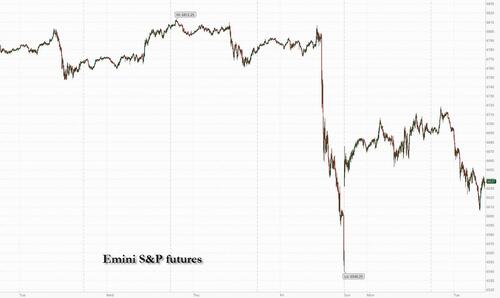

The market rollercoaster continues: after Monday’s faceripping bounce, US equity futures are lower again led by tech, part of a global risk-off tone as the US/China trade war returned after Beijing vowed to “fight to the end” in the tariff and trade war, while acknowledging that the door for negotiation is open and trade talks between the two countries had resumed yesterday. Beijing also imposed curbs on the American units of Hanwha Ocean, one of South Korea’s biggest shipbuilders, as it targets US measures against the Chinese shipping sector. As of 8:00am ET, S&P futures are down 0.9% and near session lows as market may be reading the latest response by China as an ‘escalate to de-escalate’ ahead of the Trump / Xi mtg later this month. Nasdaq 100 futs were 1.1% lower with all members of the Magnificent Seven sliding in premarket trading, while European stocks slipped 0.7%. Bond yields are lower as the curve bull steepens, pushing 10Y yields briefly below 4.0%, with USD flat as the bond market returns from holiday. In addition to MegaCap Banks we have the Small Business Survey which printed below estimates, and where the section on hiring plans will be under scrutiny given the gov’t shutdown. The biggest highlight of the session is Fed Chair Powell speaking on the Economic Outlook and Monetary Policy at 12:20pm ET.

In premarket trading, Mag 7 stocks are all lower (Nvidia -1.8%, Tesla -2.5%, Alphabet -1.6%, Apple -0.7%, Microsoft -0.7%, Meta -1.4%, Amazon -1.4%).

- Cryptocurrency-linked stocks slide amid a drop in Bitcoin prices following a flare-up in trade tensions between the US and China.

- US-listed critical mineral companies are extending gains after China hits US with more retaliatory measures on the shipping industry, a sign of persistent trade tensions between the two economies.

- Astria (ATXS) shares rose 30% following a brief halt after BioCryst announced plans to buy the biopharmaceutical company.

- Domino’s Pizza (DPZ) shares gain 1.9% after the restaurant chain reported total domestic stores comp sales growth for the third quarter that beat the average analyst estimate.

- General Motors Co. (GM) falls 1.8% as the company is incurring $1.6 billion in charges related to paring back electric-vehicle production plans, underscoring the toll on US carmakers from flagging federal support for plug-in vehicles.

- Polaris (PII) climbs 8% after saying it will separate Indian Motorcycle into a standalone company and entered a definitive agreement to sell a majority stake to Carolwood LP.

- Navitas Semiconductor (NVTS) jumps 24% after unveiling its 100 V GaN FETs, 650 V GaN and high voltage SiC devices for Nvidia’s 800 VDC AI factory architecture.

- Rayonier Inc. (RYN) and PotlatchDeltic Corp. (PCH) agreed to combine their businesses, creating a major US timberland owner and lumber manufacturer with a market capitalization of $7.1 billion. Rayonier +1%, PotlatchDeltic +5%

- T-Mobile (TMUS) shares rise 1% after RBC raised the stock to outperform as the firm expects the telecom operator to see stronger subscriber growth versus wireless peers in the short term.

- Wells Fargo & Co. (WFC) climbs 2.6% after raising a key profitability metric, giving its first major update about the bank’s next growth target after the removal of regulatory restraints it had operated under for more than seven years.

Global equities retreated after China upped the ante in its trade standoff with the US, stirring fresh concerns over tensions between Beijing and Washington at a time when stocks look stretched after a relentless rally. Besides hammering global stocks and marking a third day of wild stock swings, the latest standoff also sparked a rally in global bonds as investors pulled back from risk, sending the 10-year US Treasury yield down two basis points to 4.01%. Gold swung between gains and losses, while silver dipped after hitting a record over $53/oz.

“The sharp reversal shows how quickly sentiment can shift,” said Florian Ielpo, head of macro at Lombard Odier Investment Managers. “With elevated valuations already making markets vulnerable, expect continued volatility.”

Traders’ attention is also turning to the unofficial start of earnings season. JPMorgan fluctuated premarket after beating estimates for trading and investment-banking fees. Goldman Sachs fell despite posting record third-quarter revenues, on concerns about rising expenses.

Alongside renewed trade concerns, the surge in AI stocks is stoking bubble fears. In the October edition of BofA’s Fund Manager Survey survey, 54% of investors think there’s a bubble in the sector with concerns over global equity prices also at a record.

Bank earnings will be key for market direction later, with Citigroup, Goldman Sachs and JPMorgan all reporting this morning. Fed’s Powell is due to speak at 12:20pm ET, and his commentary will be crucial amid a lack of hard data.

Going back to the AI story that has rescued the market from other dips, BBG warns that it may be losing steam. Samsung shares fell, despite the company reporting its biggest quarterly profit in more than three years, with some investors cashing in on its recent AI-mania fueled gains.

In other assets, cryptocurrencies continued to lose ground after a historic round of liquidations that triggered a sharp selloff over the weekend, with Bitcoin slumping as much as 3.7%. Oil fell after the IEA raised its estimate for a record oversupply.

In Europe, the Stoxx 600 falls as much a 1% after a broadly negative Asian session. European stocks fell on renewed trade jitters as China sanctioned the US units of a South Korean shipping giant Hanwha Ocean. Telecommunications and real estate equities are the biggest gainers, while mining and automobile shares led the declines. Here are the biggest movers Tuesday:

- Ericsson shares jump as much as 15%, the most since April 2018, after the Swedish telecommunications group beat estimates. Analysts were impressed by robust profitability and strong gross margins in the Networks divisions

- Bellway shares rise as much as 6.2%, the most in four months, as the housebuilder leaves guidance broadly unchanged and unveils a £150m share buyback program

- EasyJet shares jump as much as 11%, the most since January 2023, after a report that Mediterranean Shipping Company is considering making an offer for the budget airline, in partnership with an investment firm

- Klepierre climbs as much as 2.5% following a double-upgrade to overweight at JPMorgan, based on more positive capital growth assumptions for the French property management company

- European mining shares are the worst-performing sector in the Stoxx 600 index on Tuesday after iron ore fell from the highest since late February as some concerns over potential supply issues from new port fees in China eased

- Siemens Energy falls as much as 7.4% in Frankfurt trading, the most since April, with traders citing profit-taking in momentum stocks

- Siemens slips as much as 3.5% on Tuesday as Morgan Stanley says the firm is no longer trading at a material discount to its “theoretical sum-of-the-parts” valuation following a strong re-rating this year, and downgrades to equal-weight

- BASF shares fall as much as 2.1%, the most since August, after the chemicals company was downgraded to sell from hold and the price target lowered to €37 from €44 at Berenberg

- Michelin shares fall as much as 11%, the most since March 2020, after the French firm issued a profit warning, mainly due to much weaker performance in North America

- Bekaert drops as much as 12%, the most since March 2020, as Oddo BHF downgrades the Belgian steel-wire company to underperform from neutral, saying the strategy unveiled late in Dec. 2023 has yielded “very little.”

Earlier in the session, Asian stocks slipped on Tuesday, hurt by broad worries over US-China trade frictions as well as losses in Japan, where political uncertainty dragged shares lower after a long weekend. The MSCI Asia Pacific Index fell as much as 1.5%, to head for a third day of declines, with Chinese tech names Alibaba and Tencent among the biggest drags. The Hang Seng Tech Index entered a technical correction after the gauge fell more than 10% from a high on Oct. 2 following a blistering five-month rally through September.

“China’s new tit-for-tat move against Hanwha Ocean’s US units marks another escalation in the strategic supply chain rivalry, deepening cracks in an already fragile risk backdrop,” said Hebe Chen, an analyst at Vantage Markets in Melbourne. “In essence, it reinforces the de-risking narrative.”

Australian mining companies with critical minerals projects jumped, fueled by signs of US interest in equity stakes as Trump and China intensify their strategic competition. In Japan, the Topix and Nikkei both slumped at least 2% each as trading resumed following Monday’s holiday. Japan’s governing coalition abruptly collapsed Friday in a major blow to new ruling party leader Sanae Takaichi, plunging the country into one of its biggest political crises in decades. Meanwhile, LG Electronics India soared in its Mumbai trading debut after investors flocked to the firm’s initial public offering, one of India’s biggest this year.

In FX, the Bloomberg Dollar Spot Index reverses losses to rise as much as 0.3% to its highest since Aug. 1; the pound drops 0.4% while the Aussie dollar is the weakest of the G-10 currencies, down 0.9%. Hedge funds in Asia and Europe are buying vanilla dollar call options versus a range of currencies amid a pickup in risk-off sentiment, according to European and Asian traders, BBG reports.

- USD/JPY +0.2% to 151.96 (range 151.62 – 152.61)

- EUR/USD little changed at 1.1561 (range 1.1555 – 1.1594)

- GBP/USD -0.6% to 1.3259 (range 1.3258 – 1.3353)

In rates, treasuries climb, pushing US 10-year yields down 3 bps to 4.01%. Gilts lead an advance in European government bonds after the UK unemployment rate unexpectedly rose, prompting traders to boost BOE easing bets. UK 10-year yields fall 7 bps to 4.59%.

In commodities, spot gold has recovered to add $30 after an abrupt selloff saw it briefly turn negative. Silver also fell sharply from a record and is still down 2%. Bitcoin falls 3.5% below $112,000.

Looking to the day ahead now, data releases include UK unemployment for August, the German ZEW survey for October, and the US NFIB small business optimism index for September. Central bank speakers include Fed Chair Powell, the Fed’s Bowman, Waller and Collins, the ECB’s Cipollone, Makhlouf, Kocher and Villeroy, BoE Governor Bailey, and the BoE’s Taylor. Finally, earnings releases include JPMorgan Chase, Johnson & Johnson, Wells Fargo, Goldman Sachs, BlackRock and Citigroup.

Market Snapshot

- S&P 500 mini -0.8%

- Nasdaq 100 mini -1%

- Russell 2000 mini -0.8%

- Stoxx Europe 600 -0.4%

- DAX -0.9%

- CAC 40 -0.7%

- 10-year Treasury yield -3 basis points at 4.01%

- VIX +2.4 points at 21.47

- Bloomberg Dollar Index +0.2% at 1217.9

- euro little changed at $1.1562

- WTI crude -2.1% at $58.23/barrel

Top Overnight News

- US Treasury secretary Bessent has accused China of trying to hurt the world’s economy after Beijing imposed sweeping export controls on rare earths and critical minerals, hitting global supply chains. Bessent told the FT that China’s introduction of the controls (3 wks before Trump/Xi meeting) reflected problems in its own economy. FT

- China added 5 US subsidiaries of South Korean shipbuilder Hanwha Ocean to its sanctions list for allegedly co-operating with American efforts to impose punitive fees on Chinese vessels that took effect on Tuesday. FT

- Chinese rare earth magnet companies have been facing tighter scrutiny on export license applications since September, sources say, even before Beijing’s move last week to expand controls over the critical minerals used in magnets. RTRS

- European Union officials called for strong measures against China after Beijing imposed fresh export restrictions on rare minerals used in computer chips and other advanced technologies. “We should have a tough response,” said Danish Foreign Minister Lars Lokke Rasmussen. BBG

- Republicans on Capitol Hill and inside the Trump administration are said to be discussing potential pathways to prevent the tax credits from expiring at the end of the year. Some members of the House GOP leadership circle are having early, informal conversations with officials from the White House Office of Legislative Affairs and the Domestic Policy Council to develop a framework for a deal: Politico

- Japanese stocks slump in Tues trading (they were closed Monday) as markets react to political uncertainty following Fri’s news of LDP’s junior partner withdrawing from the party’s coalition. Nikkei

- Crude fell after the IEA warned of a record oversupply in 2026. Supply may exceed demand by about 4 million barrels a day — 18% higher than September estimates — an unprecedented overhang in annual terms, the agency said. BBG

- UK unemployment unexpectedly rose and wage growth slowed more than forecast in the three months through August, prompting traders to boost bets on further BOE rate cuts next year. The pound fell. BBG

- EPS in full swing this morning with banks – JPMorgan beat most estimates, with both equities and FICC sales trading revenue well above expectations. Wells Fargo beat earnings and was as expected at a high level, missing on NIIs but beating on fees. BBG

- Donald Trump’s lumber tariffs take effect today, with the import duties on kitchen cabinets, upholstered furniture and other items threatening to raise renovation costs and deter new home purchases. BBG

Trade/Tariffs

- China officially began special port fees for US ships, while it was earlier reported that China issued implementation rules on port fees on US ships and exempted China-made ships owned by US companies from port fees, while it is to adjust special port fees on US ships as needed.

- China’s MOFCOM responded to the US saying it has proposed talks with China after rare earth restrictions, in which MOFCOM stated the US cannot have talks while threatening to intimidate and introduce new restrictions, which is not the right way to get along with China, while it urged the US to correct its “wrong practices” as soon as possible and show sincerity in talks with China. It also stated that export curbs are not an export ban and do not prohibit exports. Furthermore, it said they held working-level talks on Monday and noted that both sides have maintained communication under the framework of the China-US economic and trade consultation mechanism. However, MOFCOM later announced that it is taking countermeasures against five US-linked firms.

- China Transport Ministry said it opened an investigation into the impact of US 301 tariffs on China’s shipping industry.

- China’s Commerce Ministry urges the US to correct mistakes and hopes to resolve concerns through dialogue.

- China increases oversight of export license applications for rare earth magnets, via Reuters citing sources.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed following the rebound on Wall St and with underperformance in Japanese markets as they reopened from the extended weekend and reacted to the recent US-China tariff tensions, as well as the Japanese ruling coalition split. ASX 200 struggled for direction as weakness in the financial and consumer-related sectors offset the gains in materials and miners, with the latter helped by the recent upside in metal prices and with Rio Tinto gaining following its quarterly activity update. Nikkei 225 underperformed as participants returned from the holiday closure and reacted to the recent US-China trade frictions and political uncertainty in Japan, while there were late headwinds after reports of China trade-related actions against the US. Hang Seng and Shanghai Comp are lower amid the backdrop of the tumultuous trade/tariff related headlines in which the recent softening in tone by the US on China was followed by reports overnight that China’s MOFCOM is taking countermeasures against five US-linked firms and that China’s Transport Ministry opened an investigation into US 301 tariffs impact on China shipping industry.

Top Asian News

- Monetary Authority of Singapore kept the prevailing rate of appreciation of the SGD NEER policy band, as well as made no change to the width and level at which the band is centred, as expected. MAS said it is in an appropriate position to respond effectively to any risk to medium-term price stability and MAS core inflation should trough in the near term but rise gradually over the course of 2026, while it added that Singapore’s economic growth has turned out stronger than expected and the output gap will remain positive in 2025.

- RBA Minutes from the September meeting stated the Board agreed no need for immediate reduction in the cash rate, while it added that future policy decisions are to be cautious and data dependent. RBA said the market path for the cash rate is within estimates of neutral but too imprecise to guide policy and it is important to see what Q3 data shows on the economy and supply capacity, as well as noted that policy is probably still a little restrictive, but this is difficult to determine and there are still risks on both sides for the economy.

- Japan’s LDP proposes October 21st for extraordinary Diet, via FNN.

- China’s Central Bank-backed Publication will continue to uphold decisive role of market in exchange rate formation and strengthen guidance of expectations.

European bourses (STOXX 600 -0.4%) are broadly lower across the board, with sentiment hampered by the ongoing US-China spat; overnight, China’s MOFCOM announced that it is taking countermeasures against five US-linked firms. European sectors hold a strong negative bias. Telecoms takes the top spot, boosted by post-earning strength in Ericsson (+13%) after it beat on profits and raised guidance. To the bottom of the pile resides Basic Resources, hampered by broader weakness in underlying metals prices. US equity futures (ES -0.8%, NQ -1.1%, RTY -0.9%) are lower across the board, following a similar theme seen in Europe. All focus today on a number of bank results, to kick off Q3 earnings seasons. BP (BP/ LN) Q3’25 Trading Statement: Upstream Production in Q3 is now exp. to be higher vs prior quarter, but flagged weaker trading into Q3. BlackRock Inc (BLK) Q3 2025 (USD): Adj. EPS 11.55 (exp. 11.24), Revenue 6.51bln (exp. 6.23bln); AUM 13.464tln (exp. 13.37tln).

Top European News

- Barclays UK September Consumer Spending fell 0.7% Y/Y vs prev. 0.5% Y/Y increase in August.

- The tax elements of French PM Lecornu’s draft finance bill reportedly include 30 articles, some have already been announced, but also the addition of a tax on “assets not allocated to an operational activity of property holding companies”, via Playbook. Furthermore, Playbook, citing a source, reports that there is no question for the PS of “doing another round of negotiations on Wednesday, Thursday or Friday”.

- The two motions of censure will be looked at on Thursday at 08:00 BST, but the Conference of Presidents on the National Assembly, via BFMTV.

- French fiscal watchdog HCFP says French government’s 2026 budget plan relies on overly optimistic economic assumptions; based on ambitious spending restraint that would be difficult to implement. France is at risk of under-delivering on spending and tax measures in 2026 budget. Budget bill includes belt-tightening measures worth over EUR 30bln, including EUR 13.7bln in taxes and EUR 17bln in spending cuts.

- French Socialist Party (PS) will not vote against PM Lecornu’s government in the motions filed by LFI and RN, will instead file its own motion of no confidence in the scenario it is not satisfied with the budget proposals, via Reuters citing sources

- German Economy Ministry says current indicators do not point to economic recovery in Q3.

- Riksbank’s Bunge says monetary policy must be forward looking; Inflation remains elevated, but with increased confidence that it will fall back, we were able to cut the policy rate to provide further support to the economy.

- EU Commission modifies drone wall proposals to suggest broader European drone defence initiative, via Reuters sources.

FX

- After a soft start to the session, whereby DXY was dragged lower by the haven bid into the JPY, the Greenback was able to garner support at the expense of risk-sensitive currencies and the GBP (post-jobs data). The bout of risk aversion was triggered by China’s decision to take countermeasures against five US-linked firms – a move which has dashed some of the hopes seen during yesterday’s session. Furthermore, a source piece in the WSJ overnight stated that “people close to the Trump administration say the US side likely will demand that China rescind, not merely delay or water down the rare-earth export rule“. Focus today on US NFIB Small Business Optimism index, and speakers include Fed Chair Powell, Waller, Collins & Bowman. DXY has ventured as high as 99.47, with the next target coming via last week’s peak at 99.56.

- After initially looking like it was going to make a test of 1.16 overnight, EUR/USD was dragged lower by the broader pick-up in the USD. From a macro perspective, focus in the Eurozone remains on France with PM Lecornu set to present his budget at 14:00BST, aiming to reduce the deficit to 4.7% by end-2026. In terms of the specifics, Politico reports that additional measures to those previously expected will include a tax on the richest members of society. Even with the Socialists on board, the governing coalition would still need to find additional votes in the Assembly, which looks tough given that the Far Right and Left are expected to table a no-confidence motion on Lecornu. Elsewhere in core Europe, German ZEW data showed misses for both metrics, with the current conditions component slipping further into negative territory. EUR/USD has been as low as 1.1543 and is just about holding above last week’s low at 1.1542.

- JPY is the only of the majors to out-muscle the USD given its safe-haven status. JPY was supported in early European trade as investors reacted to the increase in US-China tensions overnight (see USD section for details). Subsequently, USD/JPY was dragged as low as 151.63 vs. an earlier session high at 152.61. A pick-up in the USD has since seen the pair return to a 152 handle. In terms of the macro story for Japan, it is one that remains dominated by domestic politics following the collapse of the ruling coalition. Note, the LDP party has proposed October 21st for an extraordinary Diet session.

- GBP was hit in early European trade following the latest UK labour market report, which was largely viewed with a dovish lens. Surmising the data, Pantheon Macroeconomics highlighted the unexpected uptick in the unemployment rate and the decline in 3M/YY ex-bonus average earnings, which will factor into thinking on the MPC. Elsewhere, BRC retail sales slowed to 2.0% Y/Y in September from 2.9% as consumers remain cautious in the run-up to next month’s fiscal event. Cable has delved as low as 1.3255 to levels not seen since early August.

- Antipodeans are both are softer vs. the USD and at the bottom of the G10 leaderboard. In the absence of any material domestic updates, AUD and NZD remain at the whim of broader risk dynamics, which are being led by US and Chinese trade tensions.

Fixed Income

- USTs are bid, firmer by over 10 ticks to a 113-16+ high. Strength this morning comes on the back of the downbeat risk tone as China retaliates. Upside that has driven the benchmark to a fresh high for the month, with the next points of resistance at 113-21, 113-25+ and then the 113-29 September peak. Specifically, China’s MOFCOM announced that it is taking countermeasures against five US-linked firms and outlined that the US cannot have talks while new restrictions are being threatened. Elsewhere, the docket is packed with Fed speak via voters Bowman, Waller, Chair Powell and 2025 voter Collins.

- OATs are firmer today, in-fitting with peers. A packed agenda for French politics. The main update this morning came from the French fiscal watchdog HCFP on the 2026 budget draft, a draft that was in-fitting with overnight sources. On the draft, HCFP described it as relying on overly optimistic scenarios and ambitious spending restraint that would be difficult to implement. Perhaps most pertinently today, PM Lecornu’s General Policy Statement is scheduled for 14:00BST. The statement should take no more than 90 minutes, afterwards other party leaders can respond. It is worth highlighting that the French Socialist Party will not vote against PM Lecornu’s government, and instead opt for its own motion of no confidence, if it not satisfied with the proposal.

- Bunds are bid, given the market narrative outlined in USTs. No move to final German HICP for September this morning which was unrevised. For Bunds, the morning’s main event was October ZEW. The series came in softer than expected across the board and sparked some modest upside in Bunds, though well within earlier parameters. No move to a new Schatz auction which was fairly weak.

- Gilts are outperforming after the morning’s jobs data. Opened higher by 45 ticks before climbing to a 91.81 peak with gains of 57 ticks at best. Stopping a tick shy of the 91.82 September peak; if the move continues, then there is a bit of a gap before the 92.70 August high. The morning’s data saw an unexpected jump in the unemployment rate, going against the view from the most recent MPC statement that there is less of an immediate risk that the labour market will loosen very rapidly. A point that serves as a dovish impetus. However, this is caveated on face value by the elevated wage figure (incl-bonus). Upside that the ONS attributes to the public sector, as some pay rises are awarded earlier than they were in 2024.

- Germany sells EUR 4.25bln vs exp. EUR 5.5bln 2.00% 2027 Schatz: b/c 1.4x, average yield 1.91%, retention 22.7%.

- Italy sells EUR 8.5bln vs exp. EUR 6.75-8.5bln 2.35% 2029, 3.25% 2032, 2.80% 2028, 3.85% 2040 BTP.

Commodities

- Crude benchmarks are trending lower as renewed trade worries, easing geopolitical tensions, and an oversupplied oil market weigh on prices. Benchmarks are steadily declining as the European session continues, with WTI and Brent currently c. USD 1.7/bbl lower and trading near lows at USD 58.20/bbl and USD 62.00/bbl, respectively.

- Precious metals extended to new ATHs during APAC trade, with XAU and XAG peaking at USD 4180/oz and USD 53.59/oz respectively, before selling off as US President Trump hints of total peace in the Middle East.

- Base metals have reversed Monday’s gains, with 3M LME Copper returning to USD 10.5k/t from a peak of USD 10.86k/t, as recent dollar strength weighs on the commodity space.

- IEA OMR: lowers 2025 world oil demand growth forecast to 710k BPD (prev. 740k BPD); leaves 2026 average oil demand growth forecast steady at 700k BPD.

- TotalEnergies (TTE FP) CEO says they are still quite bullish in medium term oil demand; CEO says there is no peak oil demand.

- US Energy Secretary Wright is set to announce the Trump administration’s fusion roadmap at an industry gathering on Tuesday, via Axios citing DOE officials.

Geopolitics

- US President Trump is said to have confirmed that Israeli PM Netanyahu will not annex any part of the West Bank, according to Al Arabiya.

- Iran’s Foreign Ministry says US President Trump’s desire for peace and dialogue is in conflict with US hostile and criminal behaviour against Iran.

- US President Trump posts “Gaza is only a part of it. The big part is, PEACE IN THE MIDDLE EAST!”.

- Israeli’s Defence Force says several suspects were identified crossing the yellow line and approaching IDF troops operating in the northern Gaza Strip, which constitutes a violation of the agreement; troops opened fire to remove the threat, via CGTN.

US event calendar

- 8:45am: Fed’s Bowman in Moderated Conversation at IIF

- 12:20pm: Fed’s Powell Speaks on Economic Outlook and Monetary Policy

- 3:25pm: Fed’s Waller on Payments Panel at IIF

- 3:30pm: Fed’s Collins Speaks to the Greater Boston Chamber of Commerce

DB’s Jim Reid concludes the overnight wrap

As was looking likely in Asian trading yesterday morning, markets have recovered over the last 24 hours, with the S&P 500 (+1.56%) last night bouncing back from its tariff-induced selloff on Friday. A little momentum has been lost in the Asian session this morning but we’re still in a better place than Friday.

As we discussed this time yesterday, the biggest driver to Monday’s rally was more positive rhetoric on trade over the weekend, which suggested that the US was more open to a compromise than Trump’s initial posts from Friday had indicated. But markets also got another boost from the latest AI news, as OpenAI signed a deal with Broadcom (+9.88%) to purchase 10 gigawatts of computer chips. So by the close, it meant the S&P 500 had recovered more than half of its Friday losses, and other assets like Brent crude oil (+0.94%) also managed to pare back last week’s declines.

Stand by for the start of US earnings season today with JPMorgan Chase, Johnson & Johnson, Wells Fargo, Goldman Sachs, BlackRock and Citigroup all reporting. S&P 500 (-0.38%) and NASDAQ (-0.57%) futures are lower this morning ahead of what will soon be a deluge of earnings in a market starved of macro data due to the shutdown. Japanese markets are being hit the most this morning with the Nikkei down -2.80% with continued reverberations around the collapse of the ruling coalition late last week which puts some concerns as to whether new LDP leader Sanae Takaichi can still get enough votes to be elected PM.

In terms of the latest on the trade war, the news over the last 24 hours has continued to sound much more emollient. For instance, US Treasury Secretary Bessent was on Fox Business yesterday, and he said on the Trump-Xi meeting in South Korea, that “I believe that meeting will still be on”. Polymarket has the probability at such a meeting at 74% this morning from 62% as we went to print yesterday, 35% at the lows on Friday and 88% at the recent highs last week. Although as we go to print Bessent has been interviewed by the FT and his words seem more hawkish, accusing the Chinese of trying to hurt the world economy.

A reminder of Trump’s weekend posts, including his comment that Chinese President Xi “doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!” That backdrop led to a decent rebound for the most trade-sensitive stocks. So the NASDAQ Golden Dragon China index was up +3.21%, and that’s an index made up of companies publicly traded in the US, but who do a majority of their business in China. Similarly, the Philadelphia Semiconductor Index (+4.93%) posted its strongest daily performance since May, admittedly with a boost from the Broadcom headlines as well.

That unwind was clear across multiple asset classes, as the initial reaction from Friday was pared back. For instance, oil prices posted a decent recovery, with Brent crude (+0.94%) moving back up to $63.32/bbl, as investors lowered the chances of a wider breakdown in trade. Meanwhile US bond markets were closed for the Columbus Day holiday, but Treasury futures pointed to higher yields all day but 10yr yields are only +0.6bps higher this morning from Friday’s close at 4.038% after having approached 4.07% at the reopen in Asia. 2yr yields are actually -1.3bps lower now than Friday’s close.

Whilst the focus was mainly on trade yesterday, we’re also now two weeks into the US government shutdown, with no sign of a resolution as it stands. Indeed, if we look at prediction markets, it’s clear that a growing risk of an extended shutdown is being priced in, with Polymarket saying there’s a 27% chance now of it lasting beyond November 16. So that would still be another month from here and take it well over the 35-day record set in 2018-19. And if it did last that long, then it would continue to impact the flow of data like the jobs reports and have an increasing macroeconomic impact as federal workers remain without pay for the shutdown period.

Over in Europe, political uncertainty was also a key theme yesterday as investors remain focused on the French budget situation. In terms of the next steps, PM Lecornu will be delivering the general policy statement today after his reappointment as PM, but the same issue remains in that the National Assembly is completely fractured between the different groups, who each have their own red lines. For now, however, markets haven’t seen much reaction, with the Franco-German 10yr spread holding broadly steady at 83bps. So it’s still beneath its peak of 86bps last week, when there was briefly a lot of speculation about another snap legislative election. Polymarket suggests the probability of an election being called by the end of the month and the end of the year stands at 36% and 57% respectively this morning but both down over 10pp from Sunday’s highs.

Elsewhere in Europe, markets generally put in a solid performance yesterday, with the STOXX 600 up +0.44%, alongside gains for the DAX (+0.60%), the CAC 40 (+0.21%) and the FTSE 100 (+0.16%). Similarly, bonds rallied across the continent, with yields on 10yr bunds (-0.8bps), OATs (-0.9bps) and BTPs (-2.8bps) all moving lower, whilst Spain’s 10yr yield (-1.6bps) hit a 3-month low.

In the rest of Asia, outside of the politically motivated slump in Japan, markets are on the softer side led by the KOSPI (-1.36%) which has turned sharply lower as I’ve been typing this morning even with decent results from Samsung. China has imposed curbs on five US units of Hanwha Ocean after the US probed Chinese maritime, logistics and shipbuilding industries. Elsewhere, the Hang Seng (-0.18%) is also lower for the seventh consecutive session with the Shanghai Composite (+0.21%) holding onto its gains alongside the S&P/ASX 200 (+0.16%). The minutes from the Reserve Bank of Australia’s latest meeting revealed that the central bank remains cautious regarding future interest rate cuts due to persistent local inflation, while largely reiterating its data-dependent approach to future rate adjustments, noting that it is also awaiting the full impact of its monetary easing to be reflected in the economy.

Finally, yesterday brought another surge in gold prices (+2.30%), which continued their rally to close at $4,1110/oz. So that now takes their YTD gain up to +56.6%, still on track for their strongest annual performance since 1979. This morning we’re up another +1.38% as I type. Meanwhile, silver (+4.44%) moved up to $52.37/oz yesterday, with its own YTD gains now standing at +82%. The London short squeeze continues to have an impact.

To the day ahead now, and data releases include UK unemployment for August, the German ZEW survey for October, and the US NFIB small business optimism index for September. Central bank speakers include Fed Chair Powell, the Fed’s Bowman, Waller and Collins, the ECB’s Cipollone, Makhlouf, Kocher and Villeroy, BoE Governor Bailey, and the BoE’s Taylor. Finally, earnings releases include JPMorgan Chase, Johnson & Johnson, Wells Fargo, Goldman Sachs, BlackRock and Citigroup.

Loading recommendations…