US equity futures are higher after progress was made by US and Chinese trade negotiators, with a framework in place ahead to provide a basis for the upcoming Trump-Xi meeting on Thursday. As of 8:00am ET, S&P 500 futures rise 0.9% to a new all time high, having closed last week at a record, with Nasdaq and Russell outperforming as the framework deal is boosting Semis / Mag7 while rare earth plays are under pressure. AMD, AVGO, and NVDA are +2% with all Mag7 higher. Cyclicals are outpacing Defensives with parts of Staples in the red. Bond yields are up 2bp across the curve, pushing the 10Y to 4.02%. The dollar weakened against all major peers except the Swiss franc. Commodities are mixed as both energy and precious metals slide, though base metals are higher and Ags are mostly higher. Copper, a bellwether for global growth, neared an all-time high. Earnings and the Fed are the focus this week with ~44% of SPX market cap reporting this week and the Fed likely to cut by 25bps and potentially to halt QT.

In premarket trading, Magnificent 7 stocks are all higher (Nvidia +2.4%, Amazon +1.8%, Alphabet +2%, Tesla +1.3%, Meta +1.3%, Microsoft +1.2%, Apple +0.8%)

- US stocks with significant exposure to Argentina are rallying after President Javier Milei posted a strong showing in legislative elections, soothing worries that his economic plans would stall.

- US-listed rare earth stocks fell after US Treasury Secretary Scott Bessent said on Sunday that he believed China would delay its rare earth curbs for a year. Rare earth export restrictions were expected to impact supply.

- Avidity Biosciences (RNA) soars 43% after Novartis agreed to buy the biotechnology company in a deal valued at $12 billion. Shares in peer Dyne Therapeutics (DYN) jump 36%.

- BridgeBio Pharma (BBIO) climbs 10% after reporting positive topline results from its Phase 3 pivotal study of BBP-418 in individuals living with limb-girdle muscular dystrophy type 2I/R9.

- Cadence Bank (CADE) rises 2% after agreeing to be bought by Huntington Bancshares Inc. (HBAN) in an all-stock transaction that values Cadence at $7.4 billion. Shares of Huntington are down 4%.

- Essential Utilities Inc. (WTRG) climbs 1.9% after American Water Works Co. agreed to buy the company in an all-stock deal valued at about $12 billion

- GameStop (GME) rises 7% after the White House’s Rapid Response 47 account reposted a statement from the company on X that declared the so-called “console wars” over.

- Grindr (GRND) is up 2% and set to extend Friday’s 19% rally after the dating app confirmed the special committee of its board received a non-binding, unsolicited take-private proposal from large shareholders Ray Zage and James Lu for $18 per share in cash.

- Keurig Dr Pepper Inc. (KDP) gains 6% after raising its full-year net sales outlook, as focus turns to its acquisition of JDE Peet’s NV.

- Zenas Biopharma (ZBIO) soars 56% after the drug developer said a mid-stage trial of its investigative therapy for multiple sclerosis met its primary endpoint.

In corporate news, Novartis agreed to buy Avidity Biosciences in a $12 billion deal. Boeing factory workers in St. Louis narrowly rejected a new five-year contract that would boost wages by an average of 24%, extending a nearly three-month strike. Newmont is set to extend Friday’s losses after the company is said to be is studying a potential deal to gain control of Canadian rival Barrick Mining’s prized Nevada gold assets.

S&P 500 futures traded in fresh record territory after US and Chinese negotiators said they’d reached agreements on issues spanning tariffs, shipping fees, fentanyl and export controls ahead of a meeting between Trump and Xi Jinping later this week. Bloomberg Economics’ Chief Asia Economist Chang Shu expects leaders to approve the deal, but whether it will bring lasting relief to markets is less clear — “the new reality for US-China ties appears to be one of frequent ruptures and short-term fixes.”

“The shift of attention to the negotiations with China is causing the markets to open higher, but only a positive outcome will be sustainable,” said Guillermo Hernandez Sampere, head of trading at asset manager MPPM. “This week could be crucial for the course of the rest of the year, with the greatest focus on the Federal Reserve’s wording regarding monetary policy.”

Easing trade tensions between the world’s largest economies are giving investors fresh confidence to extend equities’ rally from April lows, when markets slumped as Trump moved to rewrite global trade rules. That advance faces key tests this week, with the Fed expected to cut interest rates and earnings from AI-heavyweights set to offer clues on profit durability.

“This looks like a win on optics for both sides — the US tempers inflation and supply-chain risks tied to rare earths and electronics, while China avoids sweeping tariffs and keeps its export channels open,” said Charu Chanana, chief investment strategist at Saxo Markets in Singapore. “But until the leaders’ summit signs off, it’s a truce extension, not a breakthrough.”

Elsewhere, Trump announced an additional 10% in tariffs on Canada in response to an advertisement by the province of Ontario that’s critical of the levies. Trump also hailed a “big win” for Javier Milei after his party’s comeback victory in Argentina’s midterm elections, which came after a series of unorthodox steps by the US aimed at stabilizing Argentine assets.

“Fears around the Trump–Xi summit are dissipating, with the tone turning more conciliatory and Bessent suggesting a 100% tariff scenario is practically off the table,” said Susana Cruz, strategist at Panmure Liberum. “Cyclical sectors are likely to benefit the most.”

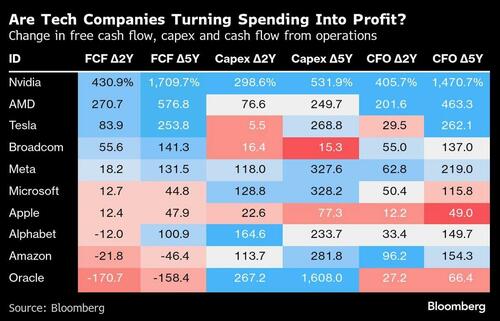

Besides key trade events, we also have a huge week of tech earnings on deck, including results from Microsoft, Alphabet, Meta Platforms, Amazon.com and Apple. Investors will be seeking color on AI spending plans — and when companies will see returns on their huge investments. Out of the 145 S&P 500 companies that have reported so far in the earnings season, 84% have managed to beat analyst forecasts, while 14% have missed.

Also on the radar is a slew of central bank policy meetings this week. The Fed is widely expected to deliver a second straight rate cut — though eyes will be on deepening divisions between policymakers. Meanwhile, Trump said he expects to make a decision on the next Fed Chair by the end of the year as Treasury Secretary Scott Bessent confirmed the names of five finalists to succeed Powell.

Equity analysts are expected to broaden their earnings revisions to more stocks toward the end of the year and into 2026, according to Morgan Stanley. The third-quarter earnings season has proved stronger than expected so far and could deliver results beyond what analysts expected prior to the tariff turmoil in April, Deutsche Bank strategists said. If beats continue at current rates, y/y earnings growth for the S&P 500 is on track to pick up to 13.2% in 3Q from 9.3% in 2Q, they said.

The US market euphoria hasn’t quite translated for European stocks, with the Stoxx 600 only rising 0.1% on a drag from France and the UK, and a slide in Switzerland. Denmark’s Sydbank surges on a surprise tie-up with two local rivals, and Porsche rises after it reported earnings on Friday after market close. Goodwin shares jump after it said it expects annual trading profit before tax to double. Here are the biggest movers Monday:

- Sydbank gains as much as 7.4%, the most since June, after the Danish lender announced it would buy and merge two of its rivals, Arbejdernes Landsbank and Vestjysk Bank

- Porsche shares rise as much as 4.4% to their highest intraday level since May after posting its latest earnings after market close on Friday. Analysts said the release was consistent with the September profit warning

- Goodwin shares jumped as much as 33%, climbing to a record high, after the engineering company said it expects annual trading profit before tax to double from the prior year and announced a special interim dividend

- Beijer Alma gains as much as 5.3%, extending Friday’s 8.5% earnings-triggered gains, after Handelsbanken upgraded its view on the Swedish industrial components group to buy, saying the company is making “significant” progress

- Galp Energia shares rise as much as 3%, hitting a nine-month high, after the oil and gas firm reported adjusted net income that blew past estimates. Management said the company is well positioned to surpass its current guidance

- Sika falls as much as 1.9% after Bank of America resumed coverage of the chemicals group with an underperform rating after the company’s disappointing 3Q earnings on Friday. Meanwhile, Oddo BHF downgraded its view to neutral

Earlier in the session, Asian stock benchmarks climbed to a fresh record after the US and China came to terms on a range of contentious points, setting the table for a finalized trade deal. The MSCI Asia Pacific Index gained 1.5%, with TSMC and Tencent among the biggest boosts. South Korea’s Kospi jumped more than 2.5% to a new all-time high, helped by chipmaker shares, while Japan’s Topix reached record levels amid strong public support for newly appointed Prime Minister Sanae Takaichi. Benchmarks in Hong Kong and mainland China rose about 1% each, as trade tensions between the world’s largest economies that rattled investors appeared set to ease. Trade egotiators announced Sunday that they’d struck agreements on issues from tariffs to shipping fees, fentanyl and export controls, ahead of Thursday’s planned meeting between Donald Trump and Xi Jinping. Thailand’s main equity gauge rose nearly 1.5% after the nation reached an agreement with Cambodia to manage a border dispute. Stocks declined in Indonesia, the Philippines and Vietnam.

In FX, Bloomberg Dollar Spot Index down 0.1%, with Aussie dollar outperforming on a combination of trade optimism and hawkish comments from RBA Governor Bullock.

In rates, treasury futures hold small losses after gapping lower at the Asian open as prospect of a US-China trade agreement stokes risk appetite, lifting stock futures. Rates market also faces pressure from two- and five-year note auctions slated for Monday, an accelerated schedule enabling supply cycle to conclude before Fed rate decision Wednesday. US yields are 2bp-3bp cheaper across the curve with 10-year around 4.03%, lagging bunds and gilts in the sector by about 1bp and 2bp respectively; curve spreads are little changed. German business confidence hit the highest since 2022, while French markets are digesting Moody’s turning negative on its debt. Monday’s auctions include $69 billion 2-year at 11:30am and $70 billion 5-year at 1pm; cycle ends Tuesday with $44 billion 7-year sale. WI 2-year yield near 3.50% is ~7bp richer than last month’s, which stopped through by 0.1bp; WI 5-year near 3.64% is also ~7bp richer than previous

In commodities, oil reverses an earlier rise and Brent slides well below $66/barrel. Copper rising but short of a record high. Gold falling, down by $73 to $4,040/oz.

The US economic calendar calendar includes October Dallas Fed manufacturing activity at 10:30am; September durable goods orders slated for 8:30am face postponement due to government shutdown.

Market Snapshot

- S&P 500 mini +0.8%

- Nasdaq 100 mini +1.1%

- Russell 2000 mini +1%

- Stoxx Europe 600 little changed

- DAX little changed

- CAC 40 -0.2%

- 10-year Treasury yield +2 basis points at 4.02%

- VIX -0.6 points at 15.74

- Bloomberg Dollar Index little changed at 1211.98

- euro little changed at $1.1634

- WTI crude -1% at $60.91/barrel

Top Overnight News

- Chinese and US trade negotiators struck a slew of agreements on issues spanning tariffs and shipping fees to fentanyl and export controls. Donald Trump said he’ll have a great talk with Xi Jinping later this week as his visit to Asia continued. BBG

- Argentine President Milei’s libertarian party has won a big victory in midterm legislative elections, giving his free-market reform drive fresh impetus after a financial market crisis threatened to derail it. Milei’s La Libertad Avanza party garnered 40.7% against 31.7% for the Peronist opposition alliance with 98% of the vote counted. FT

- President Donald Trump said a decision on the next Federal Reserve chair might be made by the end of the year. The pool of candidates has been narrowed to five, including Trump’s aide Kevin Hassett, former Fed Governor Kevin Warsh, current Fed Governor Christopher Waller, Fed Vice Chair for Supervision Michelle Bowman and BlackRock executive Rick Rieder. RTRS

- American employers are increasingly making the calculation that they can keep the size of their teams flat—or shrink through layoffs—without harming their businesses. Part of that thinking is the belief that artificial intelligence will be used to pick up some of the slack and automate more processes. WSJ

- Mark Carney said Canada is ready to resume talks, but Trump ruled out meeting him for a while. Brazil’s Lula da Silva said he had a “surprisingly good” meeting with the US president, and predicted a “definitive solution” within days. BBG

- Apartment rents nationally are advancing at their slowest pace in years, thanks to the glut of new units that has taken longer than expected to absorb. More recently, job concerns among young people are posing a new threat to the rental market. The U.S. unemployment rate for people aged 20 to 24 was 9.2% in August, more than double the overall rate. WSJ

- China’s industrial profits rose sharply in September, extending momentum from a stronger-than-expected increase in August. Industrial profits rose 21.6% from a year earlier in September, following a 20.4% rise in August that ended a three-month run of declines. WSJ

- South Korea’s President Lee Jae Myung warned its property market is a bubble that’s about to burst as he backed the central bank decision to hold rates.BBG

- French lawmakers didn’t vote on a Socialist proposal for a wealth tax Saturday, delaying a possible compromise in a budget debate. French assets wavered after Moody’s cut the country’s credit outlook to negative. BBG

- After 2 straight weeks of selling, HFs reversed course and net bought US equities this week, driven by short covers in Macro Products and to a lesser extent long buys in Single Stocks – nearly all of the ETF shorts raised last week (+6.1%) were covered this week (-5.9%). GS PB

- Fed proposed changes to boost bank stress test transparency on Friday, with the Fed to disclose and solicit feedback on stress test models and scenarios for the first time under the new proposal. Fed Vice Chair for Supervision Bowman said the changes would improve bank capital planning, while Fed’s Barr objected to the proposed changes and warned that it would weaken the test and lower bank capital.

Trade/Tariffs

- US President Trump said he expects a very fair meeting with Chinese President Xi and he is optimistic about a China deal, while he said he will do some good business with Chinese President Xi and that he has a lot to talk about with Xi.

- US President Trump said they might sign a final deal on TikTok on Thursday; received provision approval from Chinese President Xi.

- Bessent said overall inflation has come down since President Trump took office and he is confident that inflation will fall further towards the Fed’s 2% target, while Bessent also said that the government shutdown is starting to eat into the muscle of the US economy.

- US Treasury Secretary Bessent said China is ready to make a trade deal and that they have a framework for Trump-Xi talks, while he added that US President Trump and Chinese President Xi will make the final decisions. Bessent separately commented that the tariffs increase on China was averted and that China agreed to delay a new rare earths export licensing regime for a year. Bessent also stated that he expects the Chinese to be making substantial purchases of US soybeans again soon and that US soybean farmers will feel good about coming soybean seasons for several years when the Trump-Xi trade deal is announced, as well as noted that the details of the TikTok deal are ironed out with Trump and Xi able to consummate that transaction in South Korea on Thursday.

- Transportation Secretary Duffy warned that travellers will face more flight delays and cancellations in the coming weeks amid the continuing shutdown: Bloomberg.

- China’s top trade negotiator Li said they reached a consensus with the US and talked about tariffs and export controls, while he added they will enhance communication with the US and talked about 301 port fees, trade expansion and fentanyl.

- Chinese Vice Premier He said they should jointly implement the consensus reached with the US, while he added that China and the US should find ways to properly address each other’s concerns through equal dialogue and consultation.

- USTR said on Friday that they initiated a trade investigation of China’s implementation of the Phase One agreement with the US. It was also reported that China’s embassy to the US said regarding the USTR investigation that China opposes false accusations related to investigation measures and that US actions have done serious damage to US-China ties as well as economic and trade relations, while it urged the US to promptly correct wrong practices.

- Chinese Premier Li met with European Council President Costa and said China is willing to work with the EU to keep bilateral relations on the right track, according to Xinhua. It was separately reported that Costa said he shared a strong concern with Li about expanding export controls on critical raw materials, and urged Li to restore as soon as possible fluid, reliable and predictable supply chains. Furthermore, he expressed expectations that China helps to put an end to Russia’s war against Ukraine and stressed the need to make concrete progress as a follow-up to the EU-China summit.

- US President Trump says they will come away with a deal with China.

- US President Trump announced the US is to immediately raise tariffs on Canada by another 10% because of the fraudulent ad misrepresenting Ronald Reagan’s view on tariffs. Trump said Canada has been ripping the US off for a long time, and they’re not going to do it anymore.

- Canadian PM Carney says that Canada is ready to sit down with the US, hasn’t had contact with US President Trump since Thursday.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher amid trade-related optimism after the US and China reached a framework for Trump-Xi talks this week, with the US tariff increase on China averted, while China was said to have agreed to delay a new rare earth exports licensing regime for a year. ASX 200 gained as strength in tech, financials and industrials led the upside seen in most sectors, while defensives lagged. Nikkei 225 rallied to above the 50k level for the first time ahead of US President Trump’s visit to Japan, where the sides are expected to ink a tech-cooperation MOU covering areas, including bio, quantum, nuclear fusion energy and space. Hang Seng and Shanghai Comp benefitted amid hopes of improving US-China ties, with the sides said to reach a consensus ahead of the Trump-Xi meeting on Thursday, while Industrial Profits data from China showed the fastest growth in two years.

Top Asian News

- PBoC Governor says they will resume government bond purchases and selling in the open market; will continue to maintain supportive monetary policy stance; to implement properly loose monetary policy.

- Almost two dozen world leaders are visiting the Malaysian capital of Kuala Lumpur for the 47th ASEAN summit, which takes place from Sunday to Tuesday.

- US President Trump posted “Just leaving Malaysia, a great and very vibrant Country. Signed major Trade and Rare Earth Deals, and yesterday, most importantly, signed the Peace Treaty between Thailand and Cambodia. NO WAR! Millions of lives saved. Such an honor to have gotten this done. Now, off to Japan!!!”

- RBA’s Bullock says that reducing inflation while maintaining employment levels is very satisfying; unemployment rate could come down once again in the next month. Board is cautious about policy, with rates still a bit restrictive. US tariffs could potentially be deflationary for Australia. Labour supply growth is not as fast as it was but will not fall off a cliff. Prepared to adjust policy if proven wrong on the labour market.

European bourses (STOXX 600 U/C) opened firmer across the board, with sentiment boosted by the constructive US-China trade talks over the weekend, whereby the two countries reached a framework for Trump-Xi talks. However, some indices did pare off best levels as the morning progressed, albeit still remain mostly firmer in Europe. European sectors opened with a strong positive bias, but are now mixed. Basic Resources leads, followed closely by Tech; the pair boosted by the aforementioned trade optimism. To the bottom of the pile resides Chemicals and Consumer Products.

Top European News

- French lawmakers refrained from voting on a Socialist proposal for a wealth tax on Saturday, delaying a possible compromise in a budget debate which risks collapsing the fragile minority government, according to Bloomberg.

- ECB’s Escriva said the ECB is communicating in its statements after each meeting that inflation is truly at the target of 2% and they think it is a good time to look ahead and consider the current level of interest rates appropriate.

- Moody’s maintained France’s rating at Aa3, but revised the outlook to negative from stable.

- EU nations could be called upon to raise 10s of billions of Euros worth of joint debt as part of a backup plan to support Ukraine, via Politico citing sources.

- ECB Survey on the Access to Finance of Enterprises: Inflation expectations remained unchanged across horizons. Firms continue to report upside risks to their long-term inflation outlook, broadly unchanged compared with the previous round. Firms reported a small net tightening in bank loan interest rates as well as in other loan conditions related to both price and non-price factors. Financing needs, bank loan availability and the financing gap were broadly unchanged.

FX

- DXY is flat and trades in a 98.77 to 98.99 range. Ultimately, very little action despite the US reaching a consensus with China ahead of Trump-Xi talks on Thursday and inking several trade agreements with South East Asian partners during President Trump’s visit to the region including a rare earths deal with Malaysia, while Trump now heads to Japan where he is set to meet the Emperor later today before meeting PM Takaichi on Tuesday. Dollar traders may ultimately be focusing on the looming key risk events this week, which includes; the Fed, BoC, BoJ and ECB policy announcements, and then the Trump-Xi meeting on Thursday. On the theme of trade, the US raised tariffs on Canada by another 10% following the recent ad-saga; USD/CAD currently a little higher today, trading at the upper end of a 1.3974 to 1.4010 range.

- EUR is essentially flat/slightly firmer vs USD. The Single-currency was little moved on the latest German Ifo data which was ultimately mixed; Business Climate rose a touch above expectations, Current Conditions was a little short of the consensus, whilst Expectations surpassed the top-end of the forecast range. The Ifo head said, “Expectations are increasing in all sectors”, and the German economy has not yet lost hope for a recovery. Elsewhere, the latest ECB SAFE release highlighted that inflation expectations remained unchanged across horizons. Overnight, ECB’s Escriva suggested that current interest rates are appropriate. Elsewhere, late on Friday, Moody’s maintained France’s rating at Aa3, but revised the outlook to negative from stable. The agency cited heightened risks associated with political fragmentation which could limit France’s ability to reduce its deficit. EUR/USD currently sits in a 1.1618-1.1647 range.

- JPY is slightly firmer vs the Dollar and trades within a 152.66 to 153.25 confine. Overnight, USD/JPY hovered around 153.00. Initial price action saw some pressure in the JPY, given the risk tone, though this was offset by firmer-than-expected Services PPI data from Japan. Yen traders will be mindful of Trump’s meeting with the Japanese Emperor later today, and then more pertinently his meeting with PM Takaichi. On that, reports in recent weeks have suggested the Japanese PM is willing to purchase US pickups, soybeans and gas but may avoid Trump’s new defence spending targets. She has recently been on the wires, where she said she is looking forward to having a positive discussion with the POTUS.

- GBP is on a mildly firmer footing with the high-beta currency propped up by the overall risk appetite across the markets. Comments from UK Chancellor Reeves, speaking in Riyadh, had little effect on Sterling, with less than a month to go till the Autumn Budget. On trade, the Chancellor suggested taking US President Trump seriously was key in the UK-US trade deal, whilst the UK had really good meetings around a UK-GCC trade deal in Riyadh, and she’s confident that she can get the deal over the line. GBP/USD trades within Friday’s 1.3287-1.3364 range, in a current 1.3311-1.3339 parameter.

- Antipodeans outperform due to their high-beta statuses and China exposure amid the US-China trade optimism, while the PBoC also set the strongest USD/CNY reference rate setting in just over a year. AUD is propped up by a surge in base metals amid the aforementioned optimism, with RBA Governor Bullock saying little to move the Aussie this morning. AUD/USD in a 0.6528-0.6555 range, with the 100 DMA at 0.6536 and the 50 DMA at 0.6552. NZD/USD sees shallower gains amid the AUD/NZD cross’ rise above 1.1350.

- Barclays’ proprietary month-end rebalancing model indicates weak USD selling against all majors at the end of October. October saw heightened policy uncertainty and mixed markets, driven by the US government shutdown, limited data releases, and global political shifts, though sentiment improved late in the month as US-China tensions eased.

Fixed Income

- USTs are firmer today, with upside facilitated by the latest US-China trade optimism. In brief, the US and China have come to a framework for Thursday’s leader-level talks, a US tariff increase on China has been averted which, in-turn, resulted in a one year delay to China’s new rare earth licensing regime being agreed. Updates that sent USTs to a 113-04 base, taking out last week’s 113-09 trough. Since, as the risk tone eases marginally from best, the complex has lifted off lows taking USTs to a 113-09 high, but still very much in the red. For today, the docket is light and the discussed trade points are likely to remain in focus into/after a frontloaded supply slate on account of the Fed with USD 139bln due across 2yr and 5yr notes. Elsewhere, the PBoC has announced that they will be resuming bond activity in the open market. As a reminder, the PBoC suspended such activity at the start of 2025 after beginning it in 2024 as a policy tool for liquidity management purposes. A resumption that comes after growing speculation over the last few weeks that the PBoC could recommence such activity, potentially in Q4-2025.

- Bunds in the red throughout the early morning, down to a 129.26 trough with losses of 20 ticks at most, hit by the risk tone following the trade progress (see USTs) and also potentially weighed on by talk of joint issuance. Since, as the risk tone deteriorates from best, benchmarks generally have climbed off worst and for Bunds this has been sufficient to bring them to highs of 129.45 and near the unchanged mark. Even if the benchmark moves into the green, there is some way to go before the best levels from last week’s sessions are tested, between 130.02 and 130.38. On the joint issuance report, Politico writes that EU nations could be called upon to raise 10s of billions of Euros of joint debt to support Ukraine. A backup plan following the use of frozen Russian assets being blocked by Belgium due to legal concerns.

- Gilts opened lower by 22 ticks before falling a little further to a 92.15 low, acknowledging the pressure seen in peers given the trade tone. Since, the benchmark has lifted off that low and holds around the 93.30 mark, just off a 93.36 peak. If the move continues and Gilts manage to get into the green then resistance lies at 93.60, 93.80 and 93.93 from last week. For the UK, specifics a little light after last week’s packaged data agenda. As such, the benchmark is following the direction set out by USTs/EGBs thus far. Weekend press reports remain focussed on the approaching budget. The Times outlined that Chancellor Reeves is set to increase the National & Real Living Wages, adjustments that have unsurprisingly drawn critique from some.

- OATs are outperforming post-Moody’s. On Friday, France narrowly avoided losing its final AA rating. Moody’s kept France at Aa3, but cut the outlook to negative (prev. stable). Commentary in the review was similar to the last assessment, but also highlighted the fresh concern around the postponement of pension reform until the next presidential cycle. Amidst all this, OATs trade a little better than their German peer, benefitting from Moody’s and an extra day of talks on wealth tax adjustments. As such, the OAT-Bund 10yr yield spread is a little narrower down to just below the 80bps mark after climbing incrementally over it last week.

Commodities

- Crude is currently lower after spending most of the overnight session on a firmer footing. Nothing really behind the recent dip in prices, but does come as market sentiment wanes a touch – perhaps as focus turns back to oversupply concerns. WTI and Brent trade in a USD 60.98-62.17/bbl and USD 65.37-66.64/bbl range. In geopols, US President Trump said he won’t meet with Russian President Putin until he thinks they have a peace plan.

- Spot gold is on the backfoot today, with haven assets generally shunned as traders focus on the latest trade optimism. On that, US and China agree on a framework of a trade deal ahead on the Trump-Xi meeting on Thursday. The US Trade Sec described it as a “positive framework”. XAU has gradually dipped throughout the session, and currently resides at the lower end of a USD 4,039.11-4,109.08/oz range.

- Base metals are mixed, but with some clear strength in copper prices today, as traders cheer the latest US-China trade developments. 3M LME currently trading in a USD 11,005.75-11,096/t range.

- Iraqi oil minister says there are talks to adjust Iraq’s quota within the available production capacity; says Iraq’s current production capacity is 5.5mln BPD but they are committed to the OPEC quota of 4.4mln. BPD Crude oil exports from Kurdistan region at around 195k BPD. Total oil exports at 3.6mln BPD. Fire in Iraq’s Zubair oilfield has not affected exports.

- At least 5 workers were seriously injured in an oil pipeline fire in Iraq’s Zubair oilfield, while the fire has not affected production from the oilfield, which stands at 400k bpd.

- US Energy Secretary Wright said the US is to double natural gas exports in the next five years, and could double it again in another five to ten years if demand is there.

- TotalEnergies (TTE FP) is ready to restart the USD 20bln Mozambique LNG project four years after it was halted due to a terrorist attack, according to FT.

Geopolitics: Middle East

- Israel’s military said it conducted a targeted strike in central Gaza.

- US President Trump said on Saturday that Hamas must start returning the bodies of hostages and that they will be closely watching over the next 48 hours.

- US Secretary of State Rubio said the US team is working on a possible UN resolution or international agreement to authorise a multinational force in Gaza.

Geopolitics: Ukraine

- US President Trump said he won’t meet with Russian President Putin until he thinks they have a peace plan.

- Kremlin said Russian armed forces will respond harshly in the event of strikes deep inside of Russia. It also stated that it is wrong to talk about the cancellation of the Putin-Trump summit and there is an understanding between Russia and the US that it would not be good to delay the meeting, according to RIA.

- Russian President Putin said Russian forces conducted training live launches of all three components of the strategic nuclear forces drill, while the strategic nuclear forces drill confirmed the reliability of Russia’s nuclear shield.

- Russia’s General Staff of the Armed Forces head Gerasimov said Russian forces are advancing in Ukraine’s Dnipropetrovsk and Zaporizhzhia regions, while he also stated that a successful test of the Burevestnik missile with a nuclear power unit was conducted on October 21st, according to Interfax.

- Russian President Putin’s special envoy Dmitriev said on Friday that Russia-US dialogue is vital for the world and must continue with full understanding of Russia’s position and respect for its national interests. Dmitriev said dialogue between Russia and the US is continuing despite recent ‘unfriendly steps’ from Washington, and such dialogue is only possible if Russia’s interests are treated with respect, while he added that various forces, mainly the UK and Europeans, are trying to derail direct dialogue between Putin and Trump.

- Ukrainian President Zelensky called for sanctions on all Russian oil companies, the shadow fleet and oil terminals on Friday.

- UK PM Starmer said on Friday that the coalition of the willing is determined to go further than ever to ratchet up pressure on Russian President Putin, while he stated the meeting was clear that work on using frozen Russian assets needs to come to fruition quickly.

- Russia’s Kremlin says Russia is guided by its own national interest in relation to US President Trump’s comment. On the Burevestnik missile test, the Kremlin adds that there is nothing there to strain relations with the US and are only ensuring Russia’s national security and thereby are just developing new weapons. Russia must do everything to ensure its security amid the militarist mood in Europe.

Geopolitics: Other

- US President Trump responded that they will see, when asked about strikes in Venezuela. Trump also commented that he has a lot of respect for Taiwan, while he is not sure if he will meet with North Korean leader Kim during his Asia trip, but added that he likes Kim personally. It was separately reported that North Korea may possibly be preparing for a Trump-Kim meeting, although a South Korean presidential adviser said that they don’t see a meeting between US President Trump and North Korea leader Kim likely to happen.

- US President Trump said he would like to meet North Korean leader Kim Jong Un, if the North Korean leader would like to meet; would extend his trip if it was possible to meet with the North Korean leader

- North Korea’s Foreign Minister is to visit Russia on October 26th-28th.

- US Secretary of State Rubio said Taiwan should not be concerned about US-China talks, while he added the US is not going to walk away from Taiwan in return for trade benefits with China.

- Thailand and Cambodia signed a peace deal on the sidelines of the ASEAN Summit in Kuala Lumpur, according to Nikkei.

US Event Calendar

- 8:30 am: Sep P Durable Goods Orders, est. 0.2%

- 8:30 am: Sep P Durables Ex Transportation, est. 0.2%

- 8:30 am: Sep P Cap Goods Orders Nondef Ex Air, est. 0.3%

- 8:30 am: Sep P Cap Goods Ship Nondef Ex Air

- 10:30 am: Oct Dallas Fed Manf. Activity, est. -7.8, prior -8.7

DB’s Jim Reid concludes the overnight wrap

Investors face a busy week ahead that includes rates decisions by four of the G7 central banks, with the Fed and BoC on Wednesday followed by the BoJ and ECB on Thursday. A packed earnings calendar will see reports from five of the Mag-7 (Microsoft, Alphabet, Meta, Apple and Amazon), together representing a quarter of the S&P 500 market cap. But ahead of all that, markets are in a buoyant mood this morning as US and China officials indicated that they have largely aligned a deal to ease trade tensions ahead of the Trump-Xi meeting this Thursday.

Starting with the US-China news, China’s Ministry of Commerce said that the sides reached an initial consensus on a range of issues including an extension of the tariff truce, fentanyl, agricultural trade, export controls and shipping levies. In turn, US Treasury Secretary Bessent suggested that China would defer its new rare-earth export controls for one year and make “substantial” purchases of US soybeans, while the US threat of 100% tariffs on China was “effectively off the table”. Bessent signalled that the agreed “framework” should allow Presidents Trump and Xi to have “a very productive meeting” when they meet on Thursday on the sidelines of the APEC summit. The details from that meeting should give a clearer sense whether this represents a genuine stabilisation in US-China trade relations or only a return to the uneasy trade truce in place before the rhetoric escalated earlier this month. Any reduction of the 20% fentanyl tariffs by the US will be one key barometer to watch.

Asian markets are surging amid the US-China optimism this morning, with Japan’s Nikkei (+2.17%) and Korea’s KOSPI (+2.00%) on course for new record highs. Chinese stocks are showing significant, if slightly smaller, gains, with the CSI, the Shanghai Composite and the Hang Seng all about +1% higher. US equity futures are also advancing strongly from Friday’s record close (see last week’s recap at the end), with S&P 500 and NASDAQ futures +0.75% and +0.97% higher respectively. The risk-on mood is also boosting copper (+1.54%) and oil (+0.26%), but weighing on 10yr USTs (+3.2bps) and gold (-1.06%).

In other weekend trade news, Trump signed trade framework pacts with Malaysia, Thailand, Vietnam and Cambodia. The countries will allow preferential access for US goods in return for tariff exemptions on some of their exports to the US, though many of exact details are still to be finalised. By contrast, Trump announced a 10% additional tariff on Canada amid a spat over an anti-tariff ad released by the government of Ontario. It’s not clear whether USMCA-compliant goods would remain exempt from the extra 10% levy, which would mitigate much of its impact, but it’s a reminder that tariffs remain a go-to policy tool for the US administration even if peak trade uncertainty is behind us.

Looking to the week ahead, a second consecutive 25bps Fed cut looks locked in for Wednesday’s FOMC meeting, with markets pricing 49bps of cuts across the next two meetings. With a dearth of data and a still-divided FOMC, our US economists think Chair Powell is unlikely to provide clear signals on the policy path ahead, focusing more on topics including balance sheet policy and financial stability. Indeed, their baseline is that the Fed will this week announce an end to QT in response to the recent tightening in funding markets. See our US economists’ overall Fed preview here and our strategists’ note on what to expect on the balance sheet here.

In Europe, the ECB is widely expected to keep the deposit rate steady at 2% for a third consecutive meeting. Our economists think ECB President Lagarde will again describe policy as “in a good place” and will be watching whether she maintains the net hawkish tone that she struck in July and September. The Bank of Japan (Thursday) is expected to maintain its current policy stance, while the Bank of Canada is likely to deliver its own 25bp rate cut on Wednesday.

The Q3 earnings season will reach its apex this week with key reports due from Microsoft, Alphabet and Meta on Wednesday as well as Apple and Amazon on Thursday. The five biggest companies in the world after Nvidia now make up $15tn in total market capitalisation or 25% of the S&P 500. The full list of key reports is in the week ahead calendar at the end as usual.

On the data front, in the US the Conference Board’s October consumer confidence readings (Tuesday) are likely to be the main indicator of note amid the government shutdown. In the euro area, Germany’s ifo survey today will receive extra attention after last Friday’s jump in the PMIs, the ECB’s quarterly Bank Lending Survey (Tuesday) will precede its rates decision, and we’ll get the October inflation readings for Germany and Spain on Thursday, followed by France, Italy and the Eurozone on Friday. In Asia, we have the October PMIs in China (Friday) as well as September retail sales, industrial production and the Tokyo CPI for October in Japan (Thursday).

In data out of Asia this morning, China’s industrial profits have risen by +21.6% year-on-year in September, representing the largest increase since November 2023. This follows a +20.4% surge in August and brings the YTD increase to +3.2% in the first nine months of the year.

In other overnight news, Argentina’s mid-term elections saw an unexpected clear victory for President Javier Milei’s party, with 41% of the vote according to provisional results. That should allow Milei to protect his veto power and pursue aggressive reform policies, with local assets expected to rally this morning. Political developments will also be in focus in Europe this week, with the ongoing 2026 budget deliberations in France and the snap general election in the Netherlands (Wednesday).

Now recapping last week, a risk-on mood dominated after some volatility, helped by reduced US-China fears and Friday’s soft US CPI print. This saw lower-than-expected headline (+0.31% m/m vs +0.4% expected) and core CPI (+0.23% vs. +0.3% expected), mostly driven by softness in owner equivalent rents (+0.13% m/m) which saw their slowest monthly rise since the Covid pandemic. The trimmed mean and median CPI measures were also on the softer side at +0.2% m/m, but there some concerning price increases for tariff-affected goods categories. You can see our US economists’ full CPI take here.

Friday’s softer CPI cemented expectations of 25bp rate cuts for the next two Fed meetings and helped the S&P 500 rise +0.79% (+1.92% over the week) to a new record high. A strong start to the Q3 earnings season and confirmation of the upcoming Trump-Xi meeting drove tech outperformance, with the NASDAQ (+2.31%, +1.15% Friday) and the Philadelphia Semiconductor Index (+2.94%, +1.89% Friday) also reaching new all-time highs. And bank stocks continued to pare back earlier losses, with the KBW Bank Index up +3.62% as credit quality fears eased. This meant that US IG and HY credit spreads tightened by -3bps and -12bps respectively over the week, while European IG and HY spreads were -4bps and -15 bps tighter.

Global equities also posted new highs. That included the Stoxx 600 (+1.68% Friday, +0.23% Friday) and the FTSE 100 (+3.11%, +0.70% Friday) in Europe. And in Japan, with Sanae Takaichi becoming the new PM after winning a parliamentary vote, the Nikkei was up +3.61% (+1.35% Friday) to a record high of its own.

Bonds saw a more mixed performance. Treasuries initially rallied in response to Friday’s CPI print but were little changed by the close as markets digested the signal that tariff effects still had some way to play out. The 2yr yield was up +2.5bps over the week (-0.9bps Friday) to 3.48%, while 10yr yields ended the week -0.7bps lower at 4.00% (+0.1bps Friday) after touching a 12-month low of 3.95% on Wednesday. In Europe, yields on 10yr bunds (+4.5bps), OATs (+7.2bps) and BTPs (+3.7bps) all moved higher. Most of that rise came on Friday as the Euro area composite PMI rose to a 17-month high of 52.2 and Germany’s composite PMI to a 2-year high of 53.8.

Lastly, some of the biggest market moves last week came in commodities, with both oil and precious metals seeing sharp volatility. Brent crude oil rose +7.59% to $65.94/bbl after the US announced sanctions against Russia’s two largest oil companies. For gold, a sudden -5.20% slump last Tuesday – its biggest daily drop in 5 years – left the precious metal -3.26% lower on the week.

Loading recommendations…