Heading into today’s Alphabet earnings, we said that as a result of positioning (GOOGL positioning was 9.5/10 according to Goldman’s desk), it would be difficult for the stock, which was already priced to perfection, to impress an increasingly skeptical Wall Street, especially on the day when momentum saw its 4th biggest drop on record.

Well, that’s what happened, at least initially because despite solid results which beat across the board, the company’s shocking capex guidance (see below) absolutely spooked investors, who promptly sent the stock down as much as 7.5% after hours. But more remarkably, after losing as much as $350BN in market cap in kneejerk response to the company’s stunning capex forecast, the stock managed to rebound and even turn green, a reversal of some $800BN in the span of minutes!

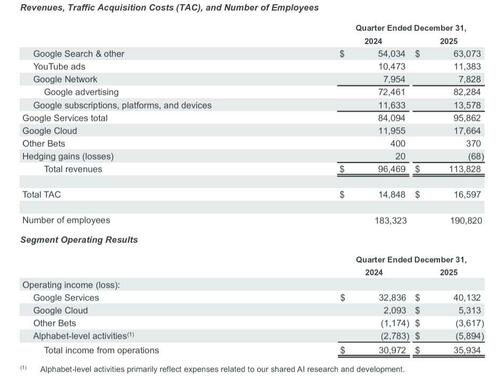

Here is what GOOGLE just reported for Q4:.

- EPS $2.82, up 31% vs. $2.15 y/y, beating estimate $2.65

- Revenue ex-TAC $97.23 billion, +19% y/y, beating estimates of $95.17 billion

- Revenue $113.83 billion, +18% y/y, beating estimates of $111.4 billion

- Google Services revenue $95.86 billion, +14% y/y, beating estimates of $94.9 billion

- Google advertising revenue $82.28 billion, +14% y/y, beating estimates of $80.89 billion

- Google Search & Other Revenue $63.07 billion, +17% y/y, beating estimates of $61.37 billion

- YouTube ads revenue $11.38 billion, +8.7% y/y, missing estimates of $11.78 billion

- Google Network Revenue $7.83 billion, -1.6% y/y, beating estimate $7.78 billion

- Google Subscriptions, Platforms and Devices Revenue $13.58 billion, +17% y/y, missing estimate $13.81 billion

- Google Cloud revenue $17.66 billion, +48% y/y, beating estimates of $16.2 billion

- Other Bets revenue $370 million, -7.5% y/y, missing estimate of $443.8 million

- Hedging losses $68 million vs. $20 million y/y, below estimate $108 million

Of the numbers above, perhaps the most important one was Google Cloud which saw a continued surge in customer demand as revenues increased 48% to $17.7 billion, led by an increase in Google Cloud Platform (GCP) across enterprise AI Infrastructure and enterprise AI Solutions, as well as core GCP products.

Going down the line:

- Total TAC $16.60 billion, +12% y/y, above the estimate $16.19 billion

- Operating income $35.93 billion, +16% y/y, missing estimates $36.95 billion

- Google Services operating income $40.13 billion, +22% y/y, beating estimates of $38.01 billion

- Google Cloud operating income $5.31 billion vs. $2.09 billion y/y, smashing estimates of $3.65 billion

- Other Bets operating loss $3.62 billion vs. loss $1.17 billion y/y, below the estimate loss $1.3 billion

- Alphabet-level activities operating loss $5.89 billion vs. loss $2.78 billion y/y, worse than estimate loss $3.57 billion

- Operating margin 32% vs. 32% y/y, missing estimate 33.1%

Here, attention immediately goes to the disappointing operating income, however, it is worth noting that consolidated operating income increased 16% and operating margin was 31.6%, both missing estimates, because operating income included a $2.1 billion employee compensation charge for Waymo. Excluding this one-time item, both would have beat expectations.

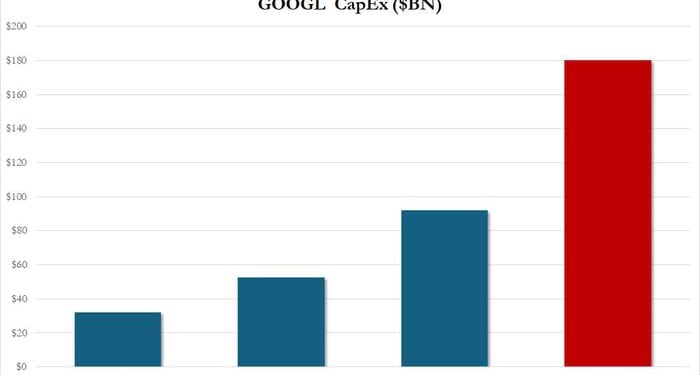

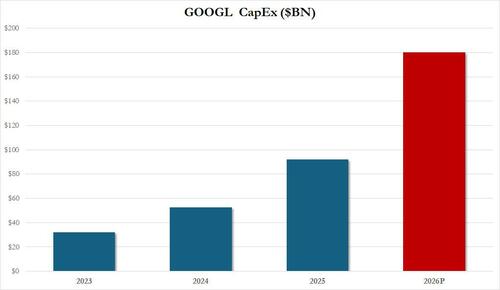

Next, we look at capex and find that the Q4 number was not too crazy; in fact at $27.85BN for Q4 it actually missed estimates.

- Capital expenditure $27.851 billion vs. $14.28 billion y/y, below estimate $28.17 billion

- Number of employees 190,820, +4.1% y/y, below estimates of 191,138

Visual summary of the results:

Alphabet also noted that YouTube’s annual revenues surpassed $60 billion across ads and subscriptions; and the it now has over 325 million paid subscriptions across consumer services, led by strong adoption for Google One and YouTube Premium.

Also Google Cloud ended 2025 at an annual run rate of over $70 billion, representing a wide breadth of customers, driven by demand for AI products.

Some more commentary on the quarter:

- 4Q Gemini App monthly active users exceed over 750 million vs. over 650 million q/q

- Google’s Gemini app, available on android, iPhone and web offers the company’s flagship AI model

- Maintained quarterly cash dividend at 21c/shr, estimate 21c/shr

So far so good: in fact, Q4 on its own was solid enough to beat even the more aggressive estimates. But what shocked Wall Street and what sent the stock tumbling in kneejerk reaction (before it bounced) was the company’s shocking announcement:

We’re seeing our AI investments and infrastructure drive revenue and growth across the board. To meet customer demand and capitalize on the growing opportunities we have ahead of us, our 2026 CapEx investments are anticipated to be in the range of $175 to $185 billion.”

That number is…. insane because it is almost double GOOGL’s 2025 capex of $92BN, and the forecast

In response to these crazy numbers, the stock first tumbled, dropping as much as 7.5% before rebounding and even trading green on the day.

Loading recommendations…