Key Events This Week: Core PCE, Durables, And Fed Speakers But All Eyes On Nvidia Earnings

Last week’s main event was the dovish tilt by Powell at Jackson Hole which left investors increasingly confident on upcoming Fed easing. While Fed news will continue to draw attention this week, the focus will also shift to a slew of inflation releases out of the US, Europe and Japan on Friday, while Nvidia’s earnings on Wednesday will be all-important after tech stocks slumped prior to Friday’s rally.

Looking ahead, DB’s Peter Sidorov writes that central bank commentary will continue to garner attention this week with the Fed’s Logan (non-voter), Williams, Barkin (non-voter) and Waller due to speak. Divisions among the FOMC are likely to remain evident, and we would expect Logan today to sound more hawkish than Powell on near-term cuts, but Waller on Thursday to lean into the dovish elements of Powell’s speech. The topic of Fed independence will also remain salient with Trump saying last Friday that he would fire Fed Governor Lisa Cook if she did not resign. As a reminder, the controversy emerged last Wednesday as FHFA Direct Bill Pulte alleged that Governor Cook may have committed mortgage fraud. Were Cook to leave her post, it would open another seat for Trump to fill, increasing the prospects of a dovish majority on the seven-person Fed Board.

In Europe, the ECB will release the accounts of its July meeting on Thursday, which come as ECB commentary at Jackson Hole was consistent with an extended pause. President Lagarde avoided discussing the policy outlook but highlighted the resilience of the euro area labour market. Germany’s Nagel argued that the bar for further cuts was high with few arguments for more easing and Finland’s Rehn said that, as “inflation is for now in a good place”, an “insurance cut” was not necessary.

On the data front, inflation will be in focus in both sides of the Atlantic on Friday. In the US, DB economists expect the July core PCE deflator to come in at +0.29% MoM (vs. +0.26% previous), bringing the YoY rate a tenth higher to 2.9%, with risks of this even rounding up to 3.0%. They also foresee the accompanying personal income (DBe: +0.4% vs. +0.3% previous) and consumption (+0.6% vs. +0.3%) releases showing solid growth. In Europe, the flash August CPI print for Germany, France, Italy and Spain are due, with our economists expecting annual inflation to edge up slightly across the Big 3 euro area economies (see here for more). And in Japan, we will have the August Tokyo CPI on Friday, with our Japan economist expecting a retreat in core inflation ex. fresh food to 2.5% YoY (2.9% in July).

Ahead of that, other notable US economic releases include new home sales (Mon), the Conference Board’s consumer confidence indicator and durable goods orders (both Tue). In Europe, we also have the Ifo survey in Germany (Mon), euro area M3 and credit data for July (Thu) and the ECB’s consumer expectations survey (Fri). The full week ahead calendar is at the end as usual.

Rounding out US events, in tariffs, the “de minimis” exemption will end this Friday, while additional 25% tariffs on India (taking the total levy to 50%) are due to come into effect on Wednesday. On tariff news, last Friday Canada announced that it will remove its retaliatory tariffs on US products that comply with the USMCA, though it will keep symmetrical tariffs on US steel, aluminium and autos.

Finally, the big event in corporate earnings will be Nvidia’s results on Wednesday, which come as tech stocks had seen their biggest five-day pullback since April prior to Friday’s rally. Other US tech earnings due include Crowdstrike, Dell and Marvell. In China, the spotlight will be on results from Alibaba, Meituan and BYD. In tech news last Friday Trump announced a deal that will see the US receive 9.9% of Intel’s shares funded by $8.9bn of government grants that have not yet been paid to the company. Intel’s stock rose by +5.53% on the news.

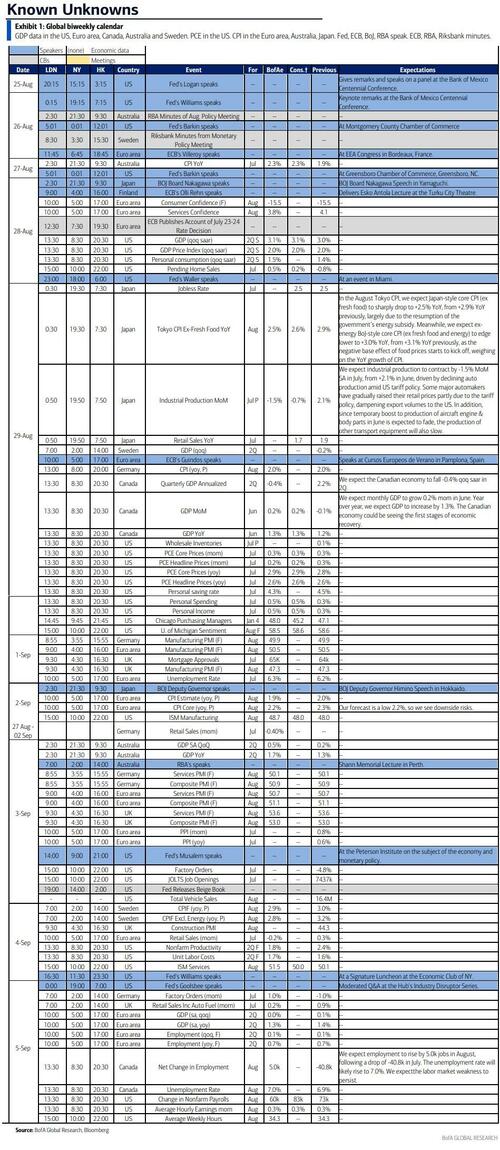

Courtesy of DB, here is a day-by-day calendar of events

Monday August 25

- Data: US July Chicago Fed national activity index, new home sales, August Dallas Fed manufacturing activity, Germany August Ifo survey

- Central banks: Fed’s Logan speaks

- Earnings: PDD Holdings

Tuesday August 26

- Data: US August Conference Board consumer confidence index, Richmond Fed manufacturing index, business conditions, Dallas Fed services activity, Philadelphia Fed non-manufacturing activity, July durable goods orders, June FHFA house price index, Q2 house price purchase index, Japan July PPI services, France August consumer confidence

- Central banks: Fed’s Williams and Barkin speak, ECB’s Villeroy speaks

- Earnings: Prudential, MongoDB, Okta

- Auctions: US 2-yr Notes ($69bn)

Wednesday August 27

Data: China July industrial profits, Germany September GfK consumer confidence, Australia July CPI

- Central banks: Fed’s Barkin speaks

- Earnings: Nvidia, Royal Bank of Canada, Crowdstrike, Meituan, Snowflake, Trip.com, Horizon Robotics, Abercrombie & Fitch, Kohl’s

- Auctions: US 2-yr FRN (reopening, $28bn), 5-yr Notes ($70bn)

Thursday August 28

- Data: US July pending home sales, August Kansas City Fed manufacturing activity, initial jobless claims, Italy August consumer confidence index, economic sentiment, manufacturing confidence, June industrial sales, EU27 July new car registrations, Eurozone July M3, August economic confidence, Canada Q2 current account balance, Switzerland Q2 GDP

- Central banks: Fed’s Waller speaks, ECB’s account of the July meeting, ECB’s Rehn speaks, BoJ’s Nakagawa speaks

- Earnings: Dell, Marvell, Autodesk, Pernod Ricard, Affirm, Dollar General, Delivery Hero

- Auctions: US 7-yr Notes ($44bn)

Friday August 29

- Data: US July PCE, personal income, personal spending, advance goods trade balance, wholesale inventories, August MNI Chicago PMI, Kansas City Fed services activity, UK August Lloyds Business Barometer, Japan July jobless rate, job-to-applicant ratio, industrial production, retail sales, housing starts, August Tokyo CPI, consumer confidence index, Germany August CPI, unemployment claims rate, July retail sales, import price index, France August CPI, July PPI, consumer spending, Q2 total payrolls, Italy August CPI, Canada Q2 GDP, Sweden Q2 GDP

- Central banks: ECB July consumer expectations survey, Guindos speaks

- Earnings: Alibaba, BYD

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the durable goods report on Tuesday and the core PCE inflation report on Friday. There are several speaking engagements by Fed officials this week, including events with New York Fed President Williams and Governor Waller on Monday and Thursday, respectively.

Monday, August 25

- 10:00 AM New home sales, July (GS -0.2%, consensus +0.5%, last +0.6%)

- 10:30 AM Dallas Fed manufacturing index, August (consensus -1.7, last +0.9)

- 03:15 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver a speech and take part in a panel at the Bank of Mexico’s Centennial Conference. Text and Q&A are expected. On July 15th, Logan said that her base case was that “we’ll need to keep interest rates modestly restrictive for some time” but noted that “some combination of softer inflation and a weakening labor market will call for lower rates fairly soon.” Since Logan’s remarks, the July employment report showed a significantly slower pace of job growth in recent months, and we saw Chair Powell’s speech at Jackson Hole this week as consistent with our baseline forecast of a 25bp cut at the FOMC’s September meeting.

- 07:15 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver keynote remarks at the Bank of Mexico’s Centennial Conference. Text and Q&A are expected. In an interview on August 1st, Williams said he thought the labor market was undergoing “a gentle gradual cooling” that still left it “in a solid place.” Williams noted that the July employment report was “important information … to understand the direction of what we’re seeing in supply and demand for labor.” He said he was not “particularly worried right now about the economy contracting,” noting he expected it to “just be at this pace of growth for a couple quarters and then come back.”

Tuesday, August 26

- 08:30 AM Durable goods orders, July preliminary (GS -5.0%, consensus -3.9%, last -9.4%); Durable goods orders ex-transportation, July preliminary (GS -0.1%, consensus +0.2%, last +0.2%); Core capital goods orders, July preliminary (GS -0.2%, consensus +0.2%, last -0.8%); Core capital goods shipments, July preliminary (GS flat, consensus +0.2%, last +0.3%): We estimate that durable goods orders declined another 5% in the preliminary July report (month-over-month, seasonally adjusted) after declining 9% in June, reflecting continued normalization in commercial aircraft orders after a spike in May. We forecast a 0.2% decline in core capital goods orders—reflecting contractionary new orders readings for manufacturing surveys in July—and unchanged core capital goods shipments—reflecting the slowdown in orders in the prior month.

- 09:00 AM FHFA house price index, June (consensus +0.1%, last +0.1%)

- 09:00 AM S&P Case-Shiller home price index, June (GS -0.2%, consensus -0.1%, last -0.3%)

- 10:00 AM Richmond Fed manufacturing index, August (last -20)

- 10:00 AM Conference Board consumer confidence, August (GS 95.0, consensus 96.5, last 97.2)

Wednesday, August 27

- There are no major economic data releases scheduled.

Thursday, August 28

- 08:30 AM GDP, Q2 second release (GS +3.2%, consensus +3.1%, last +3.0%); Personal consumption, Q2 second release (GS +1.7%, consensus +1.6%, last +1.4%): We estimate a 0.2pp upward revision to Q2 GDP growth to +3.2% (quarter-over-quarter annualized), reflecting an upward revision to consumer spending (+0.3pp to +1.7%) due to stronger public transportation and hotel details in the Quarterly Services Survey (QSS), as well as upward revisions to business fixed investment and net exports.

- 08:30 AM Initial jobless claims, week ended August 23 (GS 225k, consensus 230k, last 235k); Continuing jobless claims, week ended August 16 (consensus 1,965k, last 1,972k)

- 10:00 AM Pending home sales, July (GS -7.0%, consensus +0.3%, last -0.8%)

- 11:00 AM Kansas City Fed manufacturing index, August (last +1)

- 06:00 PM Fed Governor Waller speaks: Fed Governor Christopher Waller will speak at an event hosted by the Economic Club of Miami. Waller, alongside Governor Bowman, dissented from the FOMC’s decision to leave the fed funds rate unchanged at its July meeting. In a statement explaining his dissent released on August 1st, Waller said he believed the FOMC should look through the one-time effect of tariffs on the price level and that the slowdown in growth in the first half of the year, combined with moderate inflation readings outside of tariffs and slowing payroll growth, justified lowering the fed funds rate closer to its estimated neutral level.

Friday, August 29

- 08:30 AM Personal income, July (GS +0.4%, consensus +0.4%, last +0.3%); Personal spending, July (GS +0.4%, consensus +0.5%, last +0.3%); Core PCE price index, July (GS +0.26%, consensus +0.3%, last +0.3%); Core PCE price index (YoY), July (GS +2.88%, consensus +2.9%, last +2.8%); PCE price index, July (GS +0.18%, consensus +0.2%, last +0.3%); PCE price index (YoY), July (GS +2.60%, consensus +2.6%, last +2.6%): We estimate that both personal income and personal spending increased by 0.4% in July. We expect that the core PCE price index rose by 0.26% in July, corresponding to a year-over-year rate of 2.88%. Additionally, we expect the headline PCE price index to increase by 0.18% in July, corresponding to a year-over-year rate of 2.60%.

08:30 AM Advance goods trade balance, July (GS -$91.0bn, consensus -$89.5bn, last -$84.9bn) - 08:30 AM Wholesale inventories, July preliminary (consensus +0.1%, last +0.1%)

- 10:00 AM University of Michigan consumer sentiment, August final (GS 59.0, consensus 58.6, last 58.6): University of Michigan 5-10-year inflation expectations, August final (GS 3.8%, last 3.9%)

Source: DB, Goldman

Tyler Durden

Mon, 08/25/2025 – 09:45

Source link