President Trump campaigned on ridding U.S. taxpayers of Biden’s Green New Deal, namely the “clean” energy tax credits in the Democrat-passed Inflation Reduction Act (IRA), but the House of Representatives has only managed to repeal some 60% of the ten-year cost of the tax credits in its proposed bill. The IRA was designed as an energy entitlement program with no caps, sunsets, or accountability. Although first estimated to cost $369 billion, it is now likely to cost in the trillions. Tax credits are supposed to help an industry get off the ground. Still, the production tax credit (PTC) and the investment tax credit (ITC) for wind and solar have been around for decades, having been reinstated whenever they were to sunset. Yet, these renewable technologies only supply 2.8% of U.S. energy needs. These intermittent sources have also raised the cost of electricity as they need expensive back-up power when the sun is not shining and the wind is not blowing. They have also reduced the reliability of the U.S. electric grid. The IRA was passed as a budget reconciliation package on a straight party-line vote in August 2022.

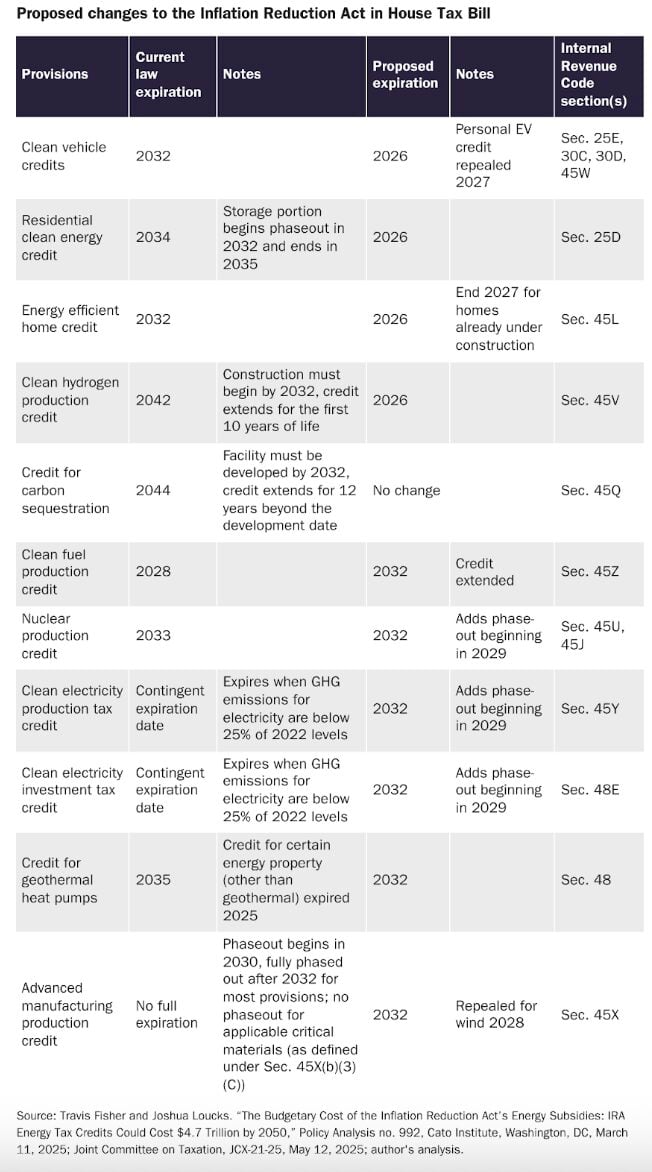

Initially set to expire in 1999, the wind PTC was extended in 1999, 2002, 2004, 2005, 2006, 2008, 2009, 2012, 2014, 2015, 2016, 2019, and 2021. The 2016 extension of the PTC was structured as a phase-down, with the value of the PTC coming down each year by 20% for five years. The solar ITC, originally introduced in 1978, was enhanced significantly in 2005 with a 2007 expiration date, and was later extended to 2016 with a clear phase-down path. The solar ITC underwent seven laws and six extensions. The IRA, however, sunsets the PTC and ITC only after the U.S. electricity sector achieves a 75% reduction in greenhouse gas emissions from the 2022 baseline, which is likely not achievable. So, there is essentially no cap on the freebies awarded to green energy via the IRA. As the table below shows, the House bill would only begin to phase out the PTC and ITC in 2029, and they would not sunset until 2032. The time is ripe for their repeal as they have not benefited the U.S. power system because they have led to increased reliability problems and added costs, and will likely be extended in the future under this phase-out plan.

Wind and solar power now represent 16% of the electricity market, while supplying less than 3% of total U.S. energy needs. According to the Cato Institute, the two subsidies could cost $130 billion annually by 2034, and all green subsidies could cost taxpayers $4.7 trillion through 2050. The original CBO 10-year score significantly underestimated the subsidy payments authorized by the IRA. Third-party estimates of the IRA’s 10-year budget score, such as the Goldman Sachs estimate of $1.2 trillion, fall comfortably between Cato’s lower- and upper-bound forecast for the upcoming 10-year budget window. It is important to note that the cost is three times more than the CBO’s estimated cost of the IRA at the time of its passage.

Besides costing taxpayers bundles of money, these subsidies have also destabilized the electric grid, as the technologies they fund are intermittent and weather-driven. Other technologies (coal and gas generators) are being used as back-up power, hurting their economics because their costs spread over far fewer hours of operation, as grid operators dispatch wind and solar plants with no fuel costs first. Some states are supplementing their wind and solar plants with very expensive storage batteries that can store excess power until needed. The result is higher electricity prices for consumers, which have increased 25% since Biden became president and favored green technologies. Heavily subsidized intermittent sources, therefore, add costs to ratepayers by distorting the market, producing a “double whammy” for prices overall.

The grid distortion caused by the wind production tax credit can sometimes make wholesale power prices negative, which means other generators would need to pay the grid for their power. Wind producers can still make money when wholesale prices fall below zero because of the value of the production tax credit, but other power plants lose money. Due to the distortions, many fossil fuel and nuclear power plants have had to shut down despite the increase in electricity demand from artificial intelligence data centers and manufacturing. The loss of these potential baseload generating units is wreaking havoc with available supplies in light of the surging demand, leaving large consumers scrambling to secure dedicated generation.

Conclusion

Congress has the opportunity to benefit the American taxpayer by removing IRA subsidies for green technologies that were passed solely by Democrats in 2022. While the CBO estimated the IRA subsidies at $369 billion, actual costs will likely be at least three times as much to support technologies that have been around for decades and should be viable without federal government support. Wind and solar power distort the grid because they cannot operate 24/7, meaning they must have back-up power from expensive storage batteries or other technologies that may not operate long enough to recover their costs, so many are forced to shutter. Congress could slow the rate of electricity price increases and save taxpayers huge sums by stopping the counterproductive subsidies lavished upon intermittent wind and solar in the IRA. Members of Congress need only look to Europe, where electricity prices are multiples higher than the rates their consumers already complain about, to see what the future holds if the United States does not change course from the IRA’s “Green New Deal” provisions.