The major winter storm that dumped heavy snow and ice across much of the eastern US is finally over, but the cold-weather danger is far from over.

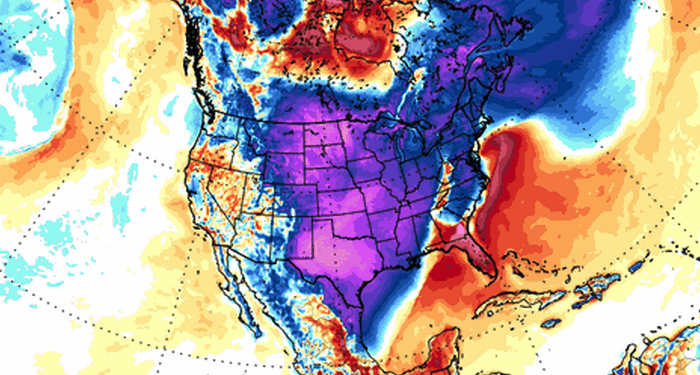

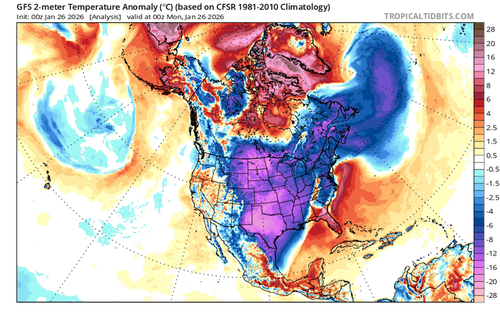

Roughly 185 million Americans remain under winter alerts today as Arctic air continues to pour deep into the central and eastern states. Wind chills are dropping into the minus 20s and minus 30s in some areas, with temperatures running 10 to 40 degrees below seasonal averages.

This prolonged cold – expected through the week – will continue to pressure major natural gas production hubs with freeze-offs, send pipeline volumes sliding, and push already-strained power grids to the brink.

The latest on grids:

-

The Electric Reliability Council of Texas projected a record demand of 86 GW on Monday, above its prior summer peak.

-

PJM Interconnection warned it faces days of extreme winter demand, an unprecedented stretch for the grid spanning the Midwest to the Mid-Atlantic.

-

Grid operators are paying large customers to curb usage to avoid widespread rolling blackouts.

-

Power prices spiked to crisis levels, with PJM on peak prices averaging about $639 per MWh and ERCOT North hub prices jumping more than 1,200% day over day.

On Sunday, the Energy Department issued emergency orders authorizing PJM to operate power plants at maximum capacity, including those fueled by coal and oil, regardless of limits set by environmental rules or state law. Similar orders were issued for ERCOT and ISO New England.

Golf clap for fossil fuels saving the grid from collapse. It wasn’t solar or wind. It was oil and natural gas.

Meantime in New England and Boston oil – yes OIL – is a stunning 39% of electricity production.

Never, ever seen this high.

Next day power costs (on the left) are super high as well.

300 miles from one of the largest nat gas fields in the world and burning … oil.… pic.twitter.com/HuMqxmkqMd

— Brian Sullivan (@SullyCNBC) January 25, 2026

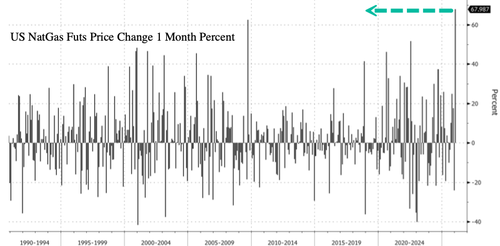

UBS analyst David Robinson told clients, “Natural gas futures have surged nearly 20% Monday Asia morning as the worst winter storm in recent years in the US has seen surging demand for heating, with plunging temperatures knocking off nearly 10% of production.”

Lower 48 U.S. Dry Gas Production today: 99.6 Bcfd, Freeze-off: 10.1 Bcfd, Cumulative: 48.9 Bcf. Be mindful revisions are certain; each post is based on latest pipeline nominations data. #NaturalGas #NatGas #GasProduction #FreezeOffs pic.twitter.com/JWL3yddOL7

— GasFundies (@RealGasFundies) January 26, 2026

US LNG feed gas nominations opened this week at a limited 14,209 MMcf/d, declining by -4,910 MMcf/d since Friday as every operator actively scaled back inflows leading into the winter storm.

That total drop also now includes reductions from Venture Global’s assets, as Calcasieu… pic.twitter.com/QU2uf299g0

— Criterion Research (@PipelineFlows) January 26, 2026

US natural gas futures in New York jumped nearly 20% to more than $6 per million British thermal units when trading opened up on Sunday (read here). Gains have largely held into early Monday, with prices still up about 17% as of 0715 ET.

Highest since 2022.

January could be the largest NatGas futures spike on record.

With 10% of US natural gas production knocked offline just as heating demand surges, this week shapes up as a major stress test for the nation’s power grids. Stack the firewood high and make sure the whole house generator is fueled up.

Loading recommendations…