James Hardie Industries – the world’s largest producer of fiber cement products, headquartered in Ireland and dual-listed in Sydney and New York – issued a grim housing outlook that sent its Sydney shares plunging the most in 50 years. The warning underscores deepening cracks emerging in the U.S. housing market under the continued weight of elevated interest rates. President Trump issued a new warning overnight about those rates “hurting” the housing industry.

James Hardie generates about 70% of its revenue from North America. Its flagship product, HardiePlank, is widely used in residential housing as an alternative to wood or vinyl siding. That makes the company’s earnings reports closely watched, given its heavy exposure to the U.S. housing market.

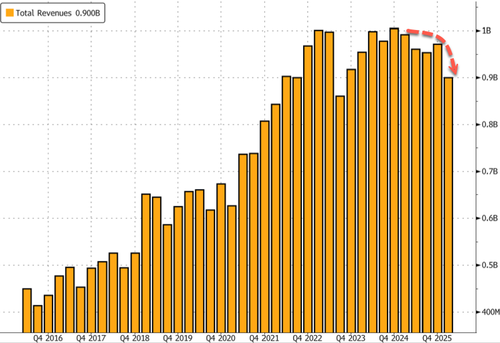

Its first-quarter results missed Wall Street expectations, highlighting ongoing uncertainty in the housing market. Quarterly profit dropped to $62.6 million, or 15 cents per share, from $155.3 million, or 36 cents, a year earlier. Adjusted EPS was 29 cents, below FactSet’s consensus of 33 cents, while revenue declined 9% to $899.9 million, also missing the $952.7 million estimate.

“The gloomy outlook reflects weaker-than-anticipated activity in single-family new construction throughout the summer, as well as challenging demand trends in the repair and remodel market,” CEO Aaron Erter stated, adding, “It also factors in expectations for further inventory calibration by the company’s channel partners in the remainder of the calendar year.”

“Uncertainty is a common thread throughout conversations with customer and contractor partners,” Erter said, pointing out, “Homeowners are deferring large-ticket remodeling projects like re-siding, and affordability remains the key impediment to improvement in single-family new construction.”

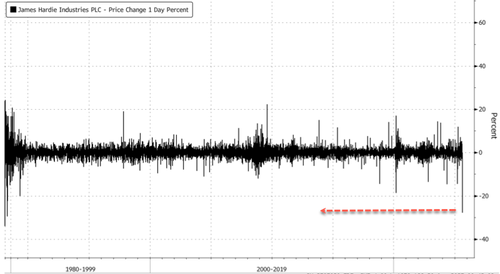

James Hardie shares are down over 30% in the US pre-open…

…the most since November 1973, following the dismal earnings report and mounting construction challenges across North America.

James Hardie’s results add to the red flags for traders materializing in the construction and property space, with lumber prices sliding in recent months. Also, Toll Brothers gave disappointing guidance.

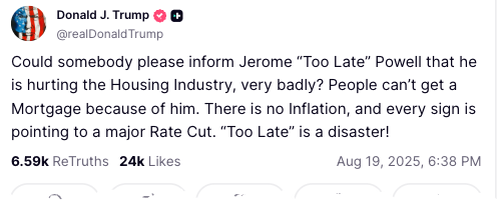

Meanwhile, President Trump fired off this Truth Social post in the overnight, “Could somebody please inform Jerome “Too Late” Powell that he is hurting the Housing Industry, very badly? People can’t get a Mortgage because of him. There is no Inflation, and every sign is pointing to a major Rate Cut. “Too Late” is a disaster!”

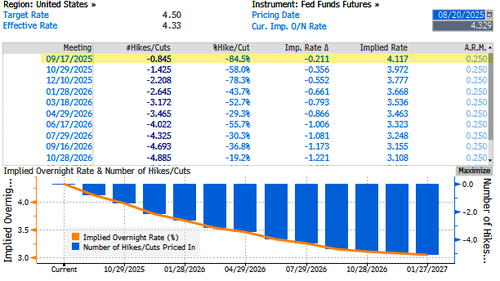

The Federal Reserve’s next policy meeting will be held on September 16-17. Interest rate swaps have odds at about 84.5% of a 25bps cut.

The downbeat outlook for the U.S. housing market and homeowners deferring large-ticket remodeling projects only suggests cracks are emerging. Maybe Trump is right.

Loading recommendations…