Two weeks after Travis Stice, CEO of shale giant Diamondback Energy, warned that the US energy industry “is at a tipping point” and – more ominously – that US shale output has finally peaked (resulting in Diamondback slashing its capex budget as Saudi Arabia launched the latest OPEC+ price war), we now have confirmation that the CEO was right.

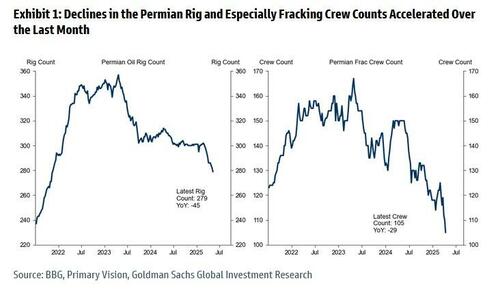

As Goldman commodity strategist Yulia Grigsby writes in her latest Oil Tracker note, amid continued declines in oil prices, there was a silver lining: namely that US total rig and frac spread count continued to decline quickly, especially in the Permian, -14% and -22% from year ago, respectively, as shown in the chart below.

Grigsby speculates that while the Permian activity slowdown may partly reflect the preservation of the best inventory rather than wells shutdowns, oil fields with higher breakevens, e.g. North Dakota shale, are also planning to reduce drilling activity.

And, having previously taken stock of Q1 earnings reports, we remind readers that several high profile public producers already reduced their drilling and completion activity on the back of lower prices and most producers reduced their 2025 capex guidance. As a result, Goldman expects the crude production in the US Lower 48 to decline by 0.4mb/d by 2026Q4 from 2024Q4.

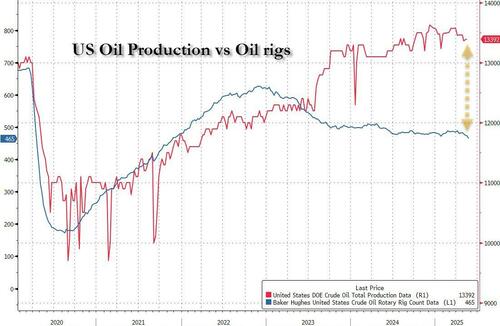

Incidentally the latest Baker Hughes data showed that rotary rigs in the US tumbled by another 8 in the latest week…

…and are now down to a 4 year low of 465 as the industry enters crisis “cash conservation” mode.

But one doesn’t have to believe in “peak oil” to expect further US production declines: regulation and sharply higher extraction prices may suffice to send the price of oil surging.

According to Bloomberg, Texas regulators are warning that wastewater from fracking in the biggest US oil basin is causing a “widespread” increase in underground pressure — a development that risks hindering crude output and harming the environment.

Shale oil wells in the Permian Basin generate millions of gallons of chemical-laced water, which drillers then pump back into the earth. Landowners and activists have said for years that this process causes toxic leaks. Now the state’s powerful oil and gas regulator, the Railroad Commission of Texas, is acknowledging the scale of the problem and imposing restrictions that could increase crude production costs.

Chevron Corp., BP Plc, and Coterra Energy Inc. as well as water management specialists Waterbridge Operating LLC and NGL Energy Partners, are among the companies that have received notices about the pressure issue from the Railroad Commission of Texas, according to a Bloomberg News review of public records. The RRC sent the messages to companies applying for new wastewater disposal wells.

Producers began injecting more water into shallow rock formations roughly five years ago after pumping it deep below the surface was found to trigger earthquakes. But the volumes are now so large that the dirty water is breaching wells and causing the ground to swell and rupture, threatening to contaminate drinking supplies for people and livestock.

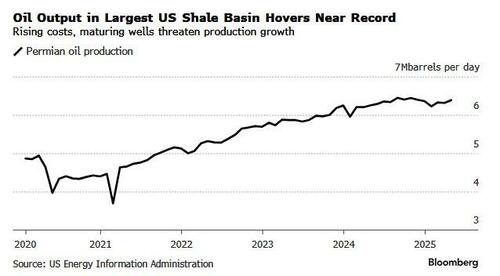

Potential restrictions on both deep and shallow injection zones could mean producers will have to pump their wastewater farther afield, increase recycling or pay to clean it up. All of these options would add to costs in the Permian, which accounts for about half of America’s total crude production. It would be the latest blow to US producers already grappling with low oil prices and a shrinking inventory of top-tier drilling sites, despite President Donald Trump’s pledge to unleash US “energy dominance” by backing fossil fuels.

According to Bloomberg, the RRC has updated its standard language in the letters to producers in a nod to the severity of the problem. It now says that disposing wastewater into the Delaware Mountain Group rock formation in the prolific western part of the Permian “has resulted in widespread increases in reservoir pressure that may not be in the public interest and may harm mineral and freshwater resources in Texas.”

“Drilling hazards, hydrocarbon production losses, uncontrolled flows, ground surface deformation, and seismic activity have been observed,” the commission says.

Guaranteeing that US oil output will slide, starting next month, the RRC will place limits on water-pressure levels due to “the physical limitations of the disposal reservoirs.” It will also require operators to assess old or unplugged oil wells within half a mile of the disposal site, twice the previous distance.

The RRC’s staff has been studying issues related to wastewater disposal for several years, spokesperson Bryce Dubee said in an email.

“Let there be no doubt that our work and analysis to protect residents and the environment in West Texas has been happening for years and will continue,” Dubee said. The commission conducted a two-hour webinar on Thursday to explain its new guidelines for permitting saltwater disposal wells in the Permian.

Permian Basin oil production has soared over the past decade to about 6.7 million barrels of oil each day, more than the output from Iraq and Kuwait combined, and in some views has become a global swing producer. But for each barrel of crude, it produces three to five barrels of water that contain so much salt and toxic materials that pumping it back underground is the only cost-effective disposal method.

The shallow disposal zones, located between oil-rich layers of shale and the surface, consist of porous rock that can absorb water. But the 100-year history of crude production in the Permian means they are perforated with thousands of well bores, some up to a mile deep. Because of higher water pressure, fluids are now breaking through to oil drilling areas and old wells that were either abandoned or poorly cemented shut decades ago.

The regulator’s tighter restrictions come just weeks after Coterra was forced to halt some oil production in Culberson County, Texas, after waste fluids leaked into its wells. Executives said the problem was localized and could be fixed by strengthening the protective casing around its wells.

Coterra is remediating the affected wells but did not give an expected completion date. The company said it doesn’t expect the issue to affect its long-term reserves.

“We thought we were well calibrated,” Blake Sirgo, Coterra’s senior vice president for operations, said on a call with analysts May 6. “Sometimes the oil field still surprises us.”

One person who’s not surprised is Sarah Stogner, the district attorney for three West Texas counties in the Permian Basin. She’s been warning of rising subsurface pressure since 2021, when a landowner noticed oil and gas oozing from old wells on her property that had sat idle for decades. Stogner, then a lawyer for the landowner, publicized the case on social media, calling them “zombie wells.” Over the next few years, several more wells blew out in the area, with some ejecting toxic fluids more than 100 feet in the air for several days.

“These were old fields that suffered from a lack of pressure for decades,” she said. “Suddenly we were seeing pressure where it shouldn’t be. It was clear even back then there was a field-wide problem.”

The RRC mostly ignored her appeals for a thorough investigation, she said. Its elected commissioners, whose campaigns are largely funded by the oil and gas industry, framed the issue as primarily a plugging problem, claiming that old and abandoned wells had been improperly cemented shut, or not at all.

But it’s now becoming clearer that the underlying problem is too much wastewater injection.

One blowout near Imperial, Texas, gushed toxic water high in the air for two weeks and had to be cemented shut in 2022. Researchers at Southern Methodist University later found the ground around the eruption site had been steadily bulging for three years, eventually rising 40 centimeters (16 inches) before it burst open. Wastewater injection volumes several kilometers away “strongly correlate” with the ground movement, they said in a paper published in July 2024.

SkyGeo, an analytics company that uses radar to track ground movements, reached a similar conclusion.

“The injection of saltwater causes this unnaturally high pressure, and then it’s going to find weak spots to come out,” said CEO Pieter Bas Leezenberg.

The RRC said its new permitting requirements will “ensure injected fluids remain confined to the disposal formations to safeguard ground and surface fresh water.” To Stogner, the measures are an admission that toxic water leaks are a serious problem for the regulator, and for the Permian Basin. “They just completely ignored us,” she said. “But now they cannot deny that it’s happening.”

And with that, oil producers will no longer be able to sweep the toxic problem under the rug – or ground as it may be – and since the mandated changes will require millions if not billions in additional spending to comply with regulations, which means all-in production costs are set to soar, and since oil prices will only continue to slide, we are about to see a wholesale shutdown of the Permian, and – as because the commodity cycle never fail – all the excess production in the US will turn into a deficit, sending oil prices soaring as the commodity bullwhip effect comes home.

Loading…