Part 1

If the Donald wishes to clear the purportedly hallowed precincts of the Federal Reserve of mortgage fraudsters, the facts of the case tell us he has a much bigger challenge than issuing Fed governor Lisa Cook her walking papers via a White House press release. That’s because her sin of obtaining a 15-year mortgage on an Ann Arbor, Michigan residence at 2.5% on June 18, 2021 and a 30-year mortgage on an Atlanta condo at 3.25% on July 2, 2021, while claiming both as a “primary” residence, wasn’t the half of it.

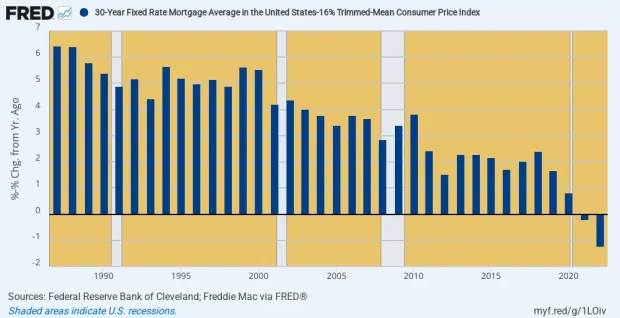

The real crime is that not only a Fed governor but any resident of America could get a long-term mortgage this cheap in 2021. After all, during 2021 the Y/Y inflation rate per our trusty 16% trimmed mean CPI posted at 3.17%. That means Cook’s Ann Arbor mortgage was written at -0.67% on an inflation-adjusted basis and the Atlanta loan at +0.08%.

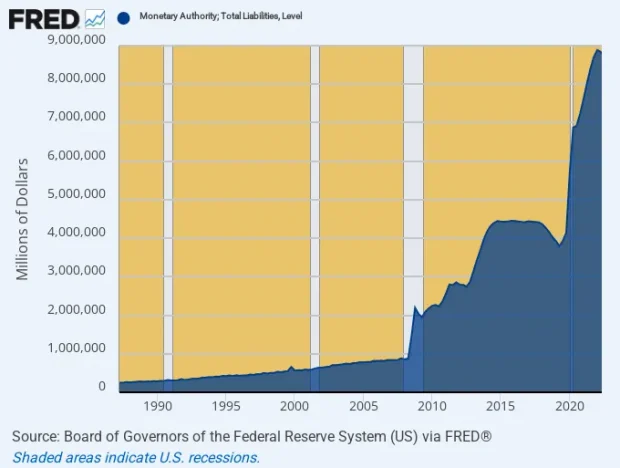

Both rates are economically absurd and were available to Lisa Cook or anyone else in America only because the monetary fraudsters on the FOMC had their big fat thumbs on the scales in the bond pits. And we do mean fraud: The Fed’s balance sheet rose by $1.2 trillion or 17% during the 12-month period ending on July 7, 2021, and at a time, as we will amplify below, when the Fed’s balance sheet should have actually grown by essentially zero.

That is to say, the FOMC was buying government debt and GSE paper hand-0ver-fist with fiat credits snatched from thin digital air, thereby starkly falsifying yields and prices in the bond pits. There is not a chance in the hot place that tax-paying, real money savers left to their own devices would accept such niggardly real yields.

For want of doubt on this matter, here is the Fed’s march of shame/fraud during the 35 years after Greenspan embarked upon Keynesian monetary central planning until the Fed’s pivot to inflation-fighting in 2022. During that period the real yield on the 30-year mortgage went from +6.4% to -1.2%, thereby representing a 760 basis point swing in a single, relentless direction over 35 years.

Needless to say, the odds of that happening on an honest free market in money and debt are 0.000%! In fact, this relentless march downhill to these absurdly low bond and mortgage yields pales Lisa Cook’s alleged fraud into insignificance. The pattern in this chart amounts to wanton monetary fraud on an epic scale.

Inflation-Adjusted Yield on 30-Year Mortgages, 1977 to 2022

Again, for want of further doubt on this matter, here is the Fed’s balance sheet over the same 35-year period.

For crying out loud! It expanded by 35X during a period in which the nominal GDP rose by only 5.2Xand real GDP by just 2.4X. That is to say, the Fed pumped fraudulent credit into the financial markets at a 11% per annum rate for 35 years running. So doing it resembled nothing so much as an end-stage alcoholic self-medicating on an endless bender.

Absent this $8.5 trillion flood of central bank credit authorized by Alan Greenspan and his heirs and assigns, of course, there is no chance whatsoever that the march of monetary shame depicted in the graph above would have occurred; and also that Lisa Cook and millions of other Americans would have gotten 30-year mortgages at just 3% in June/July 2021.

35X Rise In Fed Balance Sheet, Q2 1987 to Q1 2022

Needless to say, there is a devastating irony embedded in the near $9 trillion peak of the Fed’s balance sheet displayed above. To wit, in March 2020 the Fed in its capacity as lead bank regulator finally abolished the archaic requirement that banks maintain cash reserves against deposits at the Fed equal to stated fractions of these balances. In the period immediately before their long overdue abolition, the reserve requirements were 3% for large deposit levels (above $17 million) and 10% for very large deposit levels over $128 million.

At the same time, the Congress and the Fed substituted a more sensible balance sheet based regime that consisted of liquidity coverage ratios (LCR) and equity and other capital ratios against adjusted balance sheet assets. What this meant as a practical matter, of course, is that thereafter banks did not really need the Fed in order to remain appropriately liquid or to fund and grow their balance sheets, thereby supplying an adequate credit supply to the main street economy.

Specifically, the Liquidity Coverage ratio could be met by holding US treasury paper, traditional cash reserves at the Fed or other high quality short term paper, while lending growth and asset expansion could be accommodated by raising equity capital through retained earnings or market offerings. That is to say, the new post-Dodd-Frank liquity and capital ratios superseded the traditional central bank function of reserve provision to the banking system in order to mitigate bank runs or smoothly enable growth of bank credit and deposits.

In effect, the regulatory policy action culminating in the March 2020 abolition of required reserves took both the “banking” and the “reserve” functions out of the Fed’s remit, leaving it buck naked as the pure monetary central planning agency that it had gradually become since the time of Alan Greenspan. The only possible residual “banking” function now possessed by the Fed is that of a funding source of last resort for banks that for some reason may be unable to acquire sufficient deposits in the private money markets to fund their balance sheets.

Alas, with a proper “mobilized discount rate” at the Fed’s discount windows that function would be nearly vestigial, as well. Going way back to 1913 and the “real bills” doctrine on which Carter Glass founded the Fed, the discount window would charge the market interest rate plus a stiff penalty spread in order to discourage use except for very rare circumstances. That is to say, there is nothing wrong with the free markets in money that says private funding will not be available at market clearing rates.

Indeed, if at some point in time market clearing rates on deposits should prove to be “too high” because yields on a given banks’ assets were lower, the solution would be insolvency and liquidation of the institution in question. And in a market with more than $105 trillion of debt instruments outstanding, it is easy enough to see that a few periodic bank bankruptcies among badly managed institutions that got in over their ski’s would actually be a good thing—a purging mechanism to keep banking markets disciplined and solvent.

In any event, the Fed’s current $6.5 trillion QT (quantitative tightening) balance sheet is far, far too big for any residual function as a funds supplier of last resort at market rates. Indeed, the Fed’s balance sheet got to such brobdignagian girth purely owing to the dysfunctional pursuit of its Greenspanian monetary central planning model.

Alas, the latter is based on the dubious proposition that main street prosperity is everywhere and always retarded by the free market’s alleged inability to set interest rates and financial asset prices correctly. And that it therefore needs a monetary Sherpa to guide financial asset pricing, and the prosperity that flows from savings and capital investment.

But today’s histrionics tells you all you need to know about that misguided proposition. Main Street needs only a free market in capital and money—not Jay Powell nor Donald Trump—- to price stocks, bonds, loans, money or real estate. And not the 11 additional geniuses on the Open Market Committee, either.

So if the Donald really wants to bring back a golden age of prosperity he needs only continue his brutal attacks on individual members of the monetary politburo until the public finally sees that the entire central banking emperor is naked.

In this context, it can be well and truly said that the Fed put itself out of its historic central banking business in March 2020. What’s left, of course, is its mission creep based monetary central planning operation, which has been a disaster and nonstarter from the get go.

As it happens, the Donald has a way of stumbling into good outcomes–like the impending peace deal in Ukraine and the dismantlement of the unnecessary American Empire that can follow in its wake—even if he doesn’t know exactly why.

So in the case of the other great dysfunctional institution on the banks of the Potomac, let’s hope that the sacking of Lisa Cook is just the opening salvo. What really needs to happen is a mercy-killing of the entire FOMC and 95% of what today constitutes the massive rogue monetary central planning agency domiciled in the Eccles Building. The latter is truly a clear and present danger to American prosperity.

Part 2

If we are lucky the firing of Lisa Cook may turn out to be the straw that finally breaks the camels back. To wit, both Wall Street speculators and Washington spenders have been out in force screeching in behalf of the sacred “independence” of the Fed. But maybe people will begin to wonder how in the world a society based on free market governance of economic life and constitutional and democratic arrangement of political life came to place such massive, unaccountable power in the hands of just 12 bureaucrats (FOMC).

Indeed, we’d say bring on the Fed “independence” debate because in the present day and age there is no compelling reason at all to invest such massive financial power in an institution that is both unaccountable to the electorate and self-evidently in the tank for the gamblers, spenders and war-mongers who thrive on its largesse.

So let’s just start with a contra-factual. Assume that the entire FOMC is fired and not replaced; that the current Fed practice of buying and selling government debt paper and other securities via the FOMC is banned; that US Treasuries are made ineligible collateral for loans from the Fed’s discount windows; and that the Fed is forbidden from paying interest on bank reserves or their money market equivalent such as overnight repos.

Of course, the same crew of howlers for Fed independence–ranging from Wall Streeter’s to Senator Elizabeth Warren to huffy MSM financial journalists at CNBC and The Economist—will say that upon activation of the contra-factual summarized above all economic hell would break-out on Wall Street and main street alike.

Actually, we’d beg to differ by going straight to the core of the argument for an all-powerful state-enabled financial Sherpa. The claim is that this ensures financial stability and enhanced economic growth, while the absence of a powerful central bank would send the hapless free market economy spiraling into a paroxysm of financial crises, recessions and sub-par economic growth.

As it happens, there is not a shred of empirical evidence to support those contentions and plenty of reason to believe that the vaunted macro-economic management functions of the Fed are simply the fruits of Mission Creep over many decades. The latter being capped off by the sharp turn toward out and out monetary central planning when Alan Greenspan took the helm in August 1987.

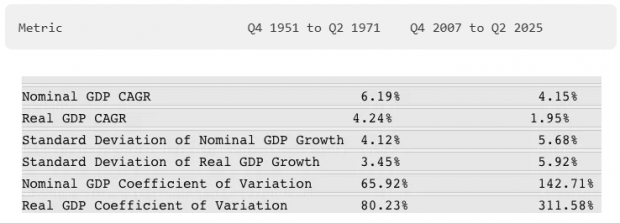

In that context, let us start with a simple performance test based on key macro-economic outcomes as between the two book-end periods:

- the two decades after the so-called Treasury Accord in March 1951 and Nixon’s deep-sixing of the gold standard at Camp David in August 1971.

- the 18 years between the Greenspan housing bubble peak in Q4 2007 and Q2 2025.

Needless to say, we have not chosen these intervals randomly. In fact, the first period represents mainly the “light touch” monetary policy era of William McChesney Martin. The latter was actually the Truman Administration’s Treasury Department official who negotiated the deal which freed the Fed from its WW II subservience to the financing needs of Uncle Sam. Crucially, Martin also had matured financially in the household of a Fed governor in the roaring 1920s and as president of the New York Stock Exchange during the crash of the 1930s. That is to say, he had experienced first hand the dangers of Fed fueled financial bubbles and their destructive aftermath, too.

By contrast, the post Q4 2007 period involved full-on monetary central planning from the Eccles Building led by Keynesian academics and Washington apparatchiks. During this interval the Fed’s massive daily presence in the canyons of Wall Street was continuous, heavy-handed and predicated upon the false contention that financial stability and sustained economic growth and full-employment were unobtainable absent massive infusions of Fed credit into the bond and stock trading pits and continuous micro-management of money market rates and the yield curve. And the latter was to be accomplished via deft buying and selling (that is, overwhelmingly “buying”) of treasury debt and other securities as instructed daily by the FOMC.

To be sure, this isn’t a perfect test but if you are not totally bamboozled by the recency bias, it is evident that there was a night and day difference in the modality of central bank operations as between the two periods. For want of doubt, consider William McChesney Martin’s famous aphorism that the job of the Fed “is to take away the punch bowl just as the party is getting started”. Yet as to the 2007-2025 period, find us any even vaguely similar utterances from Bernanke, Yellen and Powell or, for that matter, any member of the FOMC, and we will be literally shocked.

Needless to say, you won’t find one because the whole mentality of the FOMC has changed drastically since the 1950s and 1960s. The Martin Fed actually respected the free market, and sought keep its impact on financial markets and asset prices as absolutely minimal as possible. By contrast, the Fed under Bernanke et. al. since the Great Financial crisis, especially, has mistaken itself for the Little Dutch Boy with his finger in the dike.

That’s right. The FOMC actually thinks its ministrations constitute the difference between national economic prosperity and crisis-ridden economic dysfunction. And that, in turn, its ability to steer the economy toward prosperity rather than collapse is owing to the fact that the 12-person FOMC has far better insight as to the correct interest rates, yield curve and stock index level at any point in time than would a genuine free market in financial instruments that is unenlightened by the wisdom possessed at the FOMC.

Well, we not only think not. We know not!

You can’t get any better contrast on the matters of macro-economic stability and the trend level of economic growth and employment than is depicted in the table below.

As to the growth/full employment metric, the comparison speaks for itself. The two decade CAGR for real growth in the Martin era was 4.24% per annum or more than double the 1.95% per annum gain during the heavy-duty monetary central planning era originally spawned by Greenspan and then executed by Bernanke, Yellen and Powell after Q4 2007.

Indeed, the table compares long-term trends—two decades way back then compared to the two most recent decades—so there is nothing to debate about timing or short-term aberrations. The heavy-handed interventionist Fed of recent times has drastically retarded economic growth, not enhanced it.

At the same time, the modern interventionist Fed, as depicted in the second column, has caused a sharp increase in macro-economic volatility and instability compared to what prevailed during the “light touch” Martin Era when the business cycle was largely operating on its own natural steam and forces. We reach that conclusion by comparing the standard deviation for both nominal and real growth as between the two periods, and, even more crucially, the so-called coefficients of variation.

The latter tells you everything you need to know. Given that the mean growth trend was sharply lower over Q4 2007 to Q2 2025 while the standard deviation was much higher, you got a compounding effect in this bottom line metric. To wit, the coefficient of variation with respect to nominal GDP during the last 18 years was more than double its level during the Martin Era, while the coefficient of variation since 2007 with respect to real GDP was triple that which prevailed during the 1950s and 1960s.

In short, contrary to Ben Bernanke’s humbug about the “Great Moderation” in recent times—allegedly due to the superior performance of the FOMC—-the truth is very simple: Greenspanian monetary central planning has caused a sharp and unmistakable increase in economic volatility and instability.

To be sure, there should be no mystery as to why monetary central planning results in less growth and more instability. It’s actually inherent in the beast because despite all its pretensions to arcane “monetary science” the Fed’s mindset and tools alike are about as primitive as it gets: Namely, the entirety of monetary central planning is based on the proposition that debt can never be cheap enough, and that more and more of the latter is the elixir that fuels enhanced economic growth and rising prosperity.

Actually, however, not at all. Excessive and artificial debt levels due to central bank induced mispricing causes financial bubbles and diversion of capital and economic resources to unproductive speculation and malinvestment. They also generate boom and bust stock market and credit cycles, which raise the volatility and instability of the main street economy.

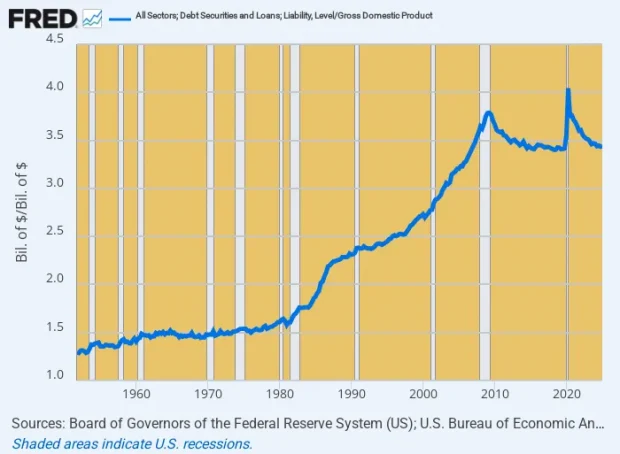

For want of doubt here is the national leverage ratio since 1951, which is measured as total public and private debt divided by nominal GDP. Self-evidently, during the high growth/low GDP volatility period of the Martin era, the national leverage ratio hugged closely to its historical level at about 150% of GDP. However, after the Fed was cut loose from the gold standard anchor of Breton Woods in August 1971 it was off to the races.

During the entirety of the post-2007 period, the national leverage ratio stood in the range of 350% to 400% of GDP. In turn, those two extra turns of debt now amount to $60 trillion of incremental debt being lugged around by the US economy.

In short, the massively excessive debt of the recent period of Keynesian monetary central planning was a growth retardant, not an elixir; and it also saturated the financial system with excessive credit and liquidity, which fostered boom and bust financial bubbles and subsequent violent collapses and liquidations.

National Leverage Ratio (Debt-to-GDP), 1951 to 2025

Finally, there is another crucial aspect of the Martin era that militates in favor of firing the entire FOMC and abolishing any further buying and selling of debt and other securities in the open market by the Fed. To wit, the overwhelmingly favored policy tool during the Martin era was the Fed’sdiscount rate, which is inherently a tool of old-fashioned central banking, not modern day monetary central planning.

In the first place, the Discount Window is passive. It is not meant to steer the financial markets or macro-manage the main street GDP. Instead, it was conceived by Carter Glass and the Fed founders as a back-up source of required reserves, enabling banks to meet unusual depositor demands for cash without shrinking their credit and deposit books; and to thereby steady the main street economy and enable a more continuous process of investment expansion and economic growth than had prevailed during the latter part of the 19th century.

Yet, heaven forfend, there were no implicit or explicit targets for GDP growth, employment rates, housing starts, CapEx or any of the other “incoming data” indicators tracked to the week and second decimal point by today’s monetary central planners. Thus, during the entirely of the Martin Era there was not a single Fed proclamation about its Federal funds targets, nor any frenzied financial market speculation about 25, 50 or even 100 basis point increases/decreases in interest rates in the run-up to each Fed meeting. Those key movements were left to the wisdom of the money markets.

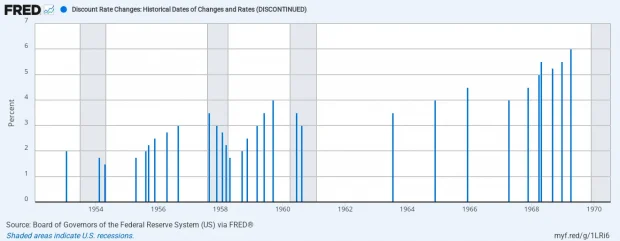

Accordingly, during the 228 months of William McChesney Martin’s tenure as Fed chairman, the Fed took interest rate action via the passive Discount Rate just 30 times, representing hardly 13% of the monthly meetings. By contrast, 100% of Fed monthly meetings are now effectively “live”, even as the FOMC’s open market desk is busy buying or selling securities virtually every week, day and hour that the financial markets are open for business.

Fed Discount Rate Levels And Changes During The Martin Era, 1951 to 1970

At the end of the day, there is plenty of historical evidence for the proposition that the entire FOMC should be fired, followed by the abolition of the FOMC entirely. As we will amplify further in Part 3, the American economy needs neither an “independent” Fed nor a super-interventionist FOMC to prosper. The US economy would do just fine with free markets in money, debt, stocks and derivatives, and at most a mobilized rate at the Discount window to provide high cost liquidity in extremis.

Part 3

The screeching in behalf of an “independent” Fed versus one purportedly stacked and dominated by the Donald has continued unabated. Lately, it seems that the talking heads on CNBC can’t gum about much else.

Alas, this barrage of self-interested humbug from Wall Street and Washington alike amounts to obsessing about the wrong question. As we have suggested in Parts 1 & 2, the question is not whether Jay Powell and the FOMC should be setting interest rates versus Donald Trump and his minions. To the contrary, the real issue is why anyone in the Eccles Building should be setting interest rates at all.

To wit, what in the hell is wrong with the free market? And by that we mean the tens of thousands, if not millions, of traders and investors with skin in the game who would otherwise set interest rates by bid and ask without any guidance and pegging from what amounts to a monetary politburo—even as the latter is pleased to be known by the utterly false and antiseptic title as the Federal Open Market Committee (FOMC).

For crying out loud. There is nothing “open” or “market” about it. The FOMC is an all-powerful price control arm of the state, which derives its massive financial clout from a monopoly on the legal right to counterfeit dollars snatched from thin air.

Yet, why in the world at this late date are they still printing dollars? As we have shown repeatedly, there is no reason whatsoever for the Fed to pursue it original mission of supplying reserves to the commercial banking system. After all, the Fed itself abolished any and all reserve requirements more than five years ago!

Instead, the banking system is now regulated—for better or worse–by a balance sheet based regime including prescribed liquidity ratios based on qualifying assets such as US treasury bills, which exist in ever increasing abundance thanks to the Trumpified spenders and borrowers in Washington; and also equity capital at prescribed ratios to total bank assets, which equity capital, again, can be acquired nearly without limit via retained earnings or new equity issuance. So there would be no barrier to commercial banking expansion so long as balance sheets are managed prudently.

Similarly, money and credit is the lifeblood of modern capitalism, but why in the world is it held that an unaccountable monetary politburo of 12 appointed bureaucrats is required in order to create serviceable money and credit? Indeed, the free market everywhere and always is responsive to demands for every kind of good or service—including that of money for transactions, payments, safekeeping, lending and borrowing.

As to the latter, there is now $4 trillion of crypto currencies outstanding. That’s a hell of a lot of private money—and it’s really no different in the context of the digital age than private bank issued money was during the national banking era prior to Washington’s granting the Fed a monopoly on the printing press. That is to say, the free market had proven back then and is doing so again now that it can create serviceable money without any action or guarantee by the state.

To be sure, the “use case” has been somewhat slow developing for the innumerable cryptos now on offer, but the recent Genius Act passed by the not-so-geniuses in Washington actually turns Treasury bills into everyday money (stable coins), which can be transacted instantly over the blockchain by anyone who can buy, borrow or steal a computer or iPhone. Indeed, so-called “stable coins” are actually the equivalent of national bank notes issued during the National Banking era between 1863 and 1913, which were also backed 100% by US Treasury debt. In short, there is nothing new under the sun about non-state or private money at all.

Stated differently, a century ago private banks created hand-to-hand currency that was backed 100% by Treasury bonds but guaranteed only by the issuing bank. Today, the Genius Act enables private crypto banks to issue essentially the same kind of hand-to-keyboard transactional money, albeit usable even more conveniently on a computer-to-computer basis over the blockchain.

As for the necessity of a state run central bank to enable adequate credit supplies, fuhgeddaboudit! There is currently $104 trillion of debt of every shape, size and domination outstanding in the USA alone. Indeed, the problem is way too much credit owing to the Fed’s repression of interest rates and the resulting sub-economic yields that result. Still, at market rates people and corporations alike would be rewarded for saving, meaning that there would be plenty of honest savings-based funding at market clearing yields for the legitimate credit needs of the economy.

In short, the banking system no longer needs “reserves” supplied by the Fed, and the economy does not need a central banking monopoly to be adequately supplied with money and credit. Accordingly, we once again get to the true core of Federal Reserve operations, which is not really about reserves, money or credit.

To the contrary, the Fed today is a destructive state agency in the business of monetary central planning, predicted upon a simple but infinitely erroneous proposition: Namely, the claim that free financial markets cannot properly price interest rates for optimum growth and macro-economic stability. Alas, in Part 2 we proved that proposition is utter nonsense with respect to both growth and stability.

Of course, the prospect of free financial markets operating without an authoritarian financial Sherpa and interest rate pegger in the Eccles Building would generate coronaries among the speculators on Wall Street and the spenders in Washington. They would falsely shriek that somehow the financial system needs a liquidity supplier of last resort to prevent the ultra-low probability that a market-clearing interest rate would somehow fail to balance the supply of private savings with the demand for investible and loanable funds.

Fine. An ultimate liquidity backstop at market rates is a contradiction in terms because at some rate there will always be depositors and liquidity providers. But for those academics and socialists—yes, we do repeat ourselves—who think capitalism needs training wheels, then just revive the Discount Window and a mobilized discount rate.

Beyond that, shutdown everything else round and about the Eccles Building. That is, fire the current FOMC , abolish the open market desk and replace the Federal Reserve Board with citizens randomly drawn from the Brooklyn telephone book. The latter would operate not through a central planning oriented open market desk, but via a passive discount window based on free market interest rates plus a penalty spread. It would be a standing facility that would be virtually never used. But a warm financial blanket nonetheless.

Needless to say, a passive discount window would put the Wall Street gamblers out of business because the leveraged carry trades would no longer be profitable, and PE multiples would fall sharply based on market driven DCF calculations, not phony 10-year Treasury yields confected by the FOMC.

Even more decisively, it would also put the Washington spenders out of business, as well. Forced to pay soaring market clearing interest rates on the Uncle Sam’s massive public debt, the spenders would have absolutely no running room to spend another dime on America’s massively overdrawn credit card.

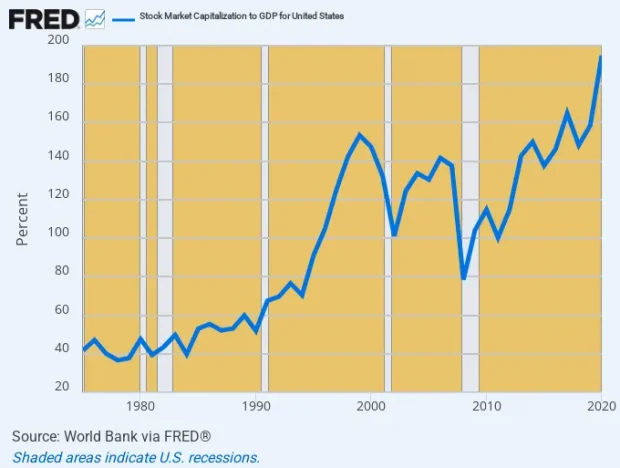

Finally, the question therefore recurs: In a free market financial system with the printing presses of the Fed set at or near idle on a permanent basis, would the stock market capitalization of the US have exploded from 40% of GDP in the era before Greenspan and his heirs and assigns to nearly 20o% at present?

As the man said on late night TV—not on your life!

US Stock Market Capitalization As a % of GDP, 1970 to 2022

Reprinted with permission from David Stockman’s Contra Corner.