By Peter Tchir of Academy Securities

pAIn Ahead

We are barely off the record highs for the market, but the market has been acting peculiarly lately.

Maybe it is the lack of “official” data (we didn’t get NFP on Friday), or maybe it is because of the data that we have been getting. I honestly cannot remember the last time “Challenger, Gray, and Christmas” was mentioned as much as it was this week.

Let’s quickly run through a few things that have seemed peculiar, or even downright weird.

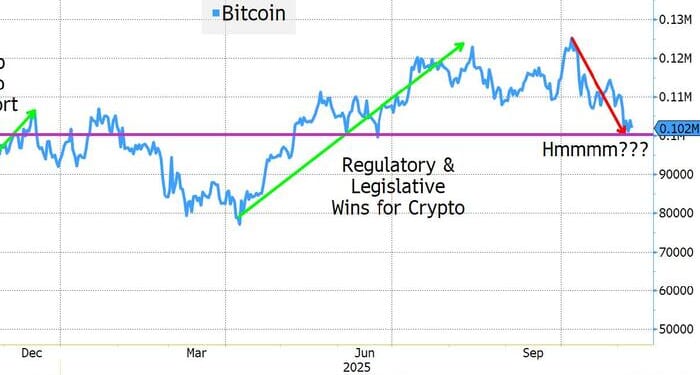

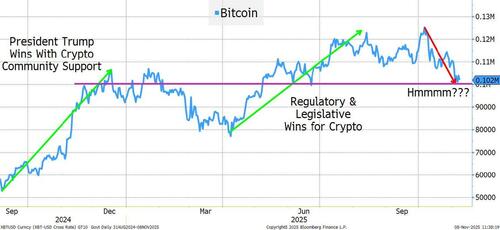

Bitcoin

I think it is safe to say that everyone keeps an eye on Bitcoin as a barometer for risk assets, especially on weekends, when markets are closed, but the news flow doesn’t stop.

Like most other risk assets, Bitcoin struggled as the admin focused on tariffs, culminating in the Liberation Day launch. Ultimately, little of the Liberation Day announcement came to pass, and risk assets responded strongly to backing off on tariffs, and a slew of other policies designed to support markets and the economy. The AI spending has played a major role in the economy and markets.

Over the years, the T-Report has used ARKK as a measure of performance for “disruption.” Year to date, it has crushed even the mighty QQQ (up 42% versus 20%). But since the morning of October 31st, it is down 10%, and was down 13% at the lows on Friday.

These moves “suggest” there could be a shift in tone and sentiment out there. Or at least in risk tolerance.

Retail Dip Buying?

So far this year (and possibly last year, and the year before that, and even the year before that), retail has stepped in to buy the dip.

Most noticeable was the dip buying as the admin changed their tune on tariffs, and pivoted to other policies.

We certainly saw some dip buyers this week. We will continue to see that. Wednesday had a shaky start but ground higher (at least until near the close, when there was a decent sell-off). On Thursday, the dip buyers tried, but failed, as we closed near the lows. On Friday, we finally saw a successful response to dip buyers. Was that the “all-clear” sign or a feeble attempt that won’t hold?

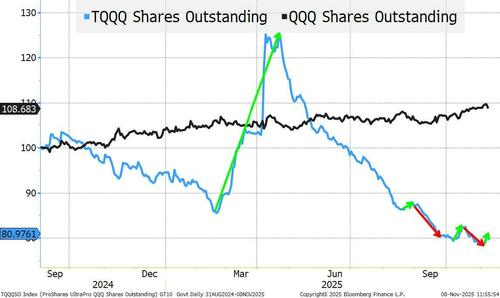

I’m not sure, but TQQQ (a triple leveraged QQQ ETF), is one of the first places I look for evidence that retail was driving this bounce.

Since the end of August, the Nasdaq 100 is up almost 6%, despite only brief, and relatively small, inflows into TQQQ.

Is the narrative that “retail” is chasing/driving this market real?

Or have “professional” investors latched on to that as an excuse/reason to be fully invested despite questions about “valuations”?

Was Friday retail buying the dip or pros covering shorts? I saw multiple comments late on Friday that the “most shorted” stocks were leading the charge higher, which seems more like a “pro” move than a retail move?

Volatility

VIX got as high as 22 on Friday. That wasn’t as high as it hit the Friday when it looked like China was cutting the U.S. off from rare earths and critical minerals and we were going to retaliate with 100% tariffs, but it caught my attention.

VIX has been creeping higher for the past two weeks, even when stocks were hitting new highs.

Yes, it could be that VIX was rising as everyone was loading up on bullish bets into year-end via options (we have seen that behavior before), but it didn’t have that feel.

In fact, I’ve been intrigued by realized vol.

10-Day realized vol has risen to about 20. It is worth pointing that out because:

- VIX, if there is real “fear” being priced in, can trade well above realized vol, an indication of people paying up to get protection.

- Rising volatility (and just as important, shifting cross-asset correlations) can cause any sort of “risk parity” strategy to de-risk.

Not sure we are at the point where we see any meaningful de-grossing of risk, but it is certainly worth watching, especially if it was professional investors (with stop losses) getting long on Friday rather than retail (which tends not to be forced into stop loss “discipline”).

More on “Sentiment”

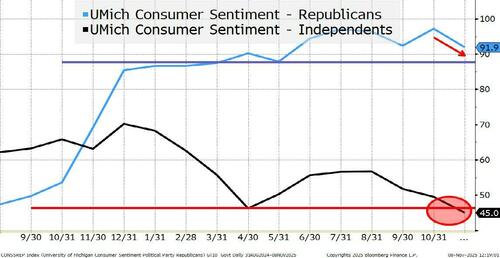

There are only two things I looked at in Friday’s CONsumer CONfidence.

I want to know how Republicans are viewing the economy and how independent voters are viewing the economy.

Republicans are still more positive than they were in April. That is positive, though the direction is not great.

Independents are below where they were during peak tariff concerns.

That seems worth mentioning. It meshes with something I think I’m seeing in my social media streams.

I am not naïve and fully understand that Twitter tries to feed you stories it thinks you want, or wants you to want. Even trying to stick to people you follow is fraught with the risk that your stream is biased. I’m aware of that, hence why I’m tentative to even mention this.

But I’ve been noticing (in the comments) a change in support/pushback on the admin. Comments are subject to heavy “bot” usage. Really easy to program a bot to respond to tweets. It is more difficult to tell bots from real people as AI has made the bots sound more real. So, take this assessment with a grain of salt, but I’m seeing a lot more pushback, especially when it comes to inflation.

On “Twitter” inflation, I think you get a real reflection of what people think inflation is, rather than what the BLS tries to tell us it is. People know what they spend money on, and how much it costs (a sentiment that seems to be showing up in some recent fast/casual dining announcements).

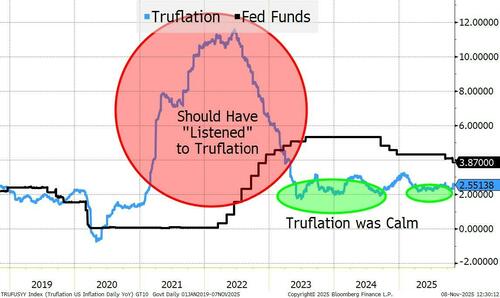

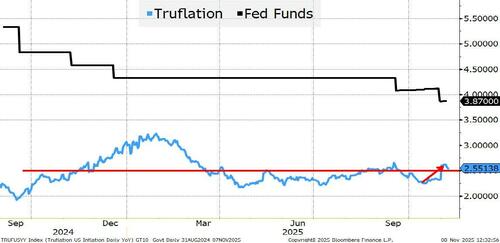

This is why so many people have been pounding the table about alternative measures of inflation. Truflation was way ahead of spotting inflation while the Fed actually continued with QE. We were doing QE even as were discussing possible hikes. Still seems bizarre to me.

Truflation is also why so many people thought the Fed could cut sooner and more.

Truflation is creeping back above 2.5%. CPI is coming down (in no small part that it is finally capturing rent declines well after the fact, and so many other calculations remain dubious at best).

If you are worried about inflation going back up, Truflation seems to be reflecting that possibility.

Also, with over $200 billion of tariff revenue collected, we are starting to get more evidence (still sparse and still small) of tariffs impacting prices. In a world where no one wants to attract attention to their company on anything related to tariffs, expect more to come (regardless of how the Supreme Court rules on some emergency powers and tariffs).

Inflation and Electricity Inflation are already topical and may have influenced last Tuesday’s elections – these issues, especially electricity inflation, are likely to grow in importance.

Which Brings Us To Bonds

The Challenger layoff announcement “saved” Treasuries on Thursday.

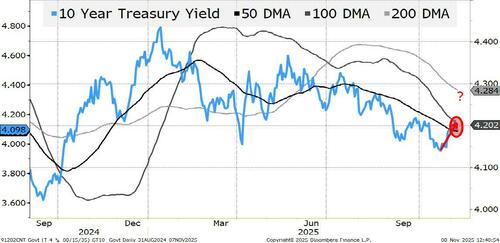

I’ve been very comfortable with rate cuts and longer dated yields, but for now, I think the next move is to higher yields.

The Fed will not cut because of Challenger (I have yet to see a study showing it is a reliable indicator of much). ADP, on the other hand, came in at 42k. Disappointing, but in line with some estimates of “replacement” rate (the number of hires required to keep the unemployment rate stable).

There is some concern amongst some Fed officials, which I agree with, that inflation is very stubborn here.

While the admin will not allow 10s to “get out of control,” 4.3% (the 200-day moving average) seems like a reasonable short-term target.

Rising yields also fit with my concerns about risk parity potentially being forced to de-gross.

While generally I’m comfortable with credit spreads, I could see the next 10 bps in spread (CDX or Bloomberg Corporate Bond Index OAS) being wider rather than tighter.

Bottom Line

Sticking to our ProSec™ (Production for Security) themes. See any of our recent reports at Academy Macro. In case you missed it, here is a replay of Investing in a Pre-War World. It is relevant to governments, corporations, and investors. Secretary of War Hegseth had some recent comments that fit this “Pre-War” concept very well.

With seasonality favoring a push higher in stocks it is difficult to be too bearish, but the combination of things is making me cautious, even on some ProSec™ names, which have become part of the “momentum” trade:

- Realized volatility is rising and cross-asset correlations seem to be shifting – creating the potential for a de-grossing/de-risking event.

- Yields seem at risk of a reasonably large (25 bp) move higher on 10s.

- The “retail is buying the dip” narrative doesn’t seem to hold water when looking at flows and/or sentiment indicators.

The potential for pAIn seems real and we didn’t even discuss many signs that the deal with China, much celebrated and rewarded by the market, doesn’t seem to be as good in the real world as it sounded on paper (or in media posts).

Loading recommendations…