Oil trader Pierre Andurand ventured into the cocoa trade in March 2024, initiating a long position with an upside target of $20,000 per ton. He was banking on worsening adverse weather and disease across West Africa to crimp global supplies, but prices only breached $12,000 for a short time, and as of August, cocoa prices have slumped around $8,000, forcing Andurand to scale back his bullish bet.

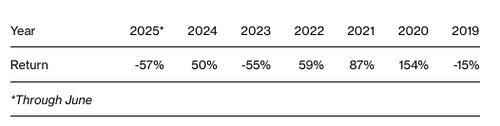

Bloomberg cites a new letter from Andurand to investors, detailing how a series of mistimed trades led to significant losses, with his fund down 57% by the end of June.

“Recent performance has been very disappointing,” Andurand wrote, adding, “Pierre Andurand has further reduced long cocoa exposure in all Andurand funds.”

Andurand began trading cocoa futures around March 2024, after spending nearly a decade primarily focused on trading crude oil and related products.

By April 2024, Andurand told Bloomberg in an emailed statement: “We believe we could break $20,000 later this year … and the year will finish with the lowest stocks-to-grinding ratio ever, and potentially run out of inventories late in the year.”

Yet while global grindings did sink lower, supplies remained stable as the worst-case scenario did not play out for the famed oil trader.

Here’s more from Bloomberg:

Initially, the analyst’s assessment of the market proved to be correct. By the end of February 2024, cocoa futures were already up some 50% for the year. Andurand’s firm initiated a small position in cocoa the following month, according to a letter sent to investors. By the end of 2024, bets on cocoa helped drive a 50% gain in his flagship Andurand Commodities Discretionary Enhanced Fund.

Those profits were short-lived. The fund dropped some 17% in January 2025 and nearly 25% in February, with losses driven by falling cocoa prices due to worries about demand, according to information sent to investors. The less volatile Andurand Commodities Fund is also down 26% through June.

In April, Andurand increased the fund’s bullish cocoa position in expectation that figures on bean processing set to be published later that month would drive up prices. The prediction proved to be correct, but the trading strategy nevertheless foundered amid the chaos caused by Trump’s so-called Liberation Day tariff announcement on April 2.

“In hindsight, if we had maintained the same positions throughout the month and not traded following Trump’s various announcements, the funds could have generated positive performance,” Andurand told investors. “At the time, it was extremely difficult not to react to Trump’s tariff announcement.”

Cocoa markets are thin and illiquid, unlike oil, something Andurand has likely learned the hard way, as large positions are difficult to manage.

Andurand has not totally cut his bullish exposure to cocoa. He explained in the letter: “Our top conviction today is that we will see higher cocoa prices. The majority of our risk remains in cocoa given our fundamentally bullish view.”

Ole Gjolberg, a professor at the School of Economics and Business at the Norwegian University of Life Sciences, told Bloomberg, “Cocoa is not like the markets that Andurand has been in before, like oil and gas and metals. So that’s also part of the risk picture. If you’re going in big you can be stuck with your positions.“

Loading recommendations…