Happy Friday! Today marks the 81st anniversary of D-Day—or the beginning of the allies’ invasion of Normandy during World War II. Gen. Dwight D. Eisenhower told his men of the Allied Expeditionary Force in the famous Order of the Day of June 6, 1944, that the “free men of the world are marching together to Victory!” Let’s not forget what they did to secure that victory.

Quick Hits: Today’s Top Stories

- President Donald Trump spoke with Chinese leader Xi Jinping over the phone Thursday to discuss trade negotiations, their first call of Trump’s second term. The phone conversation, which China says was initiated by the White House, was “very positive,” according to Trump, who also said that a meeting between negotiators from both countries would happen soon. Trade talks between the two nations have been at an impasse since both China and the U.S. agreed to temporarily lower tariff rates last month in order to facilitate negotiations.

- Trump on Wednesday ordered an investigation into the extent of the Biden administration’s cover-up of the former president’s mental decline, along with the president’s use of an autopen to sign executive orders. “Let me be clear: I made the decisions during my presidency. I made the decisions about the pardons, executive orders, legislation, and proclamations,” said Biden in a statement released on Wednesday. Trump had previously asserted that the use of an autopen by White House staffers was illegal, alleging that Biden was not mentally competent to make those decisions. But members of the previous administration have stated that they only used the autopen after a presidential decision, following established legal precedent.

- Data released by the Commerce Department on Thursday showed the U.S. trade deficit in April narrowing by a record amount, caused by a steep drop-off in imports. The decline came after March saw a sharp increase in imports, as many companies sought to stockpile inventory in advance of tariffs going into effect. The goods and services deficit was $61.6 billion, a 55 percent decrease from the previous month and the smallest since September 2023.

- Trump and Tesla CEO Elon Musk’s public break widened Thursday, as Trump threatened to cancel federal contracts with Musk’s companies following Musk’s criticism of the spending bill currently making its way through Congress. “The easiest way to save money in our Budget, Billions and Billions of Dollars, is to terminate Elon’s Governmental Subsidies and Contracts,” Trump wrote on Truth Social. “Go ahead, make my day,” replied Musk, later writing on X that he would begin decommissioning the Dragon spacecraft, used by NASA for flights to the International Space Station. Musk, who spent hundreds of millions of dollars on Trump’s 2024 reelection campaign, also threatened to use his money in the next midterm elections to challenge Republicans who vote for the bill.

- The Supreme Court on Thursday ruled that there was no legal difference between majority and minority groups when deciding discrimination cases, siding with a plaintiff who said she had been passed over for a job and then demoted because she was straight. “Congress left no room for courts to impose special requirements on majority-group plaintiffs alone,” wrote Justice Ketanji Brown Jackson for a unanimous court. The decision will affect lawsuits in 20 states and the District of Columbia, where courts had set a higher evidentiary standard for members of a majority group, like white or straight people, to prove workplace discrimination.

- German Chancellor Freidrich Merz met with Trump in the Oval Office on Thursday, where Trump said that the U.S. might have to let Russia and Ukraine “fight for a while” before re-engaging with the peace process. Trump’s remarks, which he said he also made to Russian President Vladimir Putin during a phone call earlier this week, came as Merz urged the U.S. to support Ukraine in its efforts to repel Russia’s invasion. Asked about a Russian sanctions bill currently making its way through the Senate, Trump said that any sanctions on Russia would be “guided by me.”

‘The Interest Will Bury Us’

Back in 2023, economists at the Wharton School of Business at the University of Pennsylvania tried to model the long-term U.S. economy under our current debt trends. Their findings? When trying to show a functioning economy long-term, the models “effectively crash.”

“The reason is that current fiscal policy is not sustainable, and forward-looking financial markets know it, leading to the economy ‘unraveling,’’’ the study said. Just to make functional economic projections, the models have to assume that major steps are taken to reduce the debt.

Fast forward to today, and Republicans are working on a reconciliation bill that adds to the debt by an estimated $2.4 trillion over the next decade on top of massive existing deficits. And that debt estimate is only if the bill’s “temporary” tax cuts—extensions of the 2017 Trump tax provisions that were already set to expire this year—are actually allowed to sunset in 10 years. Otherwise, the debt hike will be trillions more. If nothing is done to fix the exploding national debt over the coming decades—and Republicans and Democrats seem equally uninterested in changing their course—economists worry that the U.S. could face a major crisis in the not-too-distant future.

Even before the reconciliation bill, the national debt had ballooned to $36 trillion, with nearly $29 trillion held by the public, which is the most relevant metric for assessing the debt. The rest of the debt is in intergovernmental holdings, or money the government owes itself. But it’s even more helpful to look at the debt held by the public as a share of the U.S. economy—similar to how mortgages can be viewed as a share of income. At the beginning of this year, that ratio stood at nearly 97 percent of GDP, not far off from its peak of 106 percent of GDP after World War II. However, at that time, debt-to-GDP was on a downward trajectory.

“From the end of World War II up until about 2008, the debt averaged only 40 percent of GDP, which was manageable,” Jessica Riedl, senior fellow at the Manhattan Institute, told TMD. “Since 2008, the debt has jumped from 40 to 100 percent of GDP, and with this tax bill, combined with other costs such as Social Security and Medicare, we are heading to 250 to 300 percent of GDP debt within 30 years. That is a point that would cause an economic calamity.” Interest on the debt alone would cost as much as two-thirds of all tax revenue.

Looking at the budget deficit shows how quickly the problem is compounding. The deficit was $1.8 trillion in the last fiscal year, but the GOP megabill is set to increase that to over $4 trillion by the end of the decade. And it could send interest costs higher than $2 trillion by 2034. This would consume nearly one-third of government revenue.

Less than a month ago, Moody’s Ratings became the last of the three major American rating agencies to downgrade U.S. debt from its extremely safe AAA status, citing not only the increasing deficits but also “markedly” rising interest cost on government debt. “The interest will bury us,” Riedl said. Interest has already leapfrogged over Medicaid, Medicare, and defense in its share of the federal budget, and it now sits as the second largest budget item behind Social Security. “And it’s going to surpass Social Security in as few as 10 years,” Reidl added.

How did we get here? “The debt over time is mostly driven by the growth of a few big spending programs, mainly Social Security, Medicare, Medicaid, interest on the debt, and veteran spending. But there’s sort of a different story of what has driven the change in debt because, in theory, that rising spending could be offset by rising tax revenue,” Marc Goldwein, senior vice president and senior policy director for the Committee for a Responsible Federal Budget, told TMD. “But every time there has been an opportunity for that, politicians have turned around and cut taxes or increased spending outside of those areas.” The government also had expensive responses to both the 2008 Financial Crisis and the COVID-19 pandemic that contributed to debt levels.

Fiscal hawks have long warned of the rising debt eventually causing an economic calamity. But it is already hurting the economy in the near-term. “We’re already seeing higher interest rates, higher mortgage rates, and we very well may see elevated inflation and a drag on economic growth,” Riedl said. Under current debt trends, real income growth is projected to slow by 10 percent in the next 30 years—but if the debt rapidly rises, income growth could decline by 30 percent.

The market could also begin to see what economists call “crowding out.” When the government borrows money by selling bonds, interest rates increase, and investors buy bonds instead of investing in the private sector. “The basic idea is we’re diverting people’s money away from productive investments—that would give us more machines, and factories, and equipment, and software, and innovations—and toward government debt,” Goldwein said. It can lead to a less productive economy with higher interest rates—especially, as Riedl explained, when the government wants to borrow more money than the bond market can lend. Interest rates would increase drastically, and capital would be diverted out of private-sector investments.

These higher rates compound the debt issue further. Rising interest rates mean that borrowing for the federal government is more expensive, which leads to higher debt levels. That, in turn, leads to the government borrowing even more, which pushes interest up yet again.

This debt spiral could eventually lead to much larger problems. “The markets might panic. [Creditors are] not going to stop lending to us because we’re the United States of America, but what they’re going to do is they’re going to start lending to us at a much higher interest rate,” Goldwein said. If the yields of new bonds increase, the value of existing bonds held by the public fall, since they have lower yields. That could spark a full financial crisis.

“I think it’s not likely to happen, but its likelihood is rising over time,” Goldwein said. A time horizon for a crisis is hard to pin down, though, because markets price in future expectations. If the market decided a recession was inevitable at a certain point in the future, for example, the panic would happen now. “One thing to look at is what are the tipping points where the debt can start to spiral out of control,” Goldwein said. “And those seem most likely to be about 20 years off, but with a wide range.” The 2023 Wharton study also found that the U.S. likely has close to 20 years to avoid a default.

An explicit default on the debt—where the government fails to make payments—isn’t likely, Riedl explained, because the U.S. can print its own money. But that strategy could still lead to extreme inflation. A default could happen, however, if the U.S. chose to do so, whether through delayed payments from a debt ceiling fight or an implicit default through inflation devaluing bonds. In a gloomy future scenario, defaulting on the debt could be a better option than paying on the bonds, although it would likely lead to a global economic collapse. But an implicit default is more within the realm of possibility.

Even without a financial meltdown, the debt could lead the U.S. into a slow decline. “What I think will happen is a series of mini-panics, in which the debt causes the stretched out bond markets to panic and raise interest rates, which in turn motivates Congress to cut the easy, low-hanging fruit of, say, wasteful spending and tax loopholes,” Riedl said. “But that’s not enough.”

In Riedl’s prediction, further panics would happen in the following years, leading to deeper government cuts and steeper tax increases. “Ultimately, the result of this is that in 20 years or so, you have European taxes without the European social benefits,” Riedl said. “You have significantly higher income and payroll taxes, but rather than a European welfare state, the spending is all going to interest on the debt and benefits for seniors.”

So how does the U.S. avoid a disaster? According to the economists who spoke to TMD, the debt crisis is a fixable problem—as long as spending is cut and taxes aren’t. “The first step is to stop digging, and stop passing trillion-dollar tax cuts under Republicans and trillion-dollar spending expansions under Democrats,” Riedl said. Cutting the deficit to 3 percent of GDP would stabilize the debt at 100 percent of GDP indefinitely, Riedl said, keeping the debt growing at the same pace as the economy and avoiding a debt spiral.

“We don’t have to solve the debt overnight to prevent a crisis,” Goldwein said. “Just showing we have the capacity to solve it will allow the markets to breathe a huge sigh of relief. If we just do a little bit, incrementally, every couple of years that are focused on two things: getting the deficit down and getting the growth rate up, we’re going to be just fine.”

Today’s Must-Read

Will Trump Give Electability a Chance?

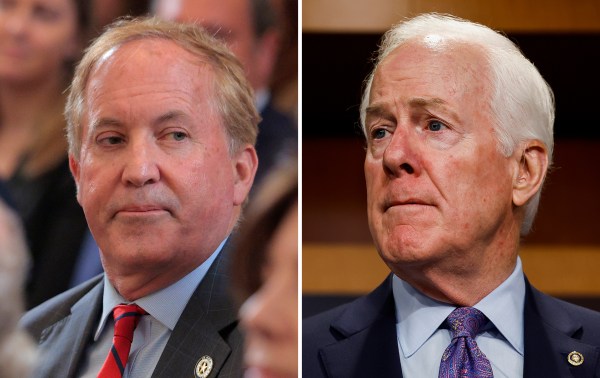

After the electoral disaster of the Barry Goldwater candidacy in 1964, William F. Buckley Jr. acquiesced to backing Richard Nixon for president over a more ideologically aligned alternative Republican. Buckley justified his stance by articulating what would become known as the Buckley rule, saying he had to “be for the most right, viable candidate who could win it.” For much of his time on the political scene, Donald Trump (who has more in common with Nixon than with any other modern-era president) has modified the Buckley rule for Republican primaries in two ways: replacing “most right” with “most pro-Trump,” and chopping off the final four words.

Toeing the Company Line

Worth Your Time

- The Texas Legislature recently passed a law mandating the display of the Ten Commandments in public school classrooms. For The Atlantic, Michael Sokolove wrote about how he, the lone Jewish child in his 1960s classroom, felt about being forced to pray: “We are of course a Christian nation and probably will always remain so. No one knows that better than non-Christians. It is a fact of life, and not an unhappy one, or at least not for me. I am married to a woman who grew up attending a Presbyterian church. We raised our children in both of our traditions. There is a big difference, however, between the choices we make and the ones forced on us. The aggressive push to flood the nation with religious faith—a specific faith, and a particular strain of that faith—undermines any notion of American plurality. It comes at a cost not just to the nation, but to individual Americans … Thirty-one million people live in Texas—67 percent of whom identify as Christian. The rest, about 10 million Texans, are Muslim, Jewish, Buddhist, Hindu, or a mix that a Pew Research Center study identified as atheists, agnostics, and ‘nothing in particular.’ Some children from those families will now have to sit in school while a faith other than their own is pressed on them.”

- Stephen Kalin and Shelby Holliday reported in the Wall Street Journal on how the Houthis, a militant group in Yemen, managed to fight the mighty U.S. Navy to a standstill: “Some 30 vessels participated in combat operations in the Red Sea from late 2023 through this year, around 10% of the Navy’s total commissioned fleet. In that time, the U.S. rained down at least $1.5 billion worth of munitions on the Houthis, a U.S. official said. The Navy was able to destroy much of the Houthis’ arsenal—but it has yet to achieve the strategic goal of restoring shipping through the Red Sea, and the Houthis continue to regularly fire missiles at Israel … The effects of the deployment will be felt for years. It drew resources from efforts in Asia to deter China and pushed back maintenance schedules for carriers. That could create critical gaps in the second half of the decade, when the giant warships will have no choice but to dock for service. Despite the wear and tear, Navy officials said the fight with the Houthis offered invaluable combat experience, and the Red Sea conflict is viewed inside the Pentagon as a warm-up for a potential ‘high-end’ conflict with China.”

The Guardian: “‘Such ingratitude’: Trump and Musk alliance devolves into bitter feud”

The Times: “Russia brands UK the ‘main source of global crises’”

In the Zeitgeist

In case you missed it, Wednesday’s Game 1 of the NBA Finals between the Indiana Pacers and the Oklahoma City Thunder became an instant classic. Here’s Pacers point guard Tyrese Haliburton somehow pulling yet another rabbit out of the hat:

Let Us Know

Are you worried about U.S. debt spiraling out of control?