It’s a very ugly morning for Oracle.

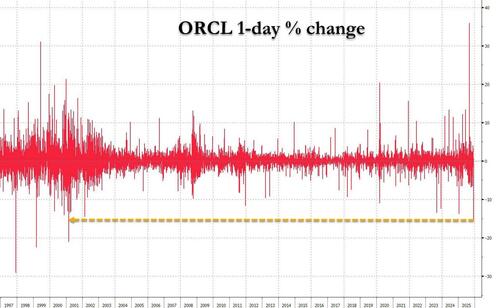

The company, once viewed as a bellwether of the AI investment boom, and which plunged as much as 40% from its September highs ahead of earnings amid fears (first discussed here) how it would fund its massive future spending plans – and which prompted banks to downgrade its debt as it became clear that Oracle would have to issue massive amounts of debt becoming the “first AI domino to fall”, was down 16% early this morning, losing $100 billion in market cap. It was the biggest one-day drop since the bursting of the dot com bubble.

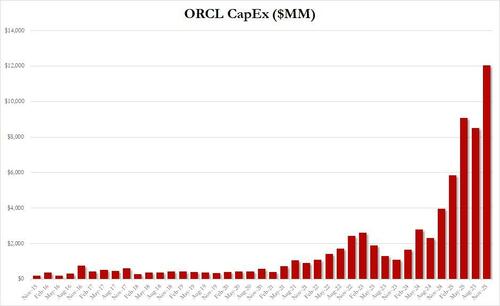

The reason, as we pointed out yesterday after it ORCL reported Q2 earnings and when the stock was still trading well north of $200 (it no longer is), is that capex, at $12BN, came in far hotter than the $8.8 consensus estimate…

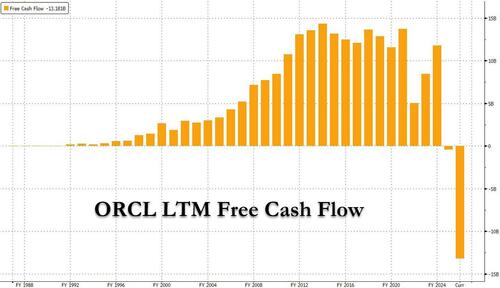

… prompting renewed questions how this company, whose free cash flow just hit a record low, will fund all this future spending.

This is how Barclays credit analyst Andrew Keches framed the results (in a note available to pro subscribers):

FCF burn worse than anticipated: FCF (pre-dividend) was -$10.0bn in the quarter, driven by a drag in working capital and higher than anticipated capex spending, as the FCF-burn has now surpassed consensus expectations for FY26 through just two quarters. Net of dividends, the YTD FCF burn is -$13.2bn, which we model will grow to a $28bn burn by the end of this fiscal year. The dividend was maintained; though we did not expect a dividend cut, many investors had asked about the potential of one into earnings. Gross and net leverage moved from 3.0x and 2.7x to 3.4x and 2.8x, respectively, following ORCL’s $18bn issuance in October, with its debt balance growing to $108bn from $91bn last quarter, and its cash balance increasing from $10.4bn to $19.2bn.

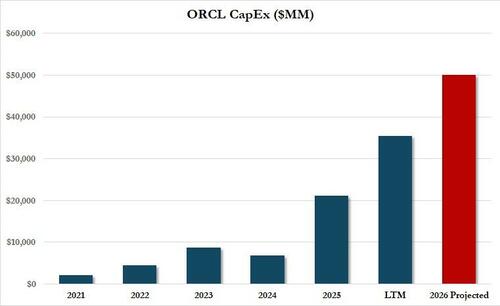

And then, the stock selloff accelerated during the earnings call when the company shocked investors – who clearly have lost their appetite for ridiculous capex spending plans at a time when the entire AI space is in flux – by raising its CapEx projection for 2026 an incremental $15B to $50BN to build capacity for the $68B in new contracts booked in Q2.

Adding insult to injury, Barclays wrote that “the FY26 capex number is higher than previously anticipated, and suggests upside risk to the 2027/28 guides. For context, the FY26 guide of $50bn is flat to current FY27 consensus.”

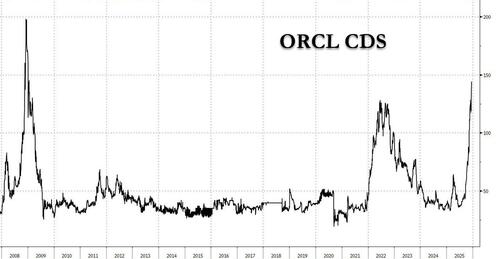

That’s when the bottom fell off the stock as investors were promptly reminded of Barclays calculation from a month ago (when the bank downgraded ORCL bonds and recommended buying its CDS), that unless something changes, Oracle “would run out of cash by the November 2026 quarter, implying substantial funding needs.“

The only thing that changed is that the cash burn became even bigger.

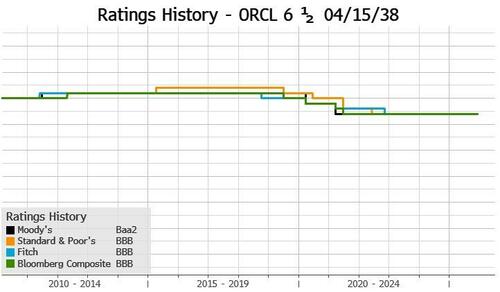

Which also means that the company’s debt-funded needs will be even bigger, and it’s why management on the call, went so far as to emphasize its commitment to Investment Grade ratings (currently rated Baa2/BBB, meaning it can be notched lower just once before it goes junk and all hell breaks loose), while laying out a variety of different funding sources including public debt markets, bank markets, and private debt markets, as well as vendor financing and leasing models (unclear if going all in on off balance sheet gimmicks is what the market wants here, but we’ll cross that bridge in time).

The company also discussed scenarios where customers may supply their own chips to be installed in the data centers (a “Bring Your Own Chips” approach) which can reduce capital intensity. Management added that it expects its funding needs to be less than $100bn, if not substantially less in some cases. We would take the over.

Goldman Delta-One head Rich Privorotsky dedicated half of his note this morning to Oracle, whose results were so shocking they offset the market’s entire positive mood from the Fed’s dovish cut, and sent futures tumbling as much as 1%, to wit:

I’m genuinely surprised and think a few had started to get more constructive… the idea that ORCL might use this report to alleviate some of the market concerns around spending and balance sheet. Last night was precisely what the market didn’t want… disappointing performance and rapidly rising capex. We’re back in the nexus of credit concerns and that explains the magnitude of the equity move. As I’ve argued, the picks-and-shovels trade has become erratic… volatile… and without clear leadership. Flows have been migrating to broader pockets of the market and the leadership has been more pro-cyclical and in financials. Watch credit today.

Going back to the latest note from Barclay’s Keches, whose analysis was one of the catalysts to trigger the ORCL meltdown a month ago, this is how he summarizes the bigger picture:

Our view on Oracle is unchanged and we reiterate our Underweight rating on the credit. We think it is important to call out that management answered the market and addressed the balance sheet rather explicitly on the earnings call. A commitment to IG ratings is arguably the most meaningful financial policy that ORCL has ever given (more so than the Cerner buyback cap/leverage target). While one could argue that keeping IG ratings is a minimum expectation at this point (“how can you really fund this as a BB?” is a very frequent and fair question), it is positive nonetheless. Framing the funding needs as being less than $100bn (or potentially much less) is also positive for credit in that it provides a goalpost.

Our concerns are that capex is running at a higher base in 2026 which we viewed as a less impacted year given the phasing of the revenue ramp being larger 2028/29. With 2027 consensus at $50bn, flat to the new 2026 guide, we continue to think there is upside to capex. To be clear, management is adjusting its approach and offering a “BYOC” option to customers which would reduce its capex (albeit from a potentially higher-than-expected base line). While this would ease the cash flow dynamics, we are unsure what it would mean for margins and earnings power if ORCL is no longer providing the hardware for certain customers.

Net net, we see a mixed set of credit implications and maintain our Underweight rating. With spreads having rallied 15bp into the results, we expect earnings to be somewhat of a “sell the news” dynamic rather than a clean clearing event for bonds and CDS. We recommend buying 5y CDS (121/128bp pre-call); the company noted that it will consider bank financing as an option which suggests that hedging demand could increase, as could non-traditional demand if vendor financing activity picks up. The stock is also down ~10% post market (as of writing) which should weigh on spreads given the correlation of those products.

The market listened: ORCL CDS is blowing up this morning, wider by about 17 bps, surpassing 140bps and at levels last seen during the global financial crisis.

Much more in the Barclays FICC research and Goldman equity research notes, both available to pro subs.

Loading recommendations…