By now, readers have been tracking our key investment themes—uranium ‘ESG’ play from 2020, the “Next AI Trade,” all things nuclear, Powering Up America, and rare earths, among others. One of the latest additions to this lineup is our emerging focus on the “hemispheric defense” theme.

Back in March, we broke down what hemispheric defense actually means in the Trump era. Then, we highlighted several defense companies poised to benefit (L3Harris Technologies, ect…) as Pentagon priorities shift, and funding increasingly flows toward agile, tech-driven firms over legacy prime contractors.

Here’s the evolution of the Hemispheric Defense theme:

As Wall Street launches into earnings season, Goldman analysts, led by Noah Poponak, have offered clients a comprehensive note on the second-quarter earnings preview, with a focus on aerospace and defense stocks within their coverage.

“Defense tech companies appear to be on the verge of receiving significant funding relative to their size as the DoD looks to procure more commercial derivative, lower-cost hardware and technology,” Poponak told clients.

The analyst stated that government IT bookings and revenue were at significant risk as DOGE gains traction within the DoD (read here).

He said the top picks ahead of the earnings season include:

-

TDG – TransDigm Group Incorporated (NYSE: TDG)

-

CAE – CAE Inc. (NYSE: CAE; also trades on TSX as CAE)

-

LHX – L3Harris Technologies, Inc. (NYSE: LHX)

-

HII – Huntington Ingalls Industries, Inc. (NYSE: HII)

Chart: L3Harris

And noted the losers:

-

BAH – Booz Allen Hamilton Holding Corporation (NYSE: BAH)

-

LMT – Lockheed Martin Corporation (NYSE: LMT)

-

SAIC – Science Applications International Corporation (NYSE: SAIC)

-

VVX – V2X, Inc. (NYSE: VVX) (formerly Vertex and Vectrus merger)

Analysts outlined their key takeaways within the defense world:

-

Aerospace OE: Boeing delivered 60 planes in June after delivering 40-45/month through the first five months of the year, indicating that product quality improvements are holding and production is successfully ramping (MAX production is at 38/month now). At the Paris Air Show, suppliers generally had positive feedback about Boeing – pulling consistent volumes of components, and has improved its communications with the supplier base. Despite recent improvements in BA production, demand remains far in excess of available supply, creating favorable economics for BA.

-

Aftermarket: Aftermarket fundamentals remain strong. While there were some pockets of North American air travel weakness developing amidst tariff and trade uncertainty, demand signals look to be improving. Aftermarket has been growing in excess of global ASMs for the last 4 quarters, a trend we attribute to pricing power, aging fleet dynamics, and pent-up demand. We think OEs will under supply the market until ~2030, creating a favorable environment into which aftermarket companies will continue to sell.

-

Business jet: Business jet leading indicators have slowed their rate of improvement or plateaued, meaning outperformance here may be more idiosyncratic going forward. Book to bills have trended between 0.8X – 1.2X for the biz jet OEs, although large orders have the potential to move the stocks. New production appears to remain disciplined, which should help retain pricing power, and the OEs are growing their aftermarket businesses, which are high quality, high margin revenue streams.

-

Defense Tech: Recent DoD memos, executive orders, and the reconciliation bill are proof points that the DoD is beginning to focus on nimbler, non-traditional defense suppliers. We don’t expect the reconciliation funding to have a large impact to numbers in the quarter, but expect it to be topical on earnings calls, providing investors with the ability to quantify opportunities, and begin showing up in backlogs in the next few quarters. We see a number of growth catalysts in the sub-sector going forward.

-

Defense hardware: This year’s defense request, when combined with Reconciliation, will be the largest on record, nearing $1.0 trillion. Despite that, we remain selective in defense hardware, preferring companies that have more exposure to the administration’s stated (and funded) priorities like shipbuilding and golden dome. We think the Pentagon will continue to implement tougher terms of trade industry wide, and there is evidence the DoD is willing to consider cuts to large, established, and well-funded programs like F-35, creating some heightened uncertainty for the Primes going forward.

-

Government IT & Services: We remain cautious on Gov IT as DOGE continues its work at the federal civilian agencies, and appears to have become more active within the DoD in recent weeks, with BAH and LDOS notching large contract cancellations. There are now multiple DoD memos indicating tougher terms for contracting Gov IT work, establishing DOGE contract reviews, and prioritizing implementation / services work from equipment manufacturers themselves. We think this will pressure book-to-bills industry wide in the quarter, and guidance from companies could be conservative.

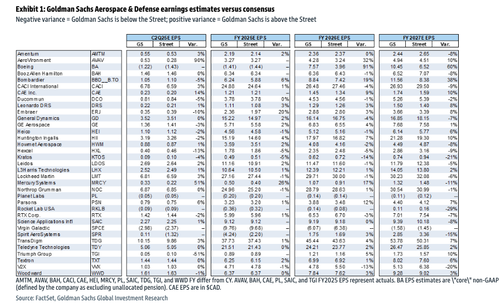

GS Aerospace & Defense earnings estimates versus consensus

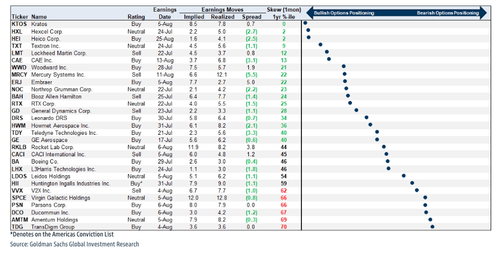

Options positioning heading into 2Q25 results

Pro Subs can read the full note here, which outlines much more and earnings estimates.

Loading…