By Peter Tchir of Academy Securities

The Fed

On the betting apps, it looks like Rick Rieder has become the odds on favorite to win. I like the idea of mixing things up at the Fed and think that having a market practitioner in charge would be an interesting change. If he gets the nomination, expect more of a focus across the yield curve (our view all along of how the Fed will operate in 2026). The balance sheet is less likely to be used as a blunt, lumbering tool (prescribed amounts for well-telegraphed time periods), but rather something to shape the curve to fit policy more frequently.

The Fed – Coordination Should Be Encouraged, Not Feared

I think coordination and cooperation between the Fed, Treasury, and the admin is good. It doesn’t defeat “independence” and has happened in the past – typically, in times of stress, with COVID being the most recent example. I continue to believe the announcement that the Fed would buy fixed income ETFs changed the trajectory of the corporate bond market overnight. For those of you following the T-Report, you know I strongly believe in the ETF Spiral™, where ETFs trading at a discount to NAV help create more selling pressure. It might seem counterintuitive, but that is a hill I will stand on and fight to the end (and have a few times). At the time, even VCSH (a short-dated corporate bond ETF) was trading at a large discount to NAV (more than 3% if I remember correctly). That ETF Spiral™ was adding to the problems at the front-end of the corporate bond market. When the announcement came that the Fed would buy these ETFs, the problem corrected itself quite literally overnight, and the corporate bond market began to heal, rapidly.

I bring this up because:

- The Federal Reserve did not have the mandate to buy corporate bond ETFs. They just didn’t.

- The Federal Reserve did not have the “plumbing,” in any case, to buy ETFs. They weren’t set up to do it at all.

But…

- The Treasury could take that risk, but didn’t have the funds to buy a lot.

- The solution was a “CLO” type of structure, where Treasury provided the “equity” capital. They would take the losses. The Fed could leverage that money, something within their repertoire.

- Voila – the ability to buy corporate bond ETFs was created through a clever interaction of the Treasury and the Fed, both using tools in their toolkit. (I am sure I have overly simplified this, but the gist of the story remains the same).

- They still didn’t have the “plumbing” and I think it took a month before any corporate bond ETFs were purchased, but that didn’t matter, as the problem resolved itself overnight. That shows the power of the balance sheet on markets (which we witnessed recently again, when the agencies announced greater purchases of mortgage-backed bonds and spreads collapsed even before the first additional bond was purchased).

The morals of the story are:

- Coordination should be welcomed and does not eliminate the independence of the Fed.

- The balance sheet is an incredibly powerful tool, and taking a new approach to its usage, could unlock some interesting new ways to shape the curve.

The Fed Won’t Cut, But They Should

The bond market is pricing in a 0.03% chance of a cut in January (which is also, sadly, the realistic probability of the Bills ever winning a Super Bowl). So, we will not get a cut this week. We are also unlikely to see a cut slated for the meeting in March.

I think the case that the “Neutral Rate” is lower than where the Fed seems to think it is, is a strong one. Miran surprised me with that argument, but I actually like it and agree.

January jobs could be strong. We continue to believe the data overstates jobs in Jan/Feb and understates jobs in the summer, as the seasonal adjustments no longer reflect seasonal reality. Construction has shifted from Northeast-centric to Southern-centric. The “gig” economy has shifted how “seasonal” workers are hired, which along with the earlier start of shopping (especially on-line, where “Black Friday” sales start before Thanksgiving) means the BLS adds too many jobs back in January. In any case, I will admit, I expect a strong jobs report for January, but it will be “adjustment” driven more than reality driven, and my case for cutting depends on other arguments.

The ”crowd-sourced” data doesn’t paint a pretty picture.

The QUITS rate in the JOLTS data remains weak. It has improved a smidge and has been affected by the government shutdown (in terms of preparation of the data), but is still below the average of the past decade. This just tells me that people with the sorts of jobs that can say “take this job and shove it” aren’t saying that. They are keeping their head down and keeping their job because they know how difficult it is to find another job.

While I think the jobs data warrants attention and gives the Fed the ammunition they need to at least look for cuts, I think they are stuck in some mythical world of higher inflation.

Again, many of these committee members were in camp “transitory” which turned out not to be transitory. Many of the people on this Fed were still doing QE when they were already talking about hiking rates. QE does not need to be well telegraphed. For the life of me, I cannot understand why we would be doing QE when hikes are on the table.

Finally, for those who manage risk, you often have “stop losses” because when something goes wrong on a view, it is difficult to change your mind. You don’t necessarily think well. So, stop losses force change. Corporations tend to see “heads roll” if a major strategic blunder occurs. I still do not think anyone from “team transitory” lost their job.

So, we are stuck, I believe, with a Fed that is fighting their own past mistakes. They are too worried about being wrong to act.

Why does OER still exist?

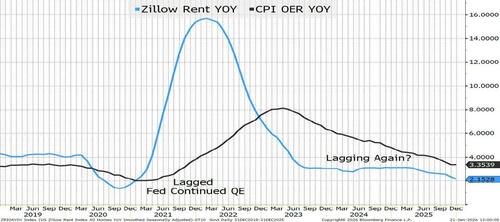

Had the Fed just looked at Zillow Rent, we would have cut off QE much sooner and probably started hiking sooner. Maybe, with the shutdown, and being forced to look at alternative data, the Fed will be more wholistic in their choice of data to be dependent on? OER is fraught with issues. (Only a portion of the market is evaluated each month, and the premise that most rentals are single family homes, is now ludicrous). Even the Cleveland Fed has developed a real-time rent estimate. Why not rely more heavily on that? Housing in CPI is currently overstated and will certainly come down in the next few quarters (just math). So cut now, rather than waiting for this particularly bad data set to conform to reality.

Maybe Truflation is on to something?

Truflation only attempts to capture part of the inflation story. But wow, it is telling a very different story than core PCE (the Fed’s preferred measure). I wouldn’t pay attention, except Truflation showed more inflation, sooner than CPI did back during time “transitory.” Again, had the Fed given this data set some serious consideration, we would have stopped QE earlier and hiked sooner.

The Fed should cut, but they won’t.

Electricity Inflation

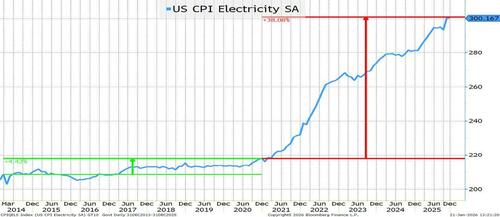

If you want to get a room with a hundred or more people engaged and focused on one topic, this is the chart to use (as I learned in Baltimore on Friday).

It has slowed of late (kind of, I guess), but is and will be one of the biggest issues politicians face in coming elections. Enough on that for now, but that is why our ProSec™ theme focuses on power generation, from solar, to coal, to gas, to fission, to fusion (I don’t see wind getting traction under this admin).

Does the EU Need Change?

The German Chancellor said that the EU was the “world champion of overregulation.” If you haven’t seen the Venn diagrams of who leads what between China, the U.S., and the EU, they are funny. There is overlap between the U.S. and China while the EU stands alone on “regulation.”

Hungary blocked the EU from sending a “joint statement” to the U.S. in response to Greenland. Sure, sticks and stones may break my bones, but joint statements will never hurt me, so it was likely to be an ineffective tactic to begin with. But sometimes ineffective is better than nothing. Hungary, at $220 billon of GDP, got to determine EU policy? I get inclusion, but this is going to be difficult if the “weakest” link has control, thereby elevating it to the “strongest” link.

You know that I felt Europe had “one job” in regards to Russia. Their job was to seize the frozen assets and come to the U.S. with “oodles” of money to spend on weapons for Ukraine (with no need to fund the purchases, etc.) Belgium said no. Maybe Hungary and Slovakia did too (can’t tell from AI or from memory).

Not saying that “might is right,” but if Germany and France and others are aligned, doesn’t that mean something?

No idea how Europe will react to so much of what is going on, though I think Europe is going to adopt ProSec™ far sooner than I had expected.

ProSec For Housing Affordability

We could do a whole section on housing affordability and we will. But today it is too cold and the report is already getting too long (though I somehow find myself in Palm Beach this weekend, so guess I should stop writing about the cold). So far, the evidence is largely anecdotal, but I’ve had several really encouraging discussion on this subject.

Production for Security has the potential to create jobs in areas that currently are not overly crowded and very expensive.

Some areas have a high cost of land. That makes it difficult to create affordable housing. While construction costs (especially the materials) don’t vary as much region to region, they do vary (especially labor).

If we can create pockets of new jobs in new areas, it could reduce the average cost of home prices in the U.S. without causing existing home prices to drop much.

That is the key – building new homes in areas that are less expensive to build in makes the average go down, without hurting existing home prices too much (there will be some drag as people move out of some expensive areas).

Just starting to explore this idea, but look at the housing boom that occurred in conjunction with the shale boom. 1Could we be at the early stages of a self-correcting housing affordability solution? New jobs in new areas?

Something to ponder (in a positive way).

ProSec Is Going Global After Davos

During the President’s speech/lecture/admonishment/address/whatever you want to call it, he did specifically say something to the effect of:

- The earths and minerals are NOT rare, it is the processed earths and minerals that are rare.

- This is the point we have been trying to make, and it seems like it is finally being addressed properly. The real bottleneck is in the processed and refined versions. See last weekend’s Production, Security, and Resilience for more on that.

For what it is worth, I think there is more to the Greenland and Venezuela story on rare earths and critical minerals. I think the “surprise” will be not just extracting more from these two countries, but also processing and refining more there. It fits the theme of keeping production of “things” we need in the Western Hemisphere where the U.S. has a renewed focus.

Bottom Line

Stay warm. The Fed won’t cut, but they should

January has been a long month already, only 11 more months to go until 2027.

Loading recommendations…