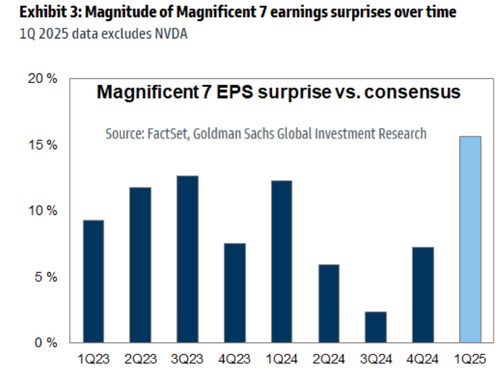

We are nearing the tail end of the first quarter earnings season. Excluding Nvidia, which is scheduled to report next Wednesday, the rest of the Magnificent Seven delivered year-over-year EPS growth of 28% in Q1, far outpacing the 9% growth recorded by the remainder of the S&P 500. Mag7 also surpassed consensus earnings estimates by 16%, marking the largest earnings surprise for Apple (AAPL) Microsoft (MSFT) Alphabet (GOOGL / GOOG) Amazon (AMZN) Nvidia (NVDA) Meta Platforms (META) Tesla (TSLA) since Q2 2021, when they outperformed estimates by 27%.

As the midpoint of 2025 quickly approaches, Goldman analysts Eric Sheridan, Ben Miller, and others have updated their investment outlook, refining their top 10 themes for the U.S. internet sector, including:

-

Secular Growth Opportunities – particularly in digital advertising, the merging of commerce and advertising, cloud computing, and local commerce.

-

Key Industry Debates – including autonomous vehicles’ impact on mobility, normalization in online travel, and expansion in interactive entertainment.

-

Major Risks – such as regulatory scrutiny and AI-driven disruption

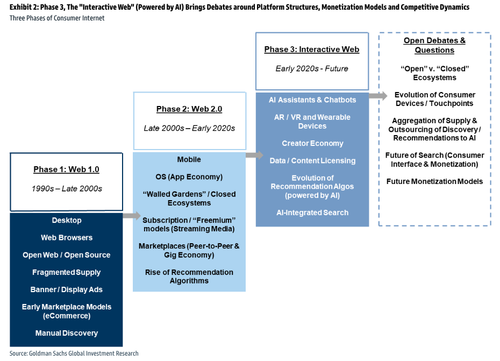

AI remains the dominant theme in the eyes of the analyst. They noted that 2025 will be critical for platforms to demonstrate real returns from massive AI investments made over the past three years. While widespread disruption of existing consumer computing habits isn’t expected, proof of utility and ROI will be closely watched.

Here’s more:

As we framed in our Consumer Internet AI deep-dive, we believe that AI will continue to permeate more products and use cases for consumers, but see those shifts playing out over time and do not expect AI to drive wholesale displacement/disintermediation of existing computing habits. We continue to look at 2025 as a year where stakes are rising for platforms to prove out the adoption/utility/use cases of their investments in AI as we are now in year three of an elevated OpEx/CapEx cycle (& investors increasingly ask for proof points on the eventual return on investment). This interplay between levels of investment, visibility into a more distinct return profile and/or elements of rising utility-like behavior around such tools will likely remain dominant themes among large cap U.S. Internet this year.

They noted that tariffs remain a volatile but critical factor, influencing cost structures and demand visibility. However, easing trade tensions in recent weeks and stronger-than-expected Q1 earnings results have helped stabilize big tech stocks.

The analysts provided an easy-to-view breakdown of the Top 10 Themes shaping their coverage across the internet sector:

The Evolution of the Consumer AI Landscape: AI is reshaping consumer and enterprise computing, spanning infrastructure (Cloud), model/platform ownership, and app-level use cases. Debates are expected to intensify in 2025. Most Exposed Stocks: Majority of coverage universe.

The Implications of AI for Cloud Computing & CapEx: Cloud providers are investing heavily in AI workloads, balancing long-term AI opportunity with CapEx discipline. AI will increasingly impact revenue and margins. Most Exposed: AMZN, GOOGL, META, MSFT, SNAP, NVDA.

The Lines Between Advertising & eCommerce Models Continue to Blur: Ad and commerce models are converging. Retail media and automation drive budgets from traditional ads to digital platforms. Most Exposed: AMZN, GOOGL, META, PINS, UBER, CART, LYFT, IBTA.

Digital Advertising Shifts to AI Automation & Direct Response: Ad platforms are moving toward AI-driven, lower-funnel/direct-response formats. This change supports performance marketing and measurable ROI. Most Exposed: GOOGL, META, AMZN, PINS, RDDT, APP, SNAP, DV, KIND, YELP, IBTA.

A Future of AVs & the Pathway for Mobility Networks: AV (autonomous vehicle) developments, particularly from Uber and Waymo, are shaping the future of mobility. Network transitions and partnerships are key. The most exposed are UBER, LYFT, and GOOGL.

The Battle for Same/Next-Day Local eCommerce: Consumer demand for faster delivery is driving innovation in local eCommerce. Restaurant and grocery segments are expanding. Most Exposed: AMZN, UBER, CART, LYFT.

The Normalization of Online Travel Demand: Travel growth is stabilizing. Companies are focused on funnel efficiency, regulatory impacts, and GenAI-driven demand strategies. Most Exposed: EXPE, BKNG, ABNB, UBER, YO, TRIP.

The Evolution of Interactive Entertainment Platforms. Interactive platforms are expanding content offerings and monetization methods. UGC, gaming, streaming, and live audio continue to grow. Most Exposed: NFLX, SPOT, RBLX, EA, TTWO, U, BILI, RBLX, GENI, WBTN.

The Transition from Spatial to Mobile Computing: Big tech continues to shift toward mobile-first and device-independent experiences, spanning hardware, software, and services. Most Exposed: META, GOOGL, AMZN, SNAP, RBLX, EA, TTWO, U, BILI, GENI.

Regulatory Matters & Changing Ecosystem Defaults: Structural risks from regulation, platform control, and consolidation dominate industry risk profiles, particularly in ad tech, app distribution, and AI. Most Exposed: AMZN, GOOGL, META, LYFT, UBER, ABNB, BKNG, EXPE.

Top stock picks:

We see the most compelling risk/reward in companies that face short-term investor concerns and highlight: 1) GOOGL where debates on the impact of AI on core search and ongoing regulatory matters overshadow strong operating performance across a) Search & Other revenue producing upside in Q1, b) strong operating margins as efficiencies help fund long-term platform/product investments, & c) a very strong mix of growth and margins from Google Cloud; & 2) AMZN where debates persist on the impact of higher tariffs but where we believe that a) price/negotiation levers can help mitigate the cost impact of tariffs, b) that AMZN remains well positioned to gain market share, and c) remains levered to several attractive longer-term secular growth themes (incl. AI, Cloud computing, retail media, streaming, sports). Within our Large Cap coverage, we are also Buy rated on META, UBER (CL), SPOT, and Neutral rated on ABNB, APP, NFLX & BKNG. For SMID Caps, we see outsized risk/reward Buy rated opportunities in PINS (on CL), CART, DKNG & MTCH over the next 12 months.

Ahead of Nvidia’s earnings next week, Mag7 stocks have recovered all losses sparked by Trump’s “Liberation Day” tariffs. While the index has been inching closer to record highs, momentum has stalled in recent sessions.

What’s next for the internet?

Pro subs can view the full note here.

Loading…