Eight Things to Know About Big Philanthropy and the Populist Reaction Against It (full series)

Getting Bigger | More Liberal and Progressive

More Politicized | Renewed Public Scrutiny

Key Points

- Philanthropy has been getting bigger.

- Big Philanthropy has been getting more liberal and progressive, overwhelmingly so in the policy- and advocacy-oriented context.

- Relatedly, it houses and funds a democratically unaccountable and monoculturally progressive managerial elite.

- It’s been getting more politicized and more partisan.

- It’s always had a tenuous place in America’s social contract.

- It doesn’t much appreciate the additional scrutiny to which it’s being subject once again.

- If you’re a taxpayer, you contribute to the pool of funds that incentivizes its growth and maintenance.

- The conservative and progressive populist reaction against Big Philanthropy is not going to go away.

The populist reaction against Big Philanthropy occurs within a broader, including historical, context. Philanthropy overall has grown significantly in recent decades. Big Philanthropy has also become increasingly liberal and progressive, overwhelmingly so in the policy- and advocacy-oriented areas. It houses and funds a democratically unaccountable, monoculturally progressive elite and has become more politicized—and more partisan.

Big Philanthropy has always had a tenuous place in America’s social contract. U.S. taxpayers contribute to the pool of funds that incentivizes its growth and maintenance, and the conservative and progressive populist reaction against it is not going to go away.

1. Philanthropy has been getting bigger.

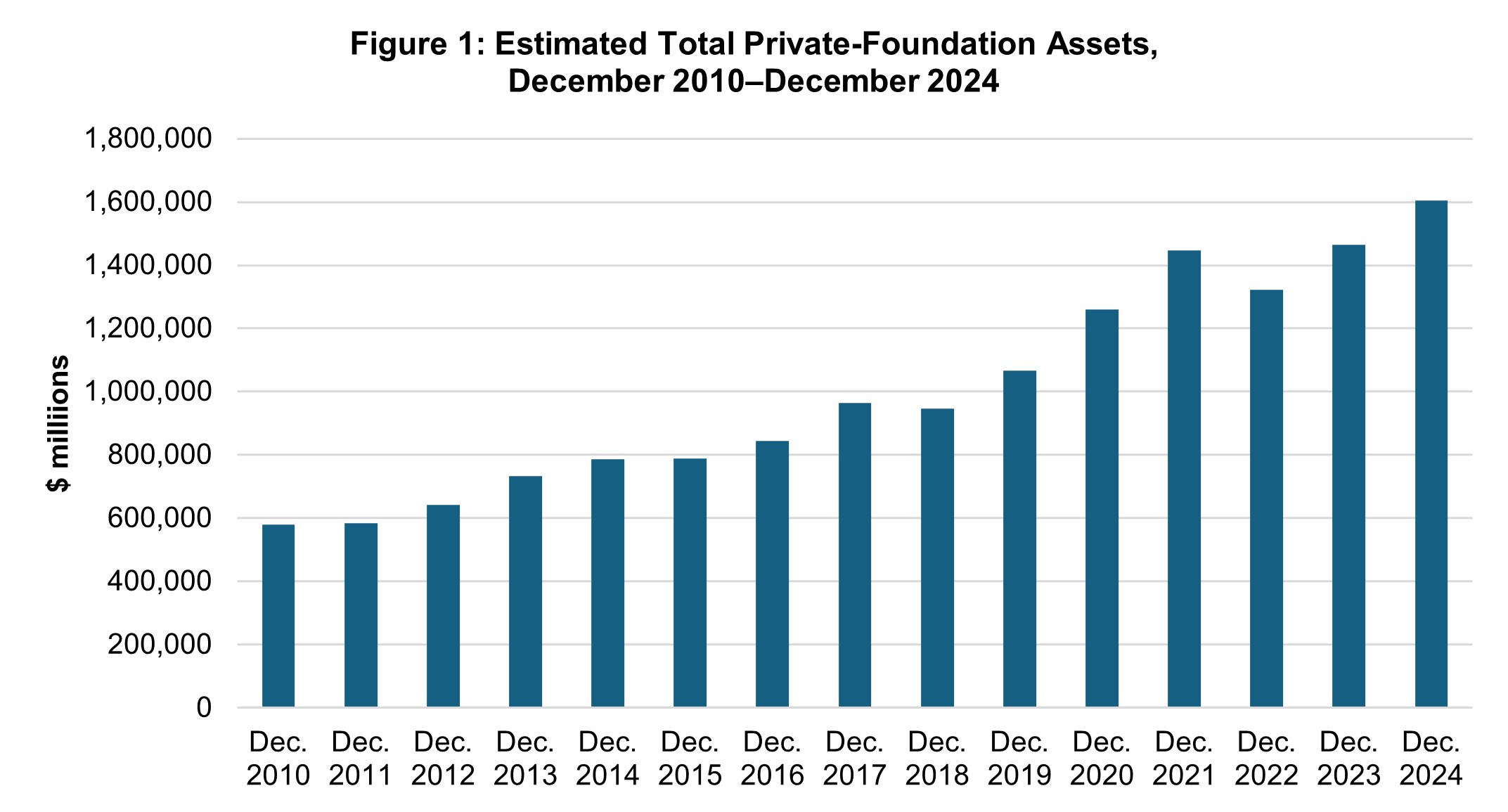

Approximately 150,000 entities have the Internal Revenue Code status of a private foundation, according to CauseIQ. Collectively, they employ almost 32,000 people and annually earn more than $159 billion in revenue. FoundationMark estimates all private-foundation assets totaled more than $1.6 trillion at the end of 2024—up 21.6 percent from almost $1.3 trillion at the end of 2020 and 176.5 percent from just less than $581 billion at the end of 2010, as illustrated in Figure 1.

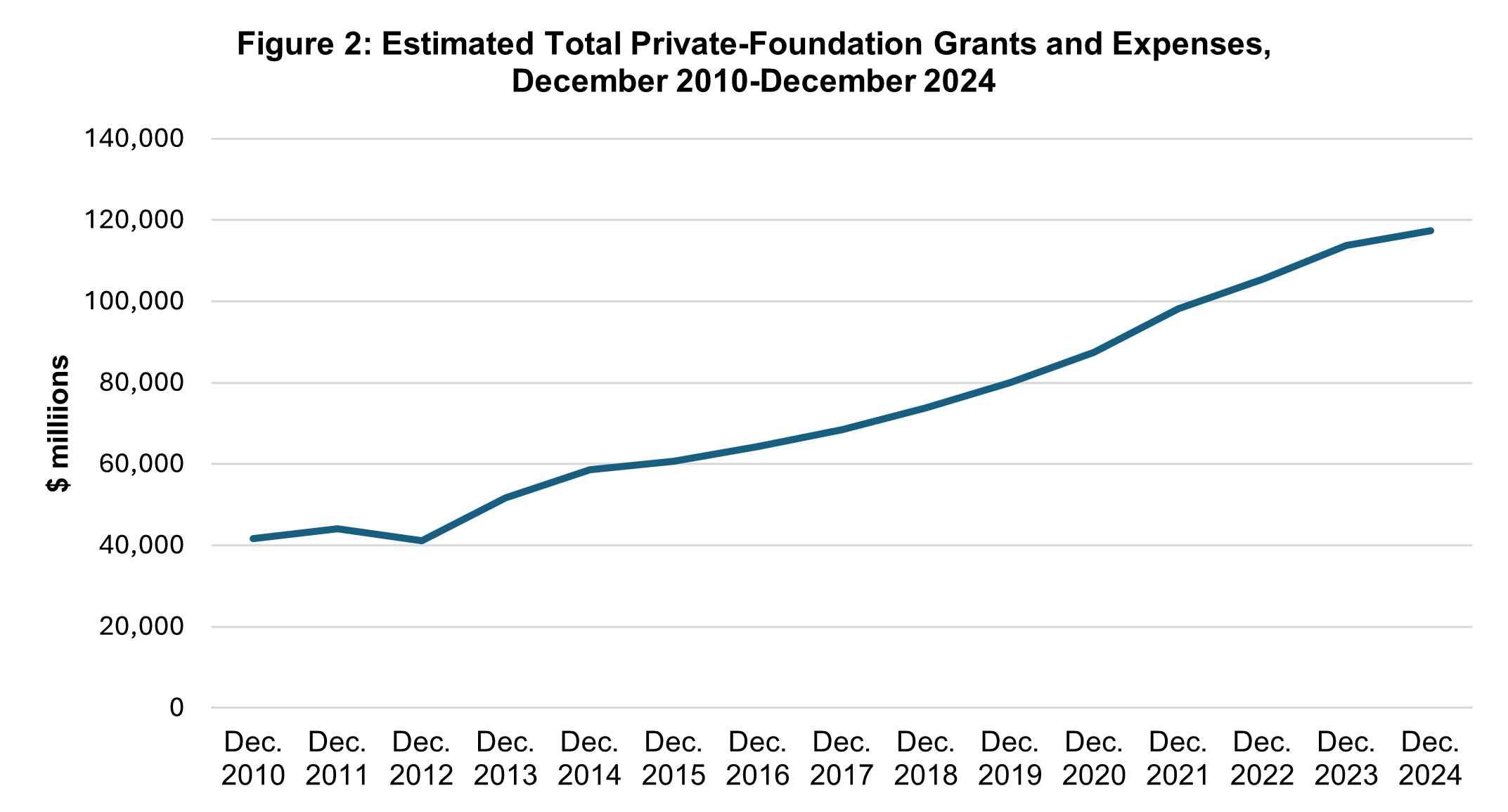

Private-foundation grants and expenses have thus also been increasing, appreciably. As shown in Figure 2, FoundationMark estimates their grants and expenses totaled more than $117 billion as of the end of 2024—up 34.3 percent from over $87 billion at the end of 2020 and 182.2 percent from over $41 billion at the end of 2010.

In February 2025, using publicly available tax-filing data collected by CauseIQ, The Chronicle of Philanthropy identified 277 private foundations and 69 community foundations that had $500 million or more in assets. Collectively, according to the Chronicle, these 346 philanthropies held more than $900 billion in assets and top-heavily accounted for roughly 55 percent of all grant dollars awarded.

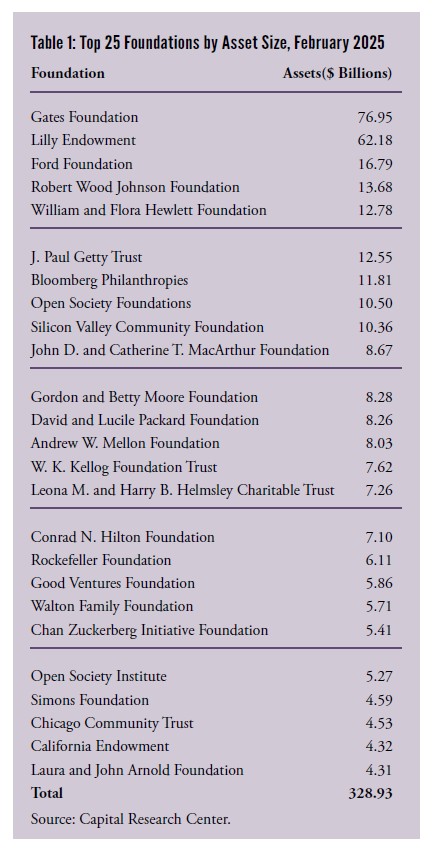

The top 25 foundations in the Chronicle’s February list are in the Table 1. The Gates Foundation is at the top of the February list, followed by the Lilly Endowment. In May, however, new Lilly Endowment tax filings showed its $79.9 billion assets as of the end of 2024 surpassed those assets of Gates’ $77.2 billion at the end of 2024. The Lilly Endowment’s assets have grown mostly because of stock it holds in Eli Lilly & Co., the value of which has greatly increased as the result of wildly successful weight-loss and diabetes drugs.

Two of the foundations in the Chronicle’s February list’s top 25 are community foundations: the $10.36 billion Silicon Valley Community Foundation and the $4.53 billion Chicago Community Trust.

The assets of these top 25 foundations collectively total $328.93 billion. The next two foundations on the list are private foundations—the $4.23 billion Knight Foundation and the $4.10 billon Carnegie Corporation of New York. So the total assets of just the top 25 private foundations would be $322.37 billion, which would be an again top-heavy 20 percent of assets held by all 150,000 private foundations.

In the next installment, Big Philanthropy has been getting more liberal and progressive.