Key Events This Week: Jobs, Jolts, ISM, And Fed Speakers Galore

After a strong August, DB’s Peter Sidorov writes that risk assets are starting September on a more tentative footing as Friday’s tech-led sell off on Wall Street has continued across most of Asia this morning although it has since stabilized. With rising Fed rate cut pricing supporting markets of late, investors will be keenly watching whether this is validated by the upcoming US payrolls release on Friday and subsquent negative revisions on Sept 9. The bar to derail a Fed rate cut on September 17 is extremely high (the real question is whether the cut is 25bps or 50), but with fed funds futures now pricing over 140bps of easing by the end of 2026, markets are expecting an amount of easing that since the 1980s has only occurred around recessions.

Before we preview payrolls and the Fed in more detail, the major story of the weekend came as late on Friday a US federal appeals court ruled that tariffs introduced under International Economist Emergency Powers Act (IEEPA) were illegal, upholding an earlier ruling by the Court of International Trade. However, in its 7-4 ruling the court left the tariffs in place until October 14 giving the administration time to appeal the case to the Supreme Court. And while a majority of judges in the appeals court ruling were nominated by Democrat Presidents, there is a 6-3 Republican-appointed majority on the Supreme Court, and Trump’s tariffs are most likely to remain. Were IEEPA tariffs to be stuck down, this would invalidate most levies introduced this year, including the “reciprocal” country rates and the “fentanyl” tariffs on China, Mexico and Canada, though the administration could look to implement more levies via other statutes.

Turning to the US payrolls print on Friday, DB’s economists expect a modest pick up in both headline (DBe +100k vs. 73k previously) and private (+100k vs. 83k) payrolls. They see the unemployment rate holding steady at 4.2%, with a risk that it rounds down to 4.1%. With Powell leaning towards a near-term rate cut at Jackson Hole and markets now pricing an 87% chance of a September cut, it would likely take a huge payrolls outperformance to dissuade a September cut. However, a stable unemployment rate could alleviate fears of a material downshift in the labor market, keeping the Fed cautious on further rate cuts.

The payrolls release will be preceded by the JOLTS survey on Wednesday and the ADP report on Thursday, two labor market indicators that have been namechecked by Governor Waller, who last week suggested that a weak payrolls print could bring a 50bp September cut in play. Other Fed officials have been less dovish but have also noted labor market risks. We will see a few Fed speakers before the blackout window starts next weekend, including St. Louis Fed President Musalem (Wednesday), NY Fed President Williams (Thursday) and Chicago Fed President Goolsbee (Thursday).

Beyond the Fedspeak, markets will be glued to the latest newsflow around President Trump’s attempted removal of Fed Governor Cook. Friday’s court hearing on the injunction to block Trump from firing her yielded no decision with further filings expected this Tuesday. In a note last week DB discussed the possible implications if Governor Cook were to be removed and Trump were to achieve a majority on the Federal Reserve Board. This Thursday, the Senate Banking Committee will also hold a hearing on Stephen Miran’s confirmation for the vacant Fed Board seat as the White House looks to have him confirmed in time for the September FOMC.

While US markets will be closed today for Labor Day, other US data highlights this week will include ISM manufacturing (Tuesday) and services (Thu) prints, with the employment components of the two series, which have slipped over the past couple of months, likely to draw attention. In Europe, the main data release will be the euro area flash August CPI print tomorrow. Following the major country prints on Friday, our European economists see headline inflation rising marginally to +2.06% YoY (vs 2.0% prev.) with core falling to +2.22% (vs 2.3% prev.).

The political situation in France will remain in focus ahead of the confidence vote scheduled on September 8. Prime Minister Bayrou’s minority government looks likely to lose this with major opposition parties repeating their intent to vote against the government over the weekend. In a note published on Friday (link), DB’s European economists outline the next key steps and likely paths forward and discuss the ECB’s likely reaction function to the situation in France.

Staying with geopolitics, the focus yesterday and today is on China hosting the annual Shanghai Cooperation Organisation summit. Yesterday China’s Xi Jinping met with India’s Narendra Modi, with the two sides pledging to “remain partners rather than rivals”. The summit has received extra attention amid Trump’s tariff pressure on Asian countries, and Modi will also meet with Russia’s Vladimir Putin today, shortly after the US raised tariffs on India to 50% last week in response to its purchases of Russian oil.

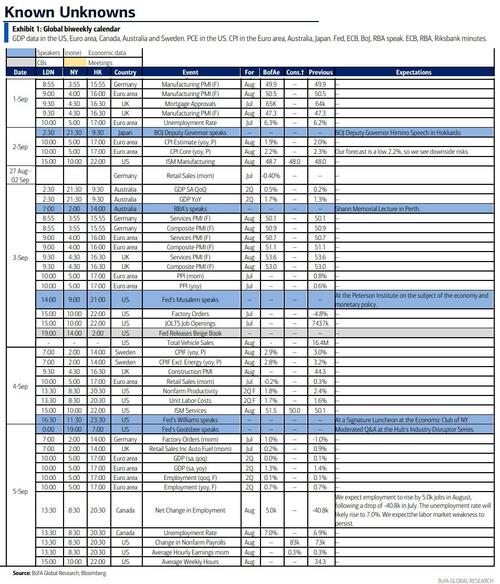

Courtesy of DB, here is a day-by-day calendar of events

Monday September 1

- Data: UK July net consumer credit, M4, Japan Q2 MoF survey, Italy August budget balance, manufacturing PMI, new car registrations, July unemployment rate, Eurozone July unemployment rate

- Other: US Labor Day holiday

Tuesday September 2

- Data: US August ISM index, July construction spending, Japan August monetary base, France July budget balance, Italy July PPI, Eurozone August CPI, Canada August manufacturing PMI

- Central banks: BoJ’s Himino speaks

- Earnings: Partners Group, Nio, Zscaler

Wednesday September 3

- Data: US July JOLTS report, factory orders, August total vehicle sales, UK August official reserves changes, Italy August services PMI, Eurozone July PPI, Canada Q2 labor productivity, Australia Q2 GDP

- Central banks: Fed’s Beige Book, Fed’s Musalem speaks, ECB’s Lagarde speaks, BoE’s Bailey, Lombardelli, Taylor, Greene and Breeden speak

- Earnings: Salesforce, HPE, Figma, Gitlab, Dollar Tree, C3.ai

Thursday September 4

- Data: US August ADP report, ISM services, July trade balance, initial jobless claims, UK August new car registrations, construction PMI, Germany August construction PMI, Eurozone July retail sales, Canada July international merchandise trade, Switzerland and Sweden August CPIs

- Central banks: Fed’s Williams speaks, ECB’s Cipollone speaks, BoE’s DMP survey

- Earnings: Broadcom, Lululemon

Friday September 5

- Data: US August jobs report, UK July retail sales, Japan July labor cash earnings, household spending, leading index, coincident index, Germany July factory orders, France July trade balance, current account balance, Italy July retail sales, Canada August jobs report

- Central banks: Fed’s Goolsbee speaks

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Tuesday, the JOLTS job openings report on Wednesday, and the employment report on Friday. There are several speaking engagements by Fed officials this week, including an event with New York Fed President Williams on Thursday.

Monday, September 1

- Labor Day holiday. There are no major economic data releases scheduled. NYSE will be closed. SIFMA recommends that bond markets also close.

Tuesday, September 2

- 09:45 AM S&P Global US manufacturing PMI, August final (consensus 53.3, last 53.3)

- 10:00 AM ISM manufacturing index, August (GS 50.0, consensus 49.0, last 48.0): We estimate the ISM manufacturing index rebounded 2.0pt to 50.0 in August, reflecting improvement in our manufacturing survey tracker (+1.2pt to 51.9) and a tailwind from residual seasonality.

- 10:00 AM Construction spending, July (GS flat, consensus -0.1%, last -0.4%)

Wednesday, September 3

- 09:00 AM St. Louis Fed President Musalem (FOMC voter) speaks: St. Louis Fed President Alberto Musalem will speak at the Peterson Institute on the subject of the economy and monetary policy. Q&A is expected. On August 14, Musalem said that he expects “most of the impact of tariffs on inflation to fade in 6 to 9 months, but it could be more persistent.” He also noted that the “economy is around full employment,” and that “if the Fed were to weigh the labor market side more and reduce rates aggressively, that could lead to higher inflation expectations and be counterproductive.”

- 10:00 AM JOLTS job openings, July (GS 7,450k, consensus 7,373k, last 7,437k): We estimate that JOLTS job openings were roughly unchanged at 7.45mn in July based on the signal from online job postings.

- 10:00 AM Factory orders, July (GS -1.2%, consensus -1.4%, last -4.8%); Durable goods orders, July final (GS -2.8%, consensus -2.8%, last -2.8%); Durable goods orders ex-transportation, July final (consensus +1.1%, last +1.1%); Core capital goods orders, July final (last +1.1%); Core capital goods shipments, July final (last +0.7%)

- 02:00 PM Fed Releases Beige Book, September meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the July FOMC meeting period noted that five districts had reported modest increases in activity, five districts reported flat activity, and the remaining two districts reported modest declines in activity, representing an improvement over the previous report, and that uncertainty remained elevated, contributing to ongoing caution by businesses. In this month’s Beige Book, we look for anecdotes related to the evolution of labor demand and firms’ expectations of activity growth for the remainder of the year.

- 05:00 PM Lightweight motor vehicle sales, August (GS 16.0mn, consensus 16.1mn, last 16.4mn)

Thursday, September 4

- 08:15 AM ADP employment change, August (GS +100k, consensus +80k, last +104k)

- 08:30 AM Nonfarm productivity, Q2 final (GS +3.1%, consensus +2.7%, last +2.4%): Unit labor costs, Q2 final (GS +0.9%, consensus +1.4%, last +1.6%)

- 08:30 AM Initial jobless claims, week ended August 30 (GS 230k, consensus 230k, last 229k): Continuing jobless claims, week ended August 23 (consensus 1,960k, last 1,954k)

- 08:30 AM Trade balance, July (GS -$76.0bn, consensus -$78.0bn, last -$60.2bn): We forecast that trade balance widened by $15.8bn to $76.0bn in July, reflecting an increase in goods imports that more than offsets an increase in exports of travel services.

- 09:45 AM S&P Global US services PMI, August final (consensus 55.3, last 55.4)

- 10:00 AM ISM services index, August (GS 51.5, consensus 50.9, last 50.1): We estimate that the ISM services index rebounded 1.4pt to 51.5 in August, reflecting sequential improvement in our non-manufacturing survey tracker (+0.9pt to 54.2) and a tailwind from residual seasonality.

- 11:30 AM New York Fed President Williams (FOMC voter) speaks: New York Fed president John Williams will speak at the Economic Club of New York on the economic outlook, monetary policy, and how to navigate a changing environment and uncertainty. On August 27, Williams said that “if [the real] neutral [rate] is 1% or a bit below, [the current monetary policy stance] is restrictive,” and that “at some point, it will be appropriate to move rates down.” He also noted that GDP growth has slowed and he expects the slowdown to continue.

- 05:00 PM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will participate in a moderated Q&A at the mHub’s Industry Disruptor Series. On August 15, Goolsbee said, “We put a note of unease in the last CPI and PPI, with inflation picking up in categories that are not obviously transitory.” He also noted, “If we can assure ourselves or get a hint that for this meeting, or the meetings this fall, that we aren’t on an inflationary spiral that looks to be persistent, I still think it makes sense given the strength of the economy to move rates more back to where we think they’re going to settle.”

Friday, September 5

- 08:30 AM Nonfarm payroll employment, August (GS +60k, consensus +75k, last +73k); Private payroll employment, August (GS +80k, consensus +75k, last +83k); Average hourly earnings (MoM), August (GS +0.3%, consensus +0.3%, : last +0.3%); Unemployment rate, August (GS 4.3%, consensus 4.3%, last 4.2%): We estimate nonfarm payrolls rose 60k in August. On the positive side, big data indicators indicated a sequentially firmer—albeit still soft—pace of private sector job growth. On the negative side, we expect unchanged government payrolls, reflecting a 20k decline in federal government payrolls and unchanged state and local government payrolls. Additionally, August payrolls have exhibited a consistent negative bias in initial prints over the last decade. We estimate that the unemployment rate edged up to 4.3% on a rounded basis (a low bar from an unrounded 4.248% in July), reflecting sequential easing in other measures of labor market slack, though see potential payback from a partial reversal of the spike in new entrant employment that boosted the unemployment rate in July. We estimate average hourly earnings rose 0.3% (month-over-month, seasonally adjusted), reflecting slightly positive calendar effects.

Source: DB, Goldman

Tyler Durden

Mon, 09/01/2025 – 11:25

Source link