After Google’s strong report last week, there is some optimism that Meta will overachieve as well although as Goldman warned in our preview, caution seems to be prevalent. There is certainly some pressure on the advertising business to keep chugging along given how much Zuckerberg is spending on AI these days.

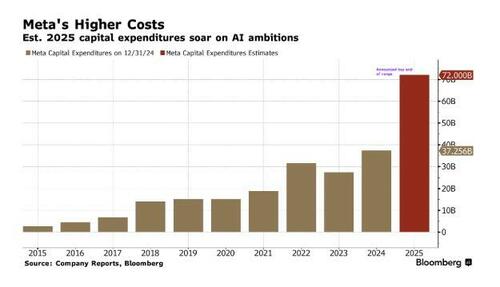

Which brings us to CapEx: as Bloomberg’s Kurt Wagner writes, he will be looking for any changes to Meta’s projected range for capital expenditures for the year, which is currently $64 billion to $72 billion. The company increased its CapEx range in April, citing the global trade disputes and its AI effort. Since then we’ve seen Zuckerberg invest more than $14 billion in Scale AI, throw nine-figure compensation packages at AI researchers, and talk about building multi-gigawatt data centers. It wouldn’t be at all surprising if this number moves higher, but it was ridiculously high to begin with.

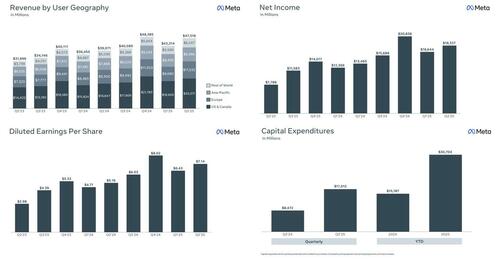

And sure enough it did, because moments ago META reported results that blew away expectations for the second quarter and gave a stronger-than-expected third-quarter revenue and full-year capex forecast, a sign the core advertising business is still growing quickly enough to support aggressive spending on artificial intelligence. Here is the breakdown:

- Revenue $47.52 billion, +22% y/y, beating estimate $44.83 billion

- Advertising rev. $46.56 billion, +21% y/y, beating estimate $44.07 billion

- Family of Apps revenue $47.15 billion, +22% y/y, beating estimate $44.4 billion

- Reality Labs revenue $370 million, +4.8% y/y, beating estimate $386 million

- Other revenue $583 million, +50% y/y, beating estimate $500.6 million

- Operating income $20.44 billion, +38% y/y, beating estimate $17.24 billion

- Family of Apps operating income $24.97 billion, +29% y/y, beating estimate $22.16 billion

- Reality Labs operating loss $4.53 billion, +0.9% y/y, better than the estimated loss $4.86 billion

- Operating margin 43% vs. 38% y/y, beating estimate 38.3%

- EPS $7.14 vs. $5.16 y/y, smashing estimate $5.89

Here is a visual recap of the results:

Other metrics:

- Ad impressions +11% vs. +10% y/y, estimate +6.91%

- Average price per ad +9% vs. +10% y/y, estimate +7.58%

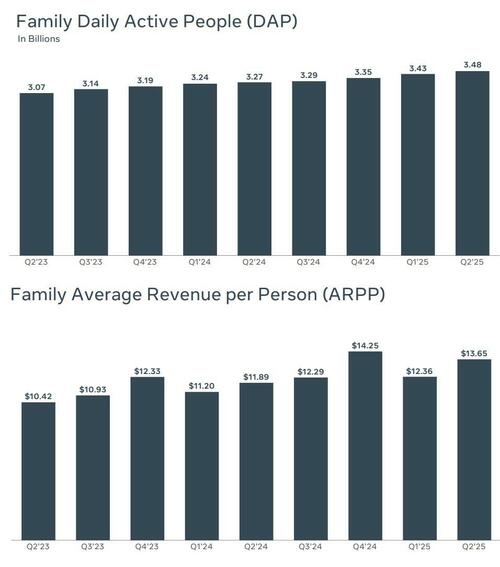

- Average Family service users per day 3.48 billion, +6.4% y/y, estimate 3.42 billion

According to META, its “family daily active people” metrics, whatever that is, hit a new record high of 3.48 billion per day, up 6% YoY, and beating estimate 3.42 billion. Because literally half the world is on Facebook every day, sure it is.

Outlook:

- META expects Q3 2025 total revenue to be in the range of $47.5-50.5 billion, higher than the average analyst estimate of $46.2 billion. The company said that while it is “not providing an outlook for fourth quarter revenue, we would expect our year-over-year growth rate in the fourth quarter of 2025 to be slower than the third quarter as we lap a period of stronger growth in the fourth quarter of 2024.”

- The company also said that full-year 2025 total expenses will be in the range of $114-118 billion, higher than the prior outlook of $113-118 billion and reflecting a growth rate of 20-24% year-over-year. META also said it sees 2026 year-over-year expense growth to be above 2025, and cited infrastructure costs and, obviously, employee compensation which is to be expected in light of anecdotes it is paying $100MM guarantees to AI scientists.

- Looking at the all important CapEx, META said it expects 2025 capital expenditures, including principal payments on finance leases, to be in the range of $66-72 billion, also higher from the previous estimate of $64-72 billion and up a stunning $30 billion year-over-year at the mid-point. The company said that it “currently expects another year of similarly significant capital expenditures dollar growth in 2026 as we continue aggressively pursuing opportunities to bring additional capacity online to meet the needs of our artificial intelligence efforts and business operations.”

And a word of caution in the CFO commentary as we look ahead to the holiday quarter:

“While we are not providing an outlook for fourth quarter revenue, we would expect our year-over-year growth rate in the fourth quarter of 2025 to be slower than the third quarter as we lap a period of stronger growth in the fourth quarter of 2024.”

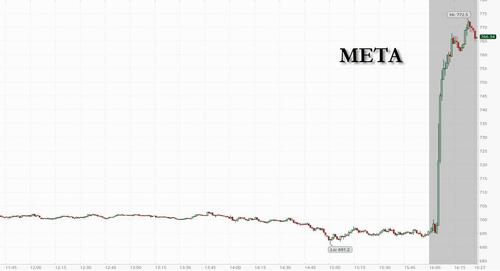

That however was hardly relevant to investors who saw the numbers and just couldn’t wait to get in, and the result is that the stock is now trading up10% to $770, a new all time high.

Investor presentation below

Loading recommendations…