By Michael Every of Rabobank

“The unmoved mover” is ancient philosophy from Aristotle interpreted to mean ‘the divine’. For modern Mammon, it means a finance industry with siloed sector coverage grudgingly agreeing that the US is primus inter pares. But not always. Yesterday, markets moved a lot: crypto crumbled, again; stocks were down; and bond yields were up, as were silver and copper. What moved them most was perhaps Japan, not the US.

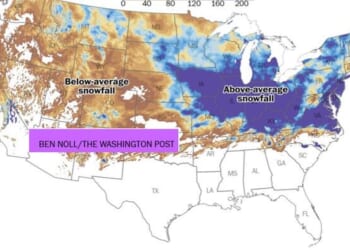

If you started working in markets after the late 90s, all you’ve known until recently is Japanese low/deflation and ultra-low or negative yields. Not anymore. Japanese CPI is around 3% and has been there for over three years: “transitory”? The 2-year JGB yields is 1.02%, as in 2008; the 10-year yield is 1.88%; and the 30-year is 3.40%, the highest this century and well into the previous. This is leading global bond yields higher just as ‘Japanification’ used to depress yields.

The BOJ is indicating it’s leaning towards a December hike. Yet JPY is still weak given the BOJ base rate is far below the level of inflation. Worse, decades of massive JGB issuance at ultra-low yields ensures higher yields raise questions about debt sustainability; but reversing BOJ course when inflation is high would weaken JPY further, which given Japan’s dependence on imported commodities, would push inflation up even more. Bloomberg called the 10-year JGB auction this morning “a global event” – though with firmer demand than the 12-month average it didn’t meet that top billing.

Market acting as if every JGB auction could be the last

— zerohedge (@zerohedge) December 2, 2025

Indeed, we live in a world full of global events, and most still revolve around the US: but not its monetary policy, rather its political, economic, and military statecraft.

Ukraine is saying there are still “tough issues” to be resolved to get to a peace deal, but the US revolver on the table may overcome them: the White House team is in Moscow to negotiate; Europeans are not at the table. That’s as Russia claimed Filipino troops are fighting in Ukraine(!); a test of its Satan II ballistic missile failed; a Chinese firm took a stake in a Russian drone maker; and Russia claimed it’s finally captured the strategic Ukrainian towns of Pokrovsk and Vovchansk. Europe is to revamp its border-control force and told the White House it won’t accept a pardon for Putin’s war crimes in any deal – but what if the US agrees one? The WSJ says ‘Trump’s Push to End the Ukraine War Is Sowing Fresh Fear About NATO’s Future.’ That all smells like a lot more military spending for Europe, and faster than timetabled; or a split between those who see it as necessary and those who think you can defend yourself with committees and acronyms.

In Latam, as Honduras’ presidential election vote is counted in a very tight race, Trump posted: “Looks like Honduras is trying to change the results of their Presidential Election. If they do, there will be hell to pay!” That’s after Trump had earlier named the only candidate he is prepared to work with. Welcome to the Monroe Doctrine.

Oil markets are monitoring Venezuela, where Trump has reportedly given Maduro a Friday deadline to leave the country as Caracas accuses the US of wanting to “take over its oil resources” and is seeking help from OPEC+: as Stalin asked, “How many divisions do they have?”

Elsewhere, Ukraine not only just struck another oil terminal, but may have attacked a ‘shadow fleet’ ship carrying Russian oil near Singapore. Who had ‘more global attacks on upstream commodity supply chains’ on their bingo cards? Those who listened to our 2026 Financial Markets Outlook.

Not being focused on by oil markets (yet) is Israel saying it will strike Iraq if Iran-backed militias there support Hezbollah, with whom tensions are again running high, as Israeli media also underline risks that Iran may try to attack it, for which Jerusalem is preparing a new spectrum of weapons – as the US warns Israel not to bomb Syria again, with which it’s now partnering against ISIS.

In broader geoeconomics, the Aussie spy boss warned businesses of “hacking, sabotage, and assassinations”;

The WSJ reports Chinese rare-earth dealers are finding ways to dodge Beijing’s export restrictions – is this “because markets” related to the US deepening rare earths supply chains with Japan, South Korea, Singapore, the Netherlands, the UK, Israel, the UAE, and Australia? That’s as European firms report debilitating impacts from rare earths restrictions – one saw it cost 20% of its global revenue, 40% see licensing process added two months-plus to delivery times, 38% expect significant disruption or production stoppages, 11% had to disclose sensitive IP info to get licenses, and 42% said once license is granted, there are further delays gaining customs clearance.

New survey shows the massive impact China’s rare earth controls are still having on EU firms

– One company said the controls cost 20% of its global revenue

– 40% said licensing process added 2 months+ to delivery times

– 38% expect significant disruption or production stoppages pic.twitter.com/zKuyAx3i34— Finbarr Bermingham (@fbermingham) December 1, 2025

Japan defense firms are seeing sales boom as Tokyo eyes the end of more export curbs – which will also help JGB yields rocket (as Bloomberg says, ‘Japan’s Inflation-Proof ‘Stan Economy’ Is Booming’);

Canada is to join the EU Security Action for Europe (SAFE) instrument (again, what did Stalin say?), as the EU will axe trade perks for countries that refuse to take back failed migrants, and its CBAM carbon border tax is criticized for going easy on ‘dirty’ Chinese imports because “Brussels got its math wrong on the carbon footprint of imports from China, Brazil and the US.”;

In politics, spot the pattern: ‘Germany’s far-right AfD attempts to rebrand as real power comes within reach’ (Politico); ‘German Mittelstand in turmoil after breaking taboo on meeting far’ (FT); ‘France’s business leaders scramble to shape far right’s agenda as election looms’ (Politico); and ‘One in four male Gen Xers now support One Nation’ (AFR). Elsewhere, the head of the UK fiscal watchdog was forced to quit after a pre-Budget info leak – so perhaps now won’t have to testify to Parliament about what happened; and the UK’s new far-left Your Party saw its first conference plagued with cries of factionalism, cliques, splittists, rigged votes, and exclusionary tactics – and decided on a 20-member ruling executive rather than a party leader.

In the economy, Aussie private sector wages just soared 6% y-o-y, outpacing profits: so, not “rate cuts!” then(?) On the other hand, the US financial press warns consumers are ‘losing patience’ with high car prices and are downsizing or opting for second-hand models, as ‘Gen Z Shoppers Aren’t Spending Like Retailers Need Them To.’

In Europe, the think tank Ember claims super-grid plans are threatened by a huge power line funding gap and that “80% of the EU power system is expected to miss the 2030 interconnection target.” The WSJ is blunter and more controversial: ‘Europe’s Green Energy Rush Slashed Emissions – and Crippled the Economy’, adding, “Political consensus is cracking, industry is hobbled and high-profile projects are being postponed thanks to some of the highest electricity prices in the developed world.”

In markets, new RBNZ Governor Breman told parliamentary select committee that she would be “laser focused” on the Bank’s core mandate of low and stable inflation, and she favoured greater transparency. Excellent. Except it’s transparent that we need to ask what a laser focus on low and stable inflation means when so many factors domestic and foreign can impact on it in so many ways and monetary policy has nothing to do with most of them. Tellingly, Powell spoke today and didn’t say anything at all for markets to mull over. Should we start to get used to it(?)

Look around and see that there is no earthly unmoved mover, be it Japan, or crypto, the Mag-7, or any central bank – even the Fed. They are all just part of a now systemic metacrisis.

Loading recommendations…