Authored by Dhaval Roshi via BCAResearch.com.

Summary

-

Trump’s trade war and disengagement from global trade is effectively ‘America’s Brexit’.

-

For pound/dollar, ‘America’s Brexit’ will cancel out ‘Britain’s Brexit’.

-

Hence, a new structural position is long pound/dollar with a price target of $1.60.

-

Investors will also switch out of the ‘fiat’ dollar into ‘non-fiat’ gold and bitcoin.

-

But given bitcoin’s market value is less than one tenth that of gold, bitcoin has considerably more upside…

-

…with our price target at $200,000+

Pound To Reach $1.60

Irrespective of how the Israel-Iran conflict evolves, a tactically oversold dollar can bounce in the near term. Longer term however, the loss of ‘exceptionalism’ for both US bonds and US stocks will put downward pressure on the greenback. Raising the question, which currency is likely to be a big winner? If it must be another fiat currency, then a strong candidate is the pound sterling.

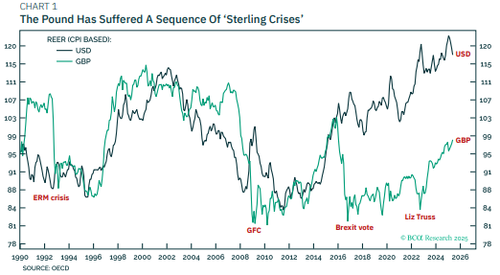

Remarkably through the past 40 years, the real effective exchange rates (REERs) of the pound sterling and the US dollar have moved in the same cycle. Given this common overarching cycle for both currencies, the pound/dollar real exchange rate is where it is largely because of multiple ‘sterling crises’ during those 40 years.

The biggest of these crises was the global financial crisis (GFC). While the GFC was made in America, it devastated the pound because of the financial-services-heavy UK economy’s high addiction to foreign financial flows.

GFC aside though, all the other sterling crises were crises of the UK’s own making: the European Exchange Rate (ERM) crisis of 1992; the Brexit vote of 2016; and the Liz Truss mini-budget fiasco of 2022. Our chart shows that the damage to the pound from the Liz Truss fiasco has been undone, but the damage from Brexit lingers. Absent Brexit, the pound would be trading in the $1.50-1.70 range.

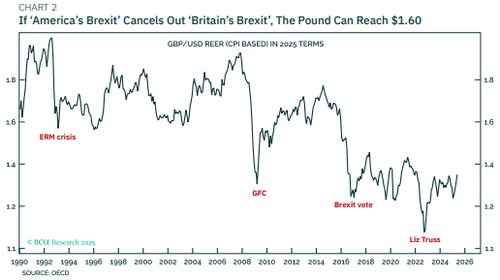

The Brexit vote in 2016, and the protectionism that it unleashed, meant that UK inflation – both actual and expected – surged versus that in other major economies. And persistently so. Furthermore, Brexit’s ‘economic disengagement’ meant that UK assets lost their privileged haven status. The result was a structural dislocation in the pound.

But now the tables have turned. Trump’s trade war and disengagement from global trade is effectively ‘America’s Brexit’. In which case, it will be the turn of the US to suffer the higher inflation rates and the turn of US assets to lose their privileged haven status. The result will be a structural dislocation in the dollar.

Given that an exchange rate is a relative price, ‘America’s Brexit’ will cancel out ‘Britain’s Brexit’, and take pound/dollar back to its pre-Brexit range. Hence, today, we are opening a new structural position: long pound/dollar, fully expecting the pound to reach $1.60 within the next couple of years.

Bitcoin To Reach $200,000+

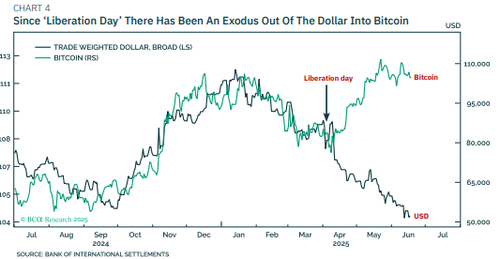

If investors switching out of US dollars do not have to switch into another fiat currency, then the strongest candidate on a multi-year horizon is bitcoin. Indeed, since ‘Liberation Day’ the biggest winner of the dollar exodus has been the world’s preeminent cryptocurrency.

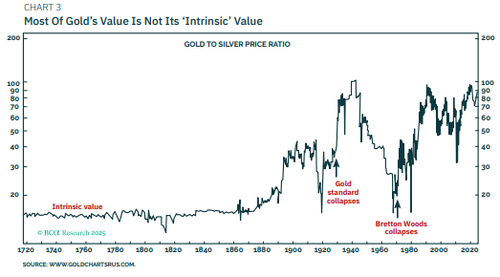

Many investors that I speak with are still uneasy about owning bitcoin. They worry that bitcoin has no ‘intrinsic’ value. Yet these same investors have no qualms owning gold. This makes no sense given that gold has very little intrinsic value either. If gold were valued just on its intrinsic value as a precious metal, then it would be trading closer to $340/oz than its current $3400/oz.

The value of both gold and bitcoin come their so-called ‘network effects’. As I previously explained in Bitcoin Closes In On $100,000, But The Ultimate Destination Is $200,000+ | BCA Research, the network effect arises from the collective belief that gold and bitcoin are the non-confiscatable assets to own in a fiat monetary system. And that a certain proportion of total wealth must be held in these non-confiscatable assets as an insurance against hyperinflation, banking system failure, or government default or expropriation.

The upshot is that the nominal dollar value of the gold and bitcoin networks is the product of three terms:

-

Global wealth in nominal dollars.

-

The share of this global wealth held in the non-confiscatable asset-class

-

The share of the non-confiscatable asset-class held in gold versus bitcoin

The evidence since ‘Liberation Day’ is that investors have lost faith in the dollar as a haven asset. They are fleeing to gold and the Swiss franc but fleeing even more to bitcoin. In which case, all three components of bitcoin’s value are going to trend much higher in the coming months and years.

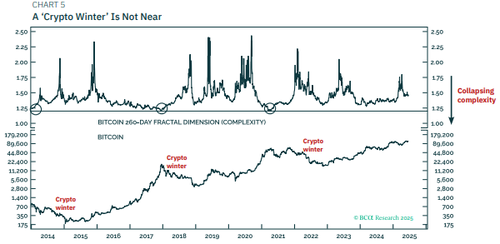

Still, bitcoin is infamous for suffering painful structural drawdowns known as ‘crypto winters.’ Our proprietary analysis of long-term price trend complexity, which has pinpointed all these crypto winters, reassures us that the next crypto winter is still some way off.

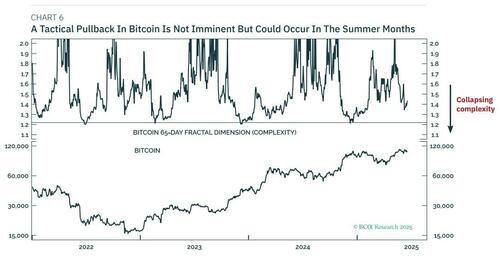

But for those who want a good entry point, is a meaningful pullback coming? Our analysis of short-term price complexity suggests that one is not imminent. But that if the rally’s short-term complexity continues to decline, there could be a pullback to around $80,000 during the summer months.

Pullback or no pullback, I fully expect bitcoin to reach $200,000+ within the next couple of years. And it remains one of our high-conviction structural long positions.

Loading…