Singapore iron ore futures closed the week near six-month highs, supported by signs of revived Chinese demand driving peak-season restocking, alongside other factors such as steel mills curbing supply and expectations for a 25-bps interest rate cut in the U.S. next week.

Earlier in the week, UBS analyst Catherine Gordon told clients, “I would flag that the team has seen strong demand for the UBS Gold Miners Basket {UBXXGOLD} amid the frenzy. Iron Ore remains the least discussed with investors on the sidelines.”

Has the iron ore market been long lost and forgotten by Wall Street desks, with prices stuck around $100 a ton for more than a year?

Possibly. UBS analyst Myles Allsop noted that iron ore volatility has collapsed to its lowest level in 15 years. With no trend to follow and prices compressed around the $100 handle, iron ore has become one of the least discussed commodities among UBS clients – well, for now.

Allsop provided more color about this collapse in volatility:

Iron ore prices: why is volatility at the lowest level in >15yrs?

The volatility in the iron ore price is at its lowest level since the industry moved to spot pricing in 2008/09, with prices trading in a tight range since mid-2024 (average ~$100/t with a low of $90/t & a high of $110/t). In our opinion, one of the key drivers of this stability is a change in buying behaviour in China, supported by widespread uncertainty & balanced market fundamentals. The Chinese govt established China Minerals Resources Group (CMRG) in Jul-22 with an aim to stabilise the iron ore market through centralised demand, price negotiations, and strategic inventory mgmt. CMRG now represents >50% of China’s steelmakers in negotiations with global suppliers, fundamentally changing the negotiating leverage from miners to Chinese steel mills and altering the iron ore market dynamics; it has also dampened speculative activity in the market by building substantial strategic inventory holdings. Looking forward, we expect lower price volatility to become the new normal, which helps steelmakers through improved cost forecasting but reduces trading opportunities for financial participants; we expect supply-demand fundamentals to continue to drive broader market price trends though the concentrated buying power of CMRG is likely to compress margins.

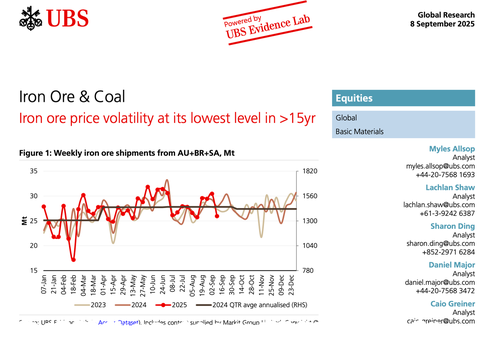

Iron ore prices holding up with supply/ demand balanced & inventories stable

Iron ore prices have shuffled up to ~$105/t last week with activity rebounding after the military parade and on improving sentiment (due to the China Work Plan & Fed rate cut expectations). On the key signals we note: 1) Iron ore inventories at ports (Fig24) and at mills (Fig26) in China are broadly stable w/w; 2) Iron ore shipments from traditional markets (Fig2) continue to recover with Brazil +3% YTD (> Access Dataset); 3) Steel production in China accelerated in early-Aug in the CISA data (Fig10), though MySteel utilisation rate data remains broadly flat (Fig14); 4) Steel exports from China remain strong at ~106Mtpa in Aug despite increasing trade restrictions (Fig19) – Baosteel expects China steel exports to remain >100Mt in 2025, albeit softer in 4Q; 5) Positioning on the Dalian has turned incrementally more negative and is now at -2Mt of net contracts (Fig37). We have Neutral ratings on Vale, RIO & BHP, and Sell on FMG & KIO; we est. spot 2026 FCF yield of BHP at 4%, RIO at 8%, Vale at 15% (interactive model).

Separately, Goldman analyst James McGeoch added more color about why prices of the steelmaking ingredient have soared in recent weeks to six-month highs:

“Your coming into the pre-golden week restock (Golden week October 1), the onshore feedback is positive, August imports at 105mt is impressive. The range $100-105 is still where the traders see it, consumer buying at $100, and producer hedging at $105. Of note the story Friday on the CMRG (China group) selling to calm prices down, they are not going away… “

Chart

The longer the compression, the larger the eventual move in iron ore markets. The big question is what could trigger a breakout to the upside: China stimulus, U.S. rate cuts, or Beijing pressuring mills to curb production?

Full chart pack available exclusively for ZeroHedge Pro Subs here.

Loading recommendations…