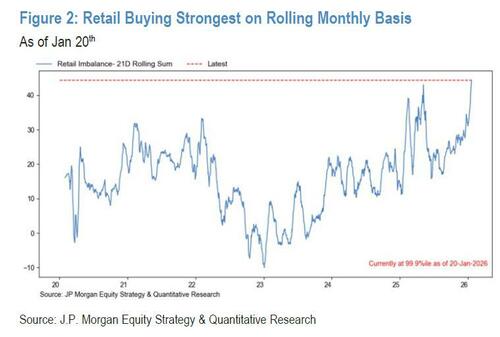

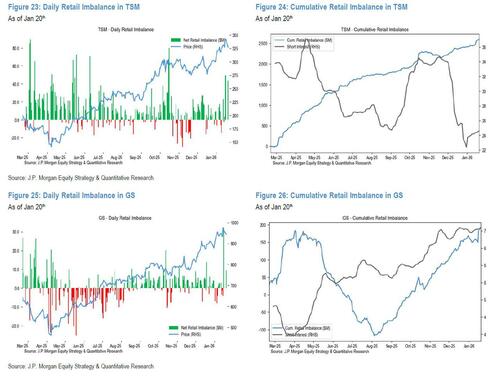

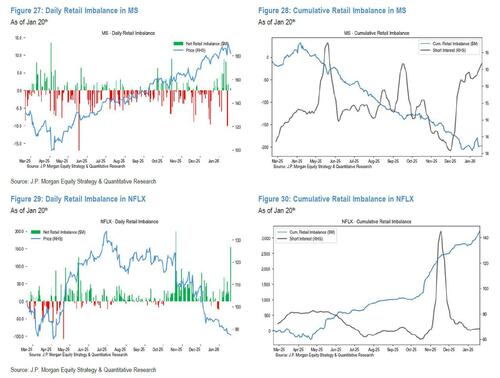

Yesterday we highlighted the unprecedented surge in retail buying in recent weeks, which has led not only to the biggest 21-day cumulative retail buying on record…

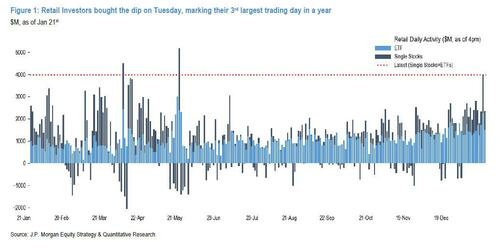

… but also saw an explosion of retail BTFD activity during Tuesday’s rout which saw institutions and algos all puke. A few hours later, we found that retail was right again, and stocks resumed their meltup to new record highs.

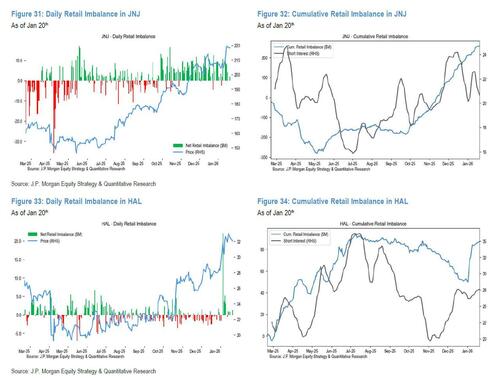

And with retail once again emerging as the dominant market maker coupled with surging volumes, similar to January 2021, as other market participants ease off the gas, it’s time to ask what stocks could see a short squeeze in the coming days as retail investors target large hedge fund short positions, in hopes of sparking another Gamestop-like squeeze.

To answer that question, we again turn to the JPM Retail Radar note, and specifically the section looking at “Single Stock Stories with Elevated Retail Activity” and specifically Hedge Funds vs. Retail: High Short Interest Meme Stocks. Three names stand out:

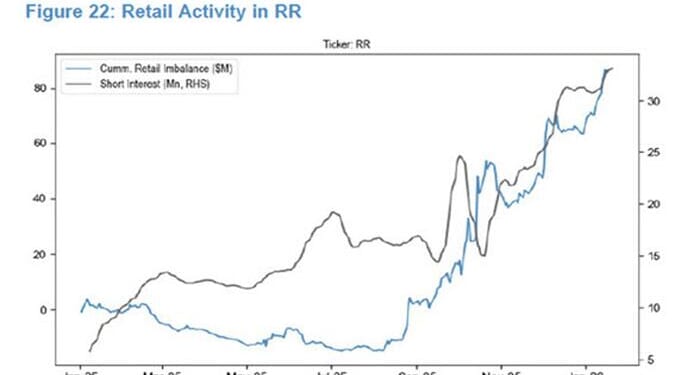

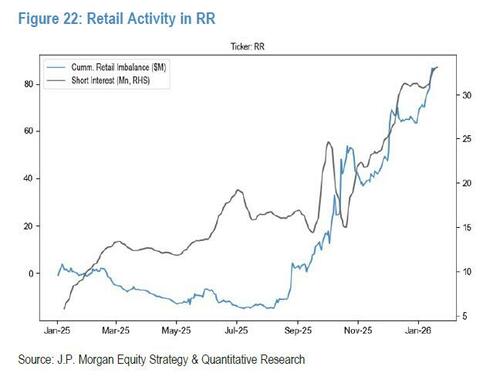

- RR ($9M bought last week, 1.3z,): The stock rose by over 14% on January 8th, accompanied by sustained retail interest since September 2025, with net purchases totaling $85M. These gains have occurred against a backdrop of rising short interest, currently at approximately 30% of the float, which has sharply increased by 10% in January 2026.

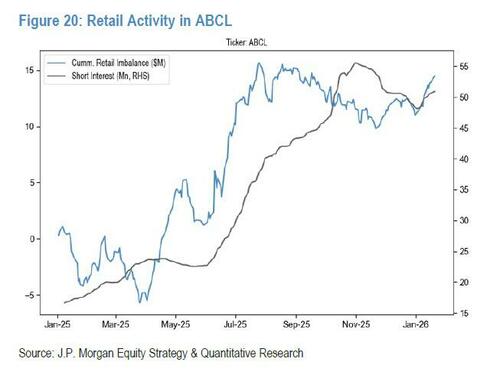

- ABCL ($1.1M bought last week, 0.5z): The stock surged by over 30% between January 5th and January 12th, following the announcement of first patients dosed in its Phase 2 trial for a drug targeting vasomotor symptoms (link). Retail investors have shown interest since April 2025, with net purchases totaling $20M. These developments have occurred amid high short interest, currently around 22.5% of the float, which has increased by 5% since September 2025.

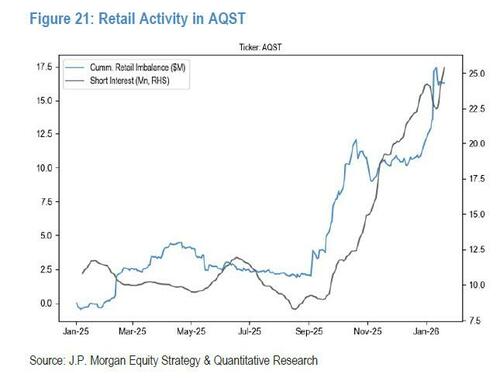

- AQST ($1.6M sold last week, -1.6z): The stock declined by more than 37% on January 9th after the FDA flagged issues with its allergy drug application (link). Despite this, the stock has been on retail investors’ radar since September 2025, with $14M in net purchases, against high short interest at 22% of the float, which has risen by 14% since September 2025.

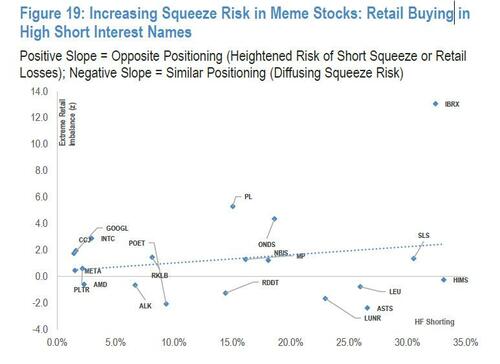

These three names stand out amid an environment of what JPM calls “increasing squeeze risk in meme stocks” and lays out the names most likely to get squeezed in the following matrix:

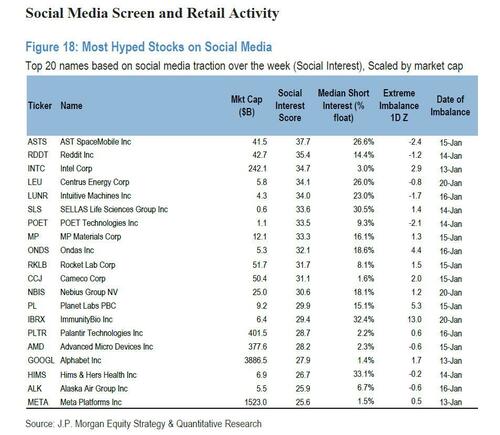

Next, JPM flags several stocks that are heavily mentioned on Social Media and have high Retail buying as well as high Hedge fund Shorting. These stocks may experience unexpected flows in case of increased activity.

Finally, here are several other names which while not immediate squeeze candidates have seen outsized earnings-related retail action in recent days.

Much more in the full JPM note available to pro subs.

Loading recommendations…