Ahead of today’s jobs report, Goldman Delta One Head Rich Privorotsky wrote that with the October print backward looking and mostly govt related and irrelevant, “anywhere near consensus for November (+/-25k of 50k) feels like the sweet spot…that said, hard to see the FOMC feeling compelled to halt accommodation or even talk about hiking if labor momentum is still sub-100k on trend. Too cold (Probably bigger risk to the market narrative is a re-acceleration in labor which is consistent with some of the bonce in open jobs visible in the higher frequency data.”

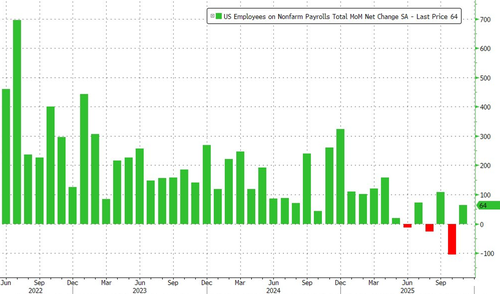

With that in mind, moments ago the the BLS published a very mixed report, with payrolls coming solid, thanks to a big beat in the November print, offset by an unexpected jump in the unemployment rate to 4.6%, above estimates, and the highest since Sept 2021.

Here are the details: in October, the US lost 105K jobs, entirely due to a plunge in government jobs (more below) but this was offset by the November jump of 64K jobs, which came in higher than the 50K expected.

Naturally, the negative revisions continued: the BLS also reported that the change in total nonfarm payroll employment for August was revised down by 22,000, from -4,000 to -26,000, and the change for September was revised down by 11,000, from +119,000 to +108,000. With these revisions, employment in August and September combined is 33,000 lower than previously reported.

Of note, government employment tumbled in November by -6,000. This follows a sharp decline of 162,000 in October, as some federal employees who accepted a deferred resignation offer came off federal payrolls. Federal government employment is down by 271,000 since reaching a peak in January. (Federal employees on furlough during the government shutdown were counted as employed in the establishment survey because they received pay, even if later than usual, for the pay period that included the 12th of the month. Employees on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey.)

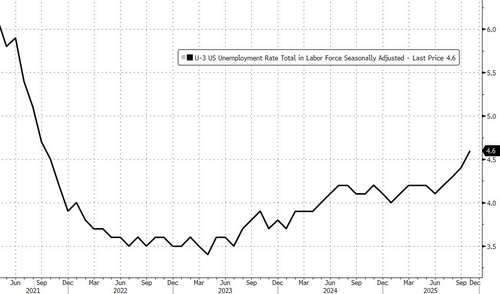

But while payrolls were generally solid, the unemployment rate was a problem and is what will likely prompt the Fed to cut more: in November, the unemp rate rose to 4.6% (with October blank), worse than the 4.5% estimate and the highest since Sept 2021.

Among the major worker groups, the unemployment rate for teenagers was 16.3% in November, an increase from September. The jobless rates for adult men (4.1 percent), adult women (4.1 percent), Whites (3.9 percent), Blacks (8.3 percent), Asians (3.6 percent), all rose, and just the unemp rate for Hispanics (5.0 percent) dropped.

Both the labor force participation rate (62.5 percent) and the employment-population ratio (59.6 percent) were little changed from September. These measures showed little or no change over the year.

In November, average hourly earnings for all employees on private nonfarm payrolls edged up by 5 cents, or 0.1 percent, to $36.86. Over the past 12 months, average hourly earnings have increased by 3.5%, lower than the 3.6% expected. The average workweek for all employees on private nonfarm payrolls edged up by 0.1 hour to 34.3 hours in November. In manufacturing, the average workweek changed little at 40.0 hours, and overtime was unchanged at 2.9 hours.

Taking a closer look at the report we find the following details:

- The number of people jobless less than 5 weeks was 2.5 million in November, up by 316,000 from September. The number of long-term unemployed (those jobless for 27 weeks or more) changed little at 1.9 million in November and accounted for 24.3 percent of all unemployed people.

- The number of people employed part time for economic reasons was 5.5 million in November, an increase of 909,000 from September. These individuals would have preferred full-time employment but were working part time because their hours had been reduced or they were unable to find full-time jobs.

- The number of people not in the labor force who currently want a job, at 6.1 million in November, was little changed from September. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of people marginally attached to the labor force, at 1.8 million in November, was little changed from September. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, also changed little at 651,000 in November.

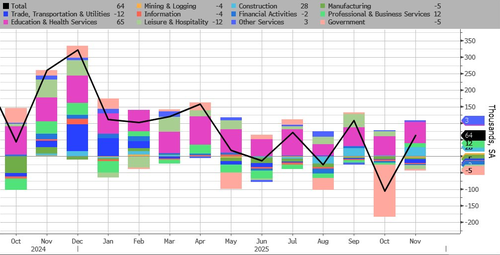

Taking a closer look at the monthly change in jobs, employment rose in health care and construction while federal government employment declined by 6,000, following a loss of 162,000 in October.

- In November, health care added 46,000 jobs, in line with the average monthly gain of 39,000 over the prior 12 months. Over the month, job gains occurred in ambulatory health care services (+24,000), hospitals (+11,000), and nursing and residential care facilities (+11,000).

- Construction employment grew by 28,000 in November, as nonresidential specialty trade contractors added 19,000 jobs. Construction employment had changed little over the prior 12 months.

- Employment in social assistance continued to trend up in November (+18,000), primarily in individual and family services (+13,000).

- In November, employment edged down in transportation and warehousing (-18,000), reflecting a job loss in couriers and messengers (-18,000). Transportation and warehousing employment has declined by 78,000 since reaching a peak in February.

- The big outlier was Federal government employment, which continued to decrease in November (-6,000). This follows a sharp decline of 162,000 in October, as some federal employees who accepted a deferred resignation offer came off federal payrolls. Federal government employment is down by 271,000 since reaching a peak in January. (Federal employees on furlough during the government shutdown were counted as employed in the establishment survey because they received pay, even if later than usual, for the pay period that included the 12th of the month. Employees on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey.)

And visually:

Developing.

Loading recommendations…