s key US NFP report. European sectors hold a strong positive bias; Tech tops the pile, followed closely by Industrials (lifted by post-earning strength in Airbus) whilst Utilities is found at the foot of the pile. A number of banks reported today; Standard Chartered (+1%, strong Q1 results), ING (+4.5%, reported record deposit growth and launched EUR 2bln share buyback), Danske Bank (+4%, strong results across the board and guidance range topped expectations), NatWest (+1.9%, Q1 headline figures beat expectations and suggested 2025 income to be at top-end of guidance range).

Top European news

- UK by-election: Reform wins Runcorn and Helsby by a margin of six votes with 38.7% of the total vote.

FX

- USD is currently softer vs. all major peers with DXY snapping a run of 3 consecutive sessions of gains which have in part been driven by the recent recovery in US risk assets. This in part has been driven by the performance of corporate America in Q1 earnings season and hopes of a US-China trade deal. On the former, reports suggest that China is conducting an assessment on US trade negotiations and evaluating possible US trade talks. DXY currently sits within Thursday’s 99.61-100.37 range.

- EUR firmer vs. the USD and one of the better performers across the majors. From a fundamental perspective, attention has been on comments from EU negotiator Sefcovic who said Europe is ready to make US President Trump an offer, in which Brussels wants to increase purchases of US goods by EUR 50bln to address the “problem” in the trade relationship. On the data front, EZ HICP Flash metrics incrementally topped expectations, but ultimately had little impact on the Single-Currency.

- USD/JPY initially extended on the prior day’s BoJ-spurred upward momentum but then pulled back from resistance just shy of the 146.00 level. There was little reaction seen following reports of US-Japan tariff talks or comments from Japanese Finance Minister Kato who said Japan’s huge US Treasury holdings are among tools it can wield in trade negotiations with the US but added whether Japan wields that card is a different question. More recently, a report in the Nikkei suggested that US trade negotiators presented a framework for an agreement with Japan, however, Japan strongly opposed the proposal. In recent trade USD/JPY has dipped below the 145.00 mark.

- GBP is firmer vs. the USD but modestly so and below the opening levels of the week despite the notable rally on Monday. Price action for Cable has largely been at the whim of the Greenback with incremental macro drivers for the UK exceptionally light aside from some upbeat commentary on the prospects of a UK-US trade deal.

- Antipodeans are both firmer and supported by the current risk-environment which has been underpinned by hopes of a potential US-China trade deal (China is both nation’s largest trading partner). AUD has overlooked disappointing Australian Retail Sales data and is looking ahead to Saturday’s federal election with PM Albanese seen as likely to secure a second term.

Fixed Income

- USTs are contained into NFP. The headline is expected to show a marked cooling in the pace of Payrolls to 130k (prev. 228k), with a range of 25-195k. The report will be scoured for signs of Trump’s tariffs and associated reciprocal measures impacting the US labour market. USTs holding around 112-00 in 111-23+ to 112-01+ confines, a tick below Thursday’s base but some way clear of that session’s 112-20 peak; the high occurred in the early US morning, before the ISM release. On the trade front, US trade relations with constructive reports in the FT around EU concessions to address the trade deficit with the US in addition to reports that the US has reached out to China to seek talks alongside constructive MOFCOM language.

- Elsewhere, the Japanese Finance Minister stated that Japan’s holdings of USTs could be “among such cards” used in trade negotiations, though Kato added “whether we actually use that card, however, is a different question”. Little move was seen in USTs at the time.

- Bunds opened near enough unchanged at 131.75 after the Labour Day holiday. Just after the resumption of trade they lifted to a 131.81 peak for the session before slipping as low as 131.34 in the early European morning as participants reacted to the US-China updates overnight. Thereafter, lifted around 25 ticks from that low but remained in the red and held around that mark into data. EZ HICP came in hotter across the board and the ex-Food & Energy measures eclipsed the forecast range alongside Services jumping to 3.9% (prev. rev. 3.5%); Bunds knee jerked lower but remained well within earlier confines and have since pared the entire move and are back to holding off lows but remain in the red by around 10 ticks.

- Gilts opened lower by around 20 ticks, catching up to the slight bearish bias in APAC hours on the points outlined in USTs. Thereafter, the benchmark began to inch its way higher and is currently modestly outperforming at the top-end of a 93.30-91 band, just eclipsing Thursday’s 93.88 high. In terms of the slight outperformance, there isn’t a clear or overt headline driver behind it and instead it may be a function of Gilts not being capped/weighed on in the way that USTs and EGBs are by progress on trade talks.

Commodities

- The crude complex opened with a positive bias, continuing the upside seen in the prior session, which stemmed from the broader risk-on sentiment and after Trump’s latest Iran threats. As the session progressed, the complex has been gradually cooling off those highs, to currently trade lower by around USD 0.40/bbl. Brent July’2025 currently trades in a USD 61.72-62.72/bbl range.

- Precious metals are broadly in the green, benefiting from the softer Dollar. XAU/USD is firmer today, attempting to make back some of its recent losses; currently higher by around USD 21/oz, in a USD 3,227.67-3,263.36/oz range.

- Base metals hold a strong positive bias, benefitting from the positive risk tone and the softer Dollar. Sentiment has also been boosted as both US and China suggested a willingness by the other side for talks. 3M LME Copper currently +1.8%, and trading within a USD 9,241.95-9,411.15/t range.

Geopolitics: Middle East

- “Israel understood from Washington that if it decides to strike Iran, it will most likely do so alone as long as the nuclear negotiations continue”, according to Sky News Arabia citing AP quoting an Israeli official

- Israeli PM Netanyahu said Israel attacked a target last night near the Syrian presidential palace in Damascus.

- Israeli Home Front said Northern Israel is under rocket attack from Yemen, according to Al Jazeera.

- Houthi-affiliated media reported US warplanes targeted the Yemeni capital Sana’a, according to Sky News Arabia.

- US Secretary of State Rubio said this is the best opportunity for Iran and that Iran should not be afraid of inspectors including Americans, according to a Fox News interview.

Geopolitics: Ukraine

- Ukrainian PM says two of the three documents on US minerals deal will not need ratification, according to a member of parliament.

- Ukraine’s Parliament plans ratification vote on US minerals deal on May 8th, according to a lawmaker cited by Reuters.

- US VP Vance said Russia’s war in Ukraine is not going to end anytime soon. It was separately reported that US Secretary of State Rubio said Ukraine and Russia’s positions are still a little far apart, while he added it’s going to take a breakthrough soon on Ukraine to make this possible or else the President will have to decide how much time to dedicate to this.

US Event Calendar

- 8:30 am: Apr Change in Nonfarm Payrolls, est. 137.5k, prior 228k

- 8:30 am: Apr Change in Private Payrolls, est. 124.5k, prior 209k

- 8:30 am: Apr Change in Manufact. Payrolls, est. -5k, prior 1k

- 8:30 am: Apr Unemployment Rate, est. 4.2%, prior 4.2%

- 8:30 am: Apr Average Hourly Earnings MoM, est. 0.3%, prior 0.3%

- 8:30 am: Apr Average Hourly Earnings YoY, est. 3.9%, prior 3.8%

- 10:00 am: Mar Factory Orders, est. 4.45%, prior 0.6%

- 10:00 am: Mar F Durable Goods Orders, est. 9.2%, prior 9.2%

- 10:00 am: Mar F Durables Ex Transportation, est. 0%, prior 0%

- 10:00 am: Mar F Cap Goods Orders Nondef Ex Air, est. 0.1%, prior 0.1%

- 10:00 am: Mar F Cap Goods Ship Nondef Ex Air, est. 0.3%, prior 0.3%

DB’s Jim Reid concludes the overnight wrap

I briefly went back inside my old school (Hampton) last night for the first time in 33 years to help record a fund raising video. So I’m feeling a little nostalgic and old this morning. However, it could also be the incredible heatwave we’re having for the time of year playing tricks on me.

In markets as most of Europe was enjoying the one of the hotter May Day holidays on record, the S&P 500 (+0.63%) closed within 1.18% of its April 2nd close, just minutes before the Liberation Day press conference after the bell that day. This now also brings its gains over the last 8 sessions to a huge +8.65%. Indeed, that marks the fastest 8-session gain since November 2020, back when markets were surging after the announcement of the Pfizer vaccine that offered a path out of the pandemic. Meanwhile, other tariff-related moves also unwound, with the dollar index (+0.78%) hitting a 3-week high (albeit -3.43% below April 2nd close), whilst US HY spreads tightened -16bps. There continued to be mounting optimism around the trade war, following on from US trade representative Greer’s comments that deals were moving closer.

This optimism has continued overnight after China’s Ministry of Commerce said that it’s evaluating trade talks with the US. The ministry said this comes as “the US has recently sent messages to China through revenant parties” and urged Washington to shows “sincerity” towards China. Against that background Asian equities are higher on the news (more below), with S&P 500 (+0.77%) and NASDAQ 100 (+0.50%) futures also moving higher even after unwhelming results from Apple and Amazon last night.

Amazon’s Q1 performance was actually a touch above expectations, but the company gave weaker-than-expected guidance for the current quarter on the back of tariffs, projecting an operating profit of $13bn to $17.5bn (vs. $17.8bn expected). Amazon’s shares fell -3.2% in extended trading, mostly reversing a +3.13% gain during yesterday’s regular session. Apple delivered a modest headline beat across revenue ($95.4bn vs $94.6bn expected) and earnings, but weaker revenue in China ($16bn vs $16.83bn) was seen as a concerning sign of the potential trade war challenges. Apple stock slid by -3.8% after-hours (+0.39% yesterday). Both companies may be helped by the renewed trade optimism overnight. For more on tech’s recent performance, see our team’s April tech performance review here.

Looking back at yesterday, the tech earnings the night before played a big role in the market rally, with the Magnificent 7 surging +2.79%, alongside a +1.52% move for the NASDAQ. Microsoft gained +7.63% and Meta +4.23% after their results. Nvidia posted a +2.47% advance, also helped by a Bloomberg report that the US is considering easing restrictions on Nvidia chip sales to the UAE.

Earlier yesterday the risk-on tone had received additional support from the latest batch of US data, which wasn’t as bad as feared. In particular, the ISM manufacturing print only fell to 48.7 (vs. 47.9 expected), which wasn’t too much of a dip from the 49.0 reading in March, and still above its levels from May-November last year. Admittedly, the weekly initial jobless claims did tick up to 241k (vs. 223k expected), but that could be explained by a surge in New York, which probably reflected difficulties in the seasonal adjustment around the Easter holidays, so it wasn’t seen as a sign of a rapidly deteriorating labour market.

Staying on the data, the next watchpoint will be the US April jobs report out today, which is the first to cover the period since Liberation Day, and one of the first hard data points we’ll have. As a reminder, our US economists expect headline nonfarm payrolls to grow by +125K (vs +228K previously), with private payrolls at +125k (vs. +209k previously). So they see a reversion after a strong March, particularly within the leisure/hospitality and retail sectors but note the late Easter has the potential to distort the data and seasonal adjustments. They also expect unemployment to remain unchanged at +4.2%. You can see their full preview and register for their post-release webinar here.

Yesterday’s data also triggered a notable rise in Treasury yields, which unwound their initial decline after the ISM manufacturing release. With the release better than expected alongside the wider risk-on tone, investors dialled back their expectations for Fed rate cuts, and the 2yr Treasury yield moved up +9.6bps on the day to 3.70%, whilst the 10yr yield was up +4.86bps to 4.22%.

In Europe, markets were fairly quiet given Germany, France and Italy were closed for a public holiday. However, the UK’s FTSE 100 (+0.02%) advanced for a 14th consecutive day, which is a joint record since the index was formed back in 1984. And with most of Europe not trading, the STOXX 600 also saw a muted gain of +0.02%. Otherwise, gilt yields moved higher in line with US Treasuries, with the 10yr yield up +4.1bps on the day to 4.48%. They are both up around another +1.5bps overnight.

Coming back to Asia, equity markets are largely rising this morning boosted by the positive overnight performance on Wall Street amid China’s openness to trade negotiations. This is outweighing concerns about the effect of tariffs, which were initially triggered by disappointing earnings from Apple and Amazon. As I check my screens, the Hang Seng Tech Index (+3.37%) is surging with the Hang Seng (+1.63%) also trading sharply higher. Elsewhere, the S&P/ASX 200 (+0.91%) and the Nikkei (+0.53%) are also trading higher with the KOSPI (+0.19%) seeing minor gains. Meanwhile, China markets are closed for the Labour Day public holiday.

Early morning data showed that Australian retail sales experienced a third consecutive month of expansion in March. The +0.3% m/m increase, while marginally below the projected +0.4%, followed a +0.2% gain in the preceding month. This is a small support to the house view that the RBA should cut 25bps this month.

To the day ahead now, as mentioned earlier we will see US data releases on April Jobs, as well as March’s factory orders. Other notable data includes France March budget balance, Italy April manufacturing PMI, budget balance, March unemployment rate, Eurozone April CPI, March unemployment rate. Earnings include Exxon Mobil, Chevron, Shell, Apollo and Natwest.

Loading…