Life, Liberty, Property #115: Has the Economy Turned the Corner Toward Steady Growth?

Forward this issue to your friends and urge them to subscribe.

Read all Life, Liberty, Property articles here, and full issues here and here.

IN THIS ISSUE:

- Has the Economy Turned the Corner Toward Steady Growth?

- Video of the Week: Labor Day Has Been Hijacked by Socialists — In The Tank Podcast #508

- The Worst Interest Rate of All

- Is the Fed Really Independent?

- Cartoon

- Bonus Video of the Week: National Academy of Sciences Goes to War Over CO₂

Has the Economy Turned the Corner Toward Steady Growth?

The latest numbers indicate that the U.S. economy may have turned the corner toward steady, noninflationary growth. There remains much to be done to improve long-term prospects.

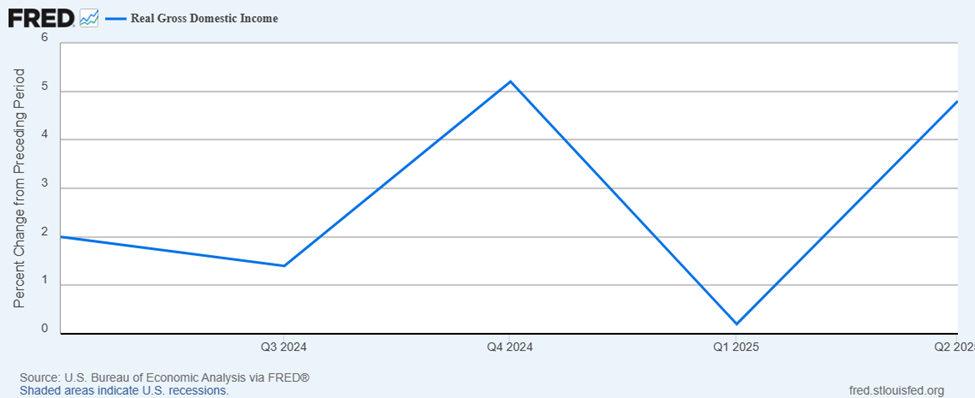

The latest official numbers from the U.S. Bureau of Economic Analysis indicate a growing economy, with gross domestic product rising at a 3.3 percent annual rate in the second quarter, 10 percent above the already encouraging original estimate of 3.0 percent. Real gross domestic income surged by a 4.8 percent annual rate:

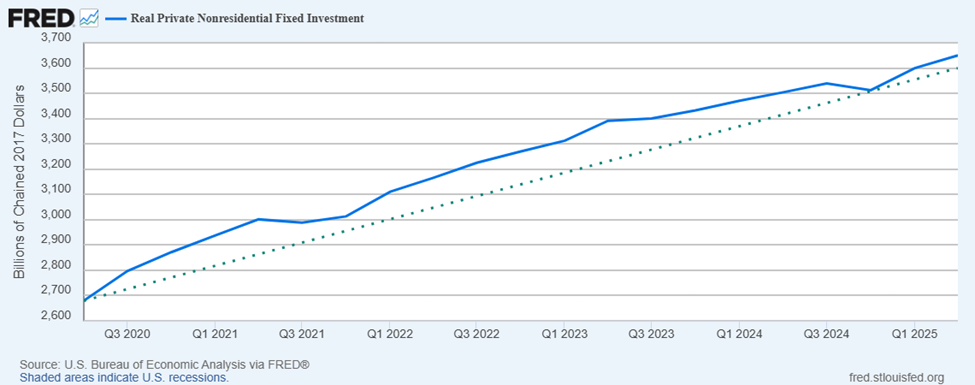

Even more importantly, government spending shrank slightly while the private sector grew. Further great news was that the revised numbers for the second quarter showed the annual rate of real private nonresidential fixed investment was triple what was previously reported: 5.7 percent versus 1.9 percent in the initial estimate. That arrived after a 10.3 percent increase in the first quarter and establishes a very strong positive trend.

The quarterly increase in consumer spending was revised upward to 1.6 percent from an initial estimate of 1.4 percent. Imports fell by 29.8 percent, and exports were down by 1.3 percent.

Inflation is at 2.5 to 2.9 percent year-over-year. That is above the Federal Reserve’s target of 2 percent, though it is still lower than the average of 2.9 percent in 2024, when the Fed cut the federal funds rate three times by a full percentage point in total in attempt to begin stimulating the economy (starting in September with an election on the way, interestingly).

Trading Economics reports the updated numbers for the second quarter:

The US economy grew at an annual rate of 3.3% in Q2 2025, a sharp rebound from the 0.5% contraction in Q1, according to second estimates. The figure was revised slightly higher from the first estimate of 3%, mainly due to upward revisions to investment (5.7% vs 1.9% in the first estimate) and consumer spending (1.6% vs 1.4% in the first estimate) that were partly offset by a downward revision to government spending (-0.2% vs 0.4% in the first estimate) and an upward revision to imports (-29.8% vs -30.3% in the first estimate). Growth was driven by a decrease in imports (-29.8% vs 37.9% in Q1), which are a subtraction in the calculation of GDP, and an increase in consumer spending (1.6% vs 0.5% in Q1). These movements were partly offset by decreases in investment (5.7% vs 10.3% in Q1) and exports (-1.3% vs 0.4% in Q1).

Initial jobless claims and outstanding jobless claims for the most recent week both fell, beating expectations by 15,000 and 14,000, respectively. “The results continued to reflect a historically strong labor market, aligned with statements from the Federal Reserve, while consolidating the view that the hiring pace has slowed since the start of the year,” Trading Economics reports.

The employment figures reflect the slow but steady movement away from government to the private sector. “Initial claims filed by federal government employees, which have been under scrutiny following recent dismissals by the Department of Government Efficiency (DOGE), jumped by 158 to 596, the highest in seven weeks,” Trading Economics reports.

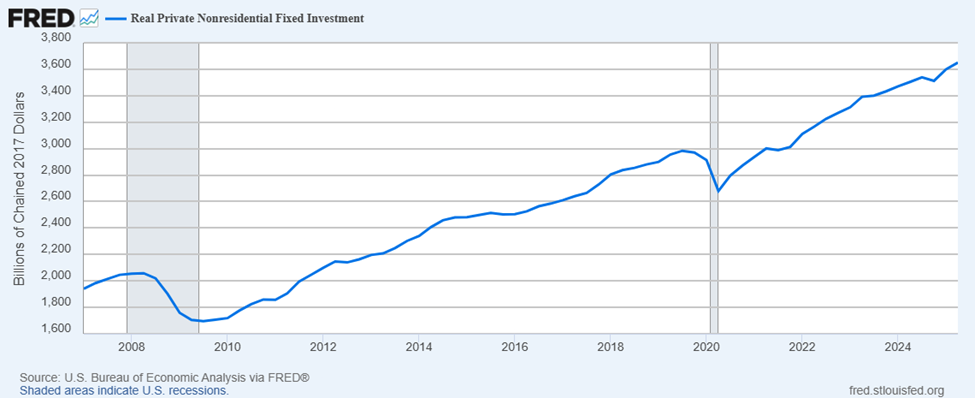

Investment and productivity increases are the keys to economic growth. Both are on the rise. Labor productivity rose at a 2.4 percent annual rate in the second quarter, according to the Bureau of Labor Statistics. Real private nonresidential fixed investment, which the Unleash Prosperity Hotline correctly describes as “the driver of long-run economic growth,” showed a healthy increase on top of the big surge in the first quarter of the year (10.3 percent annualized), as noted above:

It is always tempting to look at the economic numbers any particular week or quarter and attribute the various movements to specific policies one favors or dislikes. It certainly arises from a good impulse: the hope of connecting actions with consequences, with the goal of figuring out what policies are best.

The problem is that the national economy is extremely complicated, comprising an incalculable number of input factors and difficulties in measuring them all and gauging the relative importance of each. The global economic system in which the United States operates is even more complicated.

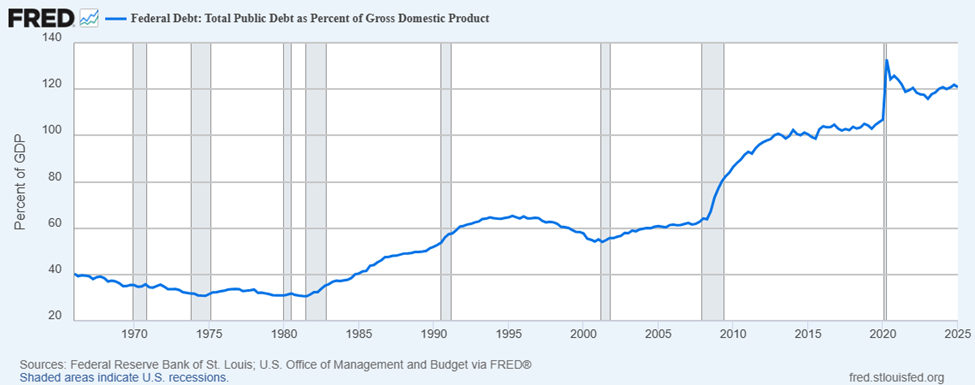

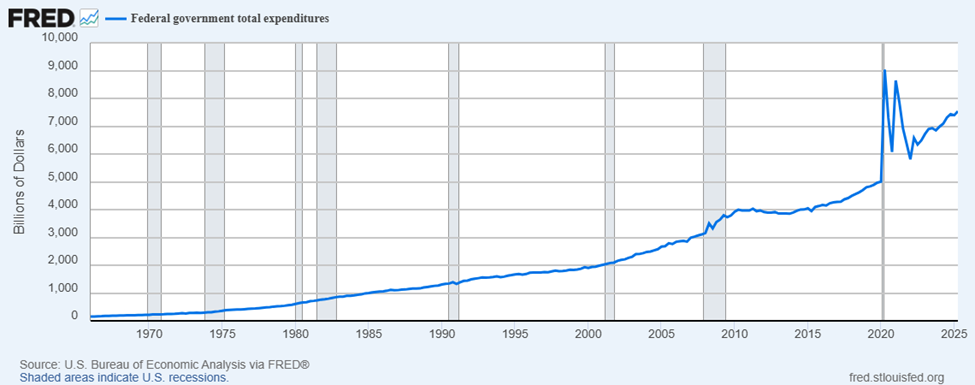

Nonetheless, decades of economic analysis have made it obvious that pro-market, small-government policies increase the production of goods and services, and that big-government, managed-economy policies suppress economic growth (in addition to immiserating people in countless other ways). The extension of the 2017 tax cuts and the Trump administration’s deregulatory efforts are critical steps in the right direction. Much more remains to be done, however, to reverse the damage of the past few decades:

That is a debt disaster brought on entirely by excessive government spending and interference in the economy (not by tax cuts!). As the charts show, the United States is still a long way away from being plausibly described as a free-market economy.

Sources: Trading Economics; Trading Economics

Video of the Week

| Labor Day has long been claimed by socialists in the United States who pretend to be champions of the working class — but history shows they’ve never truly stood with America’s workers. In fact, socialist policies hurt the middle class and working poor more than anything else, and leftist “soft on crime” agendas only make matters worse. |

The Worst Interest Rate of Them All

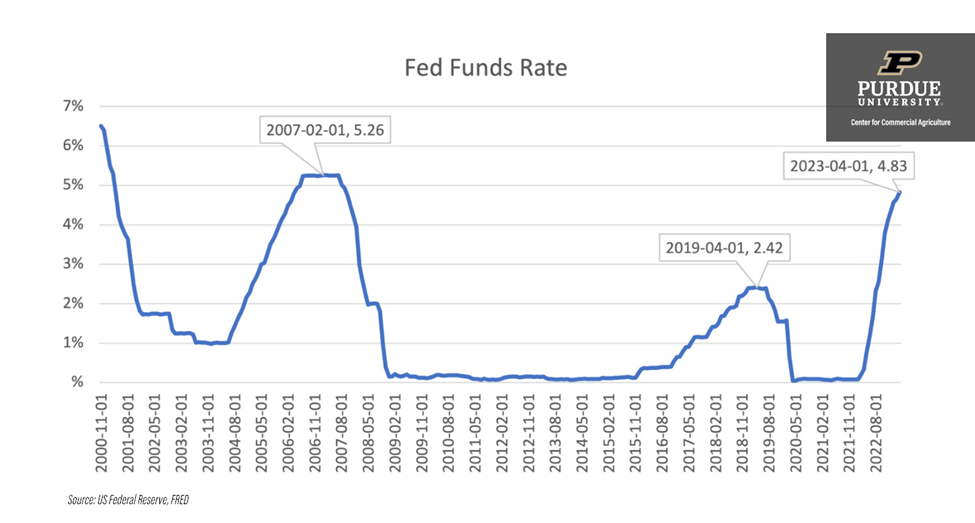

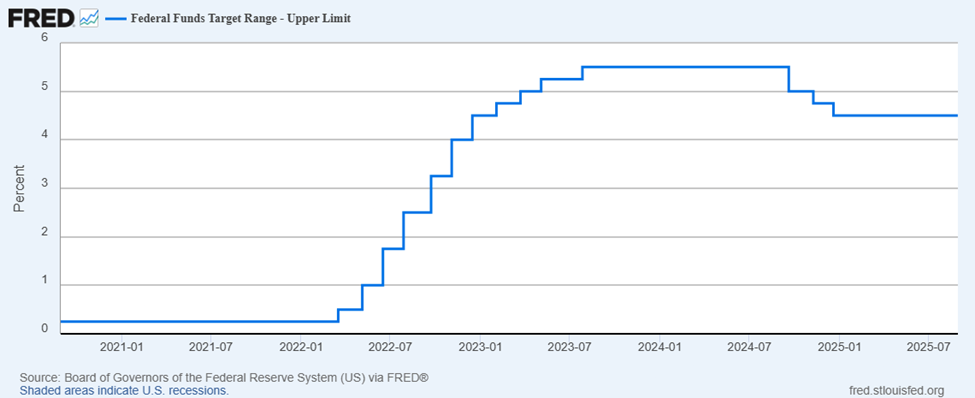

President Donald Trump’s disputes with the Federal Reserve have centered on the central bank’s refusal to reduce interest rates by cutting the federal funds rate from its current target of 5.25 to 5.5 percent. That rate is much higher than it has been through most of this century:

I think that interest rates are too high and should be cut by a couple of percentage points. That would stimulate economic growth (or rather, stop suppressing growth), and it would not increase inflation if done at a measured pace.

However, the fed funds rate might not be the best means of decreasing interest rates at present, Unleash Prosperity’s Hotline suggests:

With a rate cut likely in September, now the issue is: WHICH interest rate should the Fed cut?

Lowering the Federal Funds Rate isn’t going to achieve much, because few banks borrow at that rate today.

The fed funds rate is “the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight,” the St. Louis Fed states. The Fed has a couple of other tools by which it manipulates the money supply and interest rates. One that I have mentioned several times in the past is the Fed’s purchases and sales of securities, which loosen or tighten the money supply and thereby lower or raise interest rates, respectively.

Another Fed tool is the interest it pays banks for the reserve balances they keep at the Fed, which Congress established in 2006 (right before the United States suffered a horrible liquidity crisis; just saying) and has expanded massively since. Those interest payments keep money out of circulation, so lowering them increases liquidity. “The interest rate is set by the Board of Governors, and it is an important tool of monetary policy,” the St. Louis Fed notes.

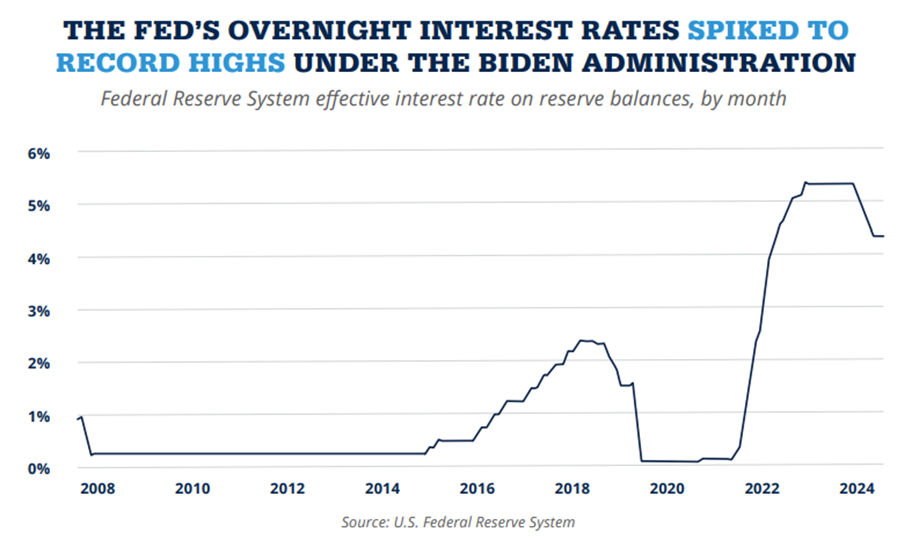

The Fed is paying banks a lot of money to keep dollars out of circulation:

That is the interest rate the Fed should reduce, Hotline argues, following a suggestion from Sen. Ted Cruz (R-TX):

We’re persuaded that Senator Ted Cruz of Texas is right that the Fed should cut the “IOR”, which is the 4.4% interest rate the Fed pays to banks on their reserve balances held at the Fed. The IOR rate has more than doubled from [its] pre-2008 levels.

That money is doing nothing but enriching banks in the safest way possible (for the banks, that is), when it could be used to finance economic growth. The interest payments on reserves (IOR) push up interest rates, including interest costs on federal debt, causing a dead loss to the taxpayers:

These are funds that banks do NOT lend out to businesses, consumers, and homebuyers. As monetary expert Judy Shelton has asked: Why bother with private sector borrowers or even investing in traditional Treasury securities that require at least a 10-year commitment, when the returns don’t come close to what the banks are passively getting on overnight cash. Good question!

Today, nearly $3.5 trillion is being stored in reserves at the Fed by banks. High-powered money from bank deposits has become passive money.

The Fed gave banks $186 billion last year alone to store their money at the central bank—with foreign banks getting one-third of that.

“Gradually lowering the IOR rate would stimulate the economy by incentivizing more bank lending and may save the government money by not paying banks to do nothing,” the Hotline states.

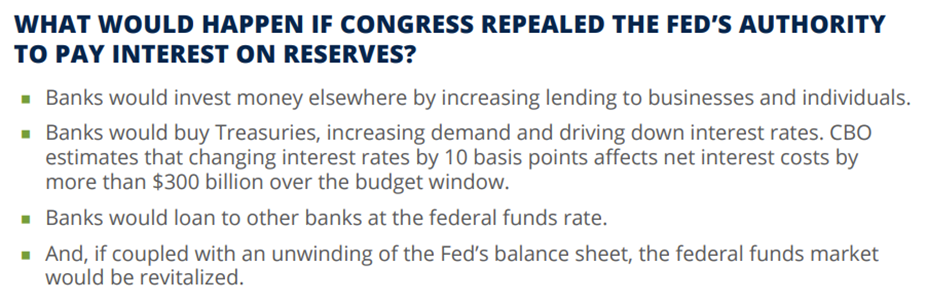

The Foundation for Government Accountability argues that Congress should repeal the IOR authority altogether:

Paying interest on bank reserves was a bad idea from the start. It distorts economic decisions, injects further artificial complications into the financial system, increases interest rates, and hikes the federal deficit by pushing up interest payments on the national debt. Get rid of it quickly or slowly, but by all means get rid of it as soon as possible.

Source: The Foundation for Government Accountability

NEW Heartland Policy Study

‘The CSDDD is the greatest threat to America’s sovereignty since the fall of the Soviet Union.’

Is the Fed Really Independent?

The controversy over President Trump’s firing of Federal Reserve Bank board member Lisa Cook arrived last week in the wake of persistent attacks by the president against the board’s recent and current interest rate policy, which Trump thinks is suppressing economic growth. The main argument that people are using against Trump’s complaints and this most recent action is the need to protect the central bank’s independence.

Is the Fed really independent? Has it ever been independent? Mises Institute Fellow Jonathan Newman, Ph.D., asks and answers those questions in a very informative article in The Misesian. Newman quotes current Fed Chairman Jerome Powell as saying, “we can make our decisions and we will only make our decisions based on our best thinking, based on our best analysis of the data about what is the way to achieve our dual mandate goals, as best as we can to serve the American people. That’s the only thing we’re ever going to do. We’re never going to be influenced by any political pressure.”

“This, of course, is plainly false,” Newman responds in his article. The Fed, Newman argues, works for the federal government and against the American people:

The Fed interprets the “price stability” part of its dual mandate to mean that it should target 2 percent annual price inflation as measured by various official statistics. Thus, the Fed by design feeds the political machine in DC by concealing the costs of government spending. The Fed serves the government, not the American people.

Examining the Fed’s history of claims of independence, Newman demonstrates that the central bank consistently works with presidents to support expansion of federal spending: “Whenever the government needs to borrow, the Fed stands ready to purchase more debt with new money,” writes Newman.

The real job of the Fed is to increase government revenues stealthily by continually devaluing the currency while avoiding too-obvious economic disasters, Newman writes:

The true nature of the central bank is that it is the federal government’s money printer. It allows the government to expropriate resources to a greater extent than if the government had to rely on taxes alone. The dual mandate “balancing act” gives the impression that the Fed is trying to keep the macroeconomy on an even keel, but this is an illusion. The Fed’s true balancing act is to inflate as much as possible on behalf of the federal government without excessive negative political outcomes like financial crises, high unemployment, and unpopular price inflation. They pretend to avoid these inevitabilities of monetary manipulation out of a sense of public service, but it’s all PR and political games.

Newman describes disputes between presidents and the Fed as “kayfabe,” like the fake dramas of professional wrestling. Both sides want expansive federal spending, Newman observes: “Fed independence platitudes are like the robes worn by Supreme Court justices. They provide the appearance of objectivity, sophistication, and sacredness. Underneath, it’s all politics.”

This drama distracts the public from the main problem, which is that the central bank is a scam and a scandal against the American people. The two possible extreme positions are for total Federal Reserve power over the currency or none at all. Ending the Fed would be best, and total Fed power over the dollar would be catastrophic, Newman writes:

Of course, the best outcome for the Fed is for it to be abolished. The worst-case scenario would be for the US government to abolish cash in favor of a central bank digital currency—this would remove the last remaining check (albeit a flimsy one) the public has on the cartelized banking system and the government’s ability to expropriate resources with monetary inflation.

“Between these two extremes,” Newman concludes, the most important thing is to tell people the truth about the central bank’s cozy relationship with the government, or to make the Fed directly answerable to the president so that there will be no doubt about whom to blame for the effects of monetary manipulation: “Explicit Fed dependence would be better,” Newman writes. “It would strip away the façade of impartiality, and ordinary people would be able to see who is responsible for high prices and business cycles. Is it the Fed or the federal government? Yes!”

Source: The Misesian

Cartoon

via Townhall

Bonus Video of the Week

The climate establishment is in full panic mode as the EPA moves to rescind its bogus 2009 “endangerment” finding on CO₂. The National Academy of Sciences is rushing activist scientists like Michael Mann to the barricades, and the attacks are getting nasty.

Contact Us

The Heartland Institute

1933 North Meacham Road, Suite 559

Schaumburg, IL 60173

p: 312/377-4000

f: 312/277-4122

e: [email protected]

Website: Heartland.org