Since the last ‘dovish’ FOMC statement (and Powell’s post-statement ‘hawkish’ presser) on July 30th, we have had ‘cool’ payrolls print and ‘hot’ inflation prints with retail sales mixed… and now everyone is anticipating Friday’s speech by Powell at Jackson Hole. So, maybe these Minutes will be a nothingburger…

Source: Bloomberg

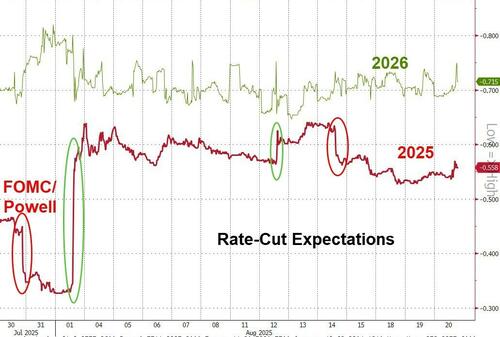

Overall, rate-cut expectations are higher…

Source: Bloomberg

…with September price-in as almost a done-deal for a cut…

Source: Bloomberg

Markets have generally gone nowhere in that time (except for crude prices, which have plunged on the heels of potential peace breaking out). Under the hood, there is some considerable pain in stock land (as momo and retail favorites have all suffered in recent days)

Source: Bloomberg

So, with two dissents (preferring to cut than hold), we anxiously await The Fed Minutes to see what Powell and his pals want us to know about the division within The (expensive) Eccles Building…

Key highlights from the Minutes (via Bloomberg):

-

*FED: SEVERAL SAID CURRENT RATE MAY NOT BE FAR ABOVE NEUTRAL

-

*FED: MAJORITY SAW INFLATION RISK OUTWEIGHING EMPLOYMENT RISK

-

*FED: MANY NOTED FULL EFFECT OF TARIFFS COULD TAKE SOME TIME

-

*FED: SEVERAL FLAGGED RISK OF INFLATION EXPECTATIONS UNANCHORING

-

*FED: SEVERAL EXPECTED COMPANIES WOULD PASS TARIFFS TO CUSTOMERS

Developing…

Read the full Minutes below:

Loading recommendations…