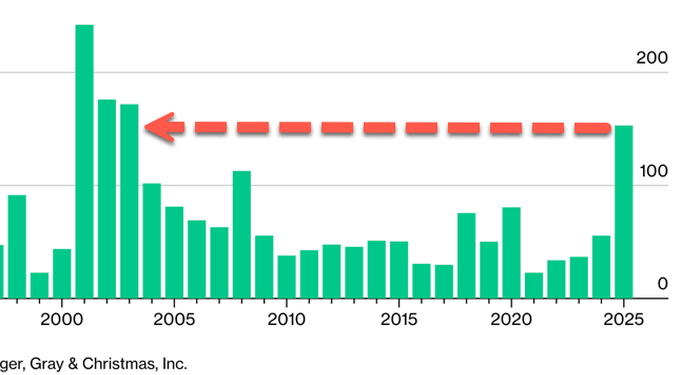

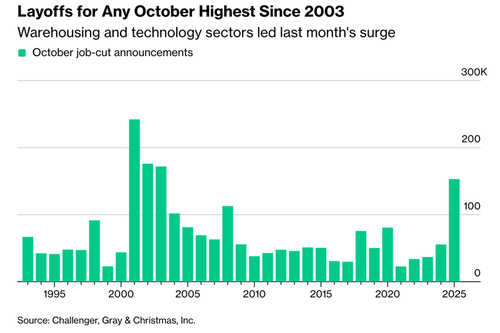

The U.S. labor market weakened considerably in October, with companies slashing 153,000 jobs, nearly triple last year’s total and the highest for that month since 2003, according to a new report from outplacement firm Challenger, Gray & Christmas.

Technology and warehousing jobs led the layoffs, mostly because companies are slashing folks who were hired during the pandemic-era overhiring period. Also, slowing consumer demand and rising costs are other contributing factors. Year-to-date job cuts have surpassed 1 million, the highest since 2020, while announced hiring plans are at their lowest level since 2011.

“October’s pace of job cutting was much higher than average for the month. Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes. Those laid off now are finding it harder to quickly secure new roles, which could further loosen the labor market,” said Andy Challenger, chief revenue officer for Challenger, Gray & Christmas.

Challenger continued, “This is the highest total for October in over 20 years, and the highest total for a single month in the fourth quarter since 2008. Like in 2003, a disruptive technology is changing the landscape.”

“Over the last decade, companies have shied away from announcing layoffs in the fourth quarter, so it’s surprising to see so many in October. With the onset of social media, and the ability for workers to share their negative experiences with their employers, the trend of announcing layoffs before the holidays fell away, a practice that seemed particularly cruel,” he said.

U.S. employers announced 153,074 job cuts in October, a 175% increase from a year ago and 183% higher than September. This is the worst October since 2003 and the biggest fourth-quarter total since 2008.

Which industries cut the most in October?

-

Technology: 33,281 cuts in October (up from 5,639 in September); 141,159 YTD (+17% y/y).

-

Warehousing: 47,878 cuts (up from 984); 90,418 YTD (+378% y/y) — signaling automation and excess capacity post-pandemic.

-

Retail: 2,431 cuts (slightly down m/m); 88,664 YTD (+145% y/y).

-

Consumer Products: 3,409 cuts; 41,033 YTD (+21% y/y).

-

Nonprofits: 27,651 cuts YTD (+419% y/y) amid federal funding losses and cost pressures.

-

Media: 16,680 cuts YTD (+26% y/y); News subset: 2,075 cuts YTD (down 41% y/y).

Reasons for the cuts:

-

“DOGE Impact” remains the leading reason for job cut announcements in 2025, cited in 293,753 planned layoffs so far this year. This includes direct reductions to the Federal workforce and its contractors. An additional 20,976 cuts have been attributed to DOGE Downstream Impact, which reflects the loss of federal funding to private and non-profit entities.

-

In October alone, Cost-Cutting was the top reason employers cited for job reductions, responsible for 50,437 announced layoffs. Artificial Intelligence (AI) was the second-most cited factor, leading to 31,039 job cuts as companies continue to restructure and automate. AI has been cited for 48,414 job cuts this year.

-

Market and Economic Conditions accounted for another 21,104 cuts in October, bringing the year-to-date total for this reason to 229,331, while Closings of stores, units, and plants resulted in 16,739 cuts for the month and 161,391 for the year. Restructuring was cited in 7,588 October announcements, for a total of 108,038 so far in 2025.

-

The Midwest logged 351 CEO exits year-to-date, up 6% from 332 in 2024. Illinois led the region with 72 CEO departures, compared to 57 last year. Indiana nearly doubled to 38 from 20, and Iowa rose to 23 from 11. Meanwhile, Ohio declined slightly to 61 from 71, and Michigan dropped to 29 from 41

Challenger data shows that the hiring outlook for the full year and in October darkened:

-

Planned hires: 488,077 YTD (down 35% y/y) – the lowest since 2011.

-

Seasonal hires: 372,520 through October – the weakest since 2012.

- Challenger expects no strong holiday hiring rebound, despite possible rate cuts.

The takeaway is that the labor market was already softening by late summer, as cost-cutting reshaped corporate labor structures amid the need to correct overhiring from the pandemic era in the era of increasing AI adoption. This is a clear sign of continued loosening in the labor market, in stark contrast to the Fed’s “gradual cooling” narrative.

And if the Challenger data is correct, the labor market has shifted into a low-hiring, high-firing regime, an unsettling development that could spell bad news for the economy.

This data may only suggest stronger views for a December interest rate cut. Goldman thinks so (read the report).

JPMorgan analyst note, “The market is weighing a weaker labor market and potential spending vs. evidence on the efficacy (and ROI) of AI plus productivity gains.”

Loading recommendations…