Not too long ago, we reported that China was stockpiling virtually every form of commodity known to man, from corn to crude and corn… and especially copper: according to a JPMorgan report in early 2022, China held an estimated 84% of all global copper (which naturally begged the question just what was China preparing for).

China currently holds an estimated 84% of global copper, 70% of corn, 51% of wheat, 40% of soybeans, 26% of crude oil and 22% of aluminum inventories: JPM

— zerohedge (@zerohedge) February 23, 2022

Fast forward just three short years, when commodities trading house Mercuria now predicts that China’s copper stockpiles (located in commercial warehouses) are on track to dwindle to nothing in just a few months – if not weeks – as the market suffers “one of the greatest tightening shocks” in its history on fears of US tariffs.

In some ways similar to the record scramble to park physical gold in US Comex vaults in late 2024 and early 2025, the Geneva-based commodity merchant said that huge US demand – as buyers rushed to get their hands on copper ahead of the potential imposition of tariffs by the Trump administration – was sucking imports of the metal into the country from the rest of the world and setting it up in direct competition with China for supplies.

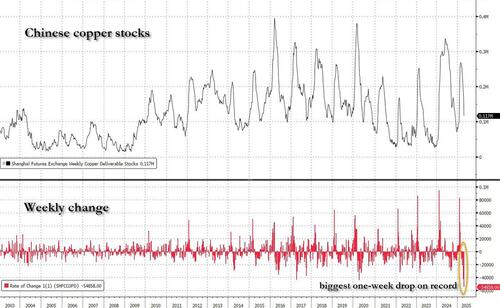

As a result, Chinese copper stocks have plunged over the past few weeks, and “at the current pace of draws, those Chinese inventories could deplete [to zero] by the middle of June”, Nicholas Snowdon, Mercuria’s head of metals and mining research, told the Financial Times.

As shown below, last week the country’s inventories fell by almost 55,000 tonnes to 116,800 tonnes last week, the biggest weekly drop on record. At this rate of decline, Chinese copper stocks would run out in 2 weeks time.

This “is potentially going to be one of the greatest tightening shocks this market’s ever seen”, Snowdon said. Beijing had a “razor thin inventory buffer” to meet domestic demand, he added.

Ironically, copper prices tumbled after Liberation Day to the lowest level in over a year, only to surge again as copper demand in China proved remarkably resilient despite headwinds from the US-led trade war and the nation’s property crisis, with buyers taking advantage of price slumps to snap up supplies.

“The copper market remains in a tight balance, despite macro-economic difficulties,” Xiao Qianjun, vice general manager of trade business at Jiangxi Copper, a top smelter, told an industry conference this week. After prices fell recently, “spot orders from fabricators exploded,” Xiao said.

At the same time, there is growing speculation Beijing may ramp up stimulus to support the world’s second-largest economy – and especially the copper-intensive housing market – to counter more challenging overseas conditions as Trump imposes punishing tariffs, while also holding out the promise of talks and a deal.

“Demand in the spot market, from surveys of downstream users or apparent consumption, are all very good,” Angela Bi, head of Asian metals and mineral research at Mercuria said at a conference, held by Shanghai Metals Market in Nanchang, Jiangxi. Indicators “are too good to be true,” Bi added.

Meanwhile, the Yangshan premium – a gauge of import demand – recently hit the highest since 2023. And local yuan-priced futures are steeply backwardated, a bullish pattern that points to near-term tightness.

The problem is that besides soaring domestic Chinese demand, there is also massive demand for physical copper from the US. Mercuria’s head of metals and mining, Kostas Bintas, said the US was for the “first time” competing with China for supplies of copper, which was likely to supercharge prices. The impact of US protectionism on the copper market adds to pressure from Chinese domestic demand and retaliatory levies that could hit vital flows of copper scrap.

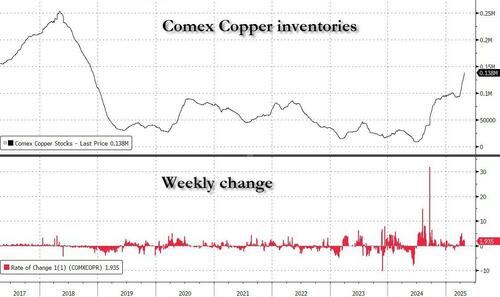

Similar to the frenzied record deliveries of physical gold to Comex, metal traders have been importing massive amounts of copper into the US ahead of possible tariffs, which could result from an investigation initiated by US President Donald Trump into alleged “dumping and state sponsored overproduction” of the metal. He has already imposed a 25% levy on aluminium and steel imports.

And just like gold, copper stocks in Comex warehouses in the US have soared this month to their highest level on Friday since 2018.

Helping drive supplies to the US is the same arbitrage observed in late 2024 in the gold market, one created by investors’ fear of tariffs, among others. This has pushed up sharply the price of the metal on New York’s Comex exchange in comparison with prices on London’s London Metal Exchange.

This spread has created an unprecedented arb for traders who buy copper futures contracts in London and sell contracts in New York. The spread stood at nearly $1,200 per tonne on Monday, having risen above $1,600 in March, well above its long-term average of roughly $0.

The arb has been so popular, a potential short squeeze is emerging: as the FT reports, “some traders who had large commitments to sell copper on Comex have been urgently trying to get their hands on additional tonnes into the US to cover those short positions before any new tariffs were introduced, said Bintas.” Which explains the panic scramble of physical out of China and into the US… because if they don’t “get their hands on additional tonnes”, the price of copper could go vertical.

There could be even more chaos: retaliatory tariffs imposed by China on US imports could also hit the crucial copper scrap market, analysts said, adding to the tightness in the Chinese market.

That could worsen if the US imposes a ban on the export of copper scrap, of which it is a big exporter. It shipped 960,000 tonnes in 2024, with almost half going to China, according to commodity pricing agency Fastmarkets.

In January and February, the latest data available, the US exported 142,000 tonnes in total, compared with 149,000 during the same period last year. That number could quickly hit zero if Washington decided to impose an embargo on the commodity to hammer Beijing, which urgently needs copper to develop everything from electrical infrastructure, to AI data centers, to ghost cities.

Sure enough, Andrew Cole, a metals analyst at Fastmarkets, said he expected “a significant plunge in scrap shipments from the US to China in March to May at the very least.

“That’s what will lead to the escalation of supply squeeze in China we have been expecting to develop as the year progresses,” he said.

“Imported copper scrap stockpiles in China have dropped significantly,” said Mercuria’s Bi

However, while Chinese stocks were being depleted, in reality markets would react before stocks reached zero, with higher prices attracting more imports of copper and scrap, said Snowdon.

“That comes at the point of record pull of copper units into the US. As those two forces meet that creates an unprecedented competition for copper,” he said.

Loading…