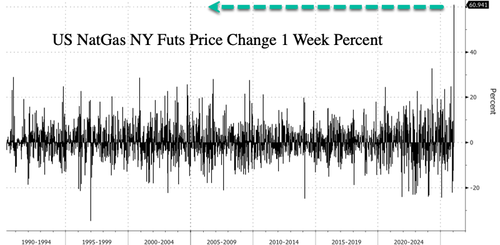

US natural gas futures surged as much as 75% over the past week, well above $5/mmBtu, driven by sharply colder weather forecasts (comparable to the 2021 Uri storm that paralyzed Texas’ power grid), ongoing production freeze-offs, and a vicious market trap for bears that unleashed epic short covering.

As of Friday morning, around 0645 ET, front-month NatGas contracts in New York fell 1.4% to $4.97/mmBtu, after surging 63% over the last three trading sessions.

Prices were still on track for the biggest weekly gain on record, with Bloomberg data going back to 1990.

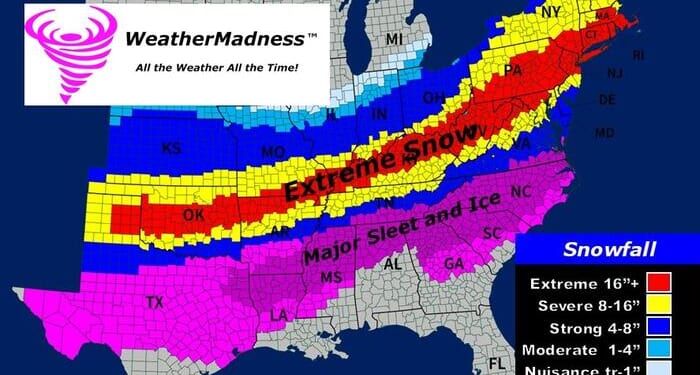

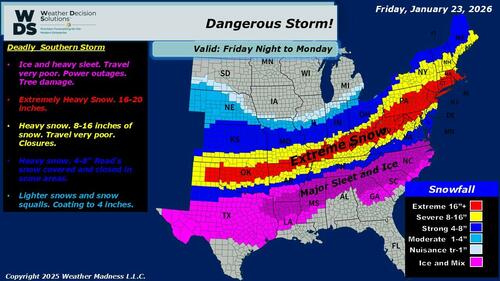

This week’s surge was largely fueled by below-average temperature forecasts across the Lower 48, combined with the threat of a potentially historic winter storm stretching from Texas to the Northeast.

Widespread winter activity across more than half the country has raised freeze-off risks, particularly in southern gas-producing states and Appalachia, while also stoking concerns about pipeline icing that could reduce volumes and pressure power grids this weekend and into next week.

Winter is Coming for Appalachia

This week’s Appalachian nat gas production is already down 1.1 Bcf/d versus last week, and the extreme cold is just getting started.Pittsburgh overnight lows are headed to -6.8°F at their most intense levels next week, with this cold coming in… pic.twitter.com/l2oyl80cfe

— Criterion Research (@PipelineFlows) January 22, 2026

Our reporting this week:

Samantha Dart, lead analyst on the Goldman Sachs commodities team, provided clients with critical color on the US NatGas market Thursday evening following a historic week of upside price action.

Dart was clear that the move in NatGas was purely weather-driven: prices surged amid sharply colder forecasts, production freeze-offs, and short covering. She said her desk views the spike as a near-term shock, with futures prices likely overshooting fundamentals rather than signaling a sustained rally.

She said that front of the curve rallied more than Summer 2026 (Sum26) contracts, highlighting two key risks:

-

Production outages might hit exactly when heating demand peaks and the system might fall temporarily short on gas

-

Storage path risks: Higher heating demand ultimately lowers overall storage levels, increasing the market’s vulnerability to tightening shocks during the 2026-27 winter.

Dart continued:

- We estimate that near-term deliverability risks are meaningful, even taking into account mitigating factors like gas-to-coal switching and the re-sale of gas by liquefaction facilities back to the grid. That said, we think this would ultimately be a temporary physical imbalance, likely to be reflected in very high cash prices during the tightening shock, rather than in a sustained rally in NYMEX gas. We think this is especially the case given the potential for strong Northeast production to help rebuild Gulf storage levels in the spring, as observed last year. As a result, while weather forecast shifts can keep price volatility elevated, prompt NYMEX prices seem to have overshot fundamentals.

She added that the upcoming storm (peak cold on Jan 26) is expected to create a temporary tightening, reflected in higher cash prices than NYMEX futures, similar to the 2021 Uri event, when cash spiked to $25/mmBtu while prompt NYMEX stayed flat.

Dart’s view is that prices post-storm and post-winter blast will return to the medium-term target, but stay above $3.50, and not exceed $4.

The full note can be found in the usual place for ZeroHedge Pro Subs.

Loading recommendations…