With positioning at extremes (9/10 long according to Goldman’s trading desk), MSFT’s results tonight are market-makers (or breakers) and the bar was set high heading in.

There was no need to worry… lol!

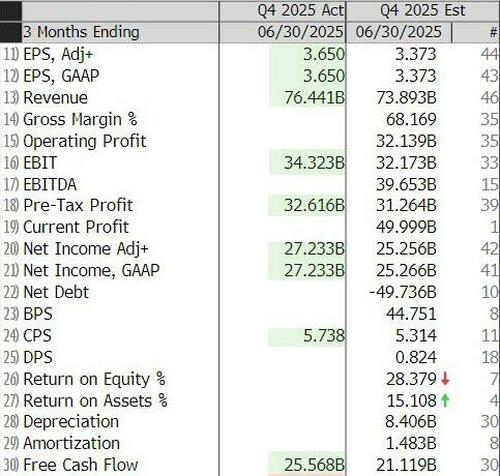

MSFT beat on the top- and bottom lines

-

*MICROSOFT 4Q REV. $76.44B, EST. $73.89B

-

*MICROSOFT 4Q EPS $3.65, EST $3.37

In fact MSFT beat on every line item:

While the last querter had analysts questioning MSFT’s CapEx spend as an indicator of a slowing pace of investment in AI, Q4 showed no signs of slowing…

- *MICROSOFT 4Q CAPEX INCLUDING LEASES $24.2B, EST. $23.17B

Under the hood, more beats:

-

*MICROSOFT 4Q CLOUD REV. $46.7B, EST. $45.96B

-

*MICROSOFT 4Q INTELLIGENT CLOUD REV. $29.88B, EST. $29.1B

“Cloud and AI is the driving force of business transformation across every industry and sector,” said Satya Nadella, chairman and chief executive officer of Microsoft.

“We’re innovating across the tech stack to help customers adapt and grow in this new era, and this year, Azure surpassed $75 billion in revenue, up 34 percent, driven by growth across all workloads.”

And this was the big one:

-

*MICROSOFT’S AZURE SURPASSED $75B IN REV. THIS YEAR, UP 34%

-

*MICROSOFT 4Q AZURE & OTHER CLOUD REV EX-FX +39%, EST. +34.2%

“We closed out the fiscal year with a strong quarter, highlighted by Microsoft Cloud revenue reaching $46.7 billion, up 27% (up 25% in constant currency) year-over-year,” said Amy Hood, executive vice president and chief financial officer of Microsoft.

MSFT shares are exploding higher after hours, up over 6%…

Extending the huge gains from Q3 earnings…

MSFT remains well positioned to capture a number of major secular trends (gen AI, public cloud consumption, SaaS adoption etc) and is relatively insulated from tariff considerations, making it a core long for many.

Loading recommendations…