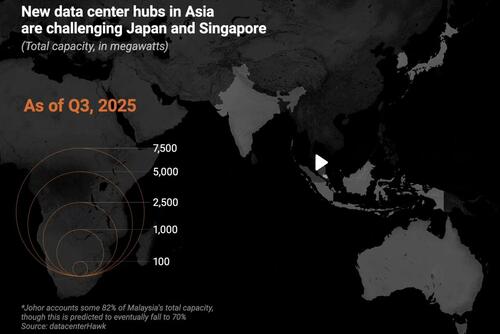

Johor, in southern Malaysia, has rapidly become a major destination for data center investment—driven by two big forces: companies diversifying supply chains amid geopolitical tension, and a post–late 2022 surge in compute demand from generative AI that’s reshaping where Asian capacity gets built, according to Nikkei.

What makes Johor especially attractive is its spillover link to Singapore. Singapore remains a connectivity hub, but land and power constraints there are pushing new builds across the border, where operators can still connect back terrestrially. A cross-border rail line expected to start operating at the end of next year, along with the Johor–Singapore Special Economic Zone launched in January, is intended to further reduce friction through incentives such as faster immigration clearance and streamlined customs procedures.

Nikkei writes that the scale-up has been fast. Analysts cited by Nikkei say Johor reached more than 900 megawatts of data center capacity in roughly three years—a pace that took Singapore more than a decade. Former industrial zones like Sedenak Tech Park have been transformed into large AI-compute campuses, backed by high-voltage power infrastructure and reclaimed water facilities. Major U.S. and Chinese tech firms, cloud providers and server manufacturers have established a presence, anchoring a growing regional ecosystem.

Malaysia as a whole has become one of Southeast Asia’s largest magnets for digital investment, attracting at least 210.4 billion ringgit in 2023 and 2024, according to government data. Johor has captured the bulk of that inflow, though Kuala Lumpur and Cyberjaya are also emerging as secondary hubs. Industry executives and policymakers argue that hosting large-scale computing clusters boosts strategic relevance, creating momentum that draws in network infrastructure such as submarine cables and strengthens regional connectivity.

The boom is also reshaping local labor markets. While data centers generate fewer jobs than manufacturing, the roles they do create—ranging from electrical engineering and telecommunications to network and cloud architecture—pay well above the national median. Central bank estimates cited by Nikkei suggest entry-level positions typically earn more than average Malaysian wages, with experienced specialists commanding significantly higher salaries.

At the same time, constraints are becoming more visible. Electricity and water are critical bottlenecks, particularly for AI facilities that rely on liquid cooling. Johor has begun rejecting new projects that depend on water-intensive cooling systems while it builds additional supply infrastructure, which officials say will take several years to come online. Analysts also point to geopolitical risk, especially uncertainty around access to advanced AI chips amid tightening export controls.

Finally, questions are emerging about oversupply. Unlike hyperscalers that build data centers to serve their own platforms, many carrier-neutral operators are betting on future tenant demand. Some projects have already been shelved, and analysts warn that Johor’s growth remains heavily dependent on foreign customers rather than domestic demand. Whether the state can sustain its rapid rise as an AI data center hub will depend on how effectively it balances infrastructure, regulation, geopolitics and long-term market demand.

Loading recommendations…