As we’ve previously outlined in our “Chilling Opportunity” theme, AI server racks in data centers are becoming significantly more powerful—and more energy-intensive. This is driving a major shift from traditional air cooling to liquid cooling across data centers.

Goldman analysts led by Allen Chang told clients, “We expect the adoption of liquid cooling to accelerate as computing power of AI servers increases (e.g. GB200 AI server rack TDP at ~120kw, vs. HGX at 60-80kw).”

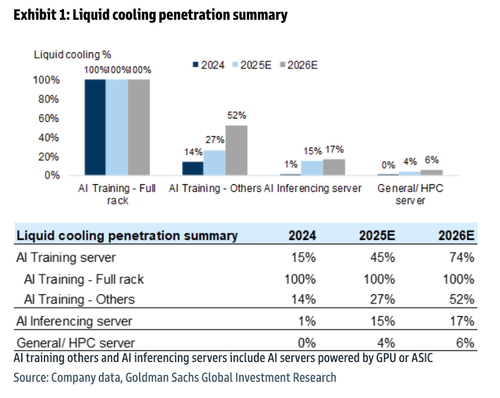

Chang stated that liquid cooling is rapidly replacing air cooling in AI servers, driven by the increasing heat output of high-power racks. He highlighted the shift underway in the data center cooling market that will only gain momentum in 2026:

-

Rack-level AI servers (e.g., powered by NVIDIA GB200/300) are all liquid cooled, with 19k / 50k racks in 2025 / 26E,

-

Baseboard-based AI training servers (e.g., powered by NVIDIA H200, B200, AMD, ASIC) liquid cooling penetration rate at 27% / 52% in 2025 / 26E.

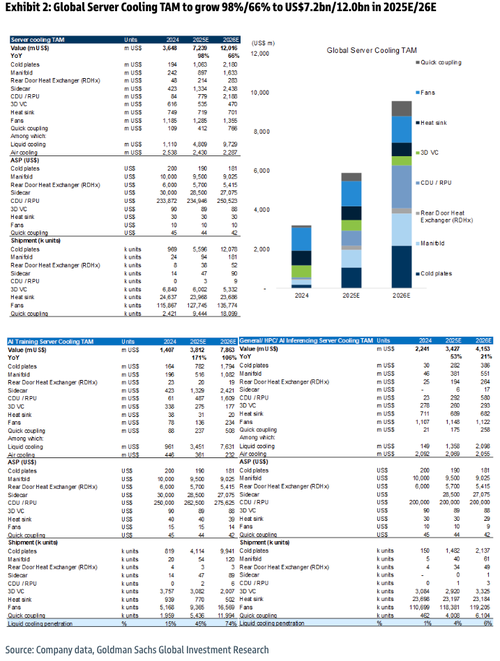

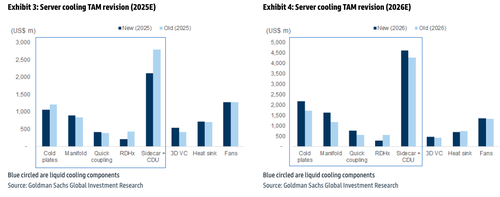

Chang estimated the total addressable market (TAM) for liquid cooling in AI training servers at $3.8 billion in 2025 and $7.9 billion in 2026, reflecting year-over-year growth of 171% and 106%, respectively.

Global liquid cooling market updates

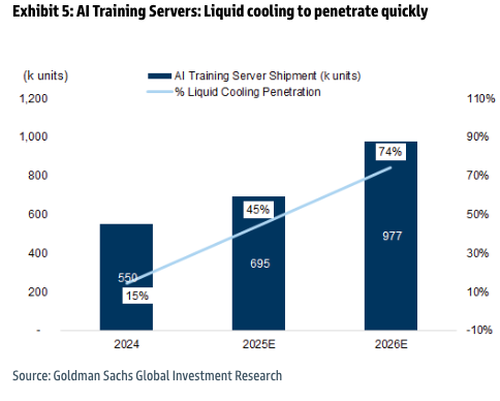

Liquid cooling is rapidly gaining traction across AI training servers.

“We expect rapid adoption of liquid cooling in ASIC AI servers, driven by the continuous upgrade of AISC chips and the potential for improved ROI with liquid cooling technology,” Chang said.

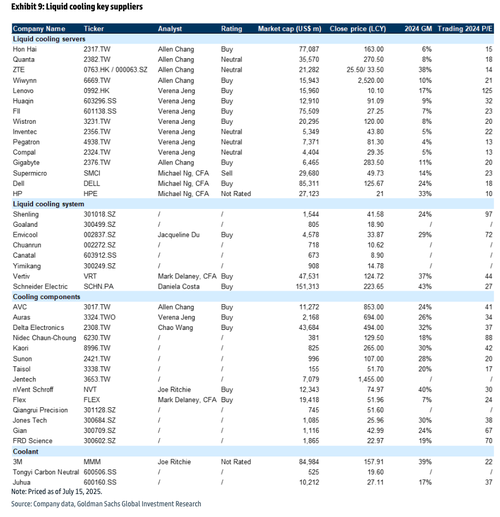

And the analysts provided a comprehensive supply chain guide to key liquid cooling suppliers…

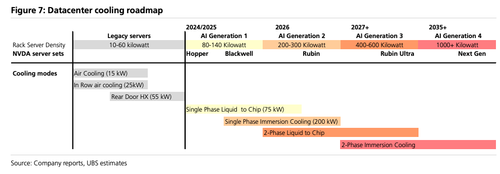

Separately, UBS has pointed out a “chilling opportunity” in data center cooling.

UBS analysts had shown this data center cooling roadmap weeks ago.

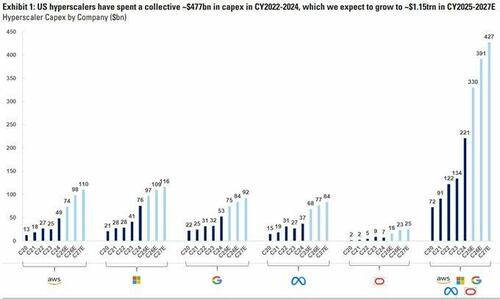

This makes sense given that U.S. hyperscalers have unleashed a wave of capital expenditures to build out AI infrastructure.

And the trend in cooling is only gaining momentum…

. . .

Loading…