Apple hosted its “Awe Dropping” product launch event one week ago, unveiling the iPhone 17 lineup alongside updates for the Apple Watch and AirPods. Aside from more megapixels and incremental improvements to processing, display, and other features, the iPhone 16 remains sufficient and does not warrant an immediate upgrade. Still, the decision to upgrade weighs heavily on many consumers trapped in Tim Cook’s Apple ecosystem hole. To gauge initial demand signals, we turn to new lead-time data from Goldman Sachs.

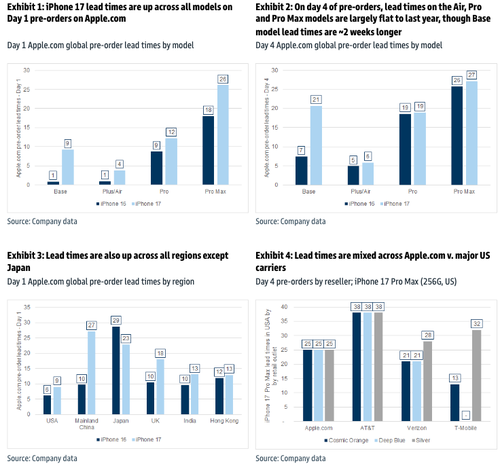

A team of Goldman analysts, led by Michael Ng, provided clients with new lead-time data on iPhone 17 models just days after the product launch, highlighting what they describe as “strong iPhone 17 demand signals from pre-order trends.”

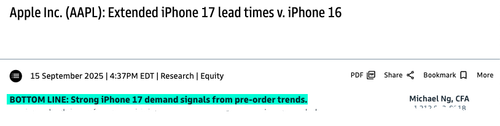

Across the board, Ng’s team found that pre-order lead times for iPhone 17 models are longer than the iPhone 16 launch in all regions (USA, Mainland China, Japan, UK, India, and Hong Kong), supporting their view of “outlook for +8% iPhone revenue growth in F4Q25, which should also benefit from some channel fill as AAPL ended F3Q25 at the low end of its channel inventory target range.”

Key Findings:

-

Lead times are extended for all iPhone 17 models globally versus iPhone 16.

-

Pro and Pro Max models show the longest wait times, maintaining their premium demand profile.

-

Mainland China has the longest delays (up to 5 weeks), though the iPhone Air launch is delayed there due to eSIM regulatory hurdles.

In-depth findings that support robust demand for the latest iteration of the iPhone:

-

iPhone 17 lead times are up across all models on Day 1 pre-orders on Apple.com. By model, the global lead times were 8 days longer for the base iPhone 17 model relative to the iPhone 16 base, 3 days longer for the iPhone Air relative to the iPhone 16 Plus, 3 days longer for the iPhone 17 Pro v. iPhone 16 Pro, and 8 days longer for the iPhone 17 Pro Max v. the iPhone 16 Pro Max. Lead times also remain elevated on day 4 of pre-orders (Monday, September 15). For our global analysis across regions, we assume the following regional weights on regions where we tracked lead times: USA (51%), Mainland China (27%), Japan (9%), UK (6%), India (6%), and Hong Kong (1%). These assumptions are consistent with the proportional distribution of Gartner’s 2024 estimates of iPhone shipments by region.

-

Lead times are also up across most regions. By region, average lead times in the USA were 3 days longer across all models for Day 1 pre-orders on Apple.com. Specifically, lead times for iPhone Air were 4 days (v. no lead time for the iPhone 16 Plus) and 24 days for the iPhone 17 Pro Max (v. 17 days for the iPhone 16 Pro Max); lead times for the iPhone 17 Base and Pro in the USA remained at 0 days. Day 1 lead times were also up in Mainland China (+17 days to 27 days), the UK (+8 days to 18 days), India (+3 days to 13 days), and Hong Kong (+1 day to 13 days). In Japan, lead times moderated relative to the iPhone 16 with 23 day lead times on average (v. 29 days prior). For our analysis across iPhone model types, we assume the following unit mix: iPhone (23%), iPhone Plus/Air (8%), iPhone Pro (33%), and iPhone Pro Max (36%). The assumptions are in-line with Canalys’ reported mix of iPhone 16 units by model life-to-date as of 4Q24.

-

Press reports that planned production for Base, Pro, and Pro Max models is up +25% yoy, iPhone Air up 3x as compared to the iPhone 16 Plus, per technology analyst Ming Chi Kuo. Longer lead times against a backdrop of longer lead times suggests stronger pre-order demand across these models.

-

iPhone Air launch delayed in China over eSIM regulation. There is minimal eSIM carrier support in China today, though Apple noted publicly that is it working with regulators to bring iPhone Air to China as soon as possible. Beyond the iPhone Air, eSIM-only iPhone 17 Pro and Pro Max are available in Bahrain, Canada, Guam, Japan, Kuwait, Mexico, Oman, Qatar, Saudi Arabia, the UAE, the USA, and the U.S. Virgin Islands. eSIM-only models have larger batteries than those with a physical eSIM card slot.

Lead times by model:

-

iPhone 17 (starting at $799 with 256 GB storage): Available ~3 weeks after September 19th launch in the US across all colors expect Mist Blue which is available in ~2 weeks. Lead times in India were ~1 week, UK was ~2 weeks, Hong Kong was ~3 weeks, Japan was ~4 weeks, and Mainland China was ~5 weeks.

-

iPhone Air (starting at $999 with 256 GB storage): Available ~1 week after September 19th launch in the US, UK, and India, with ~2 week lead times in Japan. The launch of the iPhone Air is delayed in Mainland China due to eSIM regulation.

-

iPhone 17 Pro (starting at $1,099 with 256 GB storage): ~2 week lead times in the US and India, ~3 weeks in UK and Japan, and ~5 weeks in Mainland China. By color, Cosmic Orange & Silver have the longest lead times (~3 weeks), followed by Deep Blue (~2 weeks).

-

iPhone 17 Pro Max (starting at $1,199 with 256 GB storage): ~4 week lead times across all regions and colors except Hong Kong & India, where lead times are closer to ~3 weeks. By color, Cosmic Orange & Silver have the longest lead times (~4 weeks), followed by Deep Blue (~3 weeks).

Chart of The Day

The analysts maintain a “Buy” rating on Apple with a 12-month price target of $266.

$250 Resistance.

Moar buybacks Mr. Cook?

Loading recommendations…