Solar and renewable energy stocks crashed in premarket trading after Senate Republicans unveiled a draft of a bill that would end wind and solar tax credits by 2028, while providing incentives for other energy sources like nuclear, hydropower, and geothermal (which would extend to 2036).

According to Reuters, the draft tax bill released by Senate Finance Committee Chair Mike Crapo (R-Idaho) proposes an accelerated phaseout of clean energy subsidies established under the Biden-Harris regime’s 2022 Inflation Reduction Act. Specifically, the legislation would significantly dial back solar and wind tax credits to 60% of their original value starting in 2026, with complete elimination by 2028. Under current law, these credits are scheduled to begin phasing out in 2032, meaning the proposal would effectively shorten the incentive window.

Crapo stated in a press release that this draft bill “achieves significant savings by slashing Green New Deal spending and targeting waste, fraud and abuse in spending programs while preserving and protecting them for the most vulnerable.”

Nuclear Support…

The summary of the legislation stated that tax breaks for other sources of power, such as nuclear, hydropower, and geothermal, would remain in place until 2036. How to play the nuclear trade.

Major provisions in the Senate bill:

-

Ends $7,500 EV tax credit 180 days after passage (faster than House version)

-

Eliminates $3/kg hydrogen production credit, despite industry lobbying

-

Removes solar tax credits for both leased and purchased rooftop systems

-

Retains nuclear credit without the House’s 2028 construction deadline

-

Does not include House’s 60-day construction rule or credit resale restrictions, slightly easing compliance

The shortened window significantly alters the financial outlook for renewable energy developers, which only sent solar stocks crashing in premarket trading in New York: Sunrun -29%, SolarEdge -24%, and Enphase -18%.

There will be many failures. Remember the Solyndra failure? Multiply that by many…

Green Energy Bubble: Hype to Bust via Shares Global Clean Energy ETF | ICLN

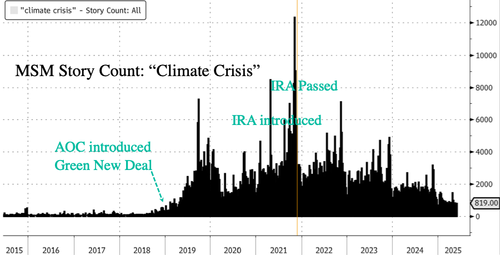

Just remember it was all one big climate MSM propaganda scam to swindle taxpayers.

Goldman Sachs analysts, led by Brian Lee, provided clients with a framework outlining the potential stock implications of the newly proposed Senate tax bill. The analysis provides a structured view of how accelerated clean energy credit phaseouts and other provisions could impact green stocks in their coverage:

While we take no view on the final outcome of the bill, we view the Senate proposal as relatively positive for FSLR, NXT, and ARRY as these companies have exposure primarily to 45X manufacturing tax credits, which are relatively unchanged and thus more intact through the end of 2031.

We view RUN, ENPH, and SEDG are the most negatively impacted by the proposed bill as the revision specifically calls out leasing and rental models which will not be eligible for tax credits starting in 2026.

We view CCJ and SMR as a potential beneficiary given positive commentary around nuclear PTC and ITCs and relatively longer runway availability for these credits for nuclear.

The bill is part of President Trump’s broader economic package and may still see revisions before a targeted July 4 vote in the House.

Loading…