Our friend, Lawrence Leopard, framed Friday’s Trumpian insanity about as well as possible:

Scott Bessent in the Oval Office:

SB: sir, we are losing the bond market, the Japanese 40 year is going parabolic and the US 10yr is creeping higher…

Trump: you’re the expert what do you recommend?

SB: sir, we need another tariff scare tohit the stock market and drive money into bonds. How about we hit Apple with 25% and the Europeans with 50%. That ought to do it.

Trump: OK let me just tell Lutnick so he can front run it.

Well, we don’t know how else to explain the Donald’s early Friday AM eruption on social media. He was apparently pissed off because his “art of the deal” posturing on trade has not produced the results he was delusionally expecting.

In response to the huge China tariffs, Apple has been frantically moving its production not back to the US of A as Trump has promised, but to India and Vietnam. So he took Tim Cook, Apple Inc’s CEO, to the woodshed, threatening a 25% tariff on Apple products brought into the US:

I had a little problem with Tim Cook yesterday. I said to him, ‘Tim you’re my friend, I treated you very good. You’re coming in with $500 billion, but now you’re building all over India. I don’t want you building in India,’” Trump said. “I said, ‘Tim, look, we’ve treated you really good. We’ve put up with all the plants that you built in China for years. Now, you gotta build in the US. We’re not interested in you building in India. India can take care of themselves. They’re doing very well. We want you to build here…

If that is not the case, a Tariff of at least 25% must be paid by Apple to the U.S.” he continued. Thank your for your attention to this matter!

Likewise, the potential massive “reciprocal tariff” on the EU-27 has not brought EU officialdom crawling to Washington on their collective bellies, chanting “Sir, how can we throw our powerful trade associations and unions under the bus to avoid your tariff wrath?”

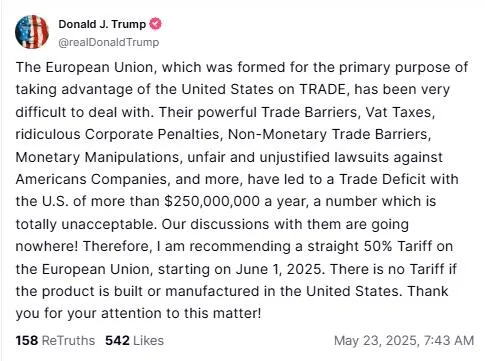

In fact, recent press reports from a wide range of sources indicate the the talks with Europe have produced virtually no progress. So the Donald let loose on Truth Social:

These outbursts are just more proof, of course, that Donald Trump has no idea whatsoever about what he is doing with his out-of-this-world TariffPalooza. He is just sliding by the seat of his ample britches, pursuing a simplistic protectionist theory of global trade he has held since the 1970s. Yet it is also one which entails shredding the Constitution with respect to the property rights of US importers and exporters alike—to say nothing of mocking the fundamentals of free market economics as taught by Milton Friedman, Hayek, Mises, Rothbard and numerous other sound economists—even the Keynesians, who tend to be mostly right on this issue.

Indeed, this latest outburst of 25% and 50% tariff threats against Apple and the EU, respectively, rests on no better predicate than the exchange depicted below.

Needless to say, the Donald’s underlying approach to global trade is that of a sharp-elbowed Bronx real estate developer. You take it as a given that property sellers, building contractors, government zoning officials, real estate lawyers etc. are all crooked thieves, meaning that you loose if they win. To avoid this unsatisfactory outcome you must therefore huff, bluff and threaten in order to set up a bargain where you get the better half of the pie.

In the case of global trade this Trumpian theory has a very simple application: Trade deficits mean that the other side is cheating and playing unfair via high tariffs, nontariff barriers and other interventions which tilt the playing field to the advantage of foreign competitors. The threat of hideously high US tariff rates, therefore, will cause them to concede their evil ways and strike a deal that promises to close the gap either by permanently higher tariffs on foreign goods or deep economic concessions from foreign governments.

Except. Except. The real world facts and empirical data do no support the Donald’s foreigners are “lying, cheating and stealing” theory at all. Of course, the world trade economy is not a perfect free market of Adam Smith’s design. There are distortions stemming from the statist policies of all countries—including the USA especially—-that deviate significantly from the norm of unhindered competition.

But those frictional variations are the result of statist policies pursued by all governments—capitalist, socialist and communist alike—that allegedly serve larger societal goals. For instance, central bank monetary stabilization, buy-national procurement standards, tax regimes that impact trade such as VATs, today’s world of sweeping health and environmental standards and, of course, traditional tariff barriers.

But here’s the thing. When it comes these free market deviations the US is as big a miscreant as almost every other major trading nation or block. In fact, the biggest distortion of free trade stems from central bank manipulation of financial asset prices, inflation rates and capital and money flows—a venue in which the Fed is the reigning champion.

Even on other NTBs (nontariff barriers) the US is not so simon pure. More than $800 billion of “buy America” requirements on Federal, state and local procurement towers far above similar NTBs among our trading partners. Likewise, the number one source of trade-distorting industrial subsidies in the world is the Pentagon by a long shot.

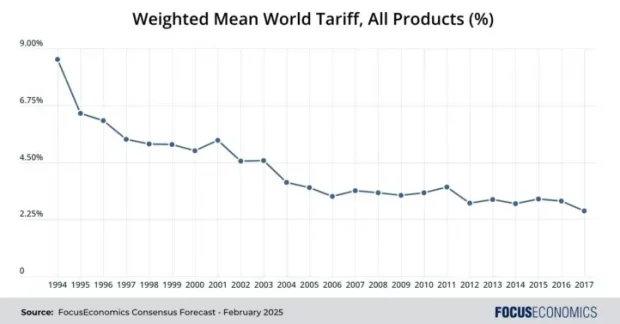

And when it comes to traditional tariff barriers, the truth is that’s a long gone issue of yesteryear. Since the early 1990s various rounds of both multi-lateral and bilateral trade deals have caused the weighted average tariff on merchandise goods traded on world markets to drop from around 9% to barely 2.0% at present. That’s nearly an 80% drop, and self-evidently an average 2% levy on imports is not evidence of market-distorting trade barriers in any way, shape or form.

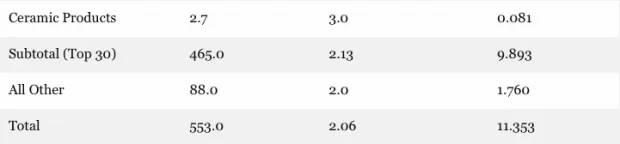

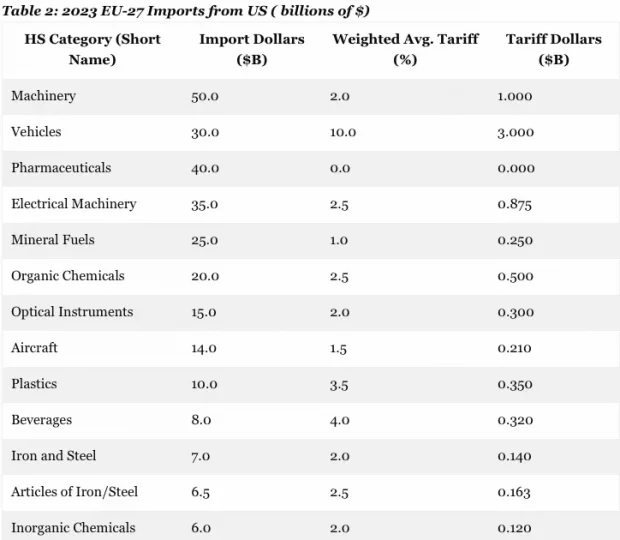

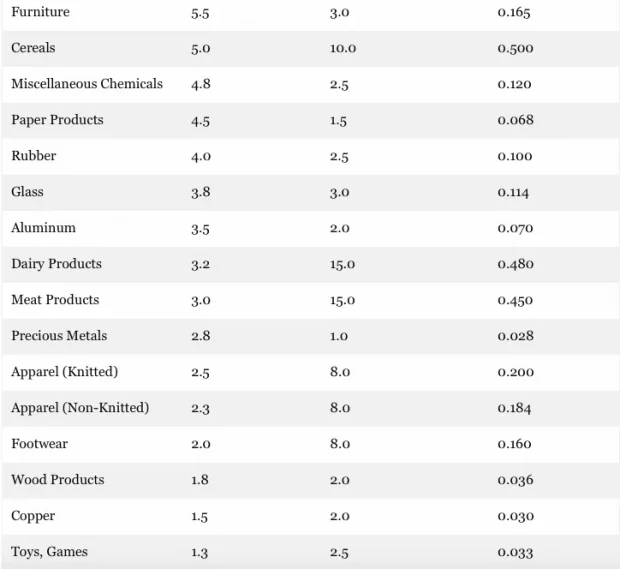

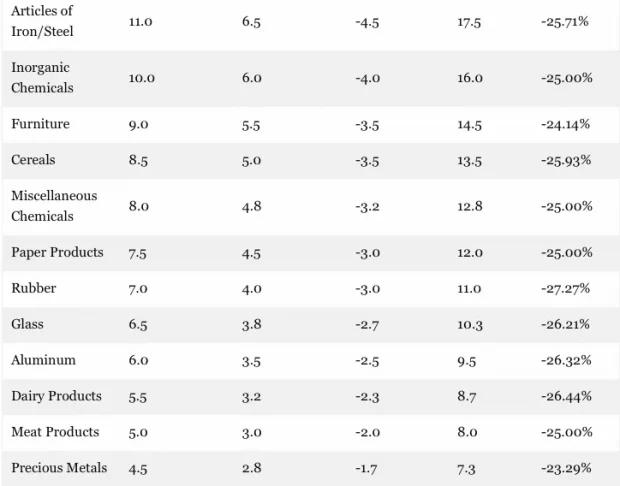

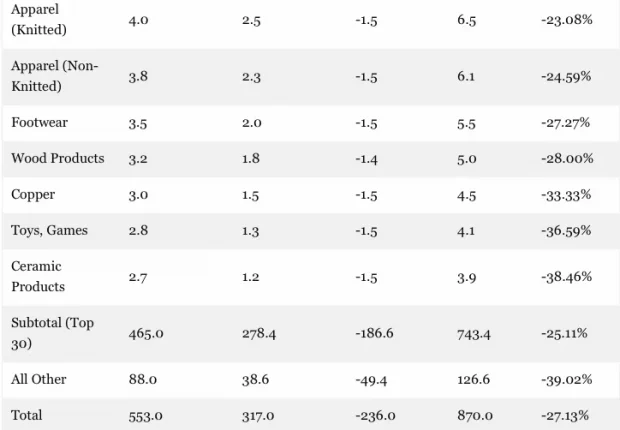

And, no, the US has not been “stupid” on the negotiated tariff-reduction front by lowering its tariffs by far more than other countries, as the Donald falsely contends. Yet to resolve all doubt, we asked GROK 3 to undertake the laborious task of computing the weighted average tariff on the top 30 categories of traded goods between the US and the EU, and to then compare these respective tariff rates to the trade surplus or deficit on each product group.

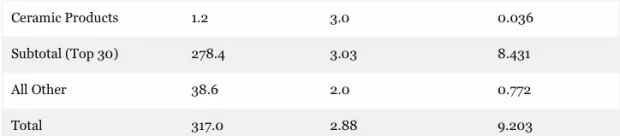

Needless to say, tariff barriers have absolutely nothing to do with the fact that in the most recent complete year (2023) the US imported $553 billion of goods from the EU-27, while exporting only $317 billion to these same trading partners. Accordingly, the yawning $236 billion US trade deficit with Europe amounted to 27% of total turnover of $870 billion.

Proof of the pudding that tariff barriers are irrelevant to this outcome and therefore are in no need of the Donald’s self-proclaimed “art of the deal” skills are these two bottom lines numbers. To wit, the US imposed a weighted average tariff of 2.06% on its imports from Europe, while the latter levied a 2.88% average duty on its imports from the USA.

In short, folks, there is not a snowballs’ chance in the hot place that a tiny 82 basis point difference in average tariffs accounted for anything, let alone the massive, quarter-trillion dollar US trade imbalance with Europe. These data are just a flat-out, screaming “no dice” answer to the Donald’s claim that the EU is a trade cheat on the fundamental matter of import duties.

Moreover, when you look at the individual categories, the story is even more unequivocal. For instance, the US had a $40 billion trade deficit with the EU on nonelectrical machinery alone, which amounted to nearly 29% of total turnover on this commodity group. But the EU tariff on nonelectrical machinery is just 1.00% versus the slightly higher US tariff of 2.25%. Again, our tariff is bigger than theirs, but both are so small as to amount to hardly detectable friction in this trading category.

Likewise, in the case of pharmaceuticals, the US had a $20 billion bilateral deficit with the EU, but in this case the tariffs are 0.0% on both sides. Similarly, in the case of aircraft the US tariff is 1.0% and the EU tariff is 1.5%. As it happened, the US had a small deficit of $4 billion or just 12.5% of turnover with the EU in the aircraft and parts category. Yet no reasonable person would think that this 50 basis points of difference on tariffs had anything to do with the outcome of the on-going battle for business between Boeing and Airbus on both sides of the Atlantic pond.

In the case of petroleum, refined products, natural gas and other mineral fuels, the small US deficit of $5 billion on $55 billion of two-way trade with the EU was not owing to onerous tariffs on the EU side, either. In fact, the EU tariff of 1.o% on trade in this product group was slightly lower than the US rate of 1.5%.

To take two more examples, the bilateral US trade deficit with Europe in optical instruments and organic chemicals is -$5 billion in each case. But in optical instruments the US average tariff of 2.5% is slightly higher than the 2.0% rate for the EU. Contrariwise, the tariff rates for organic chemicals are 2.0% on US imports from the EU versus 2.5% on European imports of organic chemicals from the US. And in both cases, of course, the fractional differences in tariffs surely have virtually nothing to do with the identical trade deficits incurred by the US.

Even in the Donald’s favorite hobby horse—automotive trade—it is not clear that the significant differences in tariff rates is the major explanatory cause of the $40 billion US deficit in that category.

The US tariff is 2.5% on passenger cars but 25% on trucks. So Europe-based global auto companies don’t ship any pickups or material numbers of SUV’s (save for Range Rovers) to the US but not because of the US tariff is a high 25%. The real reason for low volumes from Europe is that they simple don’t make many of these US style “light trucks” in their high fuel tax driven passenger car factories in Europe.

By contrast, they do send large volumes of highly engineered upper-end Mercedes, BMWs, Volkswagen’s and Porsche’s to the USA. But they sell millions of these per year here not because of the low US 2.5% tariff on passenger cars but because these European brands have taken the traditional luxury market from Cadillac and Lincoln via better products and better marketing.

At the same time, US auto producers excel in mass market pick-ups and SUVs, which account for 80% of production in US assembly plants. But the EU’s 10% tariff on autos is not the main reason US auto OEMs do not ship these products to Europe. The real reason is that there is scant demand for these US style “light truck” vehicles in Europe due, again, to high fuel taxes.

Besides, the auto trade deficit of $40 billion accounts for just 17% of the $236 billion US trade deficit with Europe. In volume terms, the bilateral auto trade with Europe of $100 billion amounts to just 11% of the $870 billion total two-way trade with the EU.

In short, tariffs did not have a damn thing to do with the huge trade imbalance with the EU that had the Donald on the warpath again on Friday morning. In Part 2, therefore, we will address and amplify on the real causes of the imbalance with the EU, China and the balance of the world.

The spoiler alert, of course, is that the underlying cause of the US trillion dollar annual trade deficit with the rest of the world has been manufactured not 10,000 miles away by untoward doings in Beijing, Tokyo and Brussels but a few blocks from the White House in the Eccles Building—-home of America’s rogue central bank.

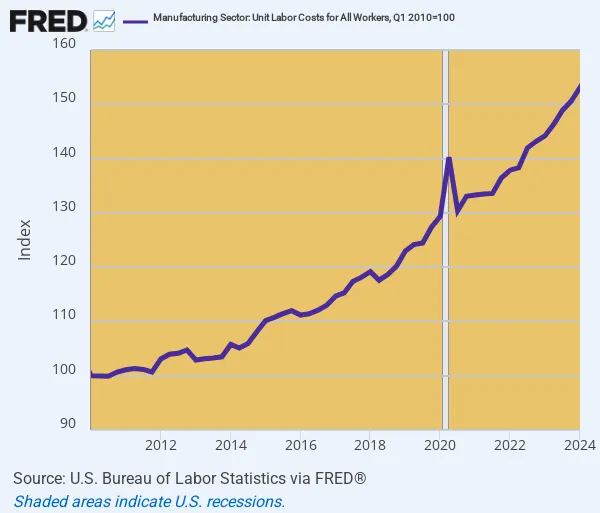

Owing to the Fed’s wrong-headed pro-inflation bias, unit labor costs in the US manufacturing sector have risen by 53% just since the recovery began in 2010. In a word, America’s industrial economy, trade balance and good paying jobs were not stolen by foreigners; they were driven abroad by the the inflationary excesses of the Washington politicians and policy apparatchiks.

Index of US Manufacturing Unit Labor Costs Since 2010

Table 1: 2023 US Imports from EU-27 ($ in billions)

Reprinted with permission from David Stockton’s Contra Corner.