Authored by Jeffrey Tucker via The Epoch Times,

The generation of young people just starting out in their careers faces an uphill battle unlike anything confronted by their parents and grandparents.

For them, the promise of the American Dream is elusive at best.

Everything is more expensive. The job market is frozen for pay for which they were hoping. Industry is changing so fast that educational credentials are ever less valuable.

There is real panic in the air among them, which is why so many have turned to substance abuse and far-flung hopes of making it rich in crypto or the influencer economy.

A new survey on the expenses faced by this generation has appeared that frames it up in alarming terms.

Over 20 years from 2005 to 2025, the cost of all essentials has soared:

-

Housing (rent) is up 120 percent.

-

Transportation is up 86 percent.

-

Education is up 133 percent.

-

Groceries are up 79 percent.

-

Entertainment is up 100 percent.

-

Utilities are up 53 percent.

-

Time to save for house down payment has gone from 8 to 14 years.

-

The average student debt burden has moved from $20K to $30K.

-

The real increase in salaries is 12 percent.

-

Health insurance these days is a killer of living standards, averaging $27,000 from the business side and that’s without using it.

-

Housing ownership seems largely out of the question.

In general, this whole generation has a delayed wealth curve that is 7 to 10 years relative to prior generations. In other words, it’s a lost generation, with a financial challenge that is matched by the trauma of pandemic lockdowns, ill-education, and digital addiction.

Behind all this is a hidden force at work, the dramatic devaluation of the currency over five years. During this time, the dollar lost 25-35 percent of its value, depending on the service or good in question. Salaries simply are not keeping up.

All this began to unfold in 2020 when the Federal Reserve accommodated the wildest spending binge by Congress in American history. The result was debt, which the Fed purchased with newly printed cash, which was then dispersed to the public in the form of stimulus payments.

Anyone with a modicum of economic knowledge could foresee the problem. This was not like the quantitative easing of 2008 which deployed an accounting trick to keep the new money locked up in bank vaults. The monetary expansion of 2020-2023 resulted in hot money on the street, which translates directly to higher prices and a lower purchasing power.

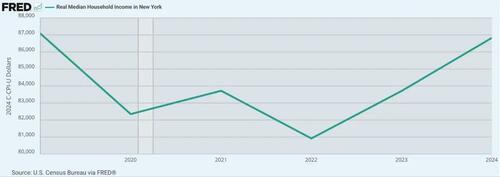

There are many ways to represent the impact on income but consider what has happened in the world center of markets for a century, New York City. What we see is a picture of massive disruption over five years, to the point of absolute calamity. Real median household income is lower now than five years ago. Many businesses were driven out or died completely. Some of the most productive residents left.

The reality on the ground is worse than it seems. The city is unaffordable for any regular income earned by a young person. Even worse, the physical conditions of the city have deteriorated dramatically. If you haven’t visited in 20 years, you will likely find the place unrecognizable. The same can be said of many U.S. cities, the very places where young people once depended upon for career starts.

All the political winds in D.C. right now are demanding lower and lower interest rates so as to make servicing the new debt more affordable. The problem with this strategy is that artificially lowered rates send distorted signals to industry. The message is borrow, expand, build in leverage or get wiped out by the competition. At some uncertain point in the future, the pattern breaks as consumers are completely tapped out.

The economy cannot operate as a perpetual motion machine. Prosperity cannot be maintained by endless cycles of fakery, with fresh money fueling higher financials and rewarding people on the other side of the divide. Anyone with a million in the bank can sit back and live off the proceeds forever while young workers just starting out can hardly pay the bills.

This is combustible, politically and culturally.

What is the solution? As with every inflation in history, the first step is to stop the money printers. That is easier said than done simply because the entire financial system today is addicted to debt finance which in turn depends on a Fed forever cranking out the fiat. The fear here is that the fix will be worse than the disease.

Today, it is widely accepted that inflation should run hotter than it has normally been in the entire postwar period, so between 2 and 3 percent. Many suspect that the Fed has quietly changed the target to 2.5 percent. There is plenty of evidence that this is true, in which case there will be no real solution forthcoming.

The latest CPI data is running hot at 3 percent, further suggesting the possibility of a second wave. This would be a disaster, sealing the fate of a generation. Meanwhile, there is no mystery about the cause: it’s the money printing!

It was four decades ago when I graduated from college without a thought about a job, debt, or paying the bills. I wasn’t irresponsible. These were not issues my generation confronted. We just assumed that if you had skill and will, everything else would fall into place. You found a place to live, worked hard, and everything worked out.

We had no idea at the time that we were living in a rare moment of history. Low inflation, low unemployment, high growth, freedom and ebullience all around. Now that moment is entirely gone, replaced with anxiety that is mutating to panic and despair. Old people don’t care much because they are doing just fine—perhaps the last American generation that can count on being comfortably well off.

The only way that Gen Z can battle this problem is by a big change in spending habits. The same survey cited above reports that young workers are spending on average $300 per month on restaurants and bars. Maybe that doesn’t sound like much but simply changing that habit—cooking at home instead of throwing away money on expensive dining—would make a big difference.

A major problem here is that Gen Z needs to change its expectations, all of which are rooted in class fears fueled by social media nonsense. They have to be at the right spots, wear the right clothes, live in the best places, and drive fashionable cars. These are extremely powerful psychological pulls. Corporate finance is there to seem to make it all possible for a while.

In the last three years, myriad companies have sprung up to give cash advances by linking one’s bank account on the spot while shopping. The fees are high because they are not classified as interest, and they evade regulatory controls. What these companies are doing is exploiting class insecurity and pillaging the people who can least afford it.

The only real solution here is the traditional value of frugality. It’s possible to buy groceries from less-fashionable places, dial back amenities in apartment living, buy used clothing from online marketplaces, and forgo vacations and entertainment. You can cut the bills, with the goal of having zero debt. This is the only way to live as a young person if you have any hope of building a secure future.

Economic headwinds are leaning hard against Gen Z and this has produced a kind of demoralization. Nothing works as it once did. Policymakers and parents can help but the ultimate solution is going to come down to a change of priorities.

Loading recommendations…