Danish pharmaceutical giant Novo Nordisk announced a major restructuring, including the reduction of 9,000 jobs, while slashing guidance for the second time in two months. The move comes as its new chief executive takes the helm and seeks to save the sinking ship amid waning market share for its blockbuster Wegovy weight-loss drug.

“Novo Nordisk today announced a company-wide transformation to simplify its organisation, improve the speed of decision-making, and reallocate resources towards the company’s growth opportunities in diabetes and obesity,” Novo wrote in a press release.

Novo added that it “intends to reduce the global workforce by approximately 9,000 of the 78,400 positions in the company, with around 5,000 reductions expected in Denmark.” This round of job cuts represents about 11% of total global staff and is expected to generate annual savings of around 8 billion Danish kroner (roughly $1.25 billion) by the end of 2026.

Sales of blockbuster drugs Ozempic and Wegovy have been battered by the flood of cheaper copycat versions of GLP-1 drugs. This is primarily due to a shortage of the weight-loss drug, which led to the practice of compounding. Now Novo is planning to crack down on GLP-1 knockoffs, as outlined in its latest earnings report:

“Novo Nordisk is pursuing multiple strategies, including litigation, to protect patients from knockoff ‘semaglutide’ drugs. Novo Nordisk is deeply concerned that, without aggressive intervention by federal and state regulators and law enforcement, patients will continue to be exposed to the significant risks posed by knockoff ‘semaglutide’ drugs made with illicit or inauthentic foreign active pharmaceutical ingredients.”

Related:

Here are more details about Novo’s latest transformation:

-

Targeting DKK 8bn in annualised savings by 2026.

-

One-off restructuring costs of DKK 8bn (mostly in Q3 2025), partly offset by Q4 savings of ~DKK 1bn.

-

This results in an updated 2025 operating profit growth outlook of 4–10% at CER, about 6pp lower due to restructuring charges.

The new Novo CEO, Mike Doustdar, stated: “As the global leader in obesity and diabetes, Novo Nordisk delivers life-changing products for patients worldwide. But our markets are evolving, particularly in obesity, as it has become more competitive and consumer-driven. Our company must evolve as well. This means instilling an increased performance-based culture, deploying our resources ever more effectively, and prioritising investment where it will have the most impact – behind our leading therapy areas.”

Doustdar’s actions mark his first major attempt to stop the hemorrhaging of the stock, which is down 44% year-to-date. Today’s announcement sent shares in Copenhagen up 4%.

Comments from Goldman and UBS analysts to clients earlier signaled disappointment and heightened uncertainty around Novo.

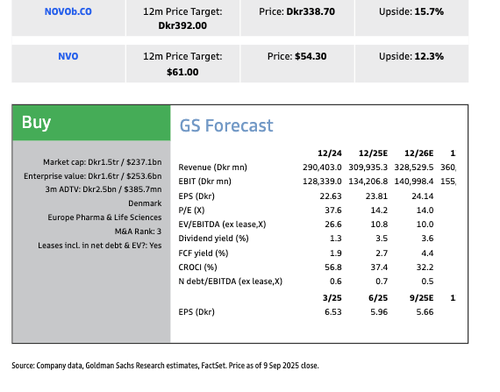

Goldman analyst James Quigley (Novo superbull)

-

Overall, another guidance downgrade is modestly disappointing, but we see it as mechanical due to one-off costs and Novo’s strict IFRS reporting (vs. core reporting by peers); however, the potential benefits of unlocking commercial and R&D firepower could increase commercial competitiveness and increased focus on performance and hopefully accountability for that performance could put Novo in a better position to compete strategically in its core markets in the future. Therefore, we see this initial strategic move by the new CEO as a positive, but believe the market may be unlikely to give credit here until we start to see signs of commercial execution improving.

-

We are Buy rated on Novo Nordisk. Our bottom-up DCF analysis suggests a valuation of DKK 396 per share for Novo Nordisk.

UBS analyst Matthew Weston (Neutral)

-

We see today’s move as the first action of the new Novo CEO. Following a period of hyper-growth in employee numbers, Novo is re-sizing headcount with the aim to reduce complexity in the organisation. The savings are expected to free up c.DKK8bn to ‘reinvest in growth’. We assume that this refers to increased investment in selling expenses in the near-term, and an increase in investment in R&D to build growth pipeline for the mid-term. Relative to UBS estimates, we note that we had already assumed margin decline in 2026 to absorb assumed growth investment to rejuvenate growth. This may now be mitigated by today’s savings. The key question is when could the topline see the benefit of the reinvestment and what pipeline assets warrant further spending. We expect that investors will remain somewhat sceptical until the growth plan is outlined.

-

While we expect a lot of attention on the guidance cut today, we note that the ‘Core’ accounting policies of all other companies in our coverage universe would likely have treated the DKK9bn cost as non-core and not changed FY25 targets. In this respect, Novo gives investors a clearer understanding of the real cost of the business, and the cost to reposition the company when needed.

. . .

Loading recommendations…