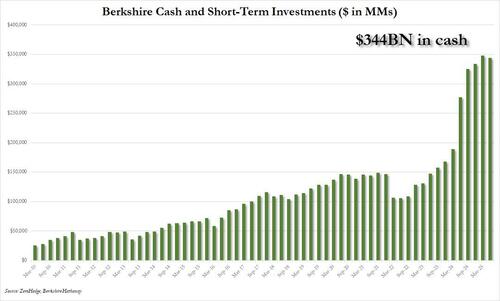

Last night we reported that around the time Warren Buffett was making a decision to retire as CEO of Berkshire (at the age of 94), he made a few notable changes to his massive $260 billion portfolio of stocks, including a new position in UnitedHealth Group (which has sent the stock soaring the most since 2008 today), and adding to his homebuilder stake in what appears to be a bet on lower rates, besides the now-traditional slow motion unwind of his AAPL and bank/financial bets while adding to his record cash hoard, which now stands at $344 billion.

So what did all the other marquee hedge funds do? Two answers here: first, it doesn’t matter, since as even Goldman discussed yesterday, retail investors have “changed the game” and are all that matters in the current market euphoria. Second: below is a breakdown of what some of the most notable hedge funds bought and sold in Q2, courtesy of Newsquawk and Roberts-Ryan.

Appaloosa (David Tepper): New INTC GT RTX DAL UAL IQV WHR MHK positions, Boosted NVDA TSM XYZ MU holdings

- New: INTC (8 mln shares), GT (0.86 mln), RTX (0.59 mln), DAL (0.55 mln), UAL (0.55 mln), IQV (0.3 mln), WHR (0.27 mln), MHK (0.07 mln)

- Increased: UNH (to 2.45 mln shares from 0.18 mln shares), NVDA (to 1.75 mln from 0.3 mln), TSM (to 1.03 mln from 0.27 mln), XYZ (to 0.64 mln from 0.08 mln), MU (to 0.83 mln from 0.4 mln), DB (to 4 mln from 3.75 mln), AMZN (to 2.7 mln from 2.51 mln), LHX (to 0.35 mln from 0.3 mln)

- Maintained: ET (4.96 mln shares), KWEB (4 mln shares), GLW (1.75 mln shares), MSFT (0.5 mln shares)

- Closed positions in: LVS (from 0.59 mln shares), WYNN (from 0.32 mln), AVGO (from 0.13 mln), EXEEZ (from 0.12 mln)

- Decreased: FXI (to 1 mln shares from 5.6 mln shares), PDD (to 2 mln from 4.37 mln), BABA (to 7.07 mln from 9.23 mln), JD (to 7 mln from 8.05 mln), LYFT (to 8 mln from 9 mln), ORCL (to 0.15 mln from 0.7 mln), GOOG (to 1.5 mln from 2.01 mln), VST (to 1.8 mln from 2.3 mln), UBER (to 2.75 mln from 3.2 mln), BEKE (to 1.5 mln from 1.9 mln) BIDU (to 0.63 mln from 0.78 mln), META (to 0.4 mln from 0.55 mln), CZR (to 2.1 mln from 2.2 mln), LRCX (to 0.4 mln from 0.5 mln), NRG (to 1.98 mln from 2.05 mln)

Baupost Group (Seth Klarman): New AMCR PAGS FI positions, Exited CLVT SOLV SGI, Boosted CRH LBRDK DG GOOG ELV QSR WCC FIS holdings

- New AMCR PAGS FI positions, Exited CLVT SOLV SGI, Boosted CRH LBRDK DG GOOG ELV QSR WCC FIS holdings Highlights from Q2 2025 filing as compared to Q1 2025 (all amounts are approximate):

- New positions in: AMCR (5.5 mln shares), PAGS (2.5 mln), FI (0.9 mln)

- Increased positions in: CRH (to 3.83 mln shares from 2.69 mln shares), LBRDK (to 0.75 mln from 0.17 mln), DG (to 2.67 mln from 2.1 mln), GOOG (to 2.63 mln from 2.08 mln), ELV (to 0.62 mln from 0.25 mln), FIS (to 3.79 mln from 3.49 mln), WCC (to 2.21 mln from 2.01 mln), QSR (to 4.05 mln from 3.89 mln)

- Maintained positions in: LBTYK (24.66 mln shares), FERG (1.13 mln)

- Closed positions in: CLVT (from 10.78 mln shares), SOLV (from 1.05 mln), SGI (from 0.7 mln)

- Decreased positions in: GDS (to 3.25 mln shares from 4.25 mln shares), VSAT (to 9.19 mln from 10.19 mln), EXP (to 0.68 mln from 0.91 mln), WTW (to 1.31 mln from 1.53 mln)

Berkshire Hathaway (Warren Buffett): New LEN NUE UNH DHI LAMR ALLE positions, Cut BAC AAPL DVA CHTR FWONK holdings

- New: LEN (7.05 mln shares), NUE (6.61 mln), UNH (5.04 mln), DHI (1.49 mln), LAMR (1.17 mln), ALLE (0.78 mln)

- Increased: CVX (to 122.06 mln shares from 118.61 mln shares), POOL (to 3.46 mln from 1.46 mln), STZ (to 13.4 mln from 12.01 mln), HEI (to 1.29 mln from 1.16 mln), LEN.B (to 0.18 mln from 0.15 mln)

- Maintained: KO (400 mln shares), KHC (325.63 mln shares), OXY (264.94 mln shares), AXP (151.61 mln shares), SIRI (119.78 mln shares), KR (50 mln shares), CB (27.03 mln shares), MCO (24.67 mln shares), VRSN (13.29 mln shares),

- Exited: TMUS (from 3.88 mln shares)

- Decreased: BAC (to 605.27 mln shares from 631.57 mln shares), AAPL (to 280 mln from 300 mln), DVA (to 33.8 mln from 35.14 mln), CHTR (to 1.06 mln from 1.98 mln), FWONK (to 3.02 mln from 3.51 mln)

Carl Icah : Boosted IEP CTRI CVI positions, Confirms DAN exit

- Increased positions in: IEP (to 494.78 mln shares from 450.79 mln shares), CTRI (to 6.4 mln from 2.49 mln), CVI (to 70.42 mln from 68.53 mln)

- Maintained positions in: BHC (34.72 mln shares), JBLU (33.62 mln shares), SWX (7.53 mln shares), UAN (4.16 mln shares), IFF (3.75 mln shares), AEP (1.21 mln shares)

- Closed positions in: DAN (from 14.29 mln shares), ILMN (from 0.22 mln)

Corvex Management (Keith Meister) : New QSR ORCL positions, Boosted VSTS WGS AQN SWX AMZN LLYVK holdings

- New: QSR (873K), ORCL (100K)

- Increased: VSTS (to 18.8 mln shares from 17.01 mln shares), WGS (to 3.06 mln from 2.47 mln), AQN (to 6.18 mln from 5.68 mln), SWX (to 5.03 mln from 4.77 mln), AMZN (to 0.68 mln from 0.57 mln), LLYVK (to 0.03 mln from 0.02 mln)

- Maintained: MGM (5.63 mln shares), ILMN (3.83 mln shares), CSX (1.75 mln shares), SRE (1.06 mln shares), LLYVA (1.01 mln shares), HSII (1 mln shares), NSC (0.3 mln shares), MSFT (0.17 mln shares)

- Closed positions in: UGI (from 1.96 mln shares), KOF (from 1 mln), TSM (from 0.31 mln), IBIT (from 0.2 mln)

- Decreased: DLTR (to 0.98 mln shares from 3.21 mln shares), MDU (to 4.18 mln from 5.87 mln), GOOGL (to 0.23 mln from 0.64 mln), LNG (to 0.06 mln from 0.14 mln)

D1 Capital: New LPX FLS DHI VIK DHR positions, Exited CP INTC RCL SNPS

- New positions in: LPX (1.81 mln shares), FLS (1.69 mln), DHI (1.54 mln), VIK (1.15 mln), DHR (162K)

- Increased positions in: NU (to 24.1 mln shares from 9.8 mln shares), LINE (to 4.6 mln from 2.5 mln), SGI (to 2.7 mln from 1.3 mln), CLH (to 1.4 mln from 0.2 mln), CNM (to 6 mln from 5mln), TOL (to 1.6 mln from 0.69 mln), BAC (to 8 mln from 7.3 mln), COF (to 1.2 mln from 0.8 mln), CRS (to 0.8 mln from 0.6 mln), RDDT (to 1.9 mln from 1.8 mln), APO (to 1.4 mln from 1.3 mln), XPO (to 3.14 mln from 3.05 mln)

- Maintained positions in: CART (22.56 mln shares), ENTG (4.17 mln shares), APP (0.79 mln shares)

- Closed positions in: CP (from 2.33 mln shares), BBWI (from 2.2 mln), INTC (from 1.44 mln), RCL (from 1.11 mln), CRL (from 777K), LEN (from 468K), LRCX (from 403K), CVNA (from 370K), SNPS (from 335K), WRBY (from 257K), AMAT (from 205K), CDNS (from 198K), QSR (from 93K)

- Decreased positions in: ALK (to 3.14 mln shares from 4.13 mln shares), SCHW (to 3.52 mln from 4.36 mln), PRMB (to 4.81 mln from 5.22 mln), BDX (to 0.34 mln from 0.67 mln), USFD (to 1.03 mln from 1.32 mln), PM (to 1.2 mln from 1.5 mln), ELV (to 326K from 578K), AMZN (to 701K from 951K), GEHC (to 1.16 mln from 1.25 mln)

Discovery Capital Management (Rob Citrone) : New QXO YPF NU JBS CLS positions, Boosted AMX IREN SNAP holdings, Exited TUR SCHW BA

- New positions: QXO (2.4 mln shares), YPF (866K), NU (606K), JBS (418K), CLS (366K), AR (288K), RRC (274K), COF (242K), PRMB (225K), EQT (214K), CORZ (198K), VNM (175K), JPM (167K), CTRN (153K), VVV (109K), EXE (106K), VIK (100K), VOYG (100K)

- Increased: AMX (to 5.3 mln shares from 2.7 mln shares), IREN (to 4.2 mln from 2.7 mln), GENI (to 6.8 mln from 5.9 mln), FCX (to 695K from 333K), SNAP (to 1.2 mln from 881K), HDB (to 515K from 257K), TEO (to 259K from 50K), PSN (to 458K from 327K), METC (to 1.3 mln from 1.2 mln), ECH (to 127K from 30K), BABA (to 156K from 66K), VIST (to 1.2 mln from 1.1 mln), JRVR (to 819K from 769K), ABL (to 296K from 251K), TTWO (to 132K from 117K), METCB (to 39K from 27K), META (to 20K from 10K), UNH (to 84K from 74K)

- Exited: TUR (from 166K), SCHW (from 125K), KRMN (from 100K), BA (from 92K), LOAR (from 75K), FSLR (from 59K), KWEB (from 48K), CHWY (from 35K)

- Decreased: GGAL (to 0.5 mln shares from 1 mln shares), AMTM (to 2.3 mln from 2.6 mln), NBIS (to 1.81 mln from 2.1 mln), GEO (to 1.3 mln from 1.4 mln), TKC (to 898K from 995K), GLNG (to 332K from 428K), EAT (to 99K from 194K), AGRO (to 271K from 354K), SLM (to 179K from 209K), ALAB (to 41K from 66K), PINS (to 266K from 280K), ROOT (to 30K from 34K)

Elliott Management (Paul Singer): New HPE HYG positions, Boosted PSX holding, Exited RIG MTCH BMRN

- New: HPE (18.63 mln shares), HYG (3.8 mln)

- Increased: PSX (to 19.25 mln shares from 15.73 mln shares)

- Maintained: TFPM (133.82 mln shares), LUV (53.98 mln shares), SU (52.67 mln shares), PINS (28 mln shares)

- Exited: RIG (from 11.87 mln), MTCH (from 6 mln),BMRN (from 3.5 mln), CRMD (from 2.44 mln), HDB(from 670K), ARM (from 140K), HWM (from 100K)

Eminence Capital (Ricky Sandler) : New PTON CPNG WBD JHX JEF SXT UNH positions, Boosted AMCR GTLB CWH FRSH WK holdings

- New positions in: PTON (16.24 mln shares), CPNG (6.84 mln), WBD (6.21 mln), JHX (3.1 mln), JEF (1.46 mln), SXT (1.01 mln), UNH (575K), FRPT (339K), FND (154K), MTN (91K), META (55K)

- Increased positions in: AMCR (to 14.17 mln shares from 3.52 mln shares), GTLB (to 6.22 mln from 2.5 mln), CWH (to 4.13 mln from 1.85 mln), FRSH (to 7.33 mln from 5.26 mln), WK (to 2.65 mln from 0.86 mln), Z (to 3.98 mln from 2.43 mln), S (to 7.07 mln from 5.66 mln), LPX (to 2.89 mln from 1.68 mln), SGI (to 3.18 mln from 2.17 mln), ATMU (to 6.45 mln from 5.76 mln)

- Maintained positions in: PLAY (2.91 mln shares)

- Closed positions in: PRMB (from 7.02 mln shares), BAC (from 2.7 mln), BERY (from 1.84 mln), GEHC (from 1.82 mln), UBER (from 1.57 mln), MSOS (from 1.48 mln), FROG (from 1.35 mln), HDB (from 1.19 mln), COF (from 0.8 mln)

- Decreased positions in: OKTA (to 0.98 mln shares from 2.48 mln shares), CF (to 1.18 mln from 2.28 mln), SE (to 1.55 mln from 2.54 mln), PINS (to 5.15 mln from 5.78 mln), DKNG (to 4.76 mln from 5.18 mln), GPK (to 2.89 mln from 3.29 mln), ELV (to 0.24 mln from 0.56 mln), BABA (to 1.1 mln from 1.26 mln), AMD (to 1.42 mln from 1.57 mln), DT (to 3.23 mln from 3.35 mln)

Engaged Capital (Glenn Welling): New FRPT position, Boosted EVH YETI holdings

- New positions in: FRPT (0.62 mln shares)

- Increased positions in: EVH (to 5.85 mln shares from 5.18 mln shares), YETI (to 2.16 mln from 1.54 mln)

- Maintained positions in: BRCC (13.54 mln shares – has lowered stake post-qtr), VFC (5.42 mln shares), GXO (0.9 mln shares)

- Closed positions in: NATL (from 0.77 mln shares), VYX (from 0.43 mln), GTLS (from 0.37 mln)

- Decreased positions in: PTLO (to 4.83 mln shares from 5.48 mln shares)

Glenview Capital (Larry Robbins and Mark Horowitz): New SGRY EYE DKS COO MKSI ON IQV RH positions, Boosted GTM BLCO TEVA MYGN GPN holdings, Exited DNB CTVA CNC BKD PINS

- New: SGRY (1.53 mln shares), EYE (813K), DKS(291K), COO (281K), MKSI (232K), ON (174K), IQV(100K), TMO (100K), RH (66K), DHR (50K)

- Increased: GTM (to 16.38 mln shares from 12.79 mln shares), BLCO (to 1.55 mln from 0.5 mln), TEVA(to 15.82 mln from 14.78 mln), MYGN (to 4.59 mln from 3.9 mln), GPN (to 4.32 mln from 3.79 mln), ESI(to 2.82 mln from 2.53 mln), UAL (to 569K from 321K), MRVL (to 407K from 206K), W (to 528K from 338K), META (to 116K from 45K), JBTM (to 241K from 187K)

- Exited: DNB (from 9.77 mln shares), CTVA (from 1.39 mln), CNC (from 1.3 mln), BKD (from 1.3 mln),PINS (from 1.06 mln), XRAY (from 855K), OSCR(from 799K), DKNG (from 470K), DIS (from 368K), SXT (from 67K), DD (from 33K)

- Decreased: ALIT (to 24.38 mln shares from 32.71 mln shares), CVS (to 8.2 mln from 11.95 mln), CLVT(to 4.76 mln from 5.89 mln), DXC (to 5.87 mln from 6.96 mln), UHS (to 0.39 mln from 0.89 mln), THC (to 2.93 mln from 3.39 mln), USFD (to 1.38 mln from 1.79 mln), VTRS (to 8.25 mln from 8.49 mln), SNDK(to 26K from 262K), KNX (to 1.2 mln from 1.4 mln), PYPL (to 1 mln from 1.2 mln), WDC (to 601K from 786K), AMZN (to 563K from 743K), UBER (to 267K from 440K), EXPE (to 508K from 648K), BC (to 659K from 732K), MCK (to 26K from 82K), DNA (to 149K from 188K)

Greenlight / DME Capital (David Einhorn): New FLR VSCO SHC positions, Boosted GPK TEVA PENN DHT OIH holdings, Exited VTRS ALIT DLTR, Lowered PTON KD CNH holdings

- New positions in: FLR (3.82 mln shares), VSCO (888K), SHC (234K), CI (94K)

- Increased positions in: GPK (to 4.7 mln shares from 1.1 mln shares), TEVA (to 3.8 mln from 568K), PENN (to 7.5 mln from 6.3 mln), DHT (to 7.6 mln from 6.6 mln), ACHC (to 865K from 121K), WFRD (to 961K from 457K), CNC (to 839K from 548K), OIH (to 16K from 12K)

- Maintained positions in: GRBK (9.5 mln shares), LBTYA (5.2 mln shares), CPRI (3.5 mln shares), HPQ (3 mln shares), BHF (2.8 mln shares), CNR (2.2 mln shares), TECK (2 mln shares), SDRL (1.6 mln shares)

- Closed positions in: VTRS (from 6 mln shares), ALIT (from 1 mln), DLTR (from 436K)

- Decreased positions in: PTON (to 180K shares from 5 mln shares), ROIV (to 4.6 mln from 5.4 mln), KD (to 3.3 mln from 4.1 mln), CNH (to 7.9 mln from 8.1 mln), SNX (to 33K from 46K), GLD (to 169K from 180K)

Hound Partners (Jonathan Auerbach): New SE ONON GIII AAPL GS ICLR positions

- New: SE (500K), ONON (250K), GIII (126K), AAPL(123K), GS (80K), ICLR (75K), FI (33K), OS (30K), TTAN (20K), UNH (13K)

- Increased: GLNG (to 654K from 508K), LLYVK (to 219K from 119K), ENTG (to 308K from 231K), MHK(to 103K from 57K), MTN (to 75K from 50K)

- Decreased: NCLH (to 3.4 mln from 4 mln), CCL (to 3.5 mln from 3.8 mln), NVDA (to 506K from 721K), EXPE (to 351K from 423K), DG (to 121K from 173K), BIO (to 182K from 202K), ARW (to 162K from 180K),RPD (to 153K from 169K), WDAY (to 62K from 70K), MSFT (to 40K from 45K), AMZN (54K from 57K)

Jana Partners (Barry Rosenstein : New WEX position, Confirms increased RPD THS FRPT holdings, Exited FIS

- New positions in: WEX (0.16 mln shares)

- Increased positions in: RPD (to 5.73 mln shares from 4.11 mln shares), THS (to 5.82 mln from 4.91 mln), FRPT (to 1.01 mln from 0.73 mln)

- Maintained positions in: EHAB (2.14 mln shares)

- Closed positions in: FIS (from 0.5 mln shares)

- Decreased positions in: LW (to 7.23 mln shares from 7.99 mln shares), TRMB (to 3.61 mln from 3.95 mln), MRCY (to 6.75 mln from 6.94 mln), SPY (to 0.51 mln from 0.54 mln), MKL (to 0.15 mln from 0.16 mln)

Lansdowne Partners: New UAL VMC positions, Boosted FCX TSM AMZN FTV TXN ROK AEM holdings:

- New positions in: UAL (856K), FTV spin off – RAL (17K), VMC (1K)

- Increased positions in: FCX (to 1438K from 558K), TSM (to 738K from 498K), AMZN (to 48K from 17K), FTV (to 50K from 27K), TXN (to 29K from 17K), ROK (to 27K from 16K), AEM (to 6K from 5K)

- Maintained positions in: SHCO (2567K), GOLF (540K), IONQ (502K)

- Closed positions in: B (from 101K), BABA (from 3K)

- Decreased positions in: SW (to 1304K from 1930K), CRH (to 525K from 1123K), DAL (to 1554K from 2025K), LIN (to 309K from 445K), ADI (to 146K from 197K), FLUT (to 4K from 5K)

Leon Cooperman: New AESI (confirmed) AVBP GEHC positions, Boosted FIHL SUN GCI KBR holdings, Exited LVS MSFT MSGS

- New positions in: AESI (5.2 mln shares), AVBP (421K), GEHC (400K)

- Increased positions in: SUN (to 1.5 mln shares from 0.3 mln shares), FIHL (to 5.8 mln from 4.8 mln), GCI (to 5.8 mln from 5.1 mln), STKL (to 6.5 mln from 6.1 mln), OMF (to 1.1 mln from 0.89 mln), EPD (to 1.3 mln from 1.2 mln), FOA (to 1.3 mln from 1.2 mln), KBR (to 1.75 mln from 1.68 mln), MSI (to 135K from 110K), FI (to 390K from 380K)

- Maintained positions in: ET (13.1 mln shares), MIR (7.1 mln shares), WSC (4 mln shares), COOP (2.9 mln shares), MANU (2.8 mln shares), VRT (2.2 mln shares), ASH (1.7 mln shares), RRX (736K), SE (326K), LAD (318K), ELV (281K)

- Closed positions in: LVS (from 1.5 mln shares), MSFT (from 106K), MSGS (from 20K), BBDC (from 3K)

- Decreased positions in: GOOGL (to 75K shares from 650K), MP (to 3.2 mln from 3.6 mln), ABR (to 1.8 mln from 2 mln), APO (to 1.3 mln from 1.4 mln), CI (to 212K from 241K)

Lone Pine: New EQT BN WIX UNH BKNG positions, Boosted VST AMZN KKR CRM LPLA holdings

- New: EQT (7.52 mln shares), BN (5.62 mln), WIX (2.16 mln), UNH (1.69 mln), BKNG (0.06 mln)

- Increased: VST (to 6.47 mln shares from 4.6 mln shares), AMZN (to 5.03 mln from 4.35 mln), KKR (to 5.22 mln from 4.76 mln), CRM (to 1.86 mln from 1.73 mln), LPLA (to 1.87 mln from 1.76 mln)

- Maintained: TLN (1.09 mln shares)

- Closed: TOL (from 3.8 mln shares), ARES (from 1.6 mln), CDNS (from 1.22 mln), LLY (from 0.55 mln), WING (from 0.45 mln)

- Decreased: SBUX (to 5.56 mln shares from 6.61 mln shares), INTU (to 0.77 mln from 1.4 mln), CVNA (to 1.77 mln from 2.31 mln), TSM (to 3.44 mln from 3.87 mln), FLUT (to 1.86 mln from 2.22 mln), APP (to 1.26 mln from 1.59 mln), PM (to 2.76 mln from 3.01 mln), MSFT (to 1.85 mln from 1.96 mln), COF (to 3.08 mln from 3.18 mln), META (to 1.67 mln from 1.76 mln)

Kerrisdale Advisers: New WDC ACLS RDDT positions, Exited CSX BAC UBER

- New positions in: WDC (74K), ACLS (7K), RDDT (2K)

- Increased positions in: DAVA (to 536K from 351K), FTRE (to 358K from 275K), ACMR (to 286K from 214K), GTM (to 342K from 291K), UNH (to 39K from 1K), CPNG (to 109K from 87K), NE (to 352K from 330K), FOXF (to 57K from 36K), KSPI (to 11K from 3K), HSIC (to 16K from 10K)

- Maintained positions in: SHC (795K), VAL (97K), UHAL.B (55K),

- Closed positions in: CSX (from 213K), DCTH (from 37K), BAC (from 26K), GOGL (from 25K), USB (from 23K), UBER (from 19K), BITB (from 13K), EPAM (from 12K),

- Decreased positions in: STX (to 293K from 565K), DEO (to 29K from 115K), RTO (to 69K from 128K), SYY (to 56K from 112K), AMZN (to 10K from 57K), PERI (to 76K from 119K), GOOGL (to 34K from 65K), CIB (to 100K from 129K), WAB (to 1K from 24K), MSFT (to 1K from 20K)

Miller Value Partners (Bill Miller) : Boosted JELD CNDT GCI FOSL AXL NBR holdings

- Increased positions: JELD (to 1.9 mln shares from 0.8 mln shares), CNDT (to 2.8 mln from 1.9 mln), GCI (to 3.3 mln from 2.7 mln), FOSL (to 3.5 mln from 3 mln), AXL (to 1.4 mln from 1 mln), NBR (to 624K from 389K), QUAD (to 2.7 mln from 2.6 mln), LNC (to 569K from 519K), BFH (to 327K from 310K), CTO (to 399K from 384K), BBW (to 105K from 100K), JXN (to 125K from 121K)

- Maintained positions: GTN (3.65 mln shares), VTRS (619K), STLA (390K), UGI (292K), VZ (198K), OMF (149K), DEA (147K), ARLP (127K), BMY (108K), BKE (105K), WAL (83K), CG (70K), CHRD (53K), BCC (40K), MSTR (15K)

- Closed position: T (116K)

- Decreased positions: TPC (to 13K from 91K), UNFI (to 137K from 189K)

Paulson & Co (John Paulson): New JNPR GOOG positions

- New: JNPR (250K shares), GOOG (9K)

- Increased: PPTA (to 32.35 mln shares from 24.77 mln shares), BHC (to 32.79 mln from 26.44 mln)

- Maintained: THM (70.24 mln shares), NG (27.24 mln shares), AAMI (8.95 mln shares), THRY (4.28 mln shares), MDGL (2.09 mln shares), SA (2.07 mln shares), AEM (784K), HON (200K)

- Exited: ITCI (from 22K shares)

Peconic Partners (William Harnisch): New XLU RRC EQT FSLR GOOGL positions

- New positions: XLU (1 mln shares), RRC (800K), EQT (480K), FSLR (300K), GOOGL (180K), NXT (10K)

- Increased positions: SHLS (to 7 mln shares from 3.9 mln shares), AMZN (to 134K from 4K), DY (to 3.8 mln from 3.7 mln)

- Exited: CZR (from 805K), NEE (from 6K)

- Decreased position: PWR (to 5 mln shares from 5.3 mln shares)

Pershing Square (Bill Ackman): New AMZN position, Exited CP, Boosted HTZ, HLT, BN, GOOGL

- New: AMZN (5.82 mln shares)

- Increased: GOOGL (to 5.36 mln shares from 4.44 mln shares), HLT (to 3.03 mln from 3 mln), BN (to 41.16 mln from 41 mln), HTZ (15.2 mln from 15 mln)

- Maintained: GOOG (6.32 mln shares), UBER (30.3 mln shares), QSR (23 mln shares), CMG (21.54 mln shares), HHH (18.85 mln shares)

- Closed positions in: CP (from 14.8 mln shares)

Scion Asset Management (Michael Burry): New BRKR LULU UNH REGN MELI positions, Buys calls in BABA ASML JD META VFC, Exited all put positions

- New positions in: BRKR (250K), LULU (50K – also has calls), UNH (20K – also has calls), REGN (15K – also has calls), MELI (3K)

- Decreased positions in: EL (to 150K from 200K – also has calls)

Scopia Capital: New LIVN MNKD AL TSM positions, Increased CC PTON VSTS holdings

- New: LIVN (814K), MNKD (695K), AL (208K), BATRK (187K), ENTG (162K), TSM (122K), LESL (98K), BIO (95K), MBLY (80K), UNH (78K)

- Increased: CC (to 3.4 mln from 2 mln), PTON (to 4.4 mln from 3.7 mln), VSTS (to 2.9 mln from 2.5 mln), MAGN (to 1.0 mln from 0.7 mln), KBR (to 1.2 mln from 1 mln), PRMB (to 1.1 mln from 0.92 mln), AMZN (to 221K from 167K), SN (to 558K from 505K), JBHT (to 235K from 219K), RRX (to 404K from 403K)

- Exited: DKNG (from 878K), FUN (from 315K), DLTR (from 284K)

- Decreased: VVV (to 516K from 1.2 mln), MRCY (to 447K from 872K), HLIT (to 3032K from 3432K), INDV (to 1655K from 1875K), CTVA (to 850K from 958K), AER (to 310K from 415K), ENS (to 239K from 286K), SGI (to 734K from 773K)

Soros Capital: New EWY SMH MU positions, Exited CORZ EWZ YUMC

- New positions: EWY (229K), SMH (113K), MU (86K), WDC (81K), STX (37K), TRU (19K), AEO (18K), RRX (6K), HD (4K)

- Increased: NVDA (to 103K from 17K), AVGO (to 37K from 11K), FI (to 31K from 15K), ZTS (to 31K from 17K), AXON (to 13K from 1K), ASML (to 18K from 6K), UNP (to 20K from 11K), ICE (to 29K from 21K), CZR (to 111K from 104K)

- Maintained: PACK (4630K), FXI (408K), FLUT (85K)

- Exited: CORZ (from 1.9 mln), EWZ (567K), YUMC (282K), BABA (181K), LRCX (47K), WIX (42K), STZ (19K), VMC (19K)

- Decreased: PTLO (to 80K from 431K), BSX (to 6K from 154K), TSM (to 64K from 174K), VRSN (to 61K from 135K), GDDY (to 29K from 65K), META (to 3K from 33K), CPAY (to 12K from 30K), NFLX (to 2K from 19K), CP (to 51K from 65K), V (to 12K from 23K)

Soros Fund (George Soros): New ETWO AVDX ARMK SRAD BRO AACT SHLS SNDK positions, Increased EVGO DNB IPG BGC SW CIFR NVDA holdings

- New positions in: ETWO (4.9 mln shares), AVDX (2.08 mln), ARMK (1.55 mln), SRAD (1.02 mln), BRO (1 mln), AACT (900K), SHLS (610K), SNDK (527K), IEF (500K), IDA (406K), CTRI (400K), AMRZ (390K), TPG (336K), JBTM (330K), SMA (328K), GLXY (311K), CRCL (305K), ECVT (287K), BPMC (250K), GOGL (250K), SKX (250K), SLDE (250K), GGAL (228K), LWACU (200K), JCI (164K), ETOR (160K), TSM (125K), CWAN (125K), MRX (124K), AHL (120K)

- Increased positions in: EVGO (to 4.98 mln shares from 1.13 mln shares) DNB (to 3.66 mln from 2.3 mln), IPG (to 1.16 mln from 0.31 mln), BGC (to 3.6 mln from 2.81 mln), SW (to 7.48 mln from 6.85 mln), CIFR (to 1.3 mln from 0.78 mln), NVDA (to 0.54 mln from 0.06 mln), SGI (to 0.63 mln from 0.28 mln), ONB (to 0.86 mln from 0.53 mln), LBRDK (to 1440K from 1120K), SAIL (to 1352K from 1035K), PRMB (to 760K from 491K), BHF (to 765K from 517K), PONY (to 2129K from 1902K), AZEK (to 384K from 185K), KKR (to 343K from 148K), CRH (to 594K from 412K), OS (to 626K from 468K), TTAM (to 476K from 326K), SNOW (to 273K from 141K), AS (to 626K from 550K), NKE (to 302K from 227K), TTAN (to 100K from 27K), AAMI (to 416K from 346K), KWEB (to 293K from 225K), DDOG (to 357K from 300K), EQH (to 87K from 38K)

- Closed positions in: AZN (from 2.74 mln shares), AUR (from 2.36 mln) PLYA (from 1.61 mln), JWN (from 1.13 mln), PACB (from 1 mln), EOLS (from 995K), AEP (from 879K), LVS (from 807K), PTVE (from 790K), ATSG (from 678K), TECK (from 668K), NDAQ (from 626K), VIK (from 558K), PDCO (from 545K), ASTS (from 470K), GLW (from 470K), DESP (from 352K), NBIS (from 333K), INSM (from 307K), ITRI (from 296K), SFD (from 277K), SLNO (from 271K), BERY (from 262K), AA (from 250K), NBIX (from 240K), LEU (from 233K), HEES (from 233K), JPM (from 231K), ZWS (from 225K), ED (from 225K), FBMS (from 197K), ALK (from 186K), JD (from 175K), VFH (from 175K), FSUN (from 150K), BBOT (from 150K)

- Decreased positions in: RDFN (to 0.09 mln shares from 0.87 mln shares), GOOGL (to 0.03 mln from 0.5 mln), AER (to 0.82 mln from 1.28 mln), CP (to 0.3 mln from 0.59 mln), ATI (to 0.36 mln from 0.61 mln), ADT (to 1.13 mln from 1.36 mln), KEY (to 0.77 mln from 1 mln), WDC (to 0.13 mln from 0.35 mln), GFL (to 2.85 mln from 3.04 mln), RKT (to 250K from 360K), ULS (to 757K from 866K), GS (to 21K from 121K), UBER (to 538K from 638K), CYBR (to 51K from 147K), FDX (to 20K from 111K), FLUT (to 490K from 581K), WWD (to 82K from 85K), ADI (to 46K from 106K), CSX (to 593K from 653K), ACN (to 75K from 132K), AMZN (to 383K from 434K), DASH (to 60K from 105K), NOC (to 28K from 36K), SPSB (to 32K from 65K), K (to 280K from 309K), LOAR (to 173K from 196K), SYF (to 115K from 138K)

Stadium Capital: New DKS position, Added to BLDR GTLB BC

- New: DKS (35K)

- Increased: GTLB (to 146K from 47K), BLDR (to 318K from 227K), BC (to 374K from 341K)

- Maintained: SNBR (2.6 mln)

- Exited: NAVI (from 369K), ETSY (from 72K), MBUU(from 24K),

- Decreased: GO (to 878K from 1601K), LCII (to 96K from 142K)

Starboard Value (Jeffrey Smith): New TRIP IWM positions, Boosted MTCH BDX PFE CRM ROG holdings

- New positions in: TRIP (8.5 mln shares), IWM (0.34 mln)

- Increased positions in: IJH (to 5.25 mln shares from 3.56 mln shares), MTCH (to 15.31 mln from 14.09 mln), BDX (to 2.62 mln from 1.75 mln), PFE (to 8.54 mln from 7.73 mln), CRM (to 1.25 mln from 0.85 mln), ROG (to 0.9 mln from 0.8 mln)

- Maintained positions in: ACTG (61.12 mln shares)

- Decreased positions in: RIOT (to 4.68 mln shares from 12.7 mln shares; also has puts), GEN (to 13.33 mln from 17.52 mln), AQN (to 63.49 mln from 66.43 mln), GDOT (to 1.73 mln from 4.6 mln), FTRE (to 2.5 mln from 5.27 mln), ALIT (to 45.87 mln from 47.92 mln), KVUE (to 20.93 mln from 22.05 mln), NWS (to 6.86 mln from 7.81 mln), HR (to 19.29 mln from 20.07 mln), ADSK (to 1.47 mln from 2 mln)

TCI Fund Management (Chris Hohn): Boosted V SPGI holdings, Lowered CNI CP GOOG / GOOGL holdings:

- Increased positions in: V (to 19.07 mln shares from 16.64 mln shares), SPGI (to 11.09 mln from 10.36 mln), FER (to 19.47 mln from 19.33 mln), MSFT (to 17.57 mln from 17.3 mln), MCO (to 13.25 mln from 13.16 mln)

- Maintained positions in: GE (47.51 mln shares)

- Decreased positions in: CNI (to 22.99 mln shares from 26.9 mln shares), CP (to 52.83 mln from 54.91 mln), GOOGL (to 3.16 mln from 4.09 mln), GOOG (to 12.97 mln from 13.86 mln)

Tiger Global: New CHYM BULL HNGE CRCL positions, Boosts AMZN RDDT XYZ Z LRCX holdings

- New positions in: CHYM (12.47 mln shares), BULL (11.72 mln), HNGE (552K), CRCL (125K), ETOR (80K), TFIN (44K), MNTN (20K)

- Increased positions in: AMZN (to 10.69 mln shares from 6.59 mln shares), RDDT (to 6.15 mln from 3.25 mln), XYZ (to 3.94 mln from 1.88 mln), Z (to 6.23 mln from 5.22 mln), LRCX (to 5.26 mln from 4.42 mln), NVDA (to 11.71 mln from 10.97 mln), AVGO (to 2.7 mln from 2.27 mln), TSM (to 4.58 mln from 4.24 mln), APP (to 2 mln from 1.67 mln), GOOGL (to 10.63 mln from 10.31 mln), MSFT (to 6.55 mln from 6.24 mln), CPAY (to 1.5 mln from 1.25 mln), LLY (to 1.51 mln from 1.33 mln), ZG (to 1 mln from 0.9 mln), GEV (to 1.1 mln from 1.06 mln)

- Maintained positions in: GRAB (92.92 mln shares), SE (16.04 mln shares), CPNG (13.59 mln shares), META (7.53 mln shares), APO (6.21 mln shares), TTWO (5.84 mln shares), FLUT (3.45 mln shares), VEEV (2.42 mln shares), ZS (1.68 mln shares), SPOT (1.3 mln), SHW (1.2 mln)

- Closed positions in: PDD (from 4.42 mln shares), TTAN (from 1.3 mln)

- Decreased positions in: DASH (to 0.03 mln shares from 2.2 mln shares), RERE (to 9.83 mln from 11.48 mln), WDAY (to 1 mln from 1.88 mln), CRWD (to 0.5 mln from 0.9 mln), NOW (to 0.3 mln from 0.58 mln)

Third Point (Dan Loeb): New RKT FLS COOP positions

- New positions in: RKT (4.75 mln shares), FLS (1.2 mln), COOP (0.93 mln), SABR (0.75 mln), DOCU (0.63 mln), DHR (0.5 mln), WDAY (0.3 mln), GTLS (0.22 mln), FIX (0.19 mln)

- Increased positions in: PRMB (to 5.78 mln shares from 2.78 mln shares), NVDA (to 2.8 mln from 1.45 mln), CSGP (to 3.09 mln from 1.98 mln), COF (to 1.8 mln from 1.05 mln), SN (to 1.2 mln from 0.55 mln), BN (to 4.68 mln from 4.24 mln), VST (to 1.25 mln from 0.85 mln), AMZN (to 2.71 mln from 2.35 mln), TLN (to 0.79 mln from 0.59 mln)

- Maintained positions in: PCG (51.1 mln shares), TDS (6.73 mln shares), LPLA (0.63 mln shares)

- Closed positions in: T (from 3.78 mln shares) EQT (from 2.95 mln) SDRL (from 1.03 mln), PINS (from 1 mln) HES (from 0.63 mln)

- Decreased positions in: KVUE (to 8.53 mln shares from 8.9 mln shares), TSM (to 1.43 mln from 1.78 mln), RBA (to 0.7 mln from 0.95 mln), APO (to 1.28 mln from 1.5 mln), ICE (to 0.95 mln from 1.1 mln), J (to 1.26 mln from 1.4 mln), CRH (to 2.59 mln from 2.72 mln), LYV (to 1.98 mln from 2.1 mln), CRS (to 0.75 mln from 0.87 mln)

Trian Fund (Nelson Peltz): Boosted FERG holding, Confirms lowered IVZ holding, Maintained JHG WEN SOLV GE holdings

- Increased positions in: FERG (to 1.09 mln shares from 1.01 mln shares)

- Maintained positions in: JHG (31.9 mln shares), WEN (30.4 mln shares), SOLV (8.5 mln shares), GE (4.0 mln shares)

- Decreased positions in: IVZ (to 14.63 mln shares from 23.17 mln shares), UHAL.B (to 338K from 1.1 mln), UHAL (to 353K from 652K), ALL (to 100K from 318K)

ValueAct (Jeffrey Ubben and Bradley Singer): New RDFN CCCS SSD COOP MDB CBRE positions, Boosted RKT AMZN holdings, Exited TOST NU, Lowered RBLX DIS NSIT EXPE META V holdings

- New: RDFN (5.81 mln shares), CCCS (2.88 mln), SSD (1.41 mln), COOP (0.9 mln), MDB (0.69 mln), CBRE (0.59 mln)

- Increased: RKT (to 15.13 mln shares from 6.73 mln shares), AMZN (to 3.87 mln from 0.56 mln), LLYVA (to 1.77 mln from 1.66 mln), LLYVK (to 3.99 mln from 3.9 mln)

- Maintained: CRM (2.9 mln shares), LYV (0.89 mln)

- Exited: NU (from 3.42 mln shares), TOST (from 2.6 mln)

- Decreased: RBLX (to 4.73 mln shares from 8.76 mln shares), DIS (to 5.09 mln from 6.57 mln), NSIT (to 2.86 mln from 4.06 mln), EXPE (to 0.28 mln from 1.12 mln), META (to 0.62 mln from 1.01 mln), V (to 1.24 mln from 1.31 mln)

Viking Global (Andreas Halvorsen): New DIS XYZ CART CSGP TTD UBS PNC APD AMD AIG positions, Exited DB SKX EQH ICE MNST TVTX UNH CB DASH

- New: DIS (5.85 mln shares), XYZ (5.42 mln), RAL (5.3 mln – FTV spin out), CART (3.75 mln), CSGP (3.22 mln), TTD (2.67 mln), UBS (2.58 mln), PNC (2.38 mln), APD (2.15 mln), AMD (1.9 mln), AIG (1.8 mln), JCI (1.5 mln), SAIA (828K), MASI (767K), CME (597K), LLY (417K), ESTA (343K), MOH (267K), HQY (220K), BLK (195K)

- Increased: PRMB (to 19.6 mln shares from 5.02 mln shares), GM (to 13.02 mln from 7.19 mln), FTV (to 15.91 mln from 12.95 mln), DHR (to 2.91 mln from 0.45 mln), MCD (to 3.13 mln from 1.15 mln), AMT (to 2.8 mln from 0.84 mln), JPM (to 4.04 mln from 2.17 mln), CSX (to 18.87 mln shares from 17.07 mln shares), QCOM (to 3.15 mln from 1.43 mln), TEVA (to 11.68 mln from 10.13 mln), AS (to 3.88 mln from 2.35 mln), BMRN (to 12.29 mln from 10.8 mln), DHI (to 2.83 mln from 1.36 mln), NKE (to 6.97 mln from 5.55 mln), TMUS (to 2.85 mln from 1.57 mln), AMZN (to 3.9 mln from 2.72 mln), LEN (to 2.52 mln shares from 1.35 mln shares), COF (to 5.67 mln from 4.59 mln), COR (to 2.08 mln from 1.07 mln), SHW (to 1.96 mln from 0.97 mln), FSLR (to 2.27 mln from 1.41 mln), CCL (to 13.21 mln from 12.41 mln), TSLA (to 1.1 mln from 0.35 mln), RRX (to 3.43 mln from 2.73 mln), HCA (to 1.87 mln from 1.18 mln)

- Maintained: TIC (34.36 mln shares), ADPT (29.99 mln)

- Exited: DB (from 15.11 mln shares), SKX (from 5.8 mln), EQH (from 3.28 mln), ICE (from 3.2 mln), MNST (from 2.86 mln), TVTX (from 2.6 mln), UNH (from 2.14 mln), CB (from 1.95 mln), DASH (from 1.86 mln), INTU (from 1.71 mln), ALL (from 1.7 mln), TRU (from 1.34 mln), MAA (from 1.12 mln), IMVT (from 1.11 mln), PGR (from 1.07 mln), SAIL (from 1.01 mln), BNTX (from 880K), NFLX (from 749K), MTB (from 746K), SNPS (from 704K), MSFT (from 684K), EWTX (from 490K), ADSK (from 304K), TWLO (from 256K), SPOT (from 193K)

- Decreased positions in: ROIV (to 34.24 mln shares from 46.01 mln shares), USB (to 24.09 mln from 34.86 mln) RPRX (to 2.6 mln from 10.56 mln), BBIO (to 18.56 mln from 22.06 mln), NVDA (to 3.68 mln from 6.54 mln), SCHW (to 15.77 mln from 17.72 mln), TRVI (to 1.54 mln shares from 3.23 mln shares), CVNA (to 1.08 mln from 2.55 mln), META (to 0.27 mln from 1.47 mln), BAC (to 31.25 mln from 32.2 mln), SE (to 3.54 mln from 4.16 mln), TSM (to 4.33 mln from 4.89 mln), V (to 1.62 mln from 2.13 mln), BA (to 2.84 mln from 3.23 mln), CMG (to 5.69 mln from 6.01 mln), FLUT (to 2.28 mln from 2.55 mln)

More in the full pdf recap available to pro subscribers.

Loading recommendations…