Since the last FOMC meeting (on June 18th), stocks have soared and gold (and crude oil) have been sold while bonds and the dollar have trod water...

Source: Bloomberg

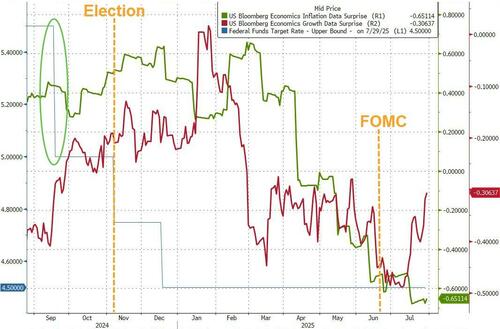

Most notably, while macro data has shown ‘growth’ has strengthened; ‘inflation’ has continued to fall, significantly…

Source: Bloomberg

Interestingly, while the voyage has been eventful, the market’s expectations for rate-cuts in 2025 is exactly where it was at the last FOMC meeting (just below 2 full cuts)…

Source: Bloomberg

Heading in to today’s FOMC decision, expectations were unequivocally for no cut today, with September signaled as better than a coin-toss for the next cut (though those odds were falling into the FOMC statement)…

Source: Bloomberg

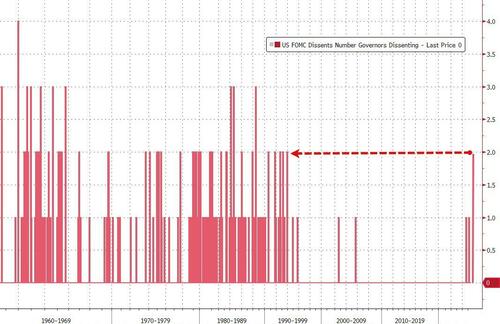

So, while expectations are for no rate-cut today, hints of future dovishness (in the statement as well as in Powell’s presser) are a key focus as the potential for the first double-Governor-dissent since 1993 is on the cards…

So, what did The Fed actually do (and say)…

The Fed held rates flat (as expected):

- *FED HOLDS BENCHMARK RATE IN 4.25%-4.5% TARGET RANGE

But see some weakness…

- *FED: ECONOMIC GROWTH MODERATED IN FIRST HALF OF YEAR

It’s a Double Dissent Day, dude!!

- *FED GOVERNORS WALLER, BOWMAN DISSENTED IN FAVOR OF RATE CUT

That’s the first time sine 1993…

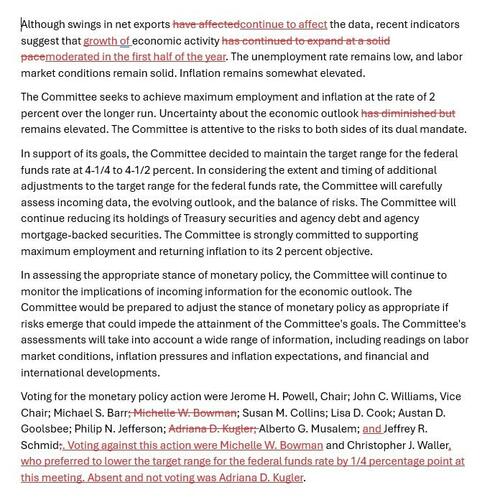

FOMC statement redline changes:

1) Replaced “economic activity has continued to expand at solid pace” with “growth of economic activity moderated in first half of the year”

2) Removed “diminished” from “uncertainty about economic outlook has diminished but remains elevated”

Read the full statement redline below:

Now, all eyes on the press conference to see if Powell can tread the fine line between claiming data-dependence and admitting he is basing his decision not to cut rates on ‘gut’ feel that tariffs are inflationary.

Loading recommendations…